Key Insights

- Bitcoin is not a top 10 asset by market cap again after a 6% decline in value.

- Gold and Silver are the top two most valuable assets, even after a price correction wiped out over $5 trillion in market cap.

- Mixed reactions trail Bitcoin’s decline as Arthur Hayes attributes it to a liquidity drop in US markets.

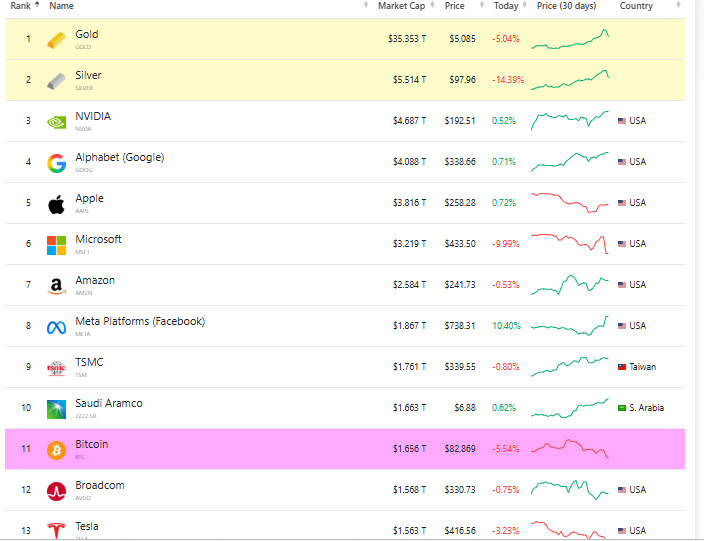

Bitcoin has fallen out of the top 10 most valuable assets after a recent 6% drop. The asset is now down to eleventh with a market cap of $1.648 trillion. It’s below Saudi Aramco and just ahead of Broadcom and Tesla.

BTC plunged sharply during the week. It fell from $90,000 at the start to $81,000 by January 30. This marked a massive slide in its value. While it has recovered slightly to $82,000, it is still significantly below $97,000, which it was on January 14.

Gold and Silver Top Two Assets Globally Despite Recent Dl

While Bitcoin is falling, the two precious metals, Gold and Silver, are now the two largest assets. Gold is right at the very top with a market cap of $35 trillion. This further solidified its position as the world’s most valuable asset.

The precious metal crossed the $5,000 threshold earlier this year, following over 60% gains in 2025. The price even rose to $5,500 per ounce this week before falling by more than 5% in a price correction.

Silver has also been on a rollercoaster in recent months. Its value has increased by more than 160% in the past six months. This has sent its market cap to $5612 trillion, surpassing Nvidia’s $4.6 trillion.

The remaining top ten assets are big tech companies, including Alphabet, Apple, Microsoft, Amazon, Meta, and TSMC.

Gold and Silver held their top positions. A sharp correction erased $5.1 trillion from their market caps. They still managed to stay dominant in the market.

Gold remains above $5,100 per ounce. This resilience suggests the pullback is temporary. The move looks like a normal market correction after its recent rally.

Hayes Attributes Bitcoin Decline to Liquidity Drying Up

Meanwhile, the rapid decline in Bitcoin value has caused the Bitcoin Fear and Greed Index to drop to 28, signalling Fear. This appears to be the general sentiment among crypto investors, with altcoins seeing steeper drops.

However, not everyone is bearish about the current market position. Former Bitmex CEO Arthur Hayes believes the recent BTC price crash was expected due to the US liquidity squeeze.

He said US dollar liquidity dropped by about $300 billion recently. The Treasury General Account alone rose by $200 billion. This shift highlighted tightening conditions in the market. He noted that while the reason for this rise in government balance is unclear, it was instrumental to the BTC fall.

Others also believe that the recent rise in gold prices is a precursor to a rebound in Crypto prices. However, CryptoQuant analyst I Moreno noted that this could be an early sign of capitulation if BTC cannot maintain its support.

He wrote:

The post Bitcoin Slides Out of Top 10 Assets After Slipping to $82,000 appeared first on The Market Periodical.