Key Insights

- Bitcoin ETFs record $753.73 million in net inflows on January 13, 2026

- Fidelity’s FBTC leads with single-day inflow of $351.36 million

- Ethereum ETFs attract $129.99 million

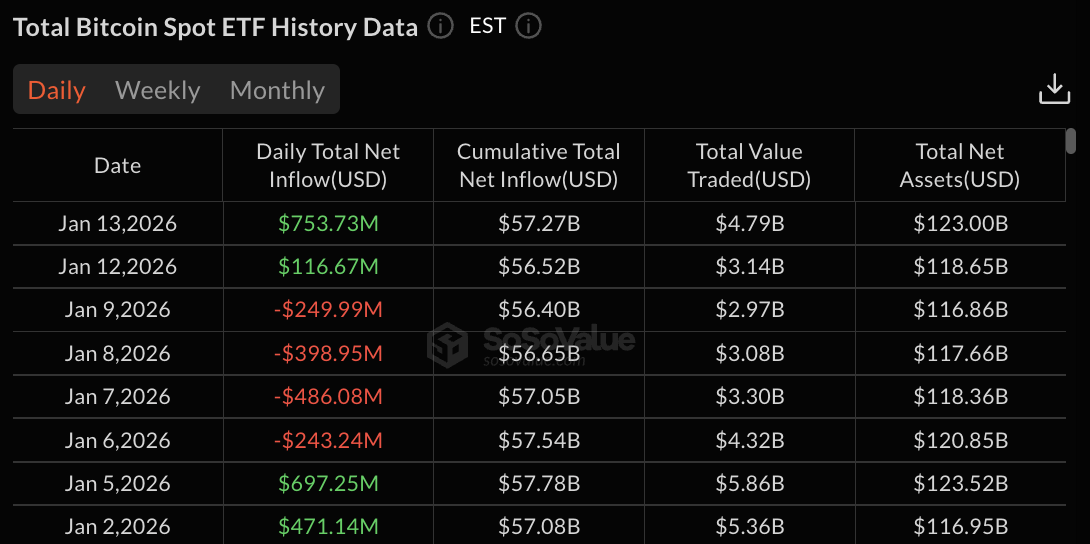

Bitcoin ETFs recorded total net inflows of $753.73 million on January 13, 2026, according to data from SoSoValue.

The inflows come one day after the funds attracted $116.67 million, ending a four-day outflow streak that saw over $1.3 billion leave the products.

Fidelity’s FBTC led the inflows with $351.36 million, the largest single-day gain among all Bitcoin spot ETF products.

The cumulative total net inflow for Bitcoin ETFs reached $57.27 billion, with total net assets standing at $123 billion.

Fidelity FBTC Captures Largest Share of Bitcoin ETF Inflows

Fidelity’s FBTC accounted for nearly half of the total Bitcoin ETF inflows on January 13. The $351.36 million deposit brought the fund’s cumulative net inflow to $12.19 billion.

Bitwise’s BITB recorded the second-largest inflow among Bitcoin ETFs with $159.42 million. The fund’s cumulative net inflow reached $2.32 billion.

BlackRock’s IBIT attracted $126.27 million, bringing its cumulative total to $62.46 billion, the highest among all Bitcoin spot ETF products.

Ark & 21Shares’ ARKB saw inflows of $84.88 million, bringing its cumulative net inflow to $1.68 billion.

Grayscale’s BTC product added $18.80 million, while VanEck’s HODL recorded $10 million in inflows. WisdomTree’s BTCW attracted $2.99 million.

Several Bitcoin ETF products reported zero activity on January 13. Grayscale’s GBTC, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, and Hashdex’s DEFI all recorded no inflows or outflows for the day.

Bitcoin ETFs Trading Activity Reaches $4.79 Billion

The total value traded across Bitcoin ETFs on January 13 reached $4.79 billion. This compares to $3.14 billion traded on January 12 and $2.97 billion on January 9.

The January 13 performance continues the recovery from the recent outflow period. Between January 6 and January 9, Bitcoin ETFs experienced four consecutive days of net outflows totaling $1.38 billion.

The largest single-day withdrawal occurred on January 7, when $486.08 million left the funds.

Before the outflow streak, Bitcoin ETFs had seen strong investor interest. On January 5, the funds attracted $697.25 million, while January 2 recorded $471.14 million in inflows.

The premium and discount rates for Bitcoin ETFs remained relatively stable on January 13. IBIT traded at a 0.12% premium, while FBTC showed a 0.17% premium. BITB recorded a 0.16% premium, and ARKB displayed a 0.10% premium.

The total net assets of $123 billion across Bitcoin ETFs place the products among the largest ETF launches in financial market history.

The asset base has grown from $116.86 billion on January 9 to its current level, recovering from the period of outflow.

Ethereum ETFs Record $129.99 Million in Inflows

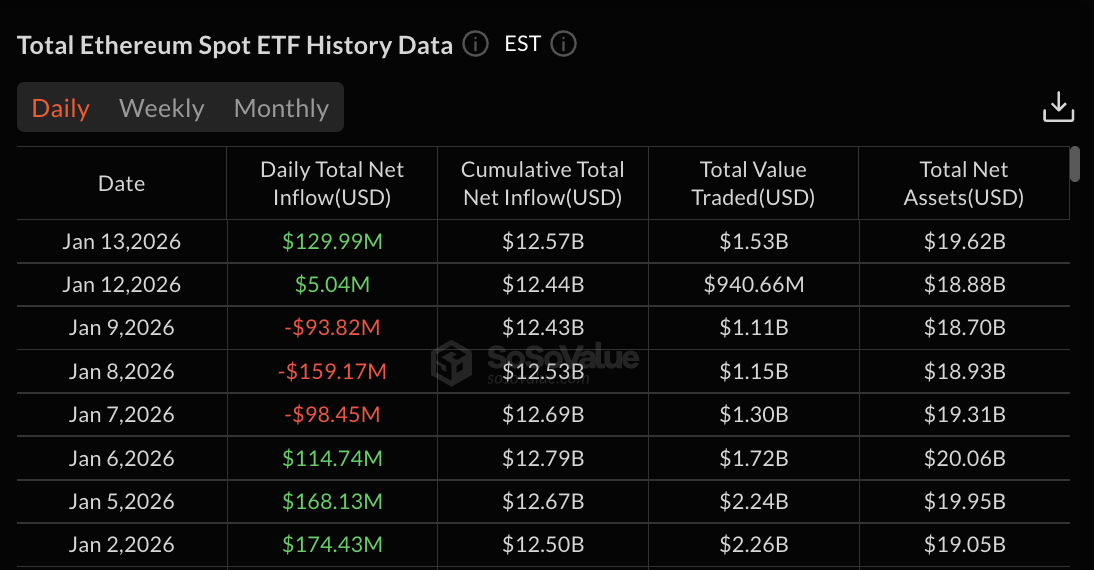

Ethereum ETFs attracted total net inflows of $129.99 million on January 13, continuing the positive trend from the previous day’s $5.04 million.

The cumulative total net inflow for Ethereum ETFs reached $12.57 billion, with total net assets of $19.62 billion.

BlackRock’s ETHA-led Ethereum ETF saw inflows of $53.31 million. Grayscale’s ETH product added $35.42 million, while Bitwise’s ETHW recorded $22.96 million.

Fidelity’s FETH attracted $14.38 million, and Grayscale’s ETHE saw $3.93 million in inflows.

The total value traded across Ethereum ETFs on January 13 reached $1.53 billion. This compares to $940.66 million on January 12 and $1.11 billion on January 9.

Several Ethereum ETF products reported no activity on January 13. VanEck’s ETHV, Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH all recorded zero inflows or outflows.

Solana spot ETFs recorded total net inflows of $5.91 million on January 13. XRP spot ETFs attracted $12.98 million during the same period.

The post Bitcoin ETFs Pull In $754M as Fidelity’s FBTC Leads With $351M appeared first on The Market Periodical.