Key Insights

- Bitcoin ETFs record $708.71 million in outflows on January 21, 2026

- Three-day outflow streak totals $1.59 billion across Bitcoin ETF products

- BlackRock’s IBIT leads withdrawals with $356.64 million in single-day outflows

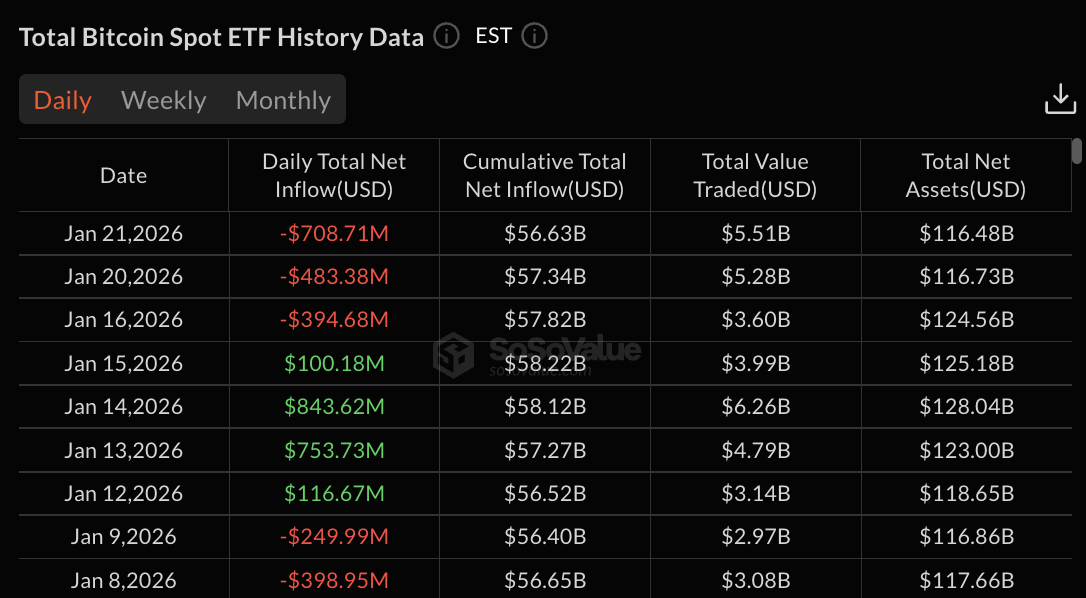

Bitcoin ETFs experienced outflows of $708.71 million on January 21, 2026, according to SoSoValue data.

The withdrawals extended a three-day outflow streak that has now totalled $1.59 billion. Cumulative total net inflows for Bitcoin ETFs declined to $56.63 billion from $57.82 billion on January 16.

BlackRock’s IBIT led the outflows with $356.64 million in withdrawals. Fidelity’s FBTC recorded the second-largest outflow at $287.67 million.

Bitcoin ETFs See Largest Single-Day Outflow in Recent Period

The January 21 outflows of $708.71 million exceeded both previous days in the current streak. January 20 saw $483.38 million leave Bitcoin ETFs, while January 16 recorded $394.68 million in withdrawals.

Between January 12 and January 15, Bitcoin ETFs had attracted $1.81 billion in inflows. Total value traded across Bitcoin ETFs reached $5.51 billion on January 21.

Total net assets for Bitcoin ETFs dropped to $116.48 billion on January 21 from $124.56 billion on January 16. The $8.08 billion decrease over the five days came from both outflows and Bitcoin price declines.

The asset base had peaked at $128.04 billion on January 14 before the outflow period began.

Multiple Sponsors Report Bitcoin ETF Withdrawals

Grayscale’s GBTC recorded $11.25 million in outflows on January 21. Bitwise’s BITB saw $25.87 million exit, while Ark & 21Shares’ ARKB experienced $29.83 million in withdrawals. Valkyrie’s BRRR had $3.80 million in outflows during the session.

VanEck’s HODL was the only Bitcoin ETF product to record positive flows on January 21, attracting $6.35 million.

Several products reported zero activity, including Grayscale’s BTC, Invesco’s BTCO, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI.

Weekly Bitcoin ETF Flows Turn Sharply Negative

Weekly data shows Bitcoin ETFs recorded $1.19 billion in outflows for the period ending January 21. This reversed the prior week’s performance, which saw $1.42 billion in inflows through January 16.

The week ending January 9 had recorded $681.01 million in outflows, sandwiched between positive weeks. The week of January 2 saw $458.77 million in inflows.

Total value traded every week reached $10.79 billion for the period ending January 21. This compares to $21.77 billion in the prior week, showing both lower flows and reduced trading activity.

Ethereum ETFs Record Concurrent Outflows

Ethereum ETFs experienced outflows of $286.95 million on January 21, extending their own outflow period. BlackRock’s ETHA led with $250.27 million in withdrawals, while Fidelity’s FETH saw $30.89 million exit. Grayscale’s ETHE recorded $11.38 million in outflows.

Grayscale’s ETH product attracted $10.01 million in inflows, one of the few positive flows among Ethereum ETF products. VanEck’s ETHV experienced $4.42 million in outflows. Several Ethereum ETF products reported zero activity for the day.

Cumulative total net inflows for Ethereum ETFs dropped to $12.40 billion from $12.91 billion on January 16. The $510 million decrease over five days came as both Bitcoin and Ethereum ETF products experienced sustained selling pressure.

Prior Positive Period Fully Reversed

The current three-day Bitcoin ETF outflow streak has erased most gains from the January 12-15 period.

Those four days saw combined inflows of $1.81 billion, including a peak of $843.62 million on January 14. The subsequent three-day outflow of $1.59 billion left net flows at just $220 million for the seven days.

The pattern shows institutional investors taking profits after the mid-January rally. Bitcoin ETFs had recovered from early January weakness. They recorded five consecutive days of inflows from January 12 through January 16.

The post Bitcoin ETFs Extend Three-Day Outflow Streak, Shed $708M appeared first on The Market Periodical.