Key Insights

- Bitcoin ETFs record $116.67 million in net inflows on January 12, ending four-day outflow streak

- Ethereum ETFs attract $5.04 million after three consecutive days of withdrawals

- Solana and XRP spot ETFs continue positive flows with combined inflows exceeding $25 million

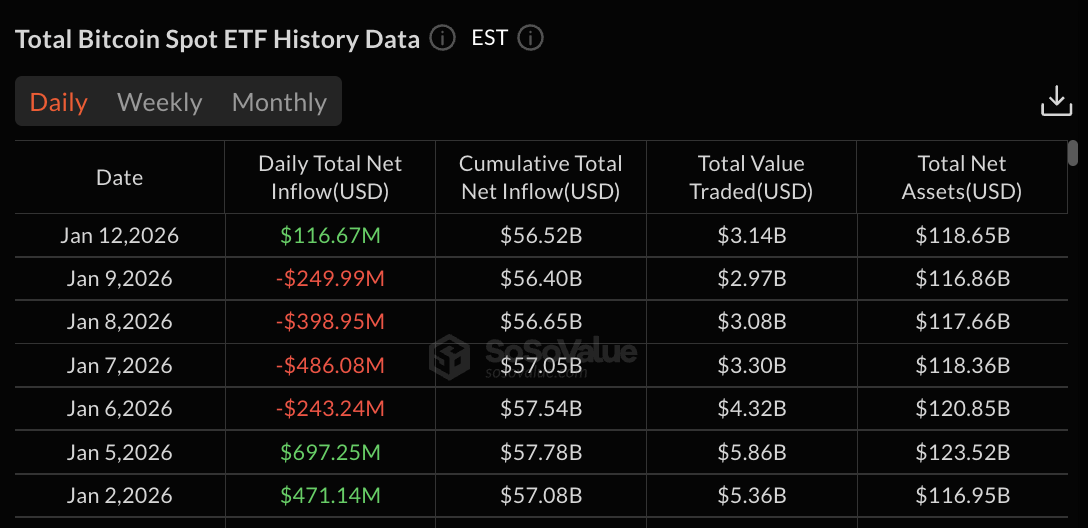

Bitcoin ETFs have returned to positive territory with a total net inflow of $116.67 million on January 12, 2026. The inflows end a four-day streak of outflows that saw investors withdraw over $1.3 billion from the funds.

The reversal comes as the cumulative total net inflow for Bitcoin ETFs reached $56.52 billion. Data shows that funds traded a total of $3.14 billion in value on January 12, with total net assets standing at $118.65 billion.

Bitcoin ETFs See Mixed Performance Across Sponsors

The January 12 inflows were distributed across multiple Bitcoin ETF sponsors, with BlackRock’s IBIT leading the outflows at $70.66 million despite the overall positive day for the category.

Fidelity’s FBTC recorded inflows of $111.75 million, one of the largest single-day gains among the funds.

Grayscale’s GBTC saw inflows of $64.25 million, while the company’s BTC product added $4.85 million.

VanEck’s HODL product recorded inflows of $6.48 million on January 12. Several other Bitcoin ETF products, including those from Bitwise, Ark & 21Shares, Invesco, Franklin, Valkyrie, and WisdomTree, reported zero activity for the day.

Four-Day Outflow Streak Ends With Return to Positive Flows

The positive inflows on January 12 ended a challenging period for Bitcoin ETFs. On January 9, the funds experienced outflows of $249.99 million, followed by $398.95 million in outflows on January 8.

January 7 saw the largest single-day withdrawal during the streak, at $486.08 million, while January 6 recorded outflows of $243.24 million.

Prior to the outflow streak, Bitcoin ETFs had recorded strong inflows. On January 5, the funds attracted $697.25 million in net inflows, while on January 2, $471.14 million entered the products.

The total value traded across Bitcoin ETFs has remained elevated throughout the period. January 12 trading volume reached $3.14 billion, compared to $2.97 billion on January 9 and $3.08 billion on January 8.

Ethereum ETFs Attract Modest Inflows After Outflow Period

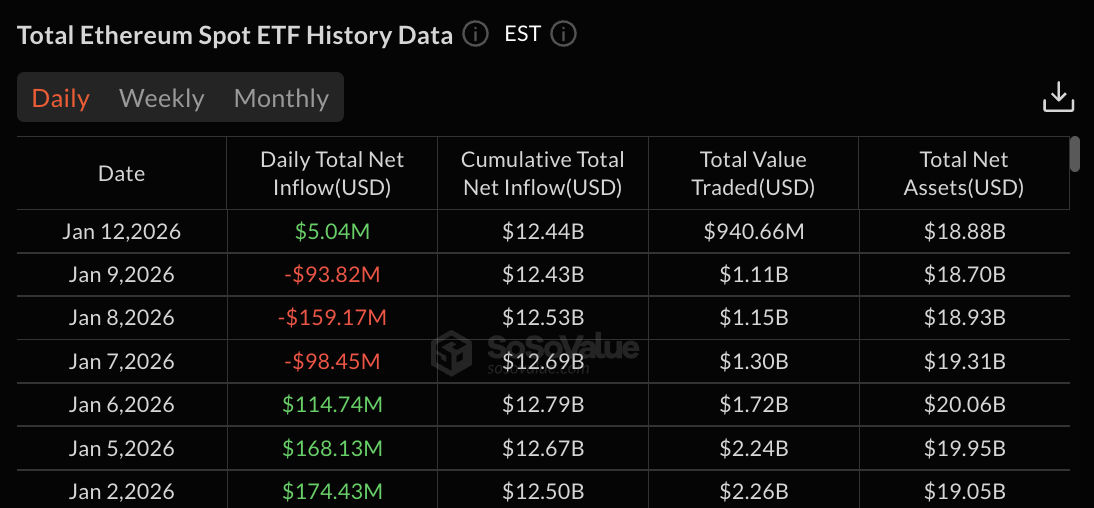

Ethereum ETFs recorded a total net inflow of $5.04 million on January 12, breaking a three-day outflow streak. The funds reached a cumulative total net inflow of $12.44 billion, with total net assets standing at $18.88 billion.

Grayscale’s ETHE product led the Ethereum ETF inflows with $50.67 million on January 12. The company’s ETH fund added $29.28 million to the positive flow.

BlackRock’s ETHA experienced outflows of $79.88 million during the same period.

21Shares’ TETH product recorded inflows of $4.97 million on January 12. Several Ethereum ETF products from Fidelity, Bitwise, VanEck, Franklin, and Invesco reported zero activity for the day. The total value traded across Ethereum ETFs reached $940.66 million on January 12.

The three-day outflow period for Ethereum ETFs included withdrawals of $93.82 million on January 9, $159.17 million on January 8, and $98.45 million on January 7.

Before this streak, the funds had seen positive inflows of $114.74 million on January 6 and $168.13 million on January 5.

Solana spot ETFs recorded a total net inflow of $10.67 million, continuing the positive trend for altcoin ETF products. XRP spot ETFs attracted $15.04 million in inflows during the same period.

The return to positive flows for Bitcoin ETFs follows a period of market uncertainty. The January 12 data shows institutional investors resuming purchases of Bitcoin through regulated ETF vehicles after several days of profit-taking and rebalancing.

The post Bitcoin ETFs Turn Positive With $117M Inflows After Four-Day Outflow Streak appeared first on The Market Periodical.