Key Insights

- Bitcoin ETFs record $6.84 million in inflows on January 26, ending five-day outflow streak

- Ethereum ETFs lead recovery with $116.99 million in positive flows after four-day decline

- Combined cryptocurrency ETF inflows total $123.83 million as selling pressure eases

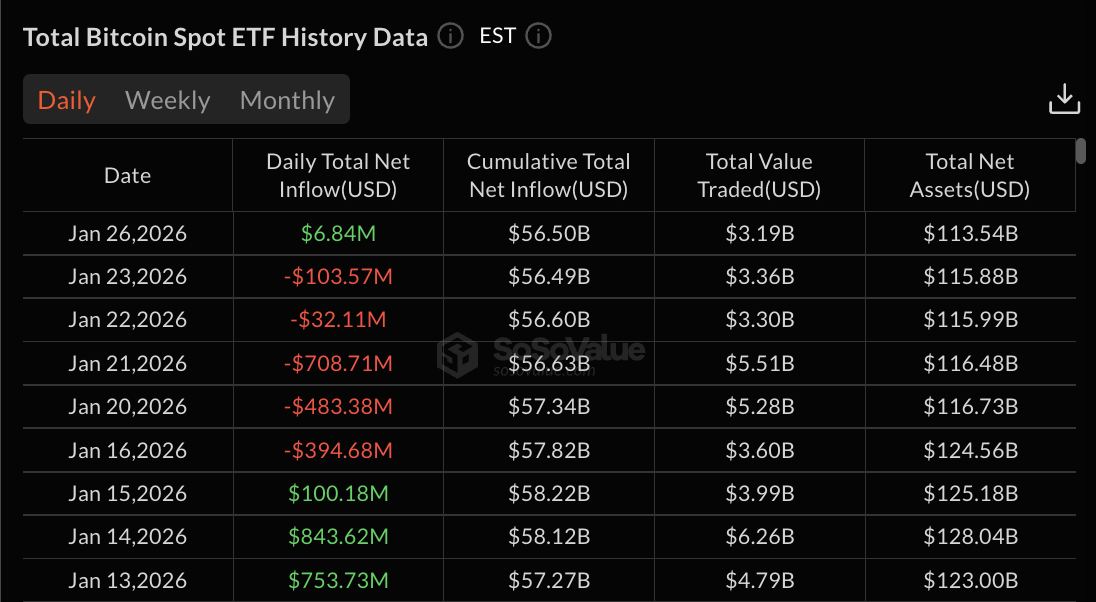

Bitcoin ETFs recorded modest inflows of $6.84 million on January 26, 2026, ending a five-day outflow streak that had totaled $1.33 billion, according to SoSoValue data.

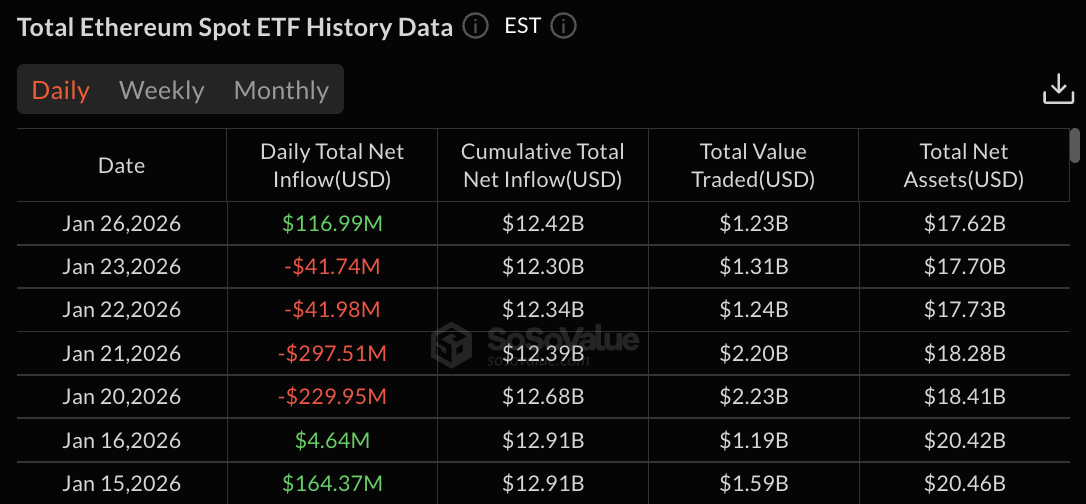

Ethereum ETFs led the recovery with $116.99 million in inflows, turning positive after four consecutive days of withdrawals.

The return to positive flows came as both cryptocurrency ETF categories stabilized following extended selling pressure.

Solana spot ETFs added $2.46 million in inflows, while XRP spot ETFs attracted $7.76 million during the same session.

BlackRock IBIT Leads Modest Bitcoin ETF Recovery

BlackRock’s IBIT recorded $15.93 million in inflows on January 26, the largest among Bitcoin ETF products.

Grayscale’s BTC product attracted $7.75 million, while WisdomTree’s BTCW saw $2.79 million enter. The three products accounted for all positive flows among Bitcoin ETFs during the session.

Fidelity’s FBTC recorded outflows of $5.73 million, Bitwise’s BITB recorded $10.97 million in withdrawals, and Ark & 21Shares’ ARKB saw $2.91 million in exits.

Several Bitcoin ETF products reported zero activity, including Grayscale’s GBTC, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, and Hashdex’s DEFI.

The net inflow of $6.84 million ended the five-day outflow period that began on January 16. During that streak, Bitcoin ETFs lost $1.33 billion through combined daily withdrawals of $394.68 million, $483.38 million, $708.71 million, $32.11 million, and $103.57 million.

Bitcoin ETFs Cumulative Flows Decline to $56.50 Billion

Cumulative total net inflows for Bitcoin ETFs stood at $56.50 billion on January 26, down from $57.82 billion on January 16.

The $1.32 billion decrease over the 10-day period came from the extended outflow streak. Total net assets fell to $113.54 billion, down from $124.56 billion on January 16.

Total value traded across Bitcoin ETFs reached $3.19 billion on January 26. The trading volume came as institutional investors ended their selling program.

The week ending January 23 had recorded $1.33 billion in Bitcoin ETF outflows, reversing the prior week’s $1.42 billion in inflows through January 16.

Ethereum ETFs Record Strongest Single-Day Inflow Since Mid-January

Ethereum ETFs attracted $116.99 million on January 26, the largest single-day inflow since January 15, when the products recorded $164.37 million.

The positive flows ended a four-day outflow streak that had totaled $611.17 million through January 23.

The January 26 performance exceeded the modest $4.64 million inflow recorded on January 16. Ethereum ETFs had experienced three particularly heavy outflow days on January 20 ($229.95 million), January 21 ($297.51 million), and January 23 ($41.74 million).

Cumulative total net inflows for Ethereum ETFs reached $12.42 billion on January 26, up from $12.30 billion on January 23.

Total net assets stood at $17.62 billion, recovering from $17.70 billion. Total value traded across Ethereum ETFs reached $1.23 billion during the session.

Weekly Ethereum ETF Flows Turn Positive

The January 26 inflows moved Ethereum ETFs back into positive territory on a weekly basis. The products had recorded $611.17 million in outflows for the week ending January 23, following $479.04 million in inflows during the week ending January 16.

The $1.09 billion swing between the two weeks came as institutional investors adjusted their positions amid volatility in the cryptocurrency market.

Solana spot ETFs recorded $2.46 million in inflows on January 26, continuing the positive trend for the newer cryptocurrency ETF products.

XRP spot ETFs attracted $7.76 million during the same session. The combined $10.22 million in inflows came as these altcoin ETFs maintained institutional interest.

The positive flows across Bitcoin, Ethereum, Solana, and XRP ETFs totaled $133.05 million on January 26. The broad-based recovery followed multiple days of concentrated selling pressure across cryptocurrency ETFs.

The post Bitcoin ETFs Edge Back Into Inflows While Ethereum Leads With $117M Rebound appeared first on The Market Periodical.