Trading veteran Peter Brandt has now identified the Bitcoin price structure that led to the ongoing downturn that has dominated the market.

Notably, Bitcoin (BTC) and the rest of the crypto market have been on a downward spiral since October 2025, with the losses intensifying on the back of the latest wave of selling pressure. Specifically, the global crypto market cap lost $311 billion yesterday alone, marking the largest intraday loss since the Oct. 10, 2025, crash.

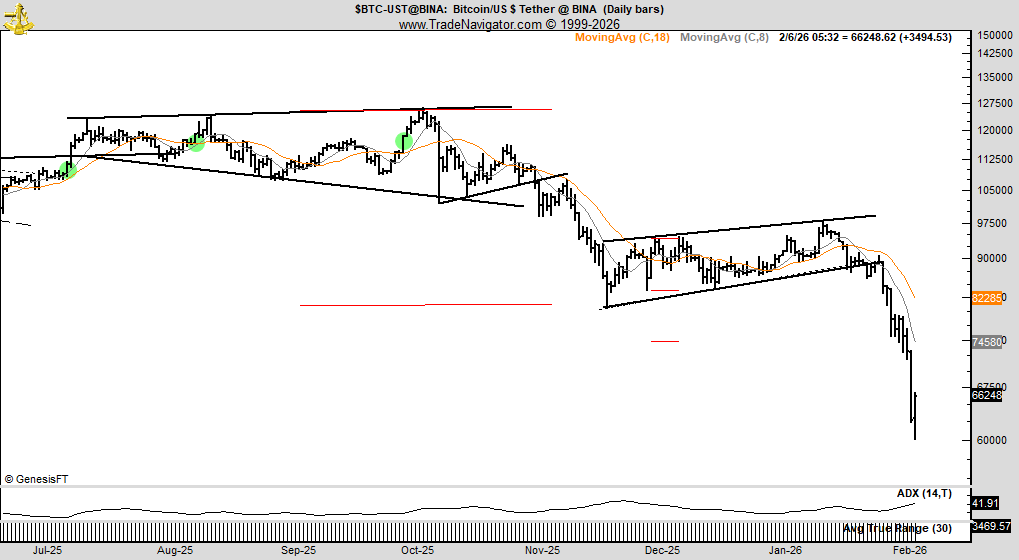

Expectedly, Bitcoin contributed the most to this Thursday crash, $206 billion that day, as prices broke below the $70,000 mark to hit $66,000 at press time.Amid these declines, Peter Brandt recently confirmed that a broadening top alongside a large flag kick-started the ongoing downturn months back.

Key Points

- With Bitcoin now down 42% since Q4 2025, Peter Brandt has now identified the structure that led to the ongoing downturn.

- Brandt suggested that a broadening top, which led to a large flag formation, kick-started the current market turbulence.

- The market veteran had identified this structure as far back as October 2025, when Bitcoin still traded for $110,000.

- At the time, Brandt set downward targets of $81,000 and $58,000, but his analysis faced pushback from the Bitcoin community.

- Bitcoin hit an 18-month low of $59,900 earlier today, eerily close to the $58,000 target.

Bitcoin Down 42% Since Q4 2025

Brandt’s latest commentary, which sought only to remind the investing public of his earlier suggestions, comes as Bitcoin loses the $70,000 psychological support and retests lows around $59,000 for the first time since October 2024.

While the crypto asset currently trades for $66,000 at press time, it had dropped to $59,900 earlier today before a sharp rebound. Despite an 8.48% uptick today, Bitcoin is down 42% since the fourth quarter of 2025. Also, with a 22% decline this year, the premier crypto asset has lost $392 billion worth of valuation within this period.

Brandt Identifies Broadening Top as Downturn Trigger

With the losses piling up, Brandt highlighted the broadening top pattern on the daily chart as the primary driver of the recent downturn. The market veteran criticized certain Bitcoin analysts, whom he called “amateurs,” for pushing back with his suggestion months ago and insisting that BTC was witnessing a H&S structure.

According to Brandt, the broadening top led to the formation of a large flag, which resulted in the steeper decline that has pushed Bitcoin below $70,000 at press time.“Sorry, amateurs, redraw your charts correctly,” Brandt quipped.

Bitcoin’s Broadening Top

For context, a broadening top or megaphone pattern occurs when price swings grow wider over time, forming higher highs and lower lows. Notably, it shows rising volatility and growing disagreement between buyers and sellers.

Essentially, the market looks more chaotic within this structure, as momentum weakens and control slowly shifts away from buyers. This pattern often warns that an uptrend may lose strength and could reverse downward.

Bitcoin’s broadening top formation started forming after the July 2025 peak of $123,000. From here, Bitcoin saw higher highs of $124,517 in August and $126,272 in October 2025. Meanwhile, it also registered lower lows of $112,000 in August, $107,488, and $103,530 in October 2025.

These price movements led to price swings that grew wider with time, forming the megaphone shape that defines a broadening top structure. As a result, Peter Brandt called attention to the pattern on Oct. 30, 2025, revealing that he was now short Bitcoin due to the formation of a megaphone.

Brandt Responds to Previous Backlash

With Bitcoin trading for $110,000 at the time of his October 2025 analysis, the asset still looked safe. This led to a wave of backlash from Bitcoin proponents who insisted that BTC remained bullish.

Notably, during his earlier analysis, Brandt had set the first downside target at $81,000, with the possibility of steeper declines to $58,000. Today, BTC dropped to $59,900 before rebounding.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author's personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.