Original Title:Bitcoin's Strategic Rebound: A Post-CPI Bull Case for 2026

Original Author: AInvest News Editorial Team

Translated by: Peggy, BlockBeats

Editor's Note: Last night, Bitcoin experienced a short-term breakout, surging 3.91% in 24 hours. This article explores three key factors—macroeconomic liquidity, institutional behavior, and on-chain valuation—to explain why Bitcoin may still be poised for a structural rebound: First, if the Federal Reserve initiates rate cuts and quantitative easing (QE) in 2026, liquidity returning to the market could once again lift the valuations of risk assets. Second, while ETF funds have retreated during market pullbacks, core institutional players have continued to accumulate Bitcoin amid volatility, positioning themselves ahead of a potential rebound. Third, multiple on-chain valuation metrics indicate that Bitcoin is approaching a historical "value zone," offering a more attractive entry point for medium- to long-term capital.

The following is the original text:

The cryptocurrency market, especially Bitcoin (BTC), has long been regarded as a key indicator of macroeconomic changes and institutional sentiment. As we approach 2026, multiple macro-level positives and a renewed inflow of institutional capital are converging, laying the groundwork for a strategic rebound in Bitcoin's price. This article will analyze how the Federal Reserve's policy trajectory, cooling inflation, and shifts in institutional behavior collectively form a compelling bullish case for Bitcoin over the next year.

Macro Trends: The Shift in Federal Reserve Policy and Inflationary Impulses

The Federal Reserve has decided to initiate interest rate cuts and quantitative easing (QE) in the first quarter of 2026, marking a pivotal shift in monetary policy. These measures aim to stimulate economic growth and address inflationary pressures that remain but are gradually easing. Historically, such policies have generally benefited risk assets, including Bitcoin.

By the end of 2025, the core CPI has cooled to 2.6%, alleviating market concerns over prolonged high inflation and reducing the urgency for further significant interest rate hikes. In such an environment, capital is more likely to be reallocated into alternative assets, and Bitcoin is increasingly viewed as "digital gold," emerging as a digital asset alternative comparable to gold.

The Federal Reserve's quantitative easing (QE) program is particularly likely to further amplify liquidity in financial markets, creating a favorable external environment for a rise in Bitcoin's price. Historically, Bitcoin has delivered an average return of about 50% in the first quarter, a period that often sees a corrective rebound following volatility in the previous fourth quarter. As central banks gradually shift their policy focus from "controlling inflation" to "prioritizing growth," the macroeconomic narrative surrounding Bitcoin is also evolving—from a more defensive logic to a more constructive bullish framework.

Institutional Accumulation: Continuously Buying During Volatility

Despite significant outflows by the end of 2025, such as a net outflow of $6.3 billion from Bitcoin ETFs in November, institutional interest in Bitcoin remains strong. Companies like MicroStrategy continue to accumulate: they added 11,000 new Bitcoin (approximately $1.1 billion) in early 2025.

Meanwhile, mid-sized holders further increased their share of the total Bitcoin supply in the first quarter of 2025. These strategic purchases amid volatility reflect the long-term commitment of institutional and mid-sized capital to Bitcoin's positioning as a "store of value" asset.

The divergence between ETF outflows and continued institutional buying highlights a more subtle structural shift in the market: when prices fall, retail sentiment-driven ETF funds tend to retreat, while core institutional investors appear to be positioning in advance for a potential rebound.

This trend also aligns with the typical pattern observed in Bitcoin's history: although Bitcoin's overall trajectory is upward in the long term, short-term holders often continue to "sell at a loss" amid volatility. This can be verified by the Short-Term Holder Spent Output Profit Ratio (SOPR): in early 2025, the indicator remained below 1 for more than 70 consecutive days, indicating that short-term holders were generally selling at a loss.

This behavior usually indicates that the market is entering a phase of "long-term capital accumulation": when short-term capital is forced to cut losses and exit, it actually creates a more strategic buying opportunity for long-term investors, and also provides favorable entry points for institutions to position themselves at lower levels.

On-chain indicators: In the "value zone," but still need to be cautious of bearish risks.

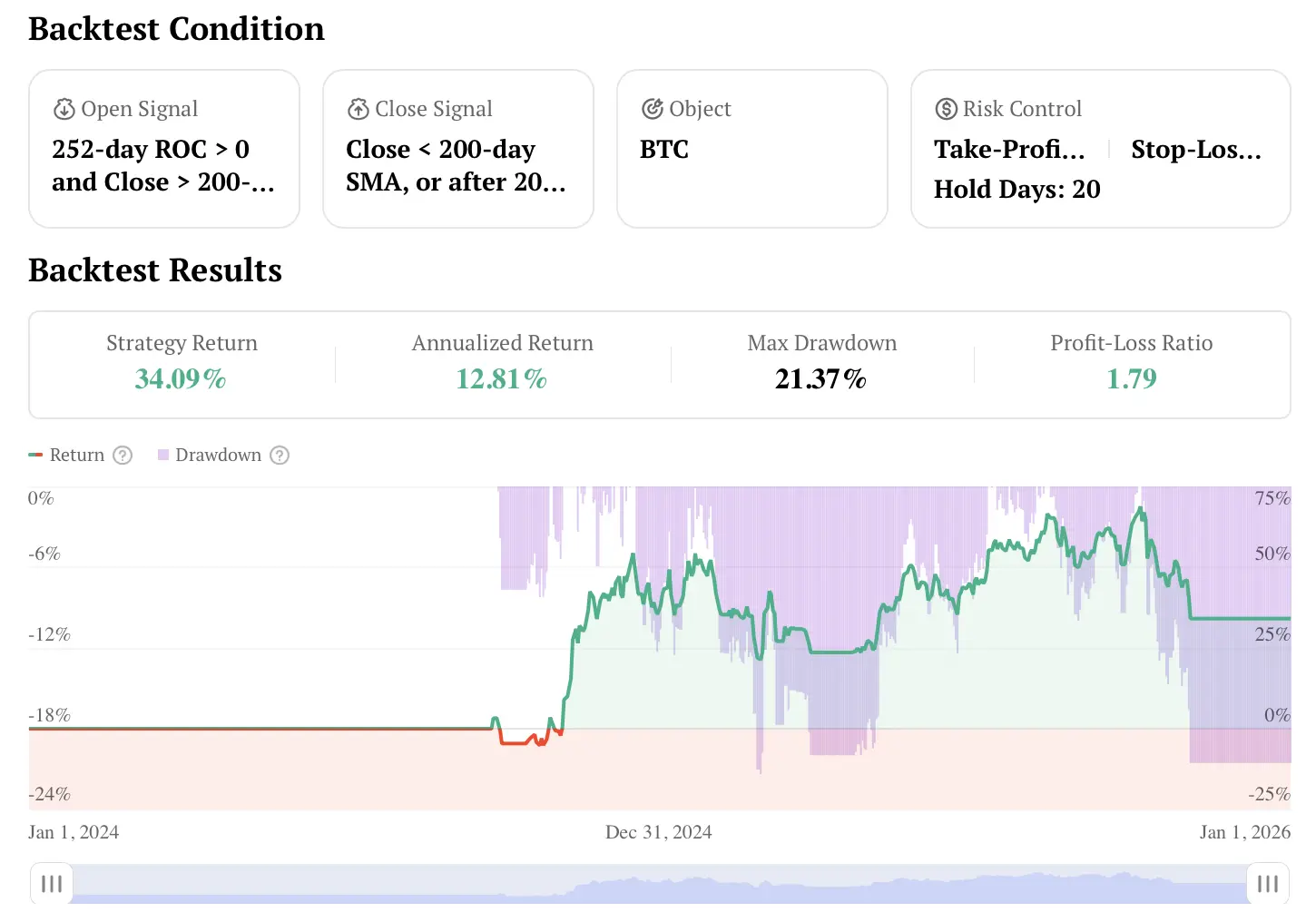

BTC Absolute Momentum Strategy (Long-Only)

Go long when the 252-day Rate of Change (ROC) is positive and the price closes above the 200-day Simple Moving Average (SMA). Exit the position when the price closes below the 200-day SMA, or exit when any of the following conditions are triggered: exit after holding the position for 20 trading days, take profit (TP) at +8%, or stop loss (SL) at -4%.

By the end of 2025, Bitcoin's price movement showed a clear pullback: it declined by approximately 6% for the entire year, with a drop of over 20% in the fourth quarter. At the same time, on-chain signals also showed divergence. On one hand, metrics such as the "Percent Addresses in Profit" continued to weaken, and selling activity by long-term holders increased. On the other hand, indicators like the "Dynamic Range NVT" and the "Bitcoin Yardstick" suggested that Bitcoin might be entering a historically significant "value zone," similar to valuation levels observed in several key bottom areas in the past.

This contradiction indicates that the market is at a critical crossroads: the short-term bearish trend continues, but the underlying fundamentals suggest that assets may be undervalued. For institutional investors, this structural divergence actually presents an asymmetric opportunity—limited downside risk but considerable potential for a rebound. Particularly under the combined catalytic effects of the Federal Reserve's policy shift and Bitcoin's historical performance in the first quarter of 2026, this opportunity is further amplified. Meanwhile, Bitcoin's narrative as an "inflation hedge" is also regaining market acceptance.

Conclusion: A rebound in 2026 is taking shape.

The combination of favorable macroeconomic conditions and the return of institutional capital is building a more compelling bullish case for Bitcoin by 2026. The Federal Reserve's potential interest rate cuts and the resumption of quantitative easing, along with gradually cooling inflation, could drive more liquidity into alternative assets, including Bitcoin. Moreover, despite significant volatility in Q4 2025, the continued buying by institutions reflects a certain level of confidence in Bitcoin's long-term value.

For investors, the key takeaway is clear: Bitcoin's upcoming "strategic rebound" is not merely a price correction, but rather a result shaped jointly by changes in the monetary policy environment and shifts in institutional behavior. As the market seeks a new equilibrium during this transitional phase, those who can identify earlier the convergence of macroeconomic trends and institutional movements may gain a more favorable position in Bitcoin's next phase of price action.