Key Insights

- Bitcoin ETFs record $483.38 million in net outflows on January 20, 2026

- Ethereum ETFs see $229.95 million in withdrawals during same trading session

- Grayscale and Fidelity lead outflows as cumulative totals drop across both asset classes

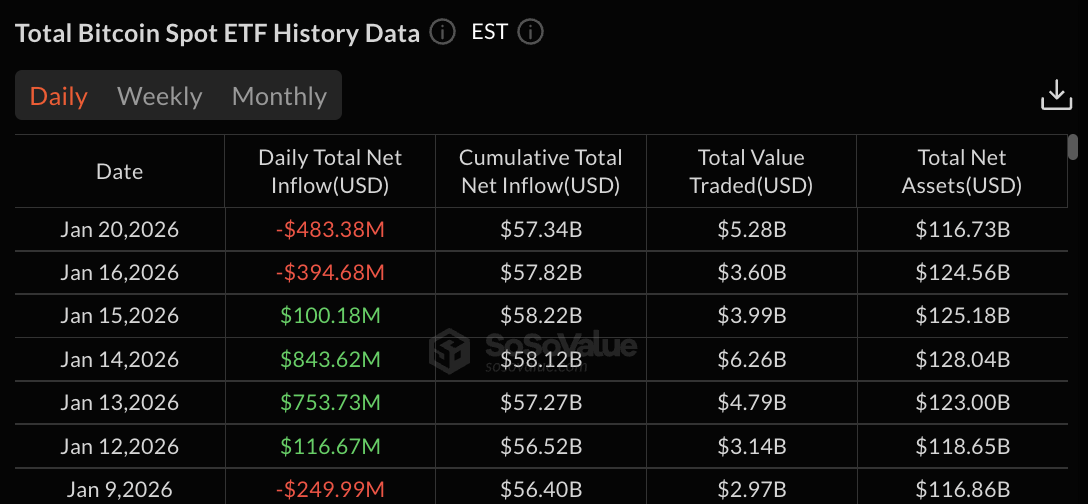

Bitcoin ETFs experienced net outflows of $483.38 million on January 20, 2026, according to SoSoValue data.

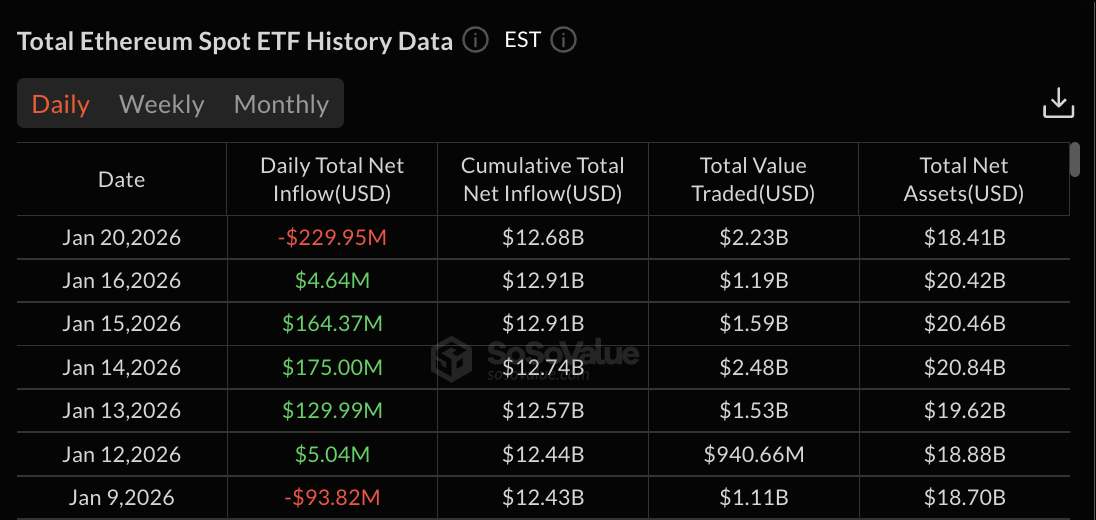

Ethereum ETFs recorded $229.95 million in outflows during the same trading session. The combined withdrawals totaled $713.33 million across both cryptocurrency ETF categories.

The outflows came after Bitcoin ETFs had seen mixed flows earlier in the week. The January 20 withdrawals brought cumulative total net inflows for Bitcoin ETFs down to $57.34 billion from $57.82 billion on January 16.

Multiple Sponsors See Bitcoin ETF Outflows

Grayscale’s GBTC led Bitcoin ETF outflows with $160.84 million in withdrawals on January 20. Fidelity’s FBTC recorded the second-largest outflow at $152.13 million.

BlackRock’s IBIT saw $56.87 million leave the fund, the first daily outflow for the product in the recent tracking period.

Bitwise’s BITB saw outflows of $40.38 million and Ark & 21Shares’ ARKB recorded $46.37 million in withdrawals.

VanEck’s HODL saw $12.66 million exit, and Franklin’s EZBC recorded $10.36 million in outflows. Valkyrie’s BRRR had the smallest outflow among active products at $3.79 million.

Several Bitcoin ETF products reported zero activity on January 20. Grayscale’s BTC, Invesco’s BTCO, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded no inflows or outflows. Total value traded across Bitcoin ETFs reached $5.28 billion on January 20.

Bitcoin ETFs See Second Consecutive Day of Withdrawals

The January 20 outflows followed $394.68 million in withdrawals on January 16. The two-day combined outflow total reached $878.06 million.

This ended the positive flow pattern that had dominated from January 12 through January 15.

During the positive period, Bitcoin ETFs attracted $116.67 million on January 12, $753.73 million on January 13, $843.62 million on January 14, and $100.18 million on January 15. The four-day inflow total of $1.81 billion preceded the recent outflow period.

Total net assets for Bitcoin ETFs declined to $116.73 billion on January 20 from $124.56 billion on January 16.

The $7.83 billion decrease came from both outflows and price movements during the period. The asset base had reached a recent high of $128.04 billion on January 14.

Ethereum ETFs Experience Widespread Outflows

BlackRock’s ETHA led Ethereum ETF outflows with $92.30 million in withdrawals on January 20. Fidelity’s FETH recorded $51.54 million in outflows, while Grayscale’s ETHE recorded $38.50 million in outflows. Grayscale’s ETH product experienced $11.06 million in withdrawals.

Bitwise’s ETHW recorded $31.08 million in outflows, and VanEck’s ETHV saw $5.47 million exit. Several Ethereum ETF products reported zero activity, including Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH.

The $229.95 million in Ethereum ETF outflows reversed the positive flows seen on January 16, when the funds attracted $4.64 million.

The January 20 withdrawals brought cumulative total net inflows down to $12.68 billion from $12.91 billion on January 16.

Total net assets for Ethereum ETFs fell to $18.41 billion on January 20, down from $20.42 billion on January 16. The $2.01 billion decline was driven by both outflows and a decrease in Ethereum’s price during the period.

The January 20 outflows followed strong inflows into Ethereum ETFs earlier in January.

Between January 12 and January 16, Ethereum ETFs attracted $474 million in total inflows. The period included daily gains of $5.04 million, $129.99 million, $175 million, $164.37 million, and $4.64 million.

The reversal to outflows on January 20 occurred across multiple Ethereum ETF sponsors. BlackRock’s ETHA, which had led weekly inflows with $219 million, saw the largest single-day outflow. The shift affected both major and smaller Ethereum ETF products.

Altcoin ETFs Show Mixed Performance

XRP spot ETFs recorded total net outflows of $53.32 million on January 20, according to the data. The withdrawals came after XRP ETFs had seen positive flows earlier in January. Solana spot ETFs recorded total net inflows of $3.08 million during the same session.

The mixed performance across different cryptocurrency ETFs shows investor selectivity during the January 20 trading session. While Bitcoin and Ethereum ETFs experienced broad selling, Solana products maintained modest positive flows.

The combined outflows of $713.33 million across Bitcoin and Ethereum ETFs on January 20 exceeded any single day of withdrawals during the recent tracking period.

The post Bitcoin ETFs Shed $483M as Ethereum ETFs See $230M in Outflows appeared first on The Market Periodical.