Key Insights:

- Bitcoin ETFs recorded $486.08 million in outflows on January 7.

- Ethereum ETFs posted $98.45 million in redemptions, ending a three-day streak.

- Combined losses of $584.53 million marked the worst single day of January.

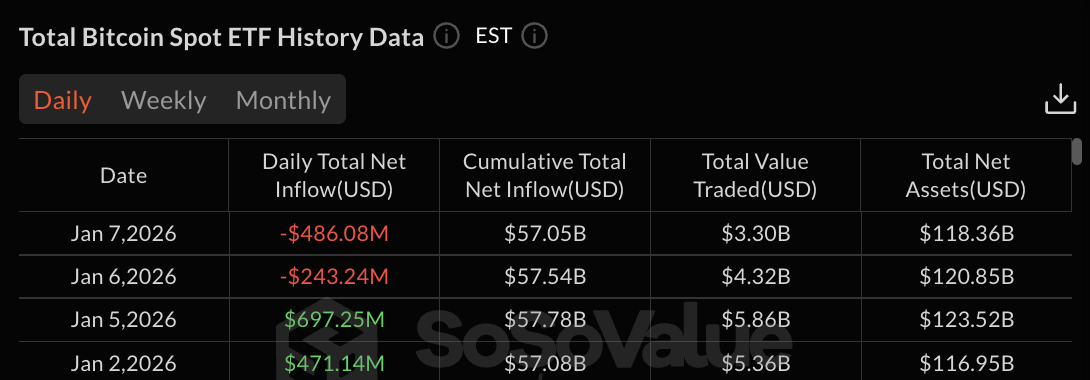

Bitcoin ETFs recorded $486.08 million in net outflows on January 7. It was the worst single-day performance of January 2026.

Data from SoSoValue shows cumulative flows declined to $57.05 billion with total net assets at $118.36 billion. Ethereum ETFs posted $98.45 million in redemptions, reversing a three-day inflow streak.

Bitcoin ETFs Suffer Largest January Outflow Day

Bitcoin ETFs faced redemptions on January 7, with only three products reporting zero flows. Fidelity’s FBTC led losses, with $247.62 million in outflows, resulting in the shedding of 2,720 BTC.

The product’s redemptions exceeded all other Bitcoin ETFs combined. FBTC maintains $11.83 billion in cumulative inflows despite the single-day loss.

BlackRock’s IBIT posted the second-largest outflow with $129.96 million, losing 1,430 BTC. The product has posted mixed results in recent sessions, following its early dominance in January.

IBIT maintains $62.85 billion in cumulative inflows and remains the largest Bitcoin ETF by assets. The January 7 outflow represents a reversal from the $372.47 million inflow on January 5. ARK 21Shares’ ARKB recorded $42.27 million in redemptions with 464.80 BTC exiting. Bitwise’s BITB saw $39.03 million in outflows, losing 429.26 BTC.

Grayscale GBTC posted $15.63 million in losses with 171.89 BTC redeemed. VanEck’s HODL recorded $11.57 million in outflows, shedding 127.28 BTC. Trading volume reached $3.30 billion for the session, down from $5.86 billion on January 5.

Fidelity Leads Bitcoin ETF Redemptions with $247.62M

Fidelity’s FBTC dominated Bitcoin ETF outflows on January 7, accounting for 50.9% of total redemptions. The $247.62 million loss marked the product’s worst single-day performance in recent weeks.

FBTC’s cumulative inflows remain positive at $11.83 billion, with total assets unchanged at approximately $17 billion.

BlackRock’s $129.96 million outflow represented 26.7% of total Bitcoin ETF losses. The combination of Fidelity and BlackRock redemptions accounted for 77.6% of the day’s total outflows. Grayscale products showed mixed results, with GBTC posting $15.63 million in losses while BTC reported zero flows.

Ethereum ETFs Post $98.45M Outflows After Three Positive Days

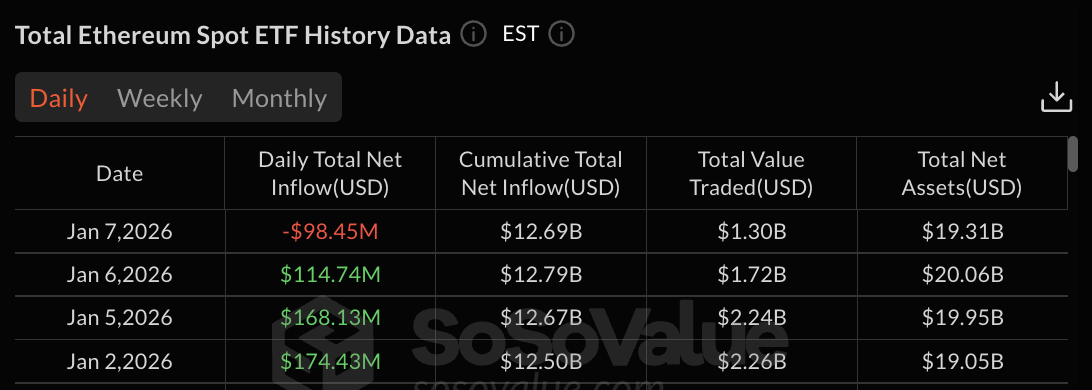

Ethereum ETFs recorded $98.45 million in net outflows on January 7, ending a three-day inflow streak that began January 2.

Cumulative flows declined to $12.69 billion with total net assets at $19.31 billion. The reversal occurred after Ethereum ETFs reported $457.30 million in combined gains from January 2 to 6.

Grayscale ETHE led Ethereum ETF redemptions with $52.05 million in outflows, shedding 16,600 ETH. The legacy trust product maintains -$5.10 billion in cumulative flows.

Grayscale ETH posted $13.03 million in losses with 4,160 ETH redeemed. Combined Grayscale products accounted for 66.1% of total Ethereum ETF outflows. Fidelity’s FETH recorded $13.29 million in redemptions, losing 4,240 ETH. The product holds $2.65 billion in cumulative inflows.

Bitwise’s ETHW saw $11.23 million exit with 3,580 ETH redeemed. BlackRock’s ETHA posted $6.64 million in outflows, shedding 2,120 ETH. VanEck’s ETHV recorded $4.59 million in losses with 1,460 ETH exiting.

Combined Bitcoin and Ethereum ETF Losses Reach $584M

Bitcoin ETFs and Ethereum ETFs produced combined outflows of $584.53 million on January 7. The total was the worst single-day performance for both asset classes in January 2026. Bitcoin ETFs contributed 83.2% of total outflows while Ethereum ETFs accounted for 16.8%.

Year-to-date flow patterns show diverging trends. Bitcoin ETFs recorded $1.52 billion in net inflows from January 2-5 before posting $729.32 million in combined outflows on January 6-7.

The net five-day result remains positive at $790.68 million. Ethereum ETFs posted $457.30 million in gains from January 2-6 before January 7’s $98.45 million loss, producing a net positive of $358.85 million for the period.

XRP ETFs posted $40.80 million in outflows on January 7, continuing their consistent performance. Cumulative XRP flows reached $1.20 billion. Solana products maintained minimal activity during the session.

The post Bitcoin ETFs Log Worst Outflow Day of January, Ethereum ETFs Follow appeared first on The Market Periodical.