Original text:@moonbirds

Compile:@BruceBlue

Abstract: Birb is a living IP character that uses a meme token as its medium and is backed in value by a physical collectibles company. The company's goal is to generate $1 billion in revenue by distributing the Birb IP globally, while converting marginal users into crypto users.

Introduction

The long-standing failures in the crypto space have primarily stemmed not from technical or financial issues, but from conceptual ones. The crypto industry has struggled for a long time to articulate its purpose, constantly oscillating between two incompatible self-identifications: is it a serious business environment, or a playground for collective absurdity? Projects that attempt to fully occupy one extreme often fail for opposite but symmetrical reasons. Those that pursue institutional legitimacy tend to abandon their meme-like qualities, thus losing the unique advantage crypto has in generating organic demand; whereas those that fully embrace pure absurdity struggle to maintain value across multiple attention cycles.

This tension is not accidental, but rather inherent to crypto. The pricing of crypto assets reflects not only discounted cash flows (DCF), but also the projection of narrative coherence and social synergy. Therefore, any attempt to analyze crypto solely through the lens of traditional corporate finance misses the essential mechanisms behind engagement, liquidity, and emergent growth.

The starting point of this article is the observation that the apparent contradictions in crypto between memes and enterprises, irony and sincerity, virality and revenue, are not flaws to be resolved, but rather a structural equilibrium that can be leveraged. The most successful assets in each cycle implicitly acknowledge this: whether by capturing attention through extreme absurdity or by imitating familiar institutional forms. However, adopting any single approach in isolation has proven insufficient. To truly win the market, $BIRB It must be a token for both the "sophisticated fool" and the "foolish sophisticate."

It's no surprise that memes have dominated the recent crypto cycle; this reflects the medium's comparative advantages over traditional markets. If crypto were merely a place to trade companies, the public stock market (equities) would have long outperformed it. Memes reduce the cognitive cost of participation and allow value to spread through social networks, gamifying value capture around a Dadaist artistic social expression that traditional financial instruments cannot rival.

Meanwhile, attention-driven growth is inherently unstable. Pure meme assets often struggle to survive across multiple cycles. Actively managed crypto businesses frequently rely on revenue models that extract value directly from their most active users, leading to negative-sum dynamics over time. While these models can be locally successful, they undermine the ecosystems they depend on, thereby limiting long-term growth.

The central argument of this article is that a sustainable crypto asset must succeed on both sides of this gap. It must be sufficiently absurd to capture attention, engagement, and the speed of cultural transmission; at the same time, it must be sufficiently credible to convert this attention into lasting economic activity. Crucially, this economic activity, in the process of being created, must in turn drive the distribution of the meme itself, especially its diffusion to audiences outside the initial community. This is not a compromise between two approaches, but rather a synthesis that views memetics and business operations as complementary rather than conflicting.

$BIRB These tokens are explicitly constructed based on this principle. Their original design intent is to operate at the intersection of memes and companies, leveraging the mutual reinforcement between the two. The following sections will attempt to formalize this framework, examine its implications, and argue why this structure is not only feasible but also essential for crypto to function successfully at its most fundamental level.

The left curve (Left Curve) generates attention; the right curve converts attention into tangible assets; these assets then regenerate attention outside the crypto sphere, while... $BIRB is the coordination layer that closes this loop.

Why Now: The Transformation of Edge Encryption Participants

This argument holds true because the cryptocurrency market itself has already changed.

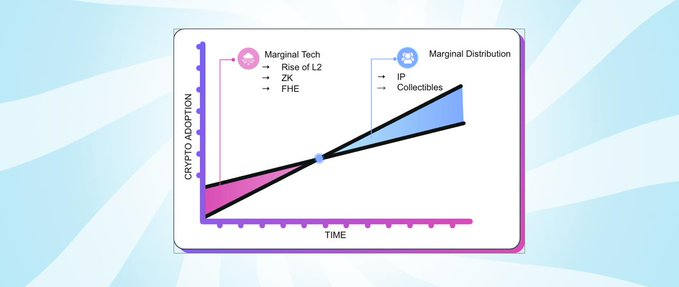

Previous crypto cycles were driven by technologists chasing marginal innovations: faster block times, cheaper fees, novel virtual machines, and incremental protocol improvements. When the industry was in its early stages, this frontier exploration became the dominant narrative for success. Today, however, this kind of innovation has largely plateaued. This is actually a sign of maturity. Multiple public blockchains are already "good enough," and in the eyes of most participants, further technical gains are no longer the key differentiator for determining winners.

Therefore, the marginal participants in the crypto market are no longer technologists or early adopters, but rather ordinary, everyday consumers who have yet to enter the space. These marginal consumers care little about throughput, latency, or the novelty of cryptography; instead, they are drawn to intuitive, understandable, and engaging tangible objects, characters, and experiences. This shift fundamentally changes the type of product that can drive growth.

These consumers are difficult to onboard directly. Abstract narratives, financial primitives, and protocol-centric marketing cannot overcome their psychological barriers to entry. Historically, what has repeatedly proven effective are physical and cultural entry points. Specifically, these are tangible items that can be touched, collected, gifted, and understood intuitively without explanation.

In a more mature crypto era where technology is no longer the bottleneck, the frontier for growth must shift toward distribution. This is why collectibles and physical items are becoming so important as distribution mechanisms now, unlike in previous cycles. They act as "Trojan horses": not to disguise crypto, but to make crypto irrelevant until the moment users feel they have earned their access. In a market where attention is abundant but trust is scarce, conversion no longer happens through education or evangelism, but through experience.

Birb as a Meme

Birb is not a "brand." Birb is a compression algorithm. In crypto, what most people are buying is not spreadsheets; they are buying a story that can be repeated. The winning assets are those that have low cost of spreading the story, are easy to remix, and are instantly socially understandable. This is the essence of a meme: a cultural unit designed for replication.

This is why the most enduring crypto tokens of the past decade are not product roadmaps, but symbols: a dog, a frog, a rock, a pixelated face. Their "stupidity" is not accidental; they use "stupidity" as an interface. This lowers the cognitive cost of participation.

Birb is specifically designed for this layer of interface. It is concise, phonologically natural, and historically native. "Doge" was a four-letter typo that became a global brand. "Birb" inherits this lineage: it is familiar enough to feel inevitable, silly enough to be easily spread, and specific enough to be owned.

But this is also precisely where most Meme coins die. Attention is a volatile resource. Pure Meme culture is like a "sugar high"—it surges, then crashes, and eventually becomes yesterday's joke, no longer amusing. The issue isn't whether Birb can go viral, but whether the virality can be transformed into lasting economic activity without killing the Meme itself.

This transformation mechanism is exactly what this paper truly aims to explore.

From Meme to Machine: The Labubu Issue

Take Labubu from Pop Mart as an example: this is one of the clearest cases of a modern meme escaping the internet and becoming part of a consumer goods flywheel. The Pop Mart stock offering is a clean instrument for capturing value related to Labubu's revenue. However, for a meme, revenue is not a perfect mechanism for capturing value.

Labubu has generated tremendous exogenous cultural value: free marketing, social recognition, energy in the secondary market, and a narrative that spreads far faster than the company's production capacity can meet. The bottleneck for Pop Mart is physical: how quickly can they manufacture, transport, and stock products? Memes can travel at internet speed; but the company cannot.

Now imagine the reverse scenario: a meme asset that can scale at internet speed, combined with a company that continuously anchors this meme in the real world and sustains its growth through products, distribution, and partnerships. This hybrid is exactly the opportunity space that Birb is targeting. We are not trying to "add a token to a toy company." We are trying to build a company whose core activity is to sustain a meme and create a token that captures the externalities generated by this continuation.

Birb as a character

Hello, how can I

The way characters occupy cultural and emotional space is something companies can never achieve. Retail investors don't pour emotions into companies; they pay for characters. Charizard is more culturally recognizable than The Pokémon Company. Labubu is more instantly recognizable than Pop Mart. Characters are the "user interface" of culture. They are things people can recognize, collect, give, and identify with without needing any explanation.

If the Birb token aims to leverage crypto as an "unfair advantage" for a cultural and meme value system, then Birb cannot simply exist as a brand. It must exist as a meme character capable of accumulating emotional attachment—not just awareness.

This also explains why relevant intellectual properties (IP) are scarce. Cultural IP exhibits path dependency. When was the last time a truly universal superhero was genuinely created? Most of the characters dominating today's popular culture originated from a narrow historical window—the Golden Age of comics in the 1940s and 1950s—and have since been continuously reinterpreted, rebooted, and restructured. While new characters are constantly introduced, very few manage to transcend their time and become enduring cultural primitives.

In my view, the NFT bull market of 2021–2022 represented the "golden age" version of crypto. It was the only period when crypto-native entities on a large scale entered mainstream awareness, creating a limited set of crypto-native intellectual properties (IP) with historical significance. Apart from Bitcoin itself, few crypto assets have crossed this threshold. This limitation is not a weakness; it is a defining characteristic of high-value IP.

We ( @Ocapgames ) Acquisition @Moonbirds Rather than launching an entirely new IP, it's because historical relevance cannot be fabricated. You can iterate on design, but you cannot fake a sense of cultural presence. We believe the future of intellectual property is digitally native, and crypto-native IP represents the next frontier of growth in crypto: not through incremental technological innovation, but through cultural resonance.

For a physical product to serve as a distribution mechanism for an IP, the IP itself must be inherently compatible with a physical form. It must be instantly recognizable as an object, visually coherent, and emotionally clear. This is where character-driven IPs succeed when abstract assets struggle. Birb works because it has a face. It has a silhouette, a personality, and a presence. It can exist on cards, figurines, or shelves without needing explanation. This readability makes large-scale distribution possible. Forming an emotional connection with Birb is far easier than forming one with Bitcoin, because what does Bitcoin even look like?

Align with revenue generation: Birbillions Target

Orange Cap Games (OCG) is the parent company of Moonbirds and the Birb IP. Our argument is simple: bring the IP to life. We are not treating the creation of a collectibles company as a "side quest" to issue tokens. We build collectibles companies because they are one of the few business models in the crypto space that can generate real revenue while distributing culture to people who don't care about crypto.

Birbillions' argument is about plucking the jewel in the crypto crown: becoming the first consumer-facing company to achieve $1 billion in annualized revenue without relying primarily on trading fees, leveraged liquidations, or token emissions as its main engine.

Most of the "revenue" in crypto is structurally misaligned with user interests. Transaction fees and clearing profits are expanded by "taxing" the most active participants. They work to some extent, but ultimately amount to cannibalism, creating internal competition within the same audience and setting a hard ceiling on growth.

A long-term, sustainable crypto company must make money like a real consumer business: by selling things that people genuinely want to display, give, trade, collect, and talk about. This kind of revenue cannot simply extract value from the market; it must expand the market. It must convert non-crypto consumers into crypto-adjacent participants without forcing them to define themselves as crypto users.

This is exactly what physical and digital collectibles do. The product is not only the item being sold, but also the distribution mechanism for the IP itself. Trading cards and blind boxes are not "merch." They are portable social objects. They exist in homes, in graded encapsulations, on shelves, and within the gift economy. They generate repeat behaviors and recruit new participants through ownership rather than ideology. Collectibles are among the cleanest known machines for converting attention into revenue at scale.

Benchmarking is crucial because it sets ambition at the right level. We are building the Pop Mart of Web3. Pop Mart is the clearest existing example of what happens when a character has cultural recognizability and when mass production and distribution create scalable compounding returns.

At comparable stages in their life cycles, the scale of Pop Mart was actually smaller than that of Orange Cap Games (OCG) today. In its second year of operation, Pop Mart generated about $900,000 in revenue. In the two years before its IPO, its annual revenue was approximately $20 million. In contrast, OCG generated about $8 million in revenue from physical collectibles in its second year of operation this year. In terms of growth, we actually outpaced Pop Mart over the same time span, and this was achieved with fewer SKUs, less global brand recognition, and without an established retail footprint.

This difference reflects timing and leverage. The category that OCG operates in has already understood role-driven demand, secondary markets, and global distribution—but we have an additional advantage that Pop Mart does not: a crypto-native coordination layer that allows culture to spread at internet speed, while still being anchored in real manufacturing and retail execution.

This is a large and mature industry. Collectibles are not a niche market, and revenue ceilings are not hypothetical. When distribution and repeat manufacturing generate compounding returns, the result is scalability. A $1 billion annualized revenue is not speculative; it is the expected outcome of properly executing this model.

This is what OCG is building: a vertically integrated collectibles company designed for scale. We focus on design, manufacturing discipline, channel trust, and distribution access, so that our revenue growth is not dependent on a single drop or a single cycle. The question is not whether we can generate revenue, but whether we can continuously create compounding effects through distribution.

This is where Birb bridges the gap. Popping has a Meme moving at internet speed and a company moving at manufacturing speed. Birb aims to eliminate this gap. The token is not the business; it is a coordination layer that makes the business culturally scalable. OCG anchors Birb in the real world through products, retail channels, and partnerships. Birb, in turn, accelerates distribution by enabling Memes to spread faster and become more relevant than through traditional channels.

Most projects view "meme" as a marketing skin on top of a protocol, but we see meme as a product primitive. Revenue is not a side effect—it is the fuel source. Each revenue cycle funds more production, broader distribution, and a larger cultural footprint for Birb. This year, thousands of people opened Birb trading cards and figurines at home. That is the mechanism. Physical products are advertisements themselves and serve as proof of the high-quality products we aim to deliver.

In short: OCG is the revenue engine and the real-world anchor. Birb is the cultural accelerator. The Birbillions argument claims that when these two merge into a single flywheel—attention becomes physical, physical becomes revenue, and revenue fuels distribution—you can build the first crypto-native consumer business to reach $1 billion in annualized revenue by doing exactly what consumer businesses have always done: win shelf space, win repeat purchase behavior, and make culture portable.

Winning Reach and Distribution

The game of physical collectibles is all about distribution. Everything else is downstream. In the crypto space, we like to pretend distribution is just content. In consumer goods, distribution is the physical location where the product resides. If you can't get shelf space, you don't have a brand.

This is why some of OCG's most important initiatives may appear on the surface to be "side quests." Our first product distributed by Asmodee (the second-largest toy distributor globally) is Lotería, a Spanish-language card game that is widely popular. Our first product to enter the distribution systems of GTS (the largest hobby distributor in North America), eVend (a key distributor within the Funko ecosystem), and Star City Games (the most important Magic: The Gathering tournament and retail operator) is Vibes TCG, featuring Pudgy Penguins and Nyan Cat. Strictly speaking, these are not "Birb SKUs." They are something more valuable: keys. They are proof that opens the next door.

To understand why this is important, you must first understand why crypto has traditionally struggled in Web2 distribution. Crypto introduces a risk appetite that cannot be clearly mapped into existing underwriting frameworks. Traditional distributors are built to assess inventory risk, credit exposure, and brand liability within stable regulatory and operational norms. Crypto products fall outside these norms: they involve ambiguous jurisdictions, unclear liability boundaries, unfamiliar custody and settlement models, and price behaviors that are unlike those of traditional consumer goods. When risks cannot be modeled, defined, or insured with existing tools, the rational response is to avoid them—even when the demand is real.

Collectibles are among the few industries where this default posture is softened, as a significant portion of the demand is downstream of the crypto cycle itself. When crypto prices rise, the disposable spending power of a group that overlaps heavily with collectors also increases. This relationship is not ideological; it is observable. It manifests in the speed of sell-outs, secondary market pricing, and allocation pressures during crypto upcycles. Giants in the collectibles industry may be cautious about crypto as a category, but they are not blind to where marginal demand is coming from.

Therefore, crypto is not an abstract externality for collectibles, but rather a demand signal that the industry has already learned to price implicitly, even if it does not openly proclaim this fact. This changes the risk calculation. Products related to crypto-native audiences are not automatically dismissed; they are evaluated within the context of an existing demand channel that is already capable of moving markets.

This creates a symmetric advantage. Traditional collectibles companies want to reach crypto consumers, while crypto wants to reach mainstream collectors. Each side is guarding the marginal users the other lacks. This is why collectibles are among the few large consumer ecosystems that value crypto customers enough to trade access for access. The Pareto-optimal outcome between OCG and major industry players is collaboration. This collaboration has already begun and is generating compounding benefits.

When you're a new company launching a new IP, you can't force your way into distribution channels. You can't barge your way onto retail endcaps just by writing bold declarations. Instead, you build credibility through a chain of trading partners. Every serious trading partner you earn makes the next one easier, because the real scarce resource isn't capital—it's trust.

Evidence of Execution

Arguments like this are only meaningful if they can stand the test of reality. In the collectibles market, execution is not theoretical. It is operational. It is whether your product can withstand the test in the hands of collectors, whether distributors trust you and give you shelf space, whether your inventory is cleared or backlogged, and whether you can repeat this process at an increasingly faster pace.

Most crypto projects have never encountered these constraints. Orange Cap Games has been operating under these constraints from day one.

The first critical test is manufacturing. The life or death of collectibles depends on their physical integrity. If the product is bent, worn, has printing errors, or degrades, everything else becomes irrelevant. With Vibes TCG, we have shipped millions of cards that have withstood the most rigorous downstream validators in the industry: PSA (the world's largest grading company). Approximately 59% of Vibes cards have received a PSA 10 rating, the highest ratio ever recorded for any trading card game. This result is not marketing hype; it is the outcome of material science, process control, and manufacturing discipline.

We are one of the few collectible issuers who manufacture our own paper stock. PSA has taken note of this. This relationship led to co-branded promotional cards at San Diego Comic-Con (SDCC) and New York Comic Con (NYCC). The only other game that has ever done a co-branded promotion with the PSA logo is One Piece TCG. When Birb Collectibles launched, PSA provided on-site grading services on the first day, and this was made possible precisely because we already had an established relationship with them through Vibes TCG.

Business cannot be built on manufacturing quality alone. Distribution can. And distribution is underwritten, not bought. Currently, we are distributing through the three largest hobby distributors in North America: GTS, ACD, and PdH, and we are a regular presence in the Star City Games circuit. We are manufacturing Lotería for Asmodee, the world's third-largest toy distributor, replacing an existing SKU. The existence of these placements has only one reason: to ensure that products arrive on time, sell out, and protect the economic interests of retailers.

Demand is the next constraint. Only demand that drains inventory is real. Our first release of Vibes TCG sold 500 booster boxes within seven minutes, directly leading to distribution expansion through Star City Games. Subsequent releases generated compounding growth. Our second major print run sold 15,000 booster boxes in the first week. In total, Vibes has sold over 8.6 million cards in the past 12 months, generating over $6 million in total primary sales. For a "crypto project," this isn't just a strong launch; it's one of the most significant launches in the trading card game industry, period. And we achieved this with an IP that is fundamentally smaller than established giants like Disney, Star Wars, or One Piece.

This execution has proven durable because it is not limited to physical channels. Since the acquisition of Moonbirds, we have expanded their digital footprint across Ethereum, Solana, and TON, increasing the number of unique wallets holding Moonbirds and Birb IP from approximately 10,000 to nearly 400,000. The Telegram sticker drop alone generated over $1.4 million in demand, and we also ran Soulbound Token (SBT) campaigns with major protocols, including CoinGecko, Jupiter, and Solana Mobile. These are lightweight, high-velocity surfaces that spread the IP alongside physical distribution, rather than competing with it.

Moonbirds are significant in their own right because their authenticity cannot be replicated or forged. They emerged during the NFT bull market of 2021–2022, the only period when crypto-native characters broke into mainstream awareness on a large scale. Moonbirds have recorded over $1 billion in lifetime trading volume and reached a historical on-chain implied market cap in the billions of dollars. That cultural timestamp cannot be recreated. Acquiring Moonbirds is not a shortcut; it is the only way to start from the position of owning crypto-native IP with historical significance and traceability.

The clearest signal of this system's effectiveness is speed. Many projects can ship once. Fewer can ship again, and even faster. Vibes' first product took a year to build, but the second one only took a week, and the Birb blind box took just a day. This compressed time-to-market (GTM) is not accidental. It is a hallmark of a real distribution engine. As this engine accelerates, OCG's ability to "crown kings"—to elevate IP flowing through its network—also increases.

This is the significance of evidence. It's not just that Orange Cap Games executed once, but that it demonstrated a repeatable system: a reinforcing cycle of manufacturing discipline, distributor trust, speed of sell-out, and cultural spread. Birb is designed to be placed on top of this system—not as marketing fluff, but as a coordinating layer that captures the externalities of cultural scale.

Execution is no longer hypothetical. It is already happening. The only remaining question is how large this flywheel can become.

Final Words

The core issue with crypto has never been speed, cost, or throughput. It's meaning. The industry has been trying to decide whether it wants to be taken seriously or embraced culturally, as if these were opposing goals. They are not. They are two forces that have driven crypto's most successful moments.

Meme resonates emotionally. The company has lasting success. Crypto only works when both are true.

Birb is an attempt to formalize this insight—not by resolving the tension between absurdity and enterprise, but by locking them together. Meme creation speed. Company creation gravity. Together, they thrive.

What makes this moment unique is not the narrative, but the context. Marginal crypto users are no longer technologists. The marginal growth vector is no longer infrastructure. It is distribution. And historically, distribution has been earned through roles, physical assets, and repeatable consumption behaviors.

Birbillions' argument is simply that this cycle can be scaled. When a meme is paired with real production and real distribution, it does not decay, but instead grows through compounding.

If crypto is to create meaning beyond itself, it won't be because it eventually convinces the world that it's serious. Rather, it will be because it has learned how to become real without ceasing to be absurd.

This is the bet. Next stop: Birb. Next stop: Birbillions.