Original Title: "Coin Price Collapse, Project Layoffs, Developer Exodus—Is Berachain Becoming a Doomed Blockchain?"

Original Author: Max, Foresight News

On January 14, BERA experienced a sharp short-term surge, rising from $0.5 to $0.9, which was rare, especially considering the previous 12 consecutive weekly declines. On the same day, the Berachain Foundation released its 2025 year-end summary, highlighting ecological expansion, technical improvements, and community engagement after the mainnet launch, while also acknowledging the various pressures caused by market volatility.

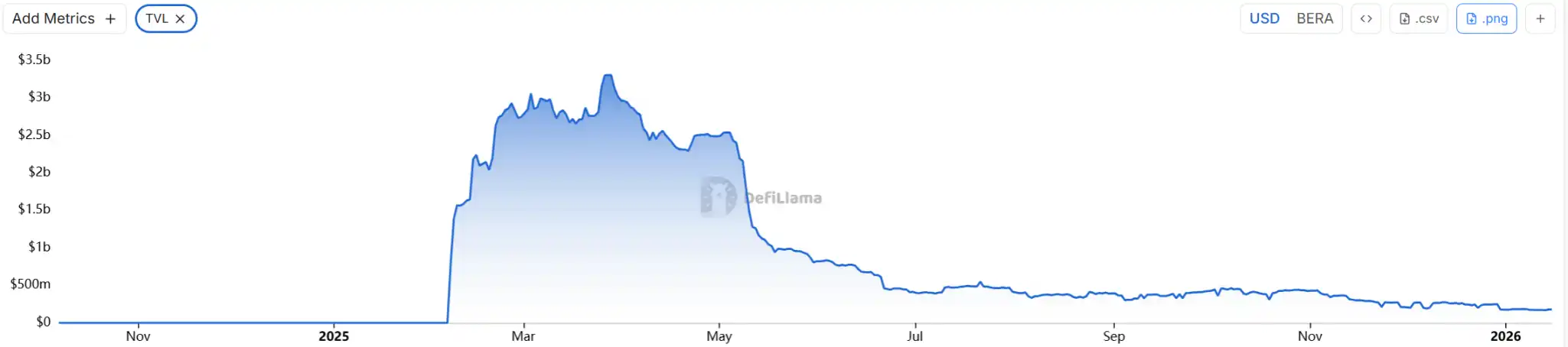

After the Berachain mainnet launch, both TVL and token price have experienced significant fluctuations. This may not only be the result of market cycles, but also a combined outcome of internal strategies and external pressures.

TVL dropped from 300 million to 18 million, chain 24-hour revenue 84 USD

In February 2025, Berachain officially launched its mainnet, introducing an innovative Proof-of-Liquidity (PoL) consensus mechanism. Designed to incentivize application and user participation through liquidity provision, this mechanism replaces the traditional Proof-of-Stake model, positioning Berachain as a Layer 1 blockchain specifically tailored for DeFi applications. The platform aims to enhance capital efficiency and user adoption. From its early launch, the ecosystem rapidly expanded, attracting hundreds of dApps, including decentralized exchanges like BEX, lending protocols, and NFT marketplaces.

TVL once surged to $3.3 billion, with over 140,000 active addresses and 9.59 million transactions. The foundation also supported multiple ecosystem projects through RFA (Request for Application) and RFC (Request for Comment) programs, and partnered with institutions like BitGo to provide custody services, enhancing the project's professionalism. Additionally, Berachain's community building and marketing strategies performed exceptionally well in the early stages. The bear-themed NFT series (such as Bong Bears) attracted a large user base, and airdrop and incentive programs further boosted participation. These initiatives helped Berachain become a hot topic in the DeFi space in the first half of 2025, ranking as the sixth-largest DeFi chain.

However, as the token price continues to decline, data from DefiLlama shows that its TVL has dropped to $180 million, with 24-hour chain revenue at just $84, and the total stablecoin supply on the chain amounts to $153.5 million.

Retail Investors First? Majority of Token Supply Allocated to VCs, Large Unlocks Expected in February

In its year-end update, the Berachain Foundation acknowledged that the "retail investor-first" strategy in the crypto market had overall poor results, leading to a reallocation of resources. This directly triggered a series of issues. First came layoffs and team changes. As part of the strategic adjustment, the Berachain Foundation cut most of its retail marketing team, shifting focus instead to foundational development. Berachain's chief developer, Alberto, will also leave the company to co-found a Web2 company with former banking colleagues.

The foundation emphasized that the departure was amicable; however, it inevitably weakened the project's core technical capabilities. Within the community, some developers have shifted to other chains, such as Monad, further exacerbating the talent drain.

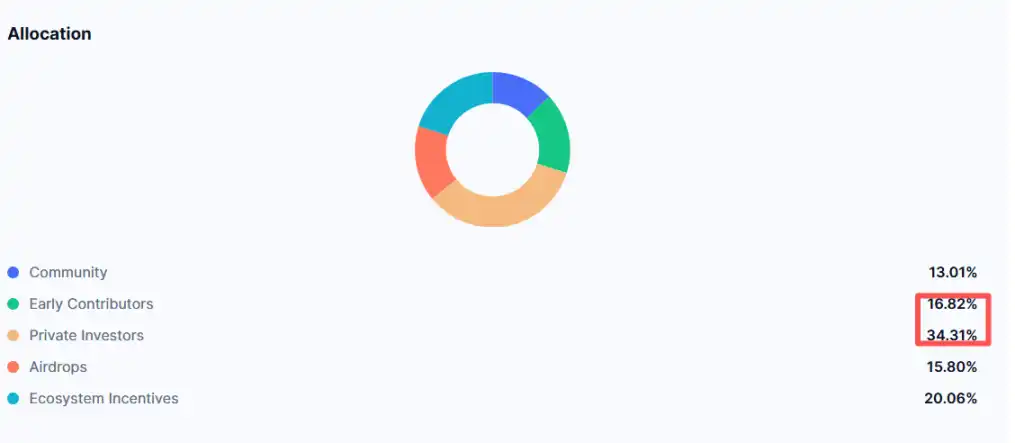

Perhaps the "retail investor-first" strategy promoted by the Berachain Foundation was never truly launched.

The project initially emphasized community-driven development, but in practice, the incentive mechanism failed to continuously attract users, and token distribution left retail investors on the sidelines.

Although the PoL mechanism is innovative, its complexity (such as the multi-token model, including BERA and BGT) deters users, leading to a sharp decline in network activity. In November 2025, the project paused the network due to a vulnerability in the Balancer protocol, but fortunately, user funds remained secure.

The price of BERA has fallen from its high of $9 to the current $0.70 in just one year. The so-called "king of the blockchain" token has experienced a price drop of more than tenfold.

This crash originated from a model with low liquidity and a high fully diluted valuation (FDV), which led to an artificial price inflation followed by a rapid collapse. The root of these issues lies in Berachain's token distribution mechanism. Early contributors received 16.82% of the total supply, while private placement investors obtained an astonishing 34.31% of the tokens, making it a very typical VC-driven token. Moreover, NFT holders could receive up to millions of dollars worth of tokens, while testnet users only received a $60 airdrop, sparking controversy over "wealth disparity" and marginalizing some loyal users.

This goes against the slogan of "retail investors first." The project is essentially a VC-dominated model with low liquidity and high FDV (Fully Diluted Valuation). Early investors entered at $0.82 and gained 10-15 times returns, while retail investors bore the crash. Foundation founder Smokey admitted that if given a second chance, he would not have sold so many tokens to VCs and has already repurchased some to reduce dilution. In October 2025, the Berachain Foundation launched BeraStrategy in collaboration with Greenlane Holdings, using BERA as a reserve asset, yet it still failed to reverse the coin's downward price trend.

In addition, VC firms such as Brevan Howard's Nova Fund hold a right of refund, allowing them to request a full refund of $25 million until February 2026, further highlighting Berachain's favoritism toward VCs.

Community dissatisfaction is rising, with many users calling it the "ultimate fraud L1."

On February 6 of this year, Berachain will unlock 63.75 million BERA tokens, accounting for approximately 12.16% of the current circulating supply, with private investors alone unlocking 28.58 million tokens. Starting from March this year, 2.53% of the total BERA supply will be unlocked each month. Considering the current liquidity shortage, these large-scale unlocks throughout the year may potentially create significant selling pressure.

Click to learn about BlockBeats' job openings.

Welcome to join the official Lulin BlockBeats community:

Telegram Subscription Group:https://t.me/theblockbeats

Telegram discussion group:https://t.me/BlockBeats_App

Official Twitter account:https://twitter.com/BlockBeatsAsia