Author: Frank, MSX Researcher at Maitong

For the same set of data, do you trust human interpretation or AI "divination"?

It sounds like a cyberpunk joke, but in today's world, where opinions are as numerous as hair and highly emotional, what the market lacks most is precisely unpolished, authentic sample data that hasn't had time to be refined.

After all, positions can really make people lie.

At the turn of the year,To get as close as possible to the reality of tokenization/Web3 at this turning point in 2025-2026, we conducted an anonymous survey targeting the frontline builder community, specifically focusing on the Metanet MSX.Mainly focusing on three issues:

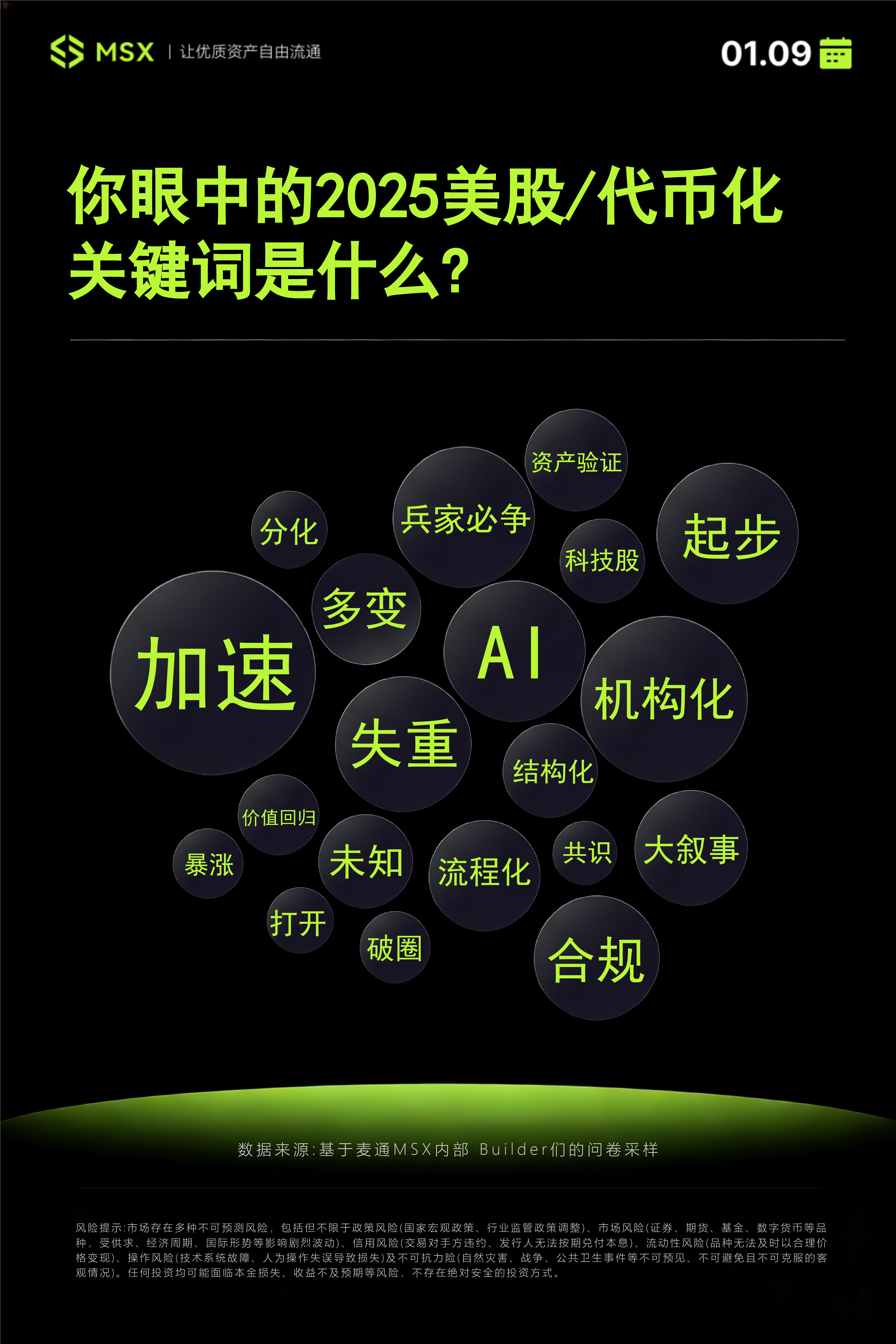

- What are the key words for the US stock market and tokenization in your eyes in 2025?

- Your actual holdings in 2025 (not limited to U.S. stocks / Web3);

- The directions you are most willing to allocate resources to in 2026 (not limited to U.S. stocks/Web3);

After a series of "persuasive" efforts, we managed to collect a sample size that was, at least, somewhat satisfactory. We then compressed the data into three word clouds that are almost entirely free from subjective judgment. It was precisely because we recognized that human interpretation inevitably involves bias that we decided...Invite the "pure" ChatGPT, Gemini, and DeepSeek to cast a divination for these three word cloud images under exactly the same prompt constraints.

Perhaps AI actually understands this generation of builders better than we do ourselves, and is even more capable of piecing together the fragmented clues to form a picture of the fate of U.S. stocks, Web3, and tokenization by 2026.

1. What are the key words you associate with the U.S. stock market/tokenization in 2025?

Prompt:You will see a set of keyword samples from practitioners in the U.S. stock tokenization/Web3 field, these keywords are used to answer the same question: "What do you see the U.S. stock/tokenization field like in 2025?" Do not judge right or wrong, and do not introduce any external market information. Based solely on these keywords themselves, analyze from the perspective of data structure and language features, and focus on answering:

Which keywords have the highest/lowest frequencies or appear particularly out of place, and what might these reflect in terms of structural characteristics? Which keywords or semantic directions show clear consensus features? Are there any keyword pairs with similar meanings, opposing directions, or strong tensions? Overall, what stage characteristics do these keywords suggest the industry is in? If we consider only these keywords and do not introduce any external information, how would you understand this industry in 2025 and 2026?

Please maintain a descriptive and restrained analytical tone, avoid providing investment advice or definitive judgments, and keep the response under 1,000 words.

Editor's note: The responses have been slightly edited and polished to improve readability, but the overall direction and ideas remain largely unchanged (the same applies below).

ChatGPT:The most frequent keywords are concentrated on "acceleration" and "institutionalization," suggesting that the industry is undergoing a process marked by a significantly changed pace but not yet stabilized. Mid-frequency keywords such as "AI," "compliance," and "differentiation" reflect a more background and normalized presence. Low-frequency or isolated terms like "weightlessness," "uncertainty," "strategic battleground," and "initial stage" carry strong subjective feelings or emotional metaphors, possibly reflecting individuals' direct projections of discomfort, competitiveness, or uncertainty in response to structural changes.

The overall corpus exhibits linguistic characteristics of the "early to mid-stage—structural development phase,"Among these, the frequency of verbs exceeds that of nouns, indicating that the focus of discussion remains on processes and changes rather than stable forms. Multiple key terms point to rules, verification, and procedures, rather than specific products or models. Emotional vocabulary exists but does not dominate, suggesting that uncertainty is perceived but has not yet spiraled out of control.

If we base our judgment solely on these keywords themselves, it is possible that...Understand 2025 as a transitional year characterized by acceleration yet without a fixed shape, where consensus is gathering but differentiation is also occurring simultaneously.

Gemini:High-frequency terms such as "acceleration" and "institutionalization" indicate a strong consensus on growth following the involvement of professional forces. Mid-frequency terms like "AI," "compliance," and "differentiation" outline the current state of technological tools, regulatory frameworks, and uneven market performance. More abrupt low-frequency terms such as "weightlessness," "proceduralization," and "asset verification" reflect underlying anxieties beneath the surface prosperity, as well as a micro-perspective shift from narratives to practical implementation.

The overall data reflects a state of "high momentum and low center of gravity," where the coexistence of "institutionalization" and "compliance" indicates that this acceleration is not driven by blind expansion, but rather by a rule-bound structural shift. This also establishes a tone of certainty for the industry.

Considering the overall characteristics of the keywords,This track is currently in a "transitional boom" phase, characterized by a mix of the chaos (disorientation, uncertainty) of the early stages and the rigor (compliance, standardization) of the pre-mature phase. The market is no longer a monolithic entity but is showing clear signs of "differentiation."Tokenization is no longer an isolated asset experiment but is beginning to integrate deeply with mainstream finance and cutting-edge technologies.

Overall, from 2025 to 2026, this will be a pivotal moment for professional entry, characterized by a frantic rush amid anxiety, reshaping within regulations, and an extreme reliance on technological validation.

DeepSeek:"Acceleration" occupies an absolute central position, while "institutionalization," "differentiation," "compliance," and "AI" form the second tier. Most terms appear only once, exhibiting a dispersed long-tail pattern. For example, the term "weightlessness" stands out in a context dominated by dynamic and positive vocabulary (such as acceleration, opening up, and breaking boundaries), possibly metaphorically implying a temporary loss of traditional reference points amid rapid change.

Among these, "institutionalization" and "compliance" are closely related in meaning, jointly indicating a trend toward deeper involvement of rules and participants from the traditional financial system; "differentiation," on the other hand, implies the potential emergence of stratification or divergence in paths within the market or specific sectors.

The dynamism of track development (acceleration, variability, volatility) and the institutionalization process (institutionalization, compliance, proceduralization, structuring) form two strongest consensus-based semantic directions.

They run in parallel, depicting a field seeking to establish rules and structures amidst rapid change.

II. Your actual holdings in 2025 (not limited to U.S. stocks/Web3)

Prompt:You will see a set of keyword samples from practitioners on the front lines of U.S. stock tokenization and Web3. These keywords are used to answer the same question: "What are your actual holdings in 2025 (not limited to U.S. stocks/Web3)?" Do not judge right or wrong, and do not introduce any external market information. Based solely on the composition of the samples, perform a logical analysis from a data structure perspective:

Classify the assets or sectors involved; are there any core assets that are repeatedly allocated? Is the overall portfolio more concentrated or diversified, and what does this reveal about the risk tolerance? From these actual holdings, can we observe any behavioral characteristics?

Please maintain a descriptive and restrained analytical tone, avoid providing investment advice or definitive judgments, and keep the response under 1,000 words.

ChatGPT:From the sample structure, the holdings can be clearly divided into several asset clusters.

- Encrypted Native Assets:High-frequency keywords include BTC, ETH, SOL, BNB, USDT, and USDC, while secondary or marginal ones include XRP, DOGE, ASTER, SUPRA, and XTTA. This category has a clear advantage in terms of quantity and repetition, and it includes both mainstream assets and exploratory configurations internally.

- U.S. tech and financial sectors:It includes both technology/platform-based companies—GOOGL, AAPL, AMZN, NVDA, TSLA, PLTR, INTC, TSM, MU, WDC—and finance/trading-related companies—COIN, HOOD—showing a preference for infrastructure, platforms, and technological capabilities.

- U.S. stocks' consumer and traditional defensive sectors:MCD, KO, LLY, JD, etc.—not numerous, but clearly playing a structural hedging or stabilizing role;

- Indices and Cash-like / Safe-haven Assets:VOO, gold, USDT, USDC, etc., provide liquidity and volatility buffers within the overall portfolio;

From the perspective of recurrence frequency, there is a very clear core asset layer:

- BTC is the single underlying asset that appears most frequently in the sample, appearing multiple times in a dense manner;

- GOOGL has the highest repetition on the US stock side, significantly higher than other tech stocks;

- ETH, SOL, and BNB form a second-layer reconfigured cryptocurrency asset portfolio;

- USDT is also mentioned multiple times as a non-risky asset, indicating that it is not a "transitional existence";

This structure indicates that respondents are not evenly distributing their holdings, but instead repeatedly concentrating in a few high-confidence assets, while maintaining diversified attempts on the periphery.

If based solely on this set of real position keywords, without introducing any external judgment, it can be understood as a kind ofAnchor on a few core assets, configure in parallel across multiple asset systems, while maintaining liquidity and room for exploration.combination structure.

Gemini:By initially organizing the sample data, these holdings can be categorized into the following five major types.

The data structure reveals an extremely significant consensus centralization phenomenon within this group. Among them, BTC is the most frequently mentioned asset, followed by GOOGL, ETH, and SOL. These four assets form the "four corner anchors" of practitioners' holdings in 2025.

The high-frequency appearances of BNB, TSLA, and USDT also reflect a dual consideration of industry ecosystem position and liquidity while pursuing high beta returns.

Although the range of underlying assets is diverse, about 50% of the sample is concentrated in the top 5-6 core assets. This suggests that industry participants' strategies for 2025 are not broadly diversified, but rather heavily focused on blue-chip assets with strong narrative support.

Specifically, risk tolerance strategies can be summarized as a barbell approach: one end consists of highly volatile assets such as tech growth stocks and cryptocurrencies, for example, RKLB (aerospace), SOL, and various semiconductor-related assets; the other end consists of highly liquid or certain assets, such as USDT, gold, and VOO (S&P 500 ETF).

Although the sample includes traditional value stocks such as MCD (McDonald's) and KO (Coca-Cola), they are only minor components, indicating that...In the 2025 investment logic, traditional dividend-paying assets have been marginalized.Practitioners are more inclined to define "value regression" as "technology growth supported by cash flow."

DeepSeek:The positions held in the sample can be roughly categorized into three types:

- Cryptocurrency:Including BTC, ETH, SOL, BNB, XRP, DOGE, and others, these assets appear frequently and cover both major cryptocurrencies and some altcoins;

- Stablecoins and Commodities:Stablecoins like USDT and USDC, and commodities like gold, are typically associated with risk-hedging or liquidity management due to their lower price volatility;

- U.S. stocks cover multiple industries and market capitalizations:Including tech stocks—GOOGL (Google), AAPL (Apple), TSLA (Tesla), NVDA (NVIDIA), COIN (Coinbase), PLTR (Palantir), INTC (Intel), MU (Micron Technology), TSM (TSMC), etc.; consumer and traditional industry stocks, such as MCD (McDonald's), KO (Coca-Cola), LLY (Eli Lilly), etc.; financial and platform stocks, such as HOOD (Robinhood), FIG (possibly a financial group), etc.; ETFs: VOO (S&P 500 Index ETF);

Core assets (BTC, GOOGL, ETH, SOL) account for approximately 37% of the total occurrences, resulting in a portfolio structure characterized by "core concentration and peripheral diversification."This means having a heavy allocation in core assets while also diversifying investments across many other targets.

Overall, the position sample data structure demonstrates a configuration approach that seeks a balance between risk and opportunity. It focuses on core sectors while building a buffer through diversification and risk-hedging instruments.

Third, the directions you are most willing to allocate resources to in 2026 (not limited to U.S. stocks/Web3)

Prompt:You will see a set of keyword samples from practitioners in the tokenized U.S. stock/Web3 space, who provided these keywords in response to the same question: "What direction (not limited to U.S. stocks/Web3) are you most willing to allocate to in 2026?" Do not judge right or wrong, and do not introduce any external market information. Based solely on the composition of the samples, perform a logical analysis from a data structure perspective:

Classify the assets or sectors involved; in 2026, which sectors or specific assets will these investors prefer? Are there core assets that are repeatedly allocated? Is the overall portfolio more concentrated or diversified, and what does this reveal about their risk tolerance? From these actual holdings, can we observe any behavioral patterns? What are the most widely agreed-upon assets or sectors in 2025 and 2026, respectively, and what changes occur between the two years?

Please maintain a descriptive and restrained analytical tone, avoid providing investment advice or definitive judgments, and keep the response under 1,000 words.

ChatGPT:Compared to 2025, the keywords for 2026 show a notable shift:Specific targets and abstract tracks began to appear side by side,When expressing their willingness to configure, respondents place more emphasis on.Directionality and Structural JudgmentRather than a single asset selection.

The samples can be roughly divided into the following categories:

- Encrypted Native Assets:BTC, ETH, and SOL are core high-frequency terms, while stablecoins and MEME cryptocurrencies still occupy the center of the sample, but a clear internal hierarchy is emerging.

- U.S. tech and high-tech sector:At the individual stock level, the focus is on TSLA, GOOGL, NVDA, AMZN, PLTR, and HOOD. At the industry level, the focus is on tech stocks, semiconductors, storage, and aerospace, showing a very clear transition from "stock selection" to "industry direction."

- Commodities and Physical Assets:Precious metals (gold, silver, copper) and oil, which were not prominent in the 2025 sample, were systematically mentioned in the 2026 intentions.

- Index and Hedging Instruments:S&P and SQQQ represent concerns regarding overall market or systematic volatility;

In terms of repetition, the core focus for 2026 is highly concentrated: BTC remains the keyword with the highest frequency, significantly outpacing other assets; TSLA and NVDA repeatedly appear on the U.S. stock side, clearly surpassing other individual stocks in frequency.

If based solely on this set of keywords, the configuration intentions for 2026 can be understood as focusing on a small number of core assets and industrial directions with high consensus, while adopting structural allocation tendencies to address uncertainties through specialized sectors, resource-based strategies, and tool-based approaches.

Gemini:The sample data from 2026 shows a broader range compared to 2025, and can mainly be categorized into the following four types:

In the 2026 sample, BTC was mentioned more than half the time, making it the only asset with a characteristic of full consensus. TSLA and RKLB/aerospace followed closely behind. Compared to 2025, practitioners showed a significantly stronger willingness to allocate resources to hard-core technologies and outer space exploration, indicating that the investment horizon is expanding from digitalization to the extreme frontiers of the physical world.

The position structure presents a "bell-shaped" configuration of "one dominant pole and multiple strong ones." One pole is the highly concentrated BTC, while the other pole consists of highly diversified hard-tech assets (covering multiple sub-sectors such as aerospace, storage, and semiconductors).

The risk tolerance approach is characterized by the coexistence of "extreme aggressiveness and extreme defense." On one hand, high-volatility assets such as MEME and RKLB are allocated; on the other hand, hedging instruments like SQQQ, gold, silver, copper, and oil are introduced. This indicates that professionals in 2026 are not expecting a one-sided upward trend, but rather structural opportunities amid significant volatility. Their risk tolerance approach has shifted from a singular pursuit of growth to managing uncertainty.

Overall,In the keywords for 2026, the density of gold, silver, copper, oil, storage, and aerospace has increased significantly, reflecting that professionals, after deep engagement in the digital arena (Web3), are beginning to shift their focus toward tangible assets and fundamental energy/resources.

Deep exploration of the industrial chain is another typical characteristic. Respondents are no longer content with merely allocating investments to leading chip stocks like NVIDIA (NVDA), but instead extend their focus downward to companies such as Micron (MU), Western Digital (WDC), and SanDisk (SNDK), which operate in storage and specific hardware segments. This reflects a professional and in-depth investment behavior grounded in industry understanding.

If 2025 is the year where professionals are "building roads" (focusing on compliance, platforms, and infrastructure), then 2026 will be the year of the "expedition" (focusing on aerospace, deep hardware, and global bulk resources).

DeepSeek:From the word frequency statistics, BTC has the highest frequency, accounting for 20.4% of the total mentions, followed closely by TSLA (9.3%). Together, they make up about 30%, indicating a relatively concentrated top preference. NVDA, RKLB, GOOGL, HOOD, stablecoins, and precious metals are also mentioned multiple times, but overall, the mentions remain dispersed across many assets and themes, forming a "core-periphery" structure—where the core is highly concentrated in a few assets, and the periphery is broadly diversified.

Among themCryptocurrencies (especially BTC) and tech stocks (such as TSLA, NVDA, etc.) are the main focus, while thematic sectors like aerospace (represented by RKLB), semiconductors, storage, as well as safe-haven assets such as precious metals and stablecoins are also receiving attention.

Notably, the allocation to stablecoins, precious metals (gold, silver, copper), oil, and SQQQ is more pronounced compared to the 2025 portfolio sample, indicating a defensive posture against macroeconomic uncertainty or market corrections.

At the individual stock/underlying asset level, compared to 2025, the consensus on BTC has further strengthened, maintaining its position as the absolute core; meanwhile, The consensus for GOOGL, ETH, and SOL has significantly decreased, while the consensus for TSLA and NVDA has increased.This may reflect a shift in configuration focus from dispersed cryptocurrencies and large tech stocks toward a more concentrated set of leading specific stocks.

At the track level, the configuration direction has expanded to thematic tracks (aerospace, chips, storage) and commodities (precious metals, oil), with consensus spreading from specific assets to diversified themes.

Overall, the data structure shows that from 2025 to 2026,The configuration of consensus has evolved from a broad layout in cryptocurrencies and tech stocks toward strengthening Bitcoin's core, focusing on specific technology targets, and increasing thematic investments and hedging allocations.Reflecting the adjustment of investors' strategies in the evolution of the market: seeking a balance between growth and defense amid uncertainty.