Original Author:Ryan Yoon, Tiger Research

Original Translation: Saoirse, Foresight News

99% of Web3 projects do not generate cash revenue. However, many companies still spend large sums of money on marketing and events each month. This article will delve into the survival rules of these projects and uncover the truth behind the "spending sprees."

Key Points

- 99% of Web3 projects lack cash flow, and their cost expenditures rely on tokens and external funding, rather than revenue from product sales.

- An early initial coin offering (ICO) can lead to a surge in marketing expenses, which in turn can weaken the competitiveness of the core product.

- The reasonable P/E ratio of the top 1% of projects demonstrates that the remaining projects lack substantial value support.

- Early token generation events (TGEs) allowed founders to "exit" and cash out regardless of whether their projects succeeded or failed, creating a distorted market cycle.

- The "survival" of 99% of projects essentially stems from a systemic flaw that is built upon investors' losses rather than the profitability of businesses.

Prerequisite for survival: Must have verified income capability.

"The prerequisite for survival is having a proven ability to generate revenue"—this is currently the most crucial warning in the Web3 space. As the market matures, investors are no longer blindly chasing vague 'visions.' If a project cannot attract real users and achieve actual sales, token holders will quickly sell off and exit.

The key issue is the "cash conversion cycle," which refers to the length of time a project can continue operating without generating profits. Even without sales, fixed costs such as salaries and server expenses must be paid monthly. A team with no income has almost no legal means to maintain its operating funds.

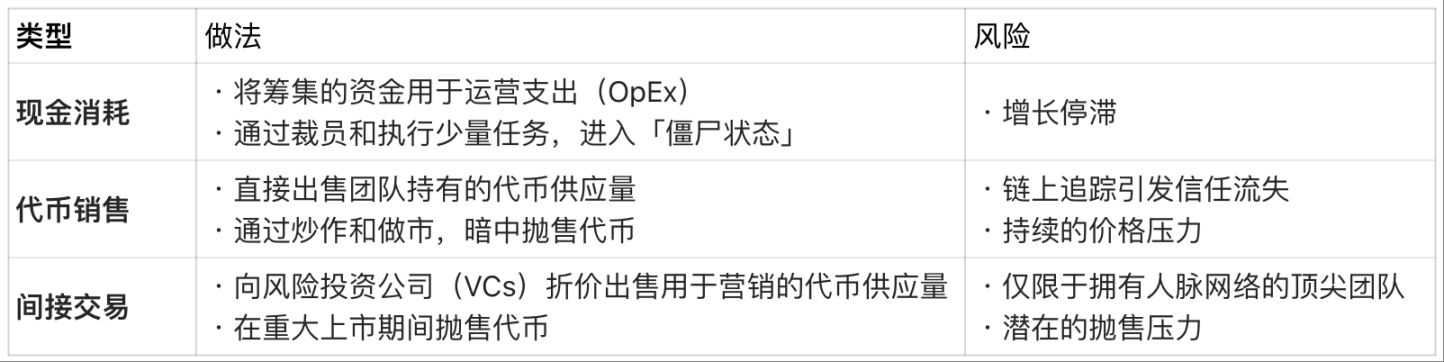

Cost of financing under no-income scenarios:

However, this "reliance on tokens and external funding to stay afloat" is merely a stopgap solution. Both the assets and token supply have clear upper limits. Ultimately, projects that exhaust all funding sources will either cease operations or quietly exit the market.

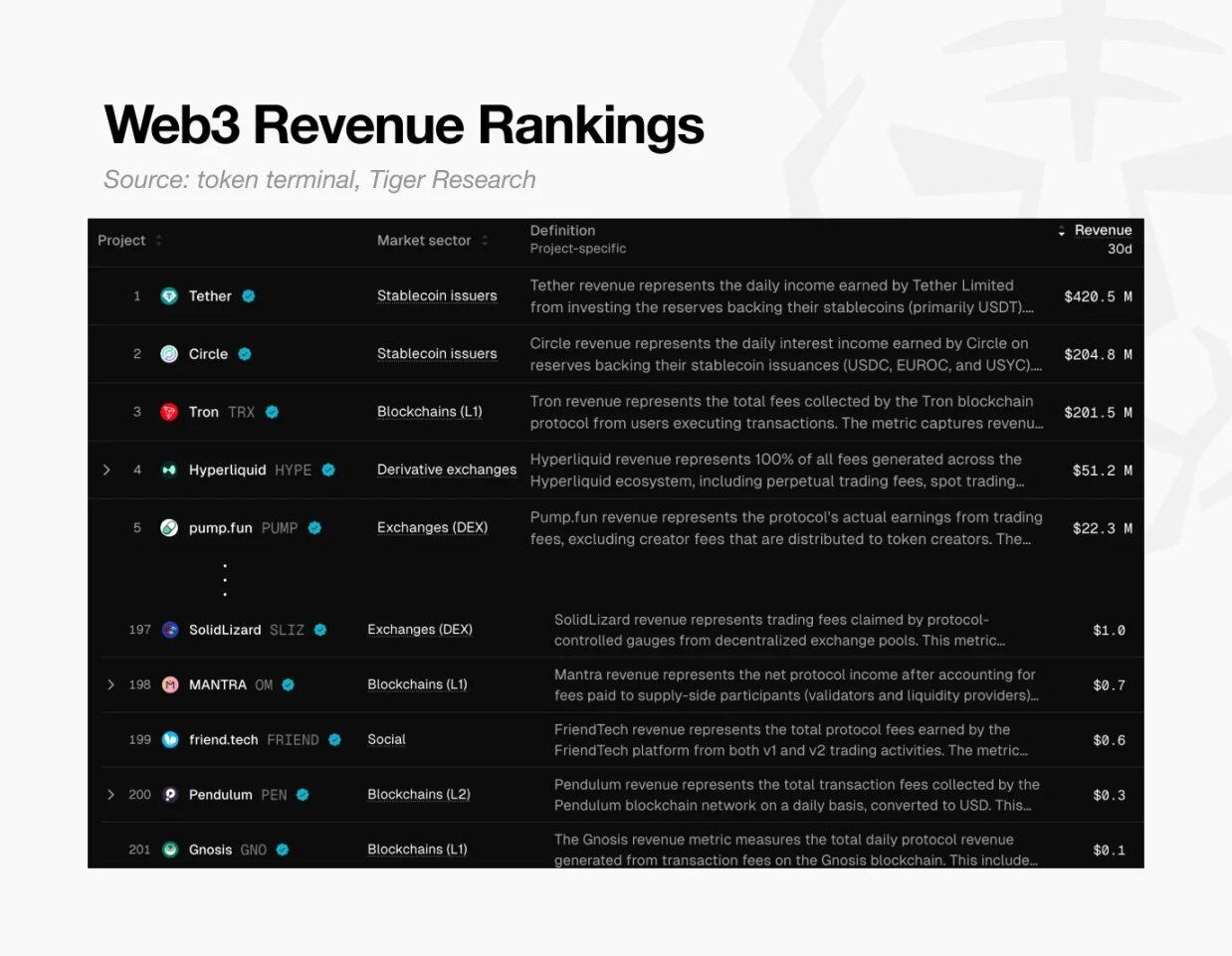

Web3 Revenue Rankings, Source: Token Terminal and Tiger Research

This crisis is widespread. According to data from Token Terminal, globally, only about 200 Web3 projects have generated revenue of $0.10 or more in the past 30 days.

This means that 99% of the projects don't even have the ability to cover their basic costs. In short, almost all cryptocurrency projects have failed to validate the viability of their business models and are gradually heading toward decline.

High Valuation Trap

This crisis was largely predetermined. Most Web3 projects complete their "token launches" (token sales) based solely on a "vision," without even having a tangible product. This contrasts sharply with traditional companies, which must demonstrate their growth potential before going public (IPO). In the Web3 space, however, teams often justify their high valuations only after the token launch (TGE).

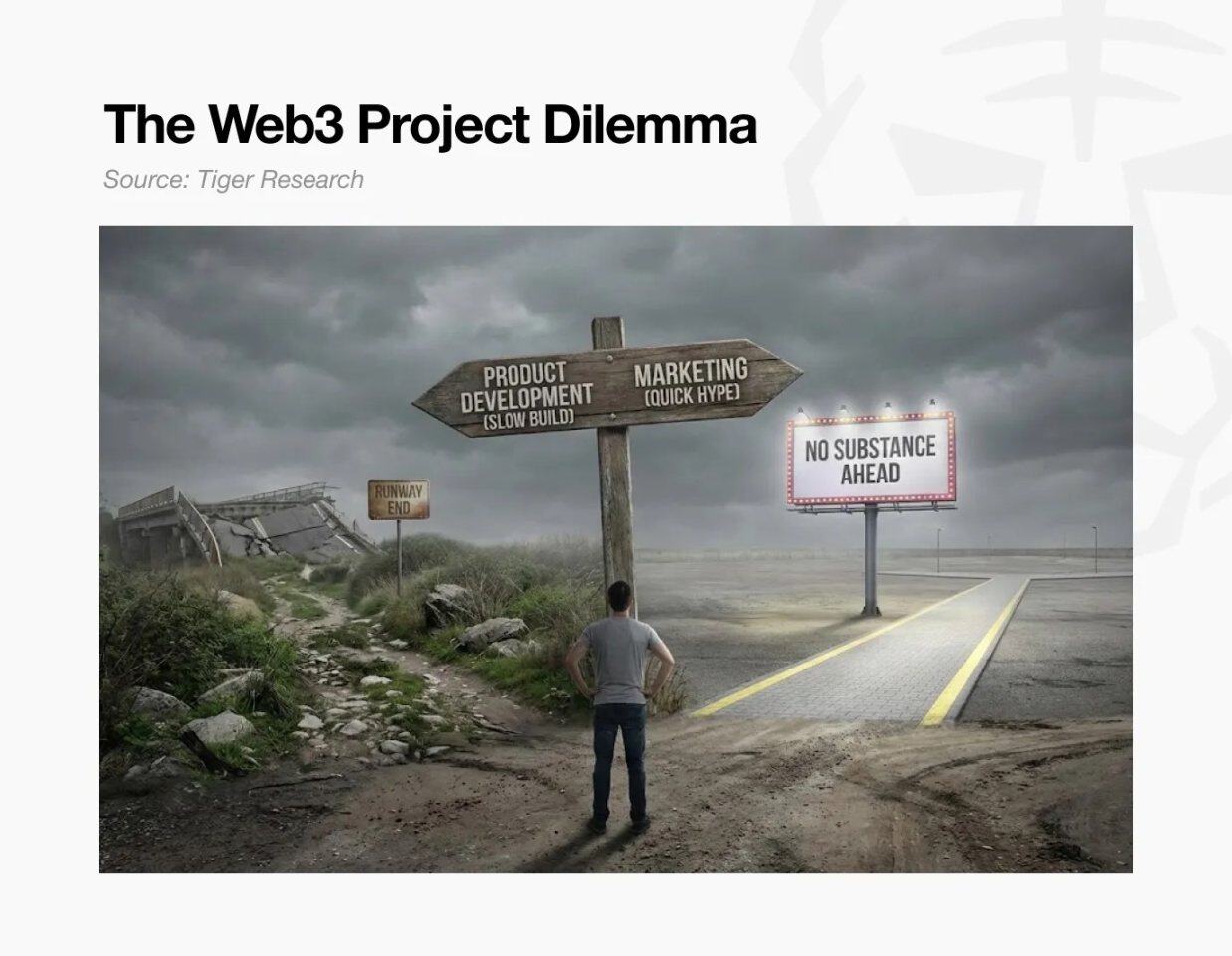

However, token holders will not wait indefinitely. As new projects emerge daily, if a project fails to meet expectations, holders will quickly sell off their tokens. This puts downward pressure on the token's price and threatens the project's survival. As a result, most projects tend to invest more funds into short-term hype rather than long-term product development. Obviously, if the product itself lacks competitiveness, even the most intensive marketing efforts will eventually become ineffective.

At this point, the project has fallen into a "dilemma trap":

At this point, the project has fallen into a "dilemma trap":

- If focusing solely on product development: it will consume a significant amount of time, and during this period, market attention will gradually fade, and the cash conversion cycle will also continuously shorten;

- If focusing solely on short-term hype, the project will become hollow and lack substantial value support.

Both paths ultimately lead to failure—the project is unable to justify its initially high valuation and eventually collapses.

See the truth of the 99% through the top 1%.

However, 1% of top projects have still demonstrated the viability of the Web3 model through substantial revenues.

We can assess the value of major profitable projects like Hyperliquid and Pump.fun by examining their price-to-earnings ratios (PER). The PER is calculated as "Market Cap ÷ Annual Revenue," and this metric reflects whether the project's valuation is reasonable relative to its actual revenue.

P/E Ratio Comparison: Top Web3 Projects (2025):

Note: Hyperliquid's sales figures are annualized estimates based on performance since June 2025.

The data shows that the price-to-earnings (P/E) ratios of profitable projects range from 1 to 17 times. In comparison to the S&P 500's average P/E ratio of about 31 times, these leading Web3 projects are either "undervalued relative to their sales" or have "exceptionally strong cash flow positions."

The fact that top projects with real earnings can maintain reasonable price-to-earnings ratios actually makes the valuations of the remaining 99% of projects seem unsustainable—it directly proves that the high valuations of most projects in the market lack a solid foundation of real value.

Can this distorted cycle be broken?

Why do projects with no sales still maintain billion-dollar valuations? For many founders, product quality is secondary—Web3's distorted structure makes "quick exits for profit" far easier than "building real businesses."

Ryan and Jay's cases perfectly illustrate this point: both initiated AAA-level game projects, but their final outcomes were completely different.

Founder Differences: Web3 vs. Traditional Models

Ryan: Choose TGE, abandon deep development

He chose a path centered on "profitability": before the game's launch, he raised early funds by selling NFTs; then, while the product was still in a rough development stage, he held a token generation event (TGE) based solely on an aggressive roadmap and successfully listed on a mid-sized exchange.

After the token's launch, he maintained its price through hype, buying himself time. Although the game's release was eventually delayed, the product quality was extremely poor, prompting holders to sell off their tokens in droves. Ryan eventually resigned, citing "taking responsibility," but he was actually the true winner of this whole game ——

On the surface, he appeared to be focused on his work, but in reality, he was earning a high salary while making substantial profits by selling unlocked tokens. Regardless of the project's ultimate success or failure, he quickly accumulated wealth and exited the market.

In contrast, Jay follows the traditional path and focuses on the product itself.

He prioritized product quality over short-term hype. However, developing an AAA game takes several years, during which his funds gradually ran out, leading him into a "cash flow crisis."

In the traditional model, founders can only achieve significant returns after the product is launched and sales are realized. Although Jay raised funds through multiple rounds of financing, the company ultimately had to shut down before the game was completed due to a lack of capital. Unlike Ryan, Jay not only failed to gain any profit but also accumulated substantial debt and left a record of failure.

Who is the real winner?

Neither case produced a successful product, but the winner is clear: Ryan accumulated wealth by exploiting Web3's distorted valuation system, while Jay lost everything in his attempt to build a quality product.

This is the harsh reality of the current Web3 market: it's far easier to exit early by capitalizing on overvaluation than to build a sustainable business model. In the end, the cost of this "failure" is entirely borne by the investors.

Back to the original question: "How do 99% of unprofitable Web3 projects survive?"

This harsh reality is the most honest answer to the question.