- Aave: Leading DeFi lending platform offering open borrowing and earning opportunities without traditional financial barriers.

- Polygon: Ethereum scaling network delivering faster transactions and lower fees for high volume decentralized applications.

- Chainlink: Oracle network supplying trusted real world data to smart contracts across multiple industries.

Ethereum Network is home to some of the most practical blockchain projects today. Many ERC-20 tokens support real products used daily across decentralized finance and Web3 services. These projects focus on lending, scaling, and data access, which remain core needs across the crypto market. Several networks already serve millions of users worldwide. Among them, Aave, Polygon, and Chainlink stand out for strong fundamentals, proven adoption, and clear long term utility heading into 2026.

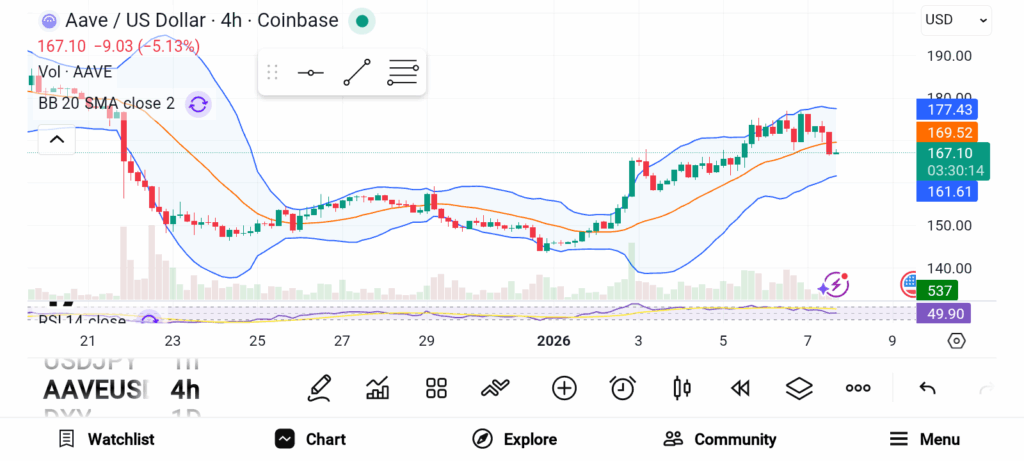

Aave (AAVE)

Aave ranks as the largest decentralized lending protocol by total value locked. The platform allows users to lend and borrow digital assets without relying on banks or intermediaries. Smart contracts manage every agreement, creating a transparent and automated lending system. This design removes the need for account approval, identity verification, or credit history. Many users in underbanked regions benefit from open access to capital.

The protocol supports major assets such as ETH, WBTC, and USDT. Lenders deposit tokens into liquidity pools that power borrowing activity. Borrowers access funds directly from those pools by providing collateral. Lenders earn interest based on demand within each pool. Withdrawals remain flexible, allowing users to access funds at any time.

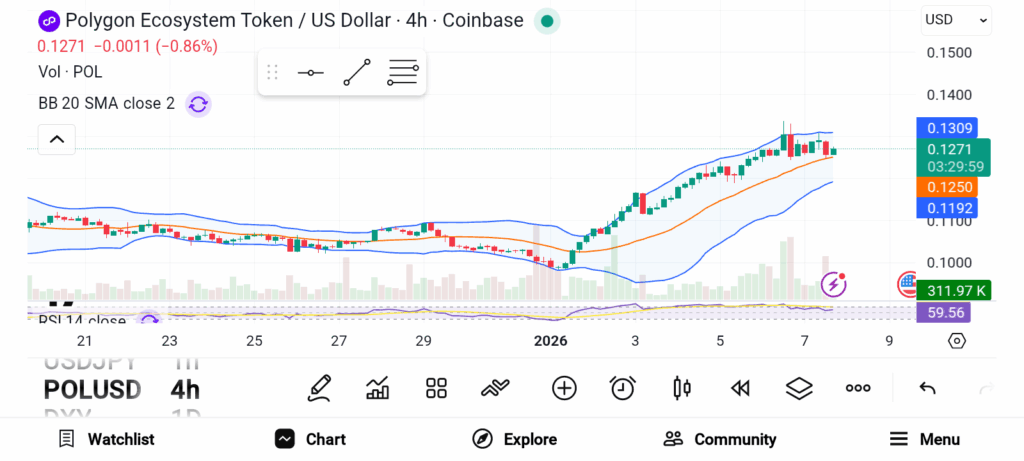

Polygon (POL)

Polygon is a scaling solution built for Ethereum applications. Ethereum processes a limited number of transactions per second, which creates congestion and high fees during peak activity. Polygon addresses this issue through a sidechain framework that processes transactions off the main Ethereum network. This structure allows faster confirmations and much lower transaction costs.

The network claims support for extremely high transaction throughput, though real usage remains far lower. Even so, current capacity easily meets demand from developers and users. Low fees make Polygon attractive for decentralized exchanges, gaming platforms, and play to earn projects. Many applications rely on frequent transactions, which become costly on Ethereum alone.

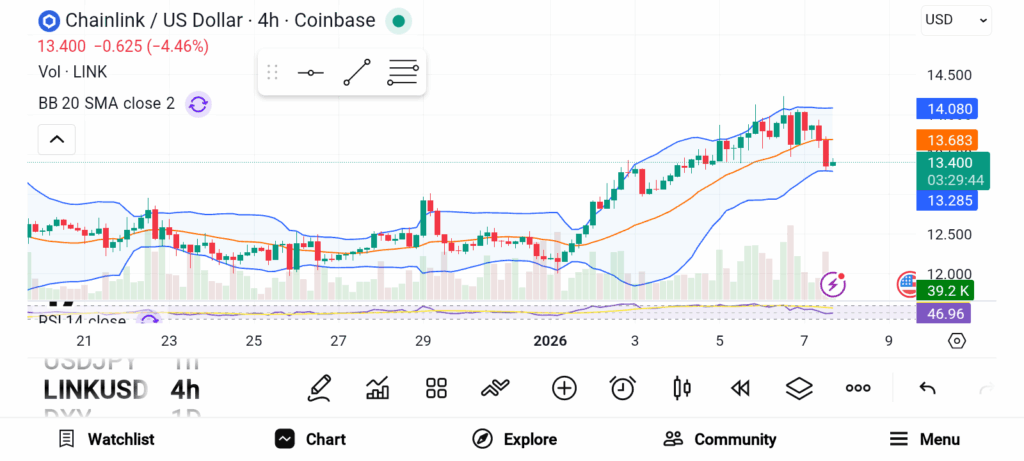

Chainlink (LINK)

Chainlink provides a critical service for decentralized applications. Smart contracts often require access to real world data such as prices, weather conditions, or event outcomes. Blockchain networks cannot retrieve this information independently. Chainlink solves this problem through a decentralized oracle network that delivers verified external data to smart contracts.

Multiple trusted data providers submit information from reliable sources. The network compares submissions to reach consensus on accuracy. Honest providers receive LINK rewards, while dishonest behavior leads to penalties. This system maintains trust without central control. Many industries rely on oracle data, including insurance, supply chain management, healthcare, prediction markets, and banking.

Aave delivers open access lending without traditional financial barriers. Polygon improves Ethereum usability through faster and cheaper transactions. Chainlink connects smart contracts with real world data. Together, these ERC20 projects offer strong fundamentals and long term relevance for 2026.