The 2025 crypto bull run has brought unprecedented excitement to the DeFi ecosystem, with Solana taking center stage. Powered by the memecoin mania driven by Pump.fun and an impending altcoin season, activity on Solana's blockchain is reaching new heights. Over the past year, Solana’s total value locked (TVL) has skyrocketed from under $1.5 billion to an impressive $11.5 billion as of January 2025.

Jupiter TVL | Source: DefiLlama

Amid this explosive growth, Jupiter (JUP) stands out as a cornerstone of Solana’s DeFi infrastructure. As the third-largest DeFi protocol on Solana, Jupiter boasts a TVL exceeding $2.8 billion, trailing only Jito and Raydium. Offering seamless token swaps, advanced trading features, and innovative tools like liquid staking, Jupiter has become a go-to platform for traders navigating the growing Solana ecosystem. Whether you’re swapping memecoins or managing complex trading strategies, Jupiter provides the tools to maximize your DeFi experience.

What Is Jupiter (JUP) DEX Aggregator on Solana?

Jupiter is a powerful DEX aggregator designed to simplify token swaps on the Solana blockchain. It connects multiple decentralized exchanges (DEXs) and liquidity pools, allowing users to access the best prices for their trades in one place. Launched in 2021, Jupiter has grown into a key player in the Solana ecosystem, catering to millions of traders worldwide. Its fast, cost-effective, and user-friendly interface makes it a preferred choice for DeFi enthusiasts.

Jupiter’s key features include:

-

Aggregating liquidity from over 20 Solana-based DEXs.

-

Advanced tools like limit orders and dollar-cost averaging (DCA).

-

A vibrant community supported by its governance token, JUP.

How Does Jupiter Decentralized Exchange Work?

Jupiter operates as a liquidity aggregator, meaning it gathers data from various DEXs to find the most efficient trading routes. Here’s how it works:

-

Trade Routing: Jupiter’s algorithm identifies the best paths for token swaps across multiple liquidity pools.

-

Efficient Execution: It reduces slippage by splitting trades into smaller transactions across various pools, ensuring users get optimal rates.

-

Integration with Solana: Leveraging Solana’s high-speed blockchain, transactions on Jupiter are completed in seconds with minimal fees, often less than $0.01.

Read more: Top Solana DEXs to Watch

What Can You Use Jupiter for?

Jupiter offers a suite of tools and features that cater to traders and investors:

-

Token Swaps: Trade a wide variety of Solana-based tokens at the best rates.

-

Limit Orders: Set specific prices for buying or selling tokens, similar to centralized exchanges.

-

Dollar-Cost Averaging (DCA): Schedule periodic purchases of tokens to mitigate market volatility.

-

Cross-Chain Bridging: Transfer assets between Solana and other blockchains via supported bridges like Wormhole.

-

Perpetual Trading: Access leveraged trading up to 100x through Jupiter’s perpetual platform.

-

Launchpad for New Projects: Participate in the LFG Launchpad, where promising Solana-based projects are introduced to the market.

JUP Token Utility

The JUP token powers Jupiter's ecosystem, offering governance, rewards, and exclusive benefits. Key utilities include:

-

Governance: JUP holders vote on platform decisions via the Jupiter DAO, influencing upgrades, liquidity plans, and ecosystem initiatives.

-

Community Rewards: JUP tokens are distributed through airdrops, trading incentives, and grants to active users.

-

Exclusive Features: JUP unlocks benefits like priority access to LFG Launchpad projects and potential fee reductions.

-

Ecosystem Growth: Tokens support liquidity provision and fund long-term development.

JUP fosters community engagement while driving Jupiter's growth as a leading Solana-based DEX aggregator.

Jupiter (JUP) is listed on KuCoin, where you can buy or sell $JUP with low trading fees and high liquidity.

All About Jupiter (JUP) Airdrop

Jupiter launched its airdrop campaign as a way to reward the most active users on its platform. The JUP token powers Jupiter’s governance and community incentives. The first Jupiter (JUP) airdrop took place on January 31, 2024, distributing 1 billion JUP tokens to eligible users as part of the platform's community reward program. The second season of Jupiter’s airdrop in January 2025 has set aside 700 million JUP tokens for distribution among participants. Here’s what you need to know:

-

Eligibility: Engage with the Jupiter platform by swapping tokens, bridging assets, or participating in community activities.

-

OG Bonus: Early adopters who interacted with Jupiter before March 2022 receive additional rewards.

-

Tokenomics:

-

Total Supply: 10 billion JUP.

-

Community Allocation: 50%, including airdrops, grants, and incentives.

-

How to Check Your Allocation: Use the official Jupiter Airdrop Checker to see if you qualify.

Learn more about the Jupiter Jupuary airdrop here.

How to Get Started with Jupiter

Now that you’ve learned what Jupiter is and how it works, you might want to know how to use it as you explore the Solana ecosystem. Getting started with Jupiter is simple. Follow these steps:

-

Set Up a Wallet: Use a Solana-compatible wallet like Phantom or Solflare.

-

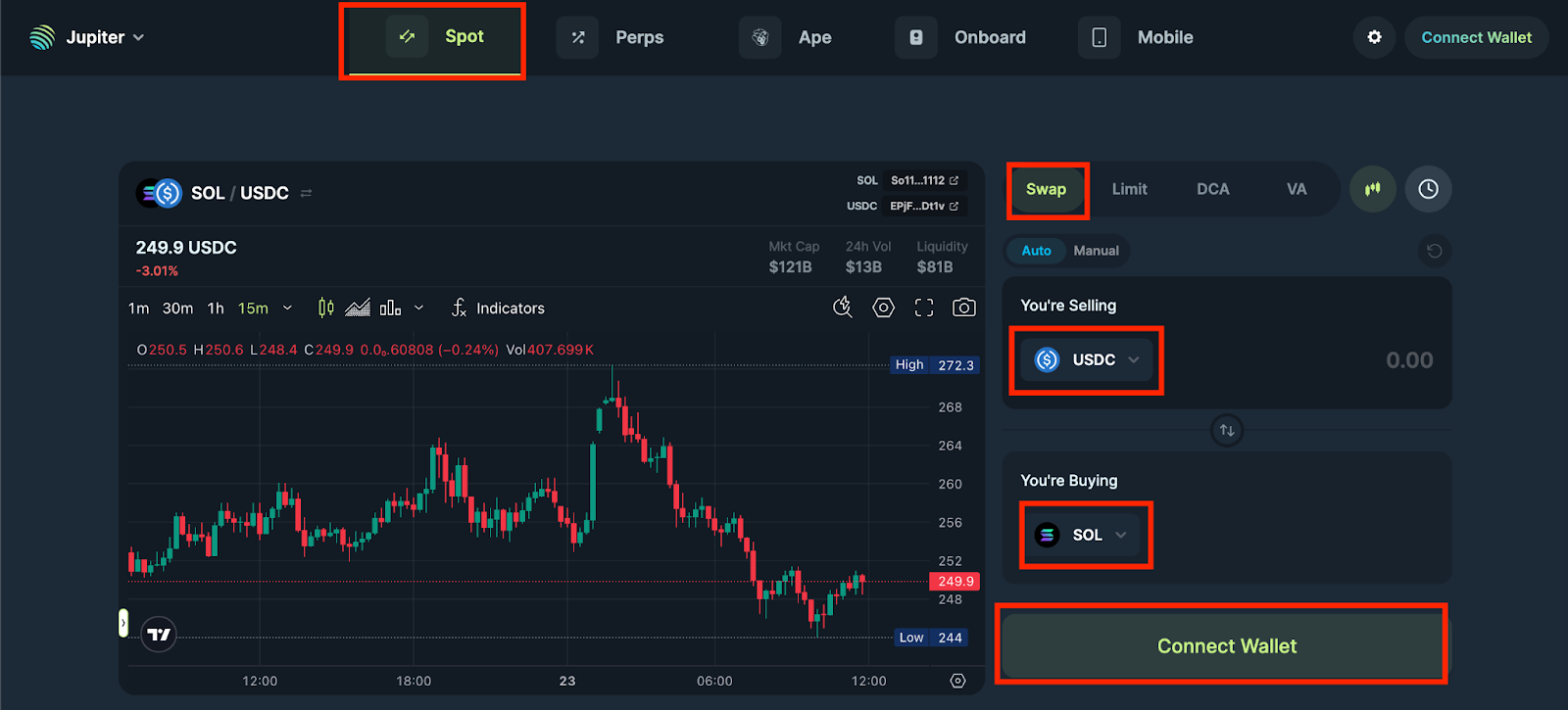

Connect to Jupiter: Visit the Jupiter website. Click "Connect Wallet" and choose your wallet provider.

-

Fund Your Wallet with SOL for Fees: Ensure you have SOL tokens for transaction fees. You can buy Solana tokens on KuCoin and transfer them to your wallet to fund it.

-

Start Trading: Navigate to the "Swap" section for token exchanges. Use advanced tools like limit orders or DCA to enhance your trades. For bridging, select the "Bridge" tab and follow the instructions.

How to Swap Tokens on Jupiter

Swapping tokens on Jupiter is simple and efficient:

-

Connect Your Wallet: Link your Solana wallet like Phantom to Jupiter.

-

Select Tokens: Choose the token pair you want to swap.

-

Enter Amount: Input the amount you wish to trade. Jupiter automatically finds the best route for the swap.

-

Review and Confirm: Check the slippage tolerance and transaction details. Approve the swap in your wallet.

Your tokens will be swapped in seconds, leveraging Jupiter’s aggregated liquidity for optimal rates.

How to Use Jupiter's Value Averaging (VA) Feature

How Jupiter VA works | Source: Jupiter docs

Jupiter's Value Averaging (VA) is an automated investment strategy designed to optimize portfolio growth by adjusting investment amounts based on token price movements. Unlike Dollar-Cost Averaging (DCA), which invests fixed amounts at regular intervals, VA increases investment when prices are low and reduces it when prices are high. Jupiter’s VA feature lets you set growth targets, timeframes, and price ranges, and Jupiter executes trades accordingly, helping balance risk and returns over time.

Value Averaging (VA) helps you build a portfolio by adjusting investment amounts based on market trends:

-

Access VA Feature: Navigate to the VA section on Jupiter’s interface.

-

Set Parameters: Define the token, investment period, and target portfolio growth rate.

-

Enable Pricing Strategy: Toggle to set a price range for automatic adjustments.

-

Start Investing: Approve the transaction, and Jupiter will execute trades periodically based on your strategy.

VA optimizes portfolio growth by investing more when prices are low and less when prices are high.

How to Bridge Cross-Chain Assets with Jupiter

Jupiter’s bridge aggregator simplifies cross-chain asset transfers:

-

Select Bridge: Navigate to the "Bridge" section and choose your source and destination blockchains.

-

Pick Tokens: Choose the asset you wish to bridge, such as USDC or SOL.

-

Review Routes: Jupiter shows multiple bridge options with fees and transaction times. Select the preferred route.

-

Complete Transfer: Approve the transaction and follow the bridge’s instructions to finalize the transfer.

Supported bridges include Wormhole, Mayan Finance, and Debridge.

How to Participate in Jupiter's LFG Launchpad

The LFG Launchpad introduces new Solana-based projects:

-

Connect Your Wallet: Use your wallet to access the LFG Launchpad on Jupiter’s website.

-

Explore Projects: Review listed projects, including their tokenomics and roadmap.

-

Invest in Projects: Stake funds or contribute liquidity to participate in the launchpool.

-

Earn Rewards: Receive tokens from supported projects as a reward for participation.

The launchpad is community-driven, with projects approved through Jupiter DAO votes.

How to Use Jupiter's Liquid Staking Token (JupSOL)

How JupSOL works | Source: Jupiter docs

JupSOL is Jupiter’s liquid staking token, representing staked Solana (SOL) with added earning potential. As of January 2025, JupSOL has a TVL of over $960 million.

JupSOL TVL | Source: DefiLlama

Here’s how to earn higher rewards with liquid staking SOL via Jupiter:

-

Stake SOL: Visit the JupSOL section on Jupiter’s platform and stake your SOL tokens.

-

Receive JupSOL: After staking, you’ll receive JupSOL tokens, which represent your staked SOL and accumulate staking rewards.

-

Earn Rewards: Continue holding JupSOL to earn validator rewards, including MEV (Maximal Extractable Value), minus a small 0.1% deposit fee.

-

Unstake Anytime: You can swap JupSOL back to SOL, allowing flexibility compared to traditional staking.

JupSOL combines staking rewards with liquidity, letting you participate in DeFi activities while earning on your staked assets.

Learn more about how to stake Solana before getting started with JupSOL.

Conclusion

Jupiter is more than just a DEX aggregator—it’s a gateway to the Solana DeFi ecosystem. With features like token swaps, limit orders, and perpetual trading, it empowers users to trade efficiently and securely. Add to that the JUP token and its community-driven approach, and you have a platform that’s shaping the future of DeFi on Solana.

Whether you’re trading meme coins or exploring advanced DeFi tools, Jupiter provides a robust and user-friendly platform. Start your journey today and experience the best of decentralized trading with Jupiter.