Navigating the RWA Revolution: Advanced Insights and Investment Strategies

2025/08/13 12:12:01

The recent launch of world's first Real World Asset (RWA) registry platform in Hong Kong is a pivotal moment that signals the maturation of the digital asset space. This regulatory milestone provides a clear framework for tokenizing tangible assets, effectively bridging the gap between traditional finance and decentralized technology.

For sophisticated investors, this is a clarion call to re-evaluate their portfolios and seize a new wave of opportunities. As the RWA sector gains momentum, platforms that offer a curated selection of assets and advanced trading tools will be essential. KuCoin has positioned itself as a prime destination for this new frontier, providing seasoned investors with the insights and resources needed to navigate the RWA revolution.

Understanding The RWA Catalyst

Image: Linkedin

Hong Kong's RWA registry is a game-changer for several reasons. By providing a legal and transparent system for asset tokenization, it addresses a core challenge that has historically limited the RWA market: trust and regulatory clarity. This move is expected to:

-

Legitimize the Sector: A government-backed registry sets a global precedent, encouraging other jurisdictions to follow suit and fostering institutional adoption.

-

Increase Capital Inflows: Institutional investors, who have been hesitant due to regulatory uncertainty, now have a clear path to participate, bringing significant capital and stability to the market.

-

Drive Innovation: The clear regulatory framework will spur further innovation in asset tokenization, decentralized lending protocols, and other RWA-related financial products.

For the savvy investor, this means the RWA market is poised for explosive growth. The era of high-risk, speculative DeFi is evolving, making way for a more stable, yield-bearing alternative that combines the best of both worlds.

Dissecting the RWA Landscape: A Sector-by-Sector Analysis

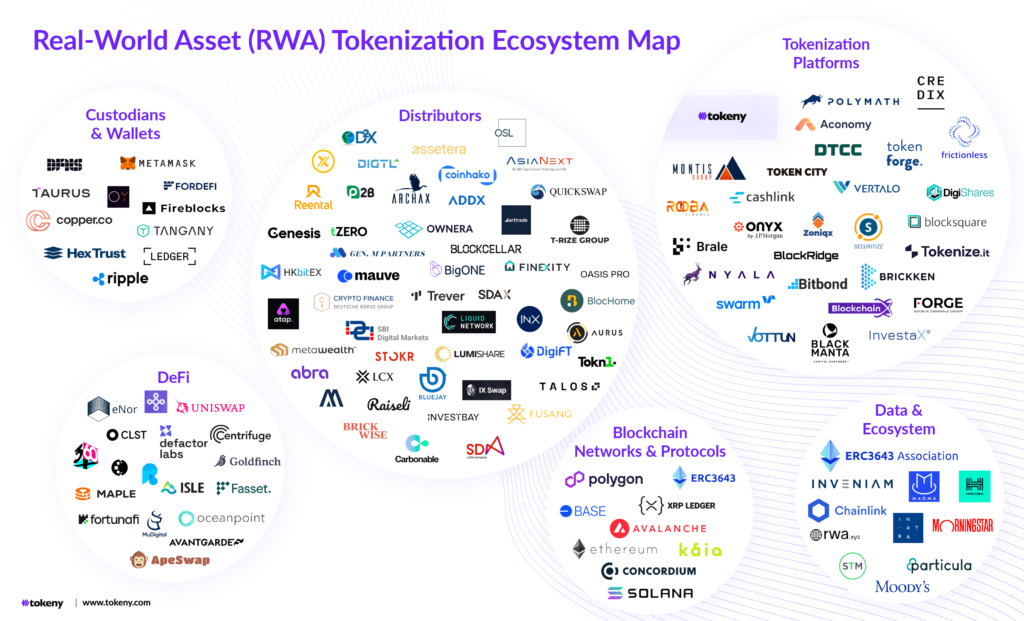

The RWA ecosystem is not monolithic; it's a diverse landscape with various sub-sectors, each with its unique risk and return profile. Smart investors will look beyond the surface to understand where the real value lies.

-

Tokenized Government Bonds: This is arguably the most prominent and secure segment of the RWA market. Projects that tokenize assets like U.S. treasuries offer investors a low-risk, predictable yield tied to real-world interest rates. These are particularly attractive in a high-interest-rate environment and serve as a safe-haven asset within a crypto portfolio.

-

Private Credit: This sector involves tokenizing loans and other forms of private debt. It offers a potentially higher yield than government bonds but comes with greater counterparty risk. Investors in this space need to perform thorough due diligence on the underlying loan portfolios and the protocol's risk management practices.

-

Real Estate: The tokenization of real estate allows for fractional ownership, turning a historically illiquid asset into a tradable one. While promising, this sector is complex, requiring careful analysis of property valuations, legal frameworks, and the liquidity of the specific tokenized assets.

-

Art and Collectibles: Tokenizing high-value items like art or luxury goods offers a new way to invest in these exclusive markets. This niche, while exciting, often has a higher risk profile due to the subjective nature of valuation and the limited size of the market.

Image: Tokeny

KuCoin: A Curated Launchpad for RWA Investment

As the RWA market expands, KuCoin has distinguished itself not just as a trading platform but as a strategic partner for serious investors. Its approach goes beyond simply listing tokens; it provides the tools and insights needed to make informed decisions.

-

Deep-Dive Project Analysis: KuCoin's research team provides in-depth reports and analyses of leading RWA projects. These insights cover key metrics such as the underlying asset quality, yield generation mechanisms, tokenomics, and the security of the smart contracts. This level of due diligence helps investors cut through the noise and identify genuinely promising opportunities.

-

Diversified Access to Top-Tier RWA Projects: KuCoin offers a carefully curated selection of high-quality RWA tokens. For instance, investors can find projects tied to tokenized U.S. treasuries, providing a stable, yield-bearing component for their portfolio. This strategic selection allows for easy diversification across different RWA sub-sectors, mitigating risk and optimizing returns.

-

Advanced Trading Tools: KuCoin provides a full suite of professional trading tools, including margin trading, futures, and trading bots. These tools empower experienced traders to execute sophisticated strategies and manage their positions effectively within the RWA market, capitalizing on price movements and yield differentials.

-

Robust Security and Regulatory Compliance: For investors dealing with assets tied to the real world, security and compliance are paramount. KuCoin operates with a world-class security infrastructure and is committed to adhering to global regulatory standards. This focus on security and compliance gives investors the confidence to allocate capital to RWA assets on the platform.

Actionable Investment Strategies for KuCoin Users

To maximize returns in the RWA market, a strategic approach is essential. Here are a few strategies that seasoned investors can implement on KuCoin:

-

Build a Diversified Portfolio: Don't put all your capital into a single RWA sub-sector. Use KuCoin to diversify your holdings across tokenized bonds for stability, private credit for higher yield, and potentially a smaller allocation to more speculative assets like tokenized real estate.

-

Analyze Yield vs. Risk: Not all yields are created equal. Use KuCoin's research to understand the source of a project's yield. A yield from tokenized U.S. treasuries has a very different risk profile than a yield from private loans. Match your investment to your personal risk tolerance.

-

Hedge with Native Crypto Assets: For some investors, using RWA tokens as collateral for borrowing native crypto assets can be a powerful strategy. This allows them to maintain exposure to high-growth crypto while using the stability of RWAs to manage their risk.

-

Stay Informed with KuCoin Research: The RWA space is evolving rapidly. Regularly consult KuCoin's research reports and market analysis to stay ahead of new projects, market trends, and regulatory changes. Knowledge is the ultimate competitive advantage.

The Future of Finance is Here

The convergence of traditional assets and blockchain is no longer a future concept; it is happening now, driven by regulatory advancements like the one in Hong Kong. For experienced investors, this moment represents a unique opportunity to participate in a market that offers both the stability of traditional finance and the innovation of Web3. KuCoin is your essential partner in this journey, providing the projects, tools, and insights you need to confidently navigate and succeed in the RWA revolution.