DeFi 101: What Is Liquidity Mining And How Does It Work?

Liquidity mining is the process of providing liquidity to AMM-based decentralized exchanges and earning rewards in return. These rewards are called LP (Liquidity Pool) rewards and are distributed among the liquidity providers based on their share of the pool. Liquidity mining is one of the many ways you can earn passive income while putting your idle crypto assets to work.

Liquidity mining was popularized by two of the largest DEX protocols, Uniswap and Compound. However, the concept of liquidity mining was first introduced by IDEX, which was the largest decentralized exchange before the DeFi hype. The concept of liquidity mining was refined further by Synthetix, a prominent derivatives liquidity protocol.

As of writing, over $55.05 billion of collateralized assets are locked in various DeFi protocols, providing liquidity across the DeFi ecosystem. At its peak this year, the Total Value Locked (TVL) for providing liquidity across the DeFi protocols exceeded $88.6 billion.

Total Value Locked in DeFi protocols | Source: DeFi Pulse

This article will cover the concept of liquidity mining and how you can earn passive income by providing liquidity to some of the most prominent DeFi protocols, such as Uniswap.

What Is Liquidity Mining?

Traditionally, market makers in the order-book exchanges provide liquidity, making money through price control and arbitrage. Becoming a liquidity provider (market maker) in the order-book exchanges requires huge amounts of capital as this space is captured by big financial institutions.

With the inception of Automated Market Maker (AMM), we no longer need centralized market makers with huge amounts of capital to provide liquidity. AMM is a mathematical formula that controls the price based on the supply and demand of a particular asset in the liquidity pools. Anyone can add their assets in the liquidity pool and become a market maker, known as the liquidity provider.

The liquidity providers in AMM-based exchanges make money by accumulating LP (liquidity pool) rewards. These rewards come from the users who use the exchange and pay a fee, which is later distributed to all the liquidity providers as LP rewards based on their share of the pool.

Let’s put this in perspective. If you provide $1,000 dollars worth of liquidity in a pool of $100,000, you own 10% of that pool. When users perform a swap or an exchange through this pool, they pay a fee (0.3% in case of Uniswap). If the fees collected from users is $500, you’ll get $50 (10% of all the fees collected). This is a very simple calculation based on various assumptions but in reality, the amount of money you make depends on the size of the pool and the underlying assets.

Another interesting aspect of the liquidity pools is that unlike various staking or lending protocols, your assets are not locked and you can withdraw your assets whenever you want to. There are no withdrawal fees, or a time lock where you have to pay a penalty for withdrawing your liquidity from the pool. The only fees you will have to pay are the network fees.

How Can You Become A Liquidity Provider?

In this section, we will outline the simple steps to become a liquidity provider on Uniswap, the largest AMM-based DEX with more than $5.5 billion in locked crypto assets.

Step 1: Buy crypto assets from KuCoin exchange

If you don’t have any crypto assets, you can buy them from the KuCoin exchange platform. With KuCoin, you can buy crypto assets with credit/debit card, Apple Pay, or a SEPA bank transfer. KuCoin also has a KuCoin Express service where you can buy crypto assets with just one click. After you’ve made a successful purchase, you can withdraw your assets to your favorite wallet. We do recommend MetaMask for Ethereum or ERC-20 assets since it is supported across all the major DEX platforms.

Step 2: Uniswap Liquidity Portal

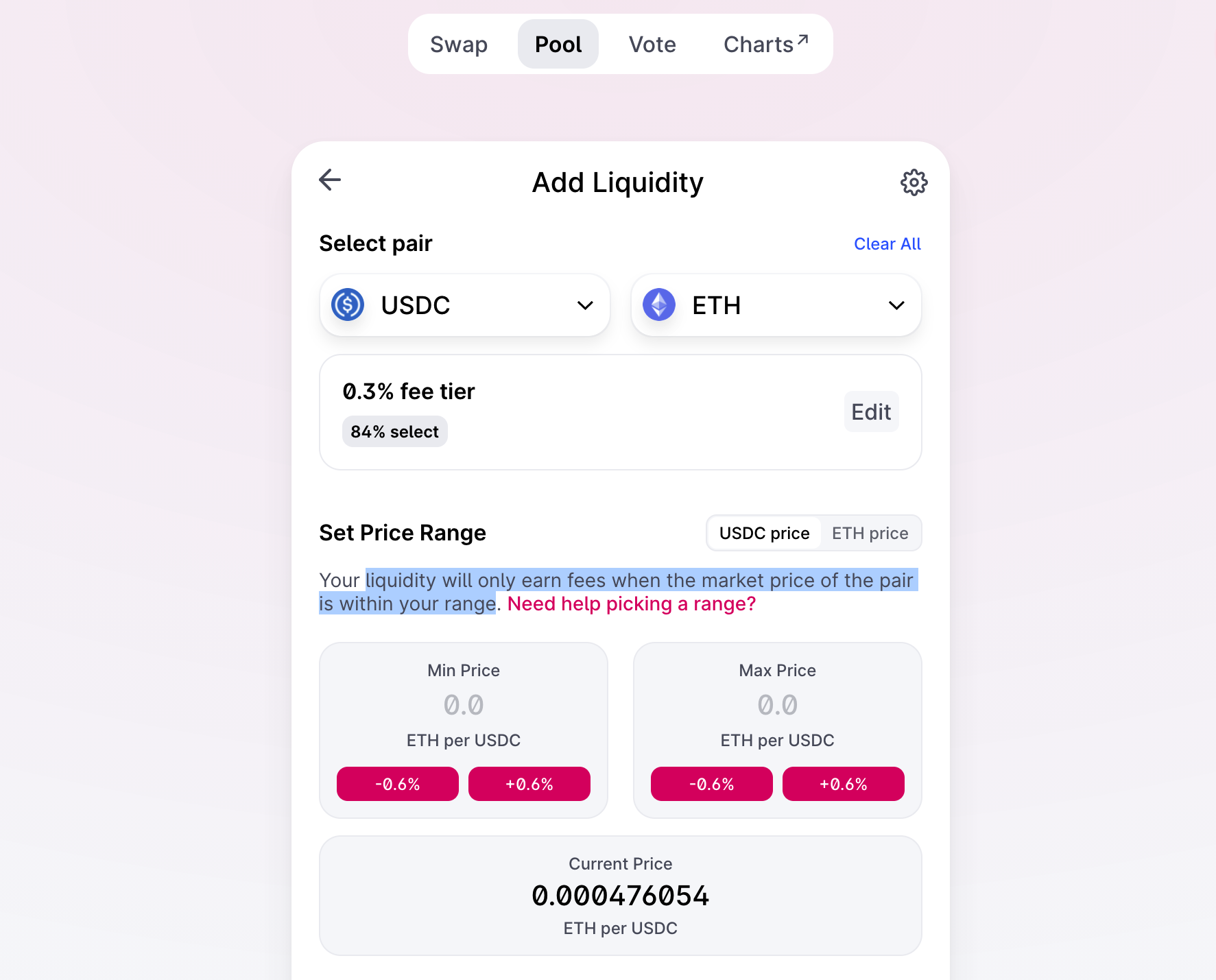

Once you have your crypto assets in your wallet, go to the Uniswap pool page, click on ‘New Position’, select the crypto assets that you purchased from KuCoin, and add liquidity.

Adding liquidity to the Uniswap pool

Step 3: Collect Rewards

Once you’ve added the liquidity, the rewards will appear in your dashboard. You can withdraw the rewards or the liquidity without any platform fees. From the dashboard, you can also add more liquidity to earn more rewards based on your share of the pool.

Uniswap dashboard to manage liquidity and rewards

Closing Thoughts

Liquidity mining is one of the best ways to become a market maker and earn passive income on your ideal crypto assets. Liquidity mining isn’t just limited to AMM-based DEX platforms like Uniswap, as there are hundreds of DeFi protocols for lending, borrowing, and derivatives where you can add your liquidity to earn passive rewards.

Are you ready to jump into the world of liquidity mining?

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also Subscribe to our Youtube Channel >>> Listen to 60s Podcast