Why Bitcoin Futures Trading Can Cause a Liquidation Cascade

The Bitcoin market is famous for its wild, unpredictable price swings. A minor dip can suddenly turn into a crash, wiping out billions of dollars in market value in a matter of hours. While this volatility is often attributed to speculation and market sentiment, a deeper, more powerful force is often at play: the liquidation cascade originating from the futures market. This phenomenon isn't just a side effect of volatility—it's a primary cause, demonstrating how the leveraged nature of BTC futures trading can dramatically amplify market moves. This article will break down how a cascade happens, explaining the critical link between futures and spot markets and why understanding it is key to navigating the crypto landscape.

The Spark: High Leverage and Position Fragility

The foundation of any liquidation cascade is leverage. In BTC futures trading, leverage allows traders to control a large position with a small amount of capital (margin). For example, with 10x leverage, a trader can open a $10,000 position using only $1,000 of their own money. This is an attractive proposition as it can multiply profits on a winning trade.

However, leverage is a double-edged sword. It not only amplifies gains but also magnifies losses. The higher the leverage, the smaller the adverse price movement required to wipe out a trader's margin. This extreme fragility makes high-leverage positions the perfect tinder for a market fire. When thousands of traders are highly leveraged in the same direction—typically long during a bull run—the market becomes incredibly vulnerable to even a minor price reversal.

The Catalyst: The Automated Force of Liquidation

The spark of high leverage is ignited by the exchange's forced liquidation mechanism. Unlike traditional trading where you might manually exit a losing position, a futures exchange's system is automated and unemotional. When the market price drops to a trader's liquidation price, the exchange's system automatically sells off the leveraged position to prevent the trader's losses from exceeding their initial margin. This automated selling is what turns a minor market downturn into a full-blown cascade.

A small price drop triggers the liquidation of the most highly leveraged positions. The system-driven sale of these large positions creates significant sell pressure, which pushes the price down even further. This additional price drop then triggers the liquidation of the next layer of leveraged positions, leading to another wave of selling. This chain reaction—the "cascade"—is a brutal feedback loop that can accelerate a market reversal into a panic-driven crash, all without human intervention.

For detailed information on liquidation, you can refer to KuCoin's official support page >>>

The Chain Reaction: How Futures Drag the Spot Market Down

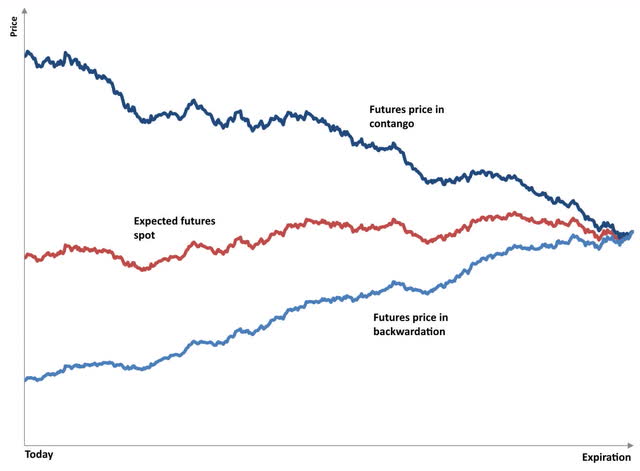

Image: Wikipedia

The most common misconception is that the futures and spot markets are separate. In reality, a liquidation cascade in the futures market has an immediate and dramatic impact on the spot market, turning a localized event into a systemic shock. This isn't just a matter of shared sentiment; it's a direct, almost physical, transmission of selling pressure. The cascade in the futures market becomes the "engine" that drives the spot price down.

This transmission of selling pressure happens through two key channels:

- Arbitrageurs as the Conduit: The most powerful connection is through arbitrageurs. When the futures price plummets due to the initial waves of forced liquidations, it often trades at a significant and temporary discount to the spot price. This price divergence creates a lucrative opportunity. Arbitrageurs will simultaneously buy the cheap futures contracts and sell an equivalent amount of Bitcoin on the spot market to capture the price difference. This behavior, driven purely by a logical pursuit of profit, injects a powerful new wave of selling pressure directly into the spot market. The futures market's sell-off becomes the spot market's sell-off.

- Psychological Contagion: Beyond arbitrage, the psychological impact of a futures cascade cannot be overstated. As the futures price charts show a rapid and steep decline, fear and uncertainty spread like wildfire. Traders on the spot market, witnessing the dramatic "flash crash" in futures, begin to panic. They may rush to sell their holdings to lock in profits or cut losses, fearing that their assets will be next. This emotional, reactive selling compounds the sell pressure from arbitrage, creating a self-fulfilling prophecy of a market-wide crash.

Ultimately, the futures market is not just a passive reflection of the spot price; it's a dynamic and active driver of market volatility. Its unique mechanisms, particularly the automated liquidation engine and the arbitrage feedback loop, give it the power to create its own severe downturns and pull the entire market down with it, turning a small crack into a systemic fissure.

Detecting and Managing Liquidation Risk

While the liquidation cascade is a powerful force, advanced traders are not helpless. Understanding the underlying mechanisms allows for proactive risk management.

Here are key indicators to monitor and strategies to implement:

- Monitor the Funding Rate: The funding rate is a key indicator of market sentiment and leverage. A high positive funding rate signals that the market is heavily skewed toward longs, making it more susceptible to a long squeeze.

- Watch Open Interest: As the total number of outstanding futures contracts, open interest can also signal a build-up of risk. A sharp increase in open interest during a strong price move, especially with a high funding rate, suggests that a large number of leveraged traders are entering the market, increasing the potential energy for a cascade.

- Practice Disciplined Risk Management: The best defense is a strong offense. By employing a disciplined approach to BTC futures trading, such as using moderate leverage (e.g., 3-5x), setting tight stop-loss orders, and maintaining a conservative position size, traders can protect themselves from being caught in the cascade. Never risk more than you can afford to lose.

Conclusion

The liquidation cascade is far from an anomaly; it stands as a defining feature of the modern cryptocurrency market, serving as the ultimate expression of how the futures market, with its high-leverage and automated liquidation protocols, can violently interact with the spot market.

Understanding this intricate feedback loop is no longer an optional skill for serious traders, but a fundamental prerequisite for survival and success within this complex ecosystem. As the cryptocurrency space continues its trajectory of institutionalization and exponential growth, the power and influence of BTC futures trading will only intensify, solidifying its role as the primary engine of price discovery and volatility.

To navigate these high-stakes dynamics and to practice disciplined trading effectively, a robust platform with transparent data and reliable execution is essential. You can explore a powerful interface for BTC perpetual futures trading on KuCoin: https://www.kucoin.com/futures/trade/XBTUSDCM.