What is World Liberty Financial? A Complete Analysis of How the $WLFI Token Works and Its Economic Model

2025/09/04 01:54:02

In the vast universe of Decentralized Finance (DeFi), World Liberty Financial (WLF) is emerging as an ambitious project dedicated to building a comprehensive ecosystem that seamlessly connects traditional finance with the decentralized world. This is not just a platform; it’s a new financial paradigm aimed at providing users with true financial freedom. The core driver of this ecosystem is its native token, $WLFI.

This ultimate guide is designed to serve as an authoritative and comprehensive resource for all investors, developers, and enthusiasts interested in the project. We will dive deep into how World Liberty Financial operates, the tokenomics behind the $WLFI token, and why it has the potential to become a new force in the DeFi space.

The Vision of World Liberty Financial: Building the Next-Gen Financial Ecosystem

World Liberty Financial's core mission is to solve three fundamental challenges currently facing the DeFi sector through its innovative Liberty Protocol:

-

User Experience Barriers: The complexity of existing DeFi protocols is a major hurdle for new users, hindering mass adoption.

-

Lack of Liquidity and Efficiency: Market liquidity is fragmented across different blockchains and protocols, leading to inefficient capital use.

-

Disconnection from Traditional Finance: There is a significant gap between the DeFi world and traditional finance (TradFi), which prevents large-scale institutional capital from entering.

To address these challenges, WLF has built an integrated platform that includes a decentralized exchange (DEX), lending, yield aggregation, and asset management. Its vision is to become a "one-stop" DeFi hub capable of serving both institutional and retail users.

The September 1st Market Context: Bullish Signals & the $WLFI Opportunity

It’s worth noting that on a key date like September 1st, the crypto market is sending out positive bullish signals. Authoritative on-chain data analysis shows that Ethereum's exchange reserves have hit a multi-year low, which is typically interpreted by market analysts as a sign of reduced selling pressure and a strong inclination for holding and staking. In such a bullish market environment, World Liberty Financial, with its innovative and integrated platform, is in an excellent position to attract a new wave of capital and user attention. Its development potential perfectly resonates with the prevailing market trend.

How the $WLFI Token Works: Core Functions and Real-World Use Cases

World Liberty Financial's operations are built upon its advanced Liberty Protocol, which is designed to provide an efficient, secure, and user-friendly DeFi environment.

Core Functional Components

-

Decentralized Exchange (DEX): The heart of the platform is a powerful DEX that offers low-slippage, low-fee token swaps.

-

Decentralized Lending Market: Users can collateralize their crypto assets to borrow funds or lend out assets to earn interest.

-

Smart Yield Aggregator: The platform automatically finds the highest-yielding staking and liquidity mining opportunities across the network for users, maximizing their asset returns.

-

Decentralized Governance: As the governance token, $WLFI holders have voting power over the protocol’s future direction.

Practical Use Cases and Innovation

-

Scenario 1: Efficient Asset TradingA user wants to swap ETH for USDT. On the WLF platform, they can complete the transaction directly on the DEX and pay transaction fees with $WLFI, receiving up to a 50% discount.

-

Scenario 2: Earning Passive IncomeA user holds stablecoins. They can deposit the stablecoins into WLF's yield aggregator, and the protocol will automatically deploy them to the highest-yielding protocols and compound the returns, earning the user passive income.

-

Scenario 3: Collateralized LendingA user holds BTC but doesn't want to sell it. They can use their BTC as collateral to borrow USDT for their financial needs, without giving up the long-term growth potential of their BTC.

A Complete Breakdown of the $WLFI Tokenomics

To understand the value of $WLFI, one must deeply analyze its Tokenomics. This is the core factor that determines the token's long-term value and scarcity.

-

Total Supply and Distribution

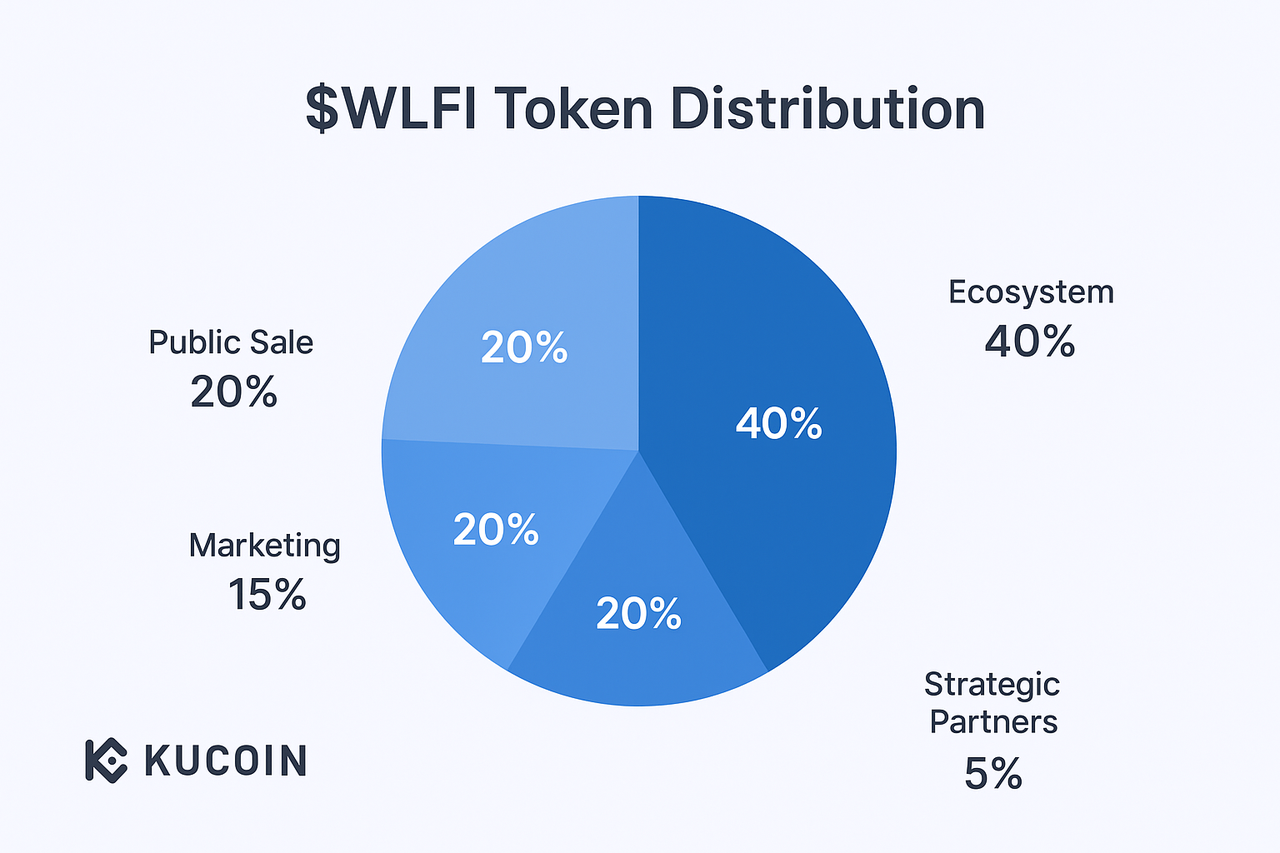

The total supply of $WLFI is set at 1,000,000,000 tokens. The distribution strategy is designed to ensure the project's long-term sustainability and decentralization.

Ecosystem & Staking Rewards (40%): This portion is used to incentivize early users and liquidity providers through staking and farming, ensuring sufficient liquidity at launch and encouraging community participation.

Public Sale (20%): This is for a public offering to allow community members to participate fairly and ensure broad token distribution.

Team & Advisors (20%): This portion will be subject to a strict lock-up and linear vesting schedule (e.g., locked for 1 year, then vested over 3 years), to ensure the team’s long-term commitment and prevent immediate selling.

Marketing & Development Fund (15%): Allocated to support brand building, partnership expansion, and future product development.

Strategic Partners (5%): Reserved for important future industry partners to jointly expand the ecosystem.

-

Token Utility

Beyond being a governance tool, $WLFI serves multiple practical roles within the ecosystem:

-

Fee Reduction: By holding and using $WLFI to pay for transaction fees on the DEX, users can receive a discount of up to 50%.

-

Staking Yield: Users can stake $WLFI in the protocol to provide network security, earning a share of protocol revenue and additional $WLFI rewards.

-

Access to Premium Features: In the future, $WLFI will be the key to unlocking exclusive platform features, such as advanced analytics tools and early access to new products.

-

Value Capture and Deflationary Mechanisms

To ensure the long-term value of $WLFI, the project has designed a buyback and burn mechanism. A portion of the protocol's transaction fees and interest income will be automatically used to buy back $WLFI from the market and permanently burn it, reducing the total supply and creating a deflationary effect. This tightly links the value of $WLFI to the overall activity of the platform, creating a virtuous cycle.

Security and Audits: Protecting Your Digital Assets

As a DeFi platform that handles user assets, security is the top priority for World Liberty Financial. The project has undergone multiple security audits by well-known blockchain security firms to ensure the robustness of its smart contract code. Additionally, the platform has built-in risk management systems to monitor and mitigate potential malicious attacks and has established a security fund to address extreme circumstances. These measures are designed to provide a reliable and secure investment environment for users.

Conclusion: The Future Outlook for $WLFI

As a bridge connecting traditional finance and DeFi, World Liberty Financial and its $WLFI token are at a crucial and opportune moment. Its comprehensive feature integration, clear economic model, and decentralized governance structure give it the potential to stand out in the highly competitive DeFi market.

Against a backdrop of bullish market sentiment, $WLFI is more than just a token; it represents a new financial service model. For anyone looking to participate in the DeFi revolution and seeking a comprehensive, highly utilitarian platform, understanding how the $WLFI token works is undoubtedly the first step toward entering the World Liberty Financial ecosystem.