Bitcoin Futures for Dummies: Your First Guide to BTC Perpetual Contracts

Bitcoin perpetual futures, a cornerstone of modern cryptocurrency trading, can seem daunting to newcomers. This guide aims to demystify this powerful financial instrument, providing a clear path from fundamental concepts to more advanced strategies. We’ll break down what perpetual futures are, how they work, and, most importantly, how to approach them with a focus on risk management.

What are Bitcoin Perpetual Futures?

Imagine you're betting on the future price of Bitcoin without ever needing to own the actual Bitcoin. That's the essence of a Bitcoin perpetual futures contract. Unlike traditional futures contracts that have a fixed expiration date and require physical settlement, perpetual futures have no expiration. They are, in a sense, a "spot market with leverage and no expiration." This key feature allows traders to hold a position indefinitely as long as they maintain sufficient margin.

A Bitcoin perpetual futures contract is a financial agreement that allows you to buy or sell Bitcoin at a future price, but with a unique twist: it has no expiration date. You can hold your position indefinitely, as long as you have enough capital in your account.

The price of a perpetual contract is designed to stay very close to the spot price of Bitcoin. This is managed by a mechanism called the funding rate. The funding rate is a small payment exchanged between long and short position holders. If the perpetual contract price is higher than the spot price, longs pay shorts. If the perpetual price is lower, shorts pay longs. This constant adjustment keeps the perpetual contract price anchored to the spot market, making it a very popular tool for speculation and hedging.

The Double-Edged Sword of Leverage

Image: VocalMedia

Leverage is what makes perpetual futures so attractive—and so dangerous. It allows you to control a large position with a small amount of capital, or margin. A 10x leverage, for example, means you can open a position worth $10,000 with just $1,000 of your own money.

However, this amplifies both gains and losses. A 1% movement in the underlying asset's price becomes a 10% movement in your position's value. The higher the leverage, the more sensitive your position is to price fluctuations.

- Low Leverage (e.g., 2x-5x): This allows for more breathing room and is generally recommended for beginners. A small price swing won't immediately trigger a liquidation, which is the forced closure of your position due to insufficient margin.

- High Leverage (e.g., 50x-100x): This is a high-risk, high-reward strategy that should only be used by experienced traders. Even a minor price movement can wipe out your entire margin. High leverage is akin to a scalpel—in the right hands, it can be very precise, but in the wrong hands, it can be devastating.

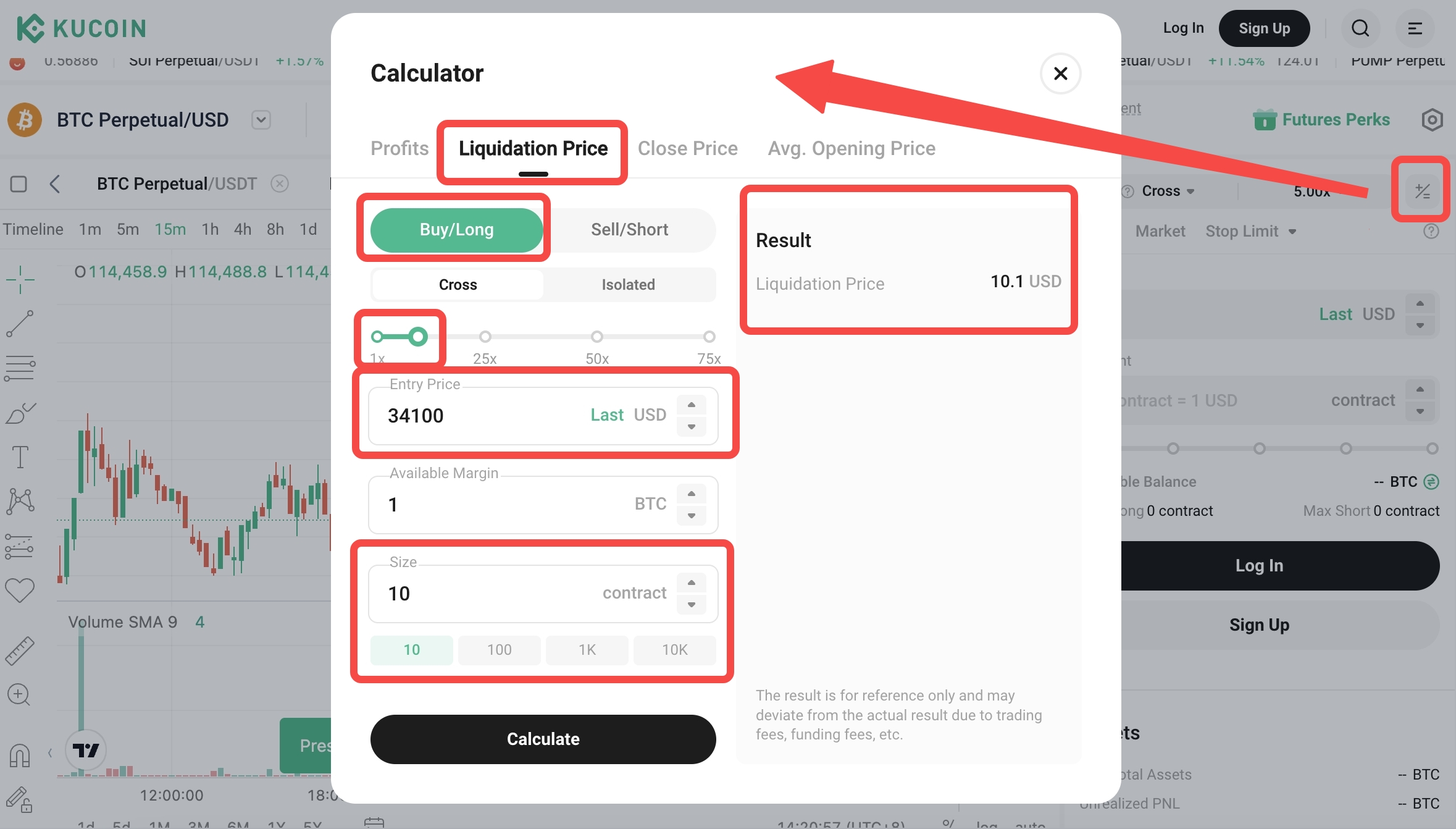

Understanding your liquidation price is paramount. This is the price at which your position will be automatically closed. The higher your leverage, the closer your liquidation price is to your entry price.

You can use KuCoin Futures’s calculator to calculate the liquidation price.

The Mechanics of Trading: A Step-by-Step Guide

Executing a trade involves more than just clicking "buy" or "sell." Understanding the different order types is crucial for precise control.

Common Order Types:

- Market Order: This order executes immediately at the best available price. It's the fastest way to get in or out of a trade, but you have no control over the exact price you receive.

- Limit Order: You set a specific price at which you want your order to be executed. The order will only be filled if the market reaches that price. This gives you price control but no guarantee of execution.

- Stop-Market Order: This is a key risk management tool. You set a "stop price" that, when triggered, automatically places a market order to close your position.

- Stop-Limit Order: This works similarly to a Stop-Market order, but instead of placing a market order, it places a limit order once the stop price is triggered.

Opening and Closing a Position:

- Opening a Position: To open a position, you first decide whether to go long (if you believe the price will rise) or short (if you believe the price will fall). You'll then choose your leverage, input your desired position size, and select an order type.

- Closing a Position: You can close a position manually at any time. Alternatively, your position can be closed automatically by a stop-loss or take-profit order, or by liquidation if you run out of margin.

Risk Management is Not a Strategy, It's the Foundation

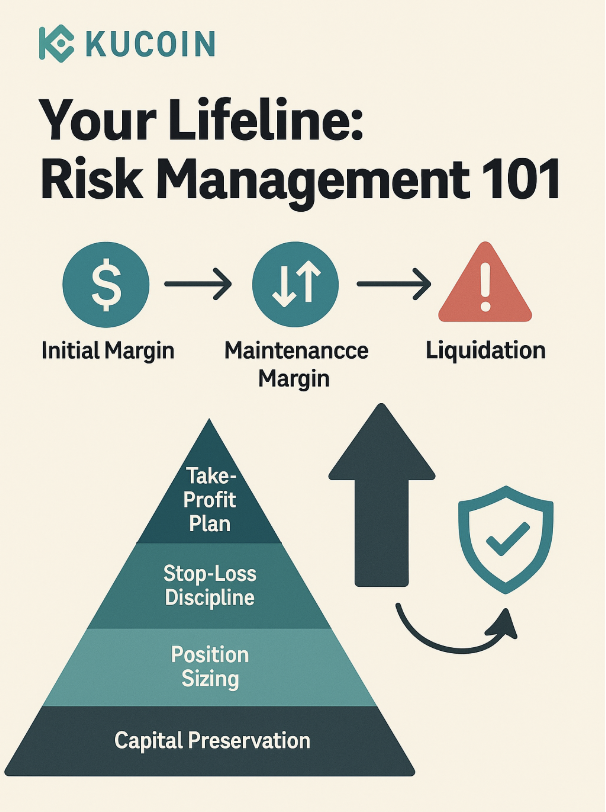

Trading is a marathon, not a sprint. The primary goal is capital preservation. Here are a few key principles for effective risk management:

Understanding Your Margin:

- Initial Margin: The amount of money you must deposit to open a leveraged position.

- Maintenance Margin: The minimum amount of money you must have in your account to keep a position open. If your account equity falls below this level, your position will be liquidated.

The Nightmare Scenario: Liquidation

Liquidation is the forced closing of your leveraged position by the exchange when your margin falls below the maintenance margin level. This happens when the market moves against your position to a point where your funds are no longer sufficient to cover potential losses. To avoid this, you must always have a liquidation price in mind and manage your position accordingly. The higher your leverage, the closer your liquidation price is to your entry price.

Your Safety Net: The Power of Stop-Loss Orders

A stop-loss order is your most critical tool. It's an order to automatically close your position at a predefined price to limit your potential losses.

- How to Set a Stop-Loss: A good practice is to set your stop-loss based on a small percentage of your total trading capital (e.g., 1-2%). For example, if you have a $1,000 account, you would not risk more than $20 on a single trade.

- Why Essential: A stop-loss prevents a small mistake from turning into a catastrophic loss. It removes emotion from the trading process, forcing you to stick to your plan.

Locking in Gains: The Take-Profit Strategy

Just as important as managing losses is locking in profits. A take-profit order automatically closes your position at a specific price to secure your gains. It ensures that you don’t let a profitable trade turn into a loss if the market reverses.

- Position Sizing: Never risk more than a small percentage of your total portfolio on a single trade. A common rule of thumb is to risk no more than 1-2% of your capital per trade.

- Use Stop-Losses Religiously: A stop-loss is your safety net. It prevents a small mistake from becoming a catastrophic one. Without a stop-loss, you are simply hoping for the best, which is a recipe for failure.

- Start Small: If you're a beginner, start with the smallest possible position size and low leverage. Focus on understanding the mechanics and managing your emotions before scaling up.

- Understand the Funding Rate: Be aware of the funding rate. Holding a position for an extended period when the funding rate is unfavorable can eat into your profits.

Conclusion

Bitcoin perpetual futures offer a powerful and flexible way to engage with the crypto market. While the potential for high returns is significant, so is the risk. The key to success lies not in finding a magic trading indicator but in a disciplined approach to risk management, a deep understanding of the contract's mechanics, and the emotional fortitude to stick to your plan. Start with low leverage, master the use of stop-losses, and never risk more than you can afford to lose.