The Complete Guide to Financial Literacy Month and How It Affects Your Cryptocurrency Investments

The month of April will be designated as National Financial Literacy Month for the 19th time in 2022, and there are a slew of reasons why the designation is as essential as it has always been. Hopefully, we are nearing the end of a pandemic that has wreaked havoc worldwide. The death toll has been staggering, and the financial impact of COVID-19 has been felt in almost every corner of the world.

In the United States, inflation has been rising at rates not seen in the last 40 years, with the current and horrific Russian invasion of Ukraine straining entire financial sectors that were already on the verge of collapse. Fuel and energy prices have already skyrocketed due to the conflict and the United States' ban on Russian oil imports. As a result, households will want to learn how to combat inflation to mitigate some of the negative effects of rising costs. Hence, financial literacy is extremely important for making a better living.

This guide is an excellent place to begin, and today is an excellent day to do so. Let's start with financial literacy—what it is and how it can help you.

What is Financial Literacy?

Financial literacy refers to comprehending and using a wide range of financial abilities, such as personal financial management, budgeting, investing, and understanding some financial principles and ideas. Such as the time worth of money, compound interest, debt management, and financial planning.

Financial literacy can assist individuals in avoiding poor financial decisions, becoming self-sufficient, and achieving financial stability. Learning how to construct a budget, track spending, pay off debt, and prepare for retirement are necessary steps toward financial literacy.

What is Financial Literacy Month?

In April, we observe National Financial Literacy Month, which provides us with an excellent opportunity to assess and promote our financial situation and skills. If you consider yourself a financial illiterate, you are not alone! Every day is an opportunity to reflect on your spending and improve your finances, whether you have just started earning or have been earning for a long time.

The origins of Financial Literacy Month can be traced back more than two decades. The campaign started with Youth Financial Literacy Day, which was established by the National Endowment for Financial Education (NEFE).

In 2000, NEFE handed over control of the campaign to the Jump$tart Coalition, which expanded it from a one-day event to an entire month called Financial Literacy for Youth Month. The event was eventually renamed Financial Literacy Month. The Senate passed a resolution in 2004 designating April as Financial Literacy Month.

What is the Goal of Financial Literacy Month, and Why Does it Matter To You?

Financial literacy month aims to help people understand how their money works, what they can do with it, and how to make better decisions about it. This matters to you because you are probably one of those people who doesn't know much about their finances. You might not be aware of the different options you have for investing or saving money-or, even how much interest you're earning on your current account balance. It doesn't matter if you're young or old, rich or poor.

Most of us have no idea how much money we've actually saved in the bank or our average salary. Therefore, it's essential that you know all your options before deciding where to put your money. Financial literacy will help you understand the advantages and disadvantages of investing or saving money differently. Where should you invest your money?

To help you decide where to invest or save money, ask yourself these three simple questions:

➢ Where can I have a financial return for my money?

➢ Where do I need to be able to access my savings quickly?

➢ What's the risk of losing my savings?

Traditional Ways of Investing Money

The first option is to deposit your money in a bank. If you're not concerned about currency depreciation and inflation, this could be a good option. However, if you want a return on your investment, this may not be the best option because there are no returns on bank funds.

Another option is to invest your savings in a CD (certificate of deposit). These are only available for a set period of time, so you won't be able to withdraw funds until the CD matures. As a result, you'll receive a fixed rate of return on your investment from the bank, which may be higher than what you'd receive elsewhere.

Therefore, it is critical to be aware of the most recent investment domains and opportunities in the market in order to allocate your investment to the best available options.

Crypto Knowledge is Catching Investor's Attention to Boost Financial Literacy

Cryptocurrency is a new and contentious form of currency. As the excitement surrounding cryptocurrency grows through social media, word-of-mouth, advertisements, influencers, and other means, many people with little financial or technological knowledge are jumping on the crypto bandwagon, hoping to make quick money.

Being a digital currency, cryptocurrency can be used as an alternative of government-issued money. It has been around since 2009 but has recently become more popular with the rise of Bitcoin. The recent Bitcoin craze has sparked increased interest in this field. Investors are eager to capitalize on the opportunity, but many lack the knowledge or experience required to launch a venture. Because any central authority does not issue cryptocurrencies, regulators may find it difficult to control their use.

Financial literacy month is an annual campaign in the United States, Canada, and Australia designed to educate people about sound financial management. This year's theme, "Money Matters," will cover budgeting, saving, credit cards, and how to choose a bank. However, there is a need for financial literacy month to protect cryptocurrencies because cryptocurrency is a new and emerging technology with numerous applications.

How Many People Use Crypto in 2022?

According to cryptocurrency statistics, the average cryptocurrency ownership rate in 2022 is estimated to be 3.9 percent, implying that more than 300 million people are using digital assets worldwide. In addition, over 18,000 businesses have chosen to accept cryptocurrency as payment for their product or service.

Key Cryptocurrency Statistics in 2022

➢ In 2022, there will be over 18,700 different types of cryptocurrencies.

➢ There are currently over 500 cryptocurrency exchanges that allow their customers to engage in active trading.

➢ The top ten cryptocurrencies account for 88 percent of the total market value.

➢ Cryptocurrency is currently used by 300 million people worldwide.

➢ There are 46 million Americans who have invested in Bitcoin, and there are more than 80 million users of Blockchain wallets.

Why Is There a Need for Financial Literacy Month to Cover Cryptocurrency Too?

The phenomenon of crypto investment is causing a worrying rise in financial illiteracy, particularly in the United States. Even in small towns and villages, many people who have probably never had any exposure to assets such as equities and mutual funds are turning to cryptocurrency to improve their fortunes. However, in the absence of proper understanding, this could be dangerous.

The financial industry and policymakers worldwide are ignoring the problem of crypto illiteracy. As a result, many investors are losing money due to poor decisions or a lack of trading knowledge. Some people have even been charged with fraud for allegedly trading cryptocurrencies when their transactions were actually made with cash, credit, or securities.

Visit KuCoin's additional resources to elevate your financial literacy on cryptocurrency:

What is Bitcoin (BTC)? How does it work?

Dogecoin 101:What is Dogecoin and How does it work?

Is Bitcoin a Strong Hedge Against Inflation?

What is staking? How does it work?

Everything You Need to Know about Crypto Lending

Trading Bot 101: What is KuCoin Trading Bot and How Does it Work?

2022 Investopedia Financial Literacy Survey

In recognition of Financial Literacy Month in April, Investopedia polled 4,000 US adults—1,000 from Generation Z (18-25), millennials (26-41), Generation X (42-57), and baby boomers (58-76)—about their financial knowledge, habits, concerns, and retirement goals.

Source: 2022 Investopedia Financial Literacy Study(1/27-2/7)

Even fewer people understand digital currency, such as cryptocurrency, blockchain, and NFTs, areas in which Investopedia has witnessed a surge of interest over the last year. Half of the poll respondents (49%) stated they have only a basic comprehension of increasingly popular components of financial technology.

According to a 2014 study conducted by the Financial Industry Regulatory Authority (FINRA), investors lose 4 percent on average after trading for two years, but some lose as much as 24 percent due, in large part, to the technology used by investors. So what are the major factors influencing these squandered investments?

The key factors are the lack of regulation for technology and the problems with self-regulation.

The lack of technology regulation has resulted in a high-risk environment riddled with numerous issues. Cyber-attacks, scammers, phishing attacks, and other high-risk behaviors pose challenges for investors.

Self-regulation, rather than regulation, creates a less secure marketplace for investors to invest in. For instance, the Financial Industry Regulatory Authority (FINRA), the National Association of Securities Dealers (NASD), and the Self-Regulatory Organizations for the Securities and Exchange Commission (SEC) Markets are among the self-regulatory organizations involved.

Given the global level of crypto adoption, financial literacy in technology and regulation is critical. That being said, there's a tremendous need for financial education on the cryptocurrency market.

Investors are Eyeing Crypto to Diversify their Portfolio and Beat High Inflation

Despite being on the front lines of the global financial crisis, Wall Street is interested in cryptocurrency. Investors are looking for a way to diversify their portfolios while beating high inflation as interest rates fall. Cryptocurrencies provide a new opportunity to profit from the wave of blockchain technology, similar to how Facebook investors benefited from social media.

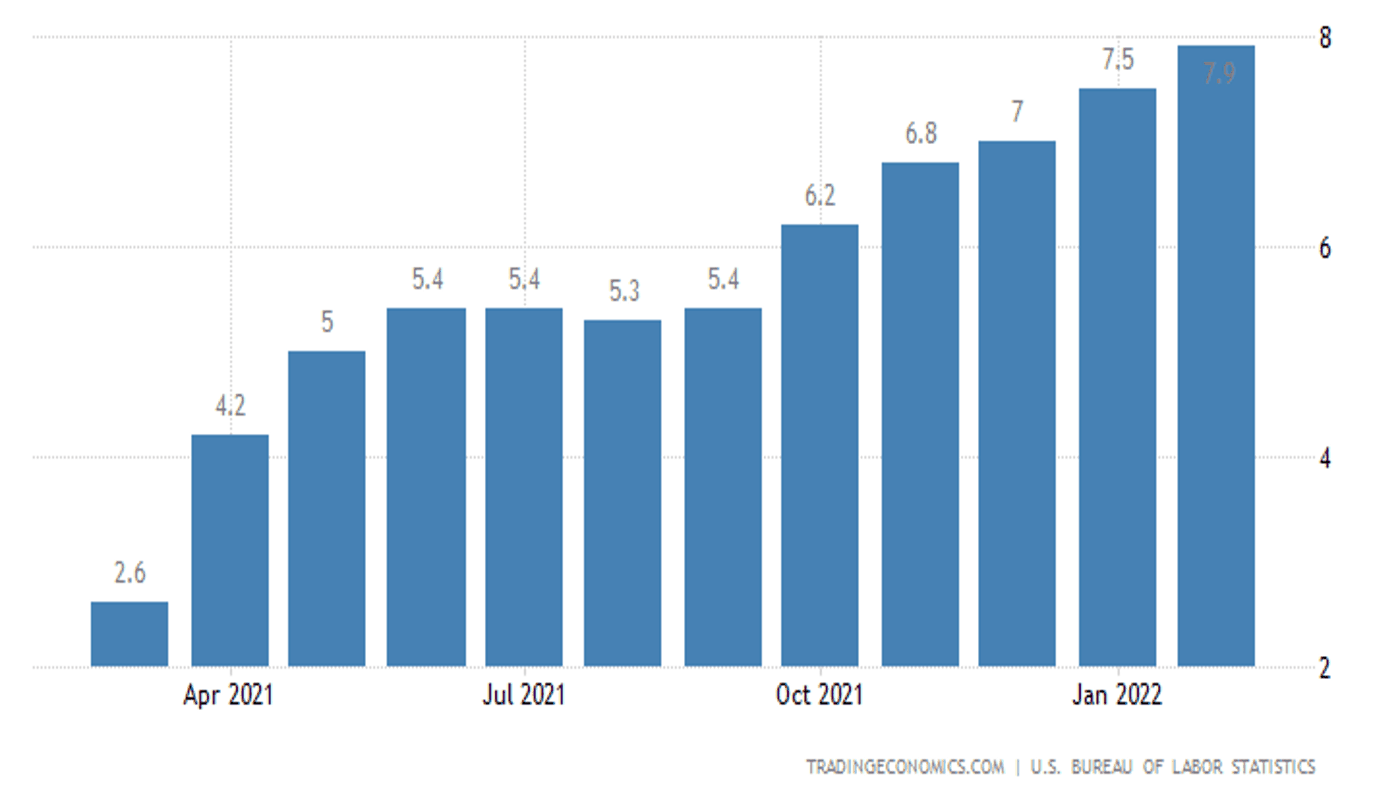

US Inflation Hits New 40-year High

Annual inflation in the United States increased to 7.9 percent in February 2022, the highest level since January 1982, matching market expectations. Energy continued to be the largest contributor (25.6 percent vs. 27 percent in January), with gasoline prices increasing by 38%.

Core CPI (Inflation excluding volatile energy and food categories) increased by 6.4 percent, the highest rate in 40 years. Still, the rise in energy prices caused by the Ukraine conflict is yet to come.

The United States Inflation Rate | Source: Tradingeconomics.com

Inflation was expected to peak in March, but recent developments in Europe, combined with ongoing supply constraints, strong demand, and labor shortages, will likely keep inflation elevated.

Most importantly, cryptocurrencies appear to be an excellent investment to combat rising inflation. Investors should consider investing in cryptocurrency to protect themselves against inflation, as the dollar's value is constantly falling and will continue to fall.

How Does Bitcoin Act as an Inflation Hedge?

The limited supply of coins is the primary factor that makes bitcoin a hedge against inflation. When Satoshi Nakamoto created the world's largest cryptocurrency, he included a hard cap in the source code that limited the number of bitcoins in circulation to 21 million.

Unlike most fiat currencies, where central banks can manipulate supply and demand, Bitcoin was always intended to have a limited supply of 21 million. Approximately 19 million coins have been generated, with only 2 million remaining. No one can alter the bitcoin source code in order to increase supply.

As a result, in the absence of an excess supply, the coins that already exist will eventually become scarce, increasing demand and, as a result, increasing the price of the asset. This may help investors fight the surge in inflation rates.

Closing Thoughts

In the investment world, cryptocurrency is a hot topic. It's been around for a while, but people are only now becoming aware of it. The appeal of cryptocurrencies is that they are decentralized and allow for peer-to-peer transactions without the use of an intermediary or third party. Investors have been flocking to this new trend because of its potential for rapid growth and high returns.

Bitcoin has grown by over 1,000% since January 2017, and some experts predict it will reach $100,000 by 2022. But, despite all of the hype, there are risks associated with crypto investing, so it's critical to educate yourself on those risks. The most significant risk to be aware of is the high volatility of cryptocurrencies. The price, like any speculative investment, can fluctuate widely and quickly. Therefore, it is critical to understand that investing in cryptocurrency will involve far more emotions than simply purchasing a stock on the stock market over time.

Financial Literacy Month is a great time to reflect and think about managing your money better. Hope this article will help you be more aware of your financial management and budget, spend, and invest smarter!

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also, Subscribe to our Youtube Channel >>>Listen to 60s Podcast