Trading 101: What is an Order book?

An order book is an electronic list containing buy and sell orders of a given investment vehicle. The book’s arrangement is made according to price, detailing all the shares or assets offered at each price level. It may also show the details of the individual selling or buying. However, some traders choose to remain anonymous. The listing enables traders to make informed decisions by ensuring market transparency.

While order books were initially associated with stock exchanges, they are now gaining traction in crypto trading. There are two types of order books. The order book level 1 shows basic market data such as prices and the best buy and sell prices. The order book level 2 shows detailed information such as the market depth. Market depth indicates the ability of the market to withstand a large order without any changes in prices.

Other than normal traders, there are also market makers who seek to benefit from the differences in the bid and ask prices. Such individuals or firms buy and sell securities or crypto for their accounts. A market maker offers a two-sided market while a market taker trades at the prices set by market makers.

ETH/USDTChart on the Daily Timeframe | Source:KuCoin

Components of an Order Book

The components of an order book may vary depending on the type of security. However, its major features include:

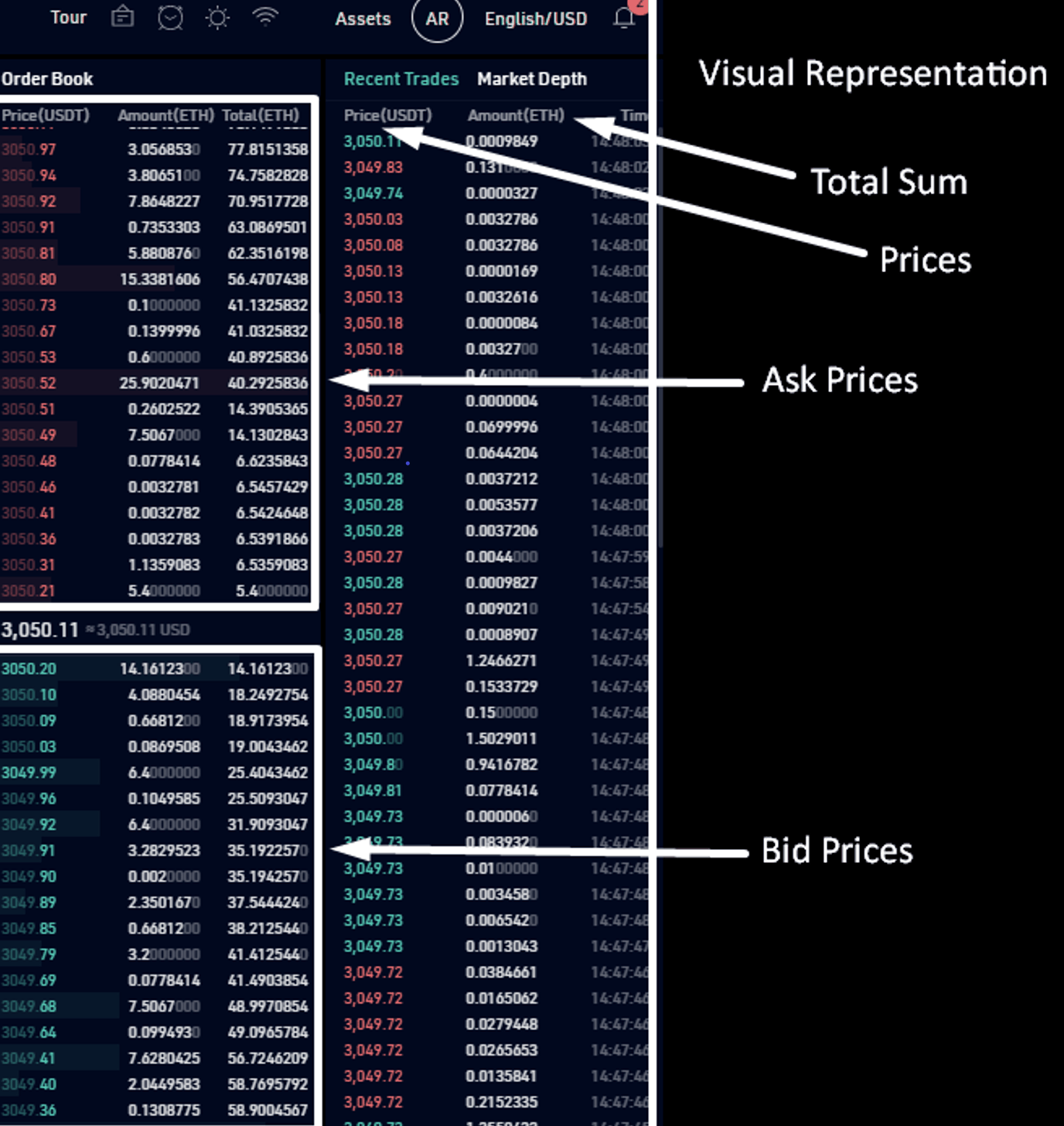

Buyer’s section and seller’s section - An order book is two-sided, as it records real-time market prices. The book has a buyers’ side and a sellers’ side. Buyers and sellers make up the two significant aspects of a trading market.

Bid and Ask - Some order books, mainly dealing with advanced traders, do not have a buyers’ section and a sellers’ section. Instead, they will have a ‘bid’ and ‘ask’ section. A buyer sets a bid for a specific number of shares at a particular price, while an ask is set by a seller asking a specific price for their securities.

Prices - The order book also records values for both sections. Prices listed in the buyer column show the amount they are bidding for, while the price on the seller section indicates at what price they are selling.

Total sum - The two columns will show the total amounts of the specific securities sold at different prices. The total indicates the levels of demand and supply and market liquidity.

ETH/USDTChart on the Daily Timeframe | Source: KuCoin

Visual representation - A visual representation of an order book ensures that traders easily find the best prices to buy or sell. The graphic can be in the form of a graph, a line chart, or others. This feature also makes it easier for the trader to understand the levels of demand and supply.

There are also three main sections of an order book. These are the buy orders, sell orders, and order history. Buy orders show the buyer’s details, including the total bids and the preferred purchase amount. A sell order is also similar to a buy order, only that it will be on the seller’s side. A market order stores all transactions that have already taken place.

The difference between a market order and a limit order usually confuses many traders. A market order closes at the best available market prices. A limit order only fills if the market prices reach a certain level. A sell stop market order is set below the current market prices. A limit order is an ideal way to avoid a maker fee and a taker fee. Maker-taker fees give a liquidity provider rebates for participating in trading markets.

Benefits of an Order Book

An order book shows the bid and ask prices in real-time, as it is constantly updated. The book enables traders to make informed decisions. It achieves this by outlining market trends and market dynamics over a given period.

The order book automatically matches the trader’s preference, which creates convenience in trading activities.

Special Considerations

The order book mainly offers transparent market operations. However, order books also have “dark pools,” which are orders hidden from the public eye. Such orders involve large transactions that could move markets without ever being executed, simply by acting as psychological support or resistance levels.

If the details of such transactions are shared with the public before the transaction, it would significantly change the price of the investment vehicle. However, when they are released after, the impact on the security’s value is lowered considerably. Dark pools reduce the utility of the order book, as there is no certainty that the figures depicted are the actual values of demand and supply.

Sign up with KuCoin, and start trading today!

Find the Next Crypto Gem on KuCoin!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>>https://www.kucoin.com/download