SEC Probe Dropped! Can Aave V4 and Horizon RWA Propel the Price to New Highs in 2026?

2025/12/18 09:00:03

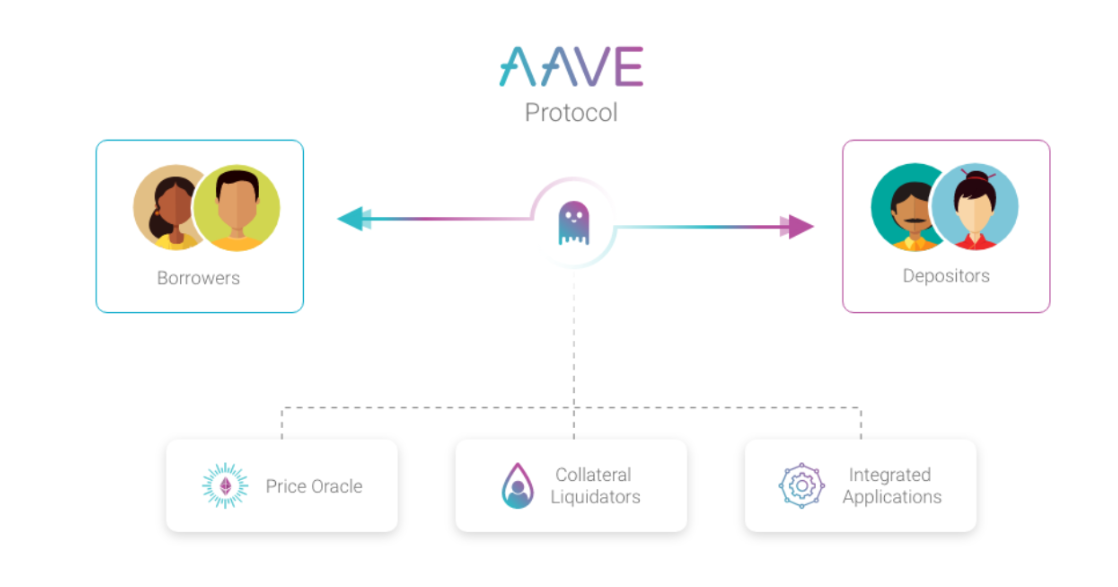

The Aave protocol | Source: Aave

Introduction: The "Coming of Age" for DeFi

On December 16, 2025, the cryptocurrency industry reached a historic milestone. The U.S. Securities and Exchange Commission (SEC) officially concluded its four-year investigation into Aave, the world's largest decentralized lending protocol, without filing any charges. This news has not only energized the DeFi sector but also dismantled the final barrier preventing major institutional capital from entering the space.

Immediately following this, Aave CEO Stani Kulechov unveiled the "2026 Master Plan" on December 17. With regulatory uncertainty finally cleared, a major technical overhaul (V4), and a robust Real-World Asset (RWA) strategy in place, investors are asking one core question: Can AAVE break its all-time high in 2026?

-

Regulatory Clarity: Removing the Valuation Ceiling

For years, AAVE’s valuation was suppressed by a "regulatory discount." Despite generating record revenues—reaching $885 million in protocol fees in 2025—legal shadows kept many institutional compliance departments on the sidelines.

-

Restored Institutional Trust: The SEC's exit confirms that Aave’s non-custodial architecture and governance model are resilient to traditional securities scrutiny. This "green light" allows pension funds and insurance companies to legally allocate capital to Aave.

-

End of the Discount: As risk premiums fade, AAVE is transitioning from a "risky experiment" to "legitimate financial infrastructure." For those looking to capitalize on this shift, you can set up an account via the https://www.kucoin.com/ucenter/signup to start positioning for the next cycle.

-

Aave V4: A Technical Singularity in DeFi

While compliance provides the foundation, the Aave V4 upgrade serves as the growth engine.

Hub-and-Spoke Architecture

Currently, liquidity in DeFi is fragmented across various blockchains. Aave V4 introduces a revolutionary design:

-

The Hub: Acts as a unified liquidity layer and central clearing house for the protocol.

-

The Spokes: Specialized, highly customizable lending markets on different chains that tap into the central Hub’s liquidity.

This architecture allows Aave to handle trillions of dollars in assets, solving the fragmentation problem and making Aave the "go-to" backend for fintech firms and traditional enterprises.

-

Horizon and RWA: Leveraging a $500 Trillion Market

Aave’s ambition extends far beyond crypto-native assets. Horizon, Aave’s dedicated institutional RWA market, is the bridge to traditional finance (TradFi).

-

Scaling to $1 Billion: Horizon currently holds roughly $550 million in net deposits. The 2026 Master Plan targets scaling this to $1 billion and beyond.

-

Global Partnerships: By collaborating with giants like Circle, Ripple, Franklin Templeton, and VanEck, Aave is onboarding major global asset classes—from tokenized Treasuries to credit-based assets.

As the RWA market is estimated at over $500 trillion, Aave’s ability to capture even a fraction of this liquidity through Horizon will fundamentally redefine its market cap.

-

The Aave App: Targeting One Million Users

Aave is no longer just a protocol for "whale" traders; it is becoming a consumer product. The Aave App, a mobile-first banking-style application, aims to capture a share of the $2 trillion mobile fintech industry.

-

Mainstream Adoption: The app abstracts away the complexities of gas fees and private keys, offering a "savings account" experience to non-crypto-native users.

-

Targeting Growth: With a goal of one million users by 2026, Aave is shifting focus from "protocol liquidity" to "product-level adoption."

-

AAVE Price Prediction 2026: The Path to the Top

Market Scenarios

-

Conservative Case: If Aave V4 successfully unifies cross-chain liquidity, AAVE is projected to trade between $450 and $600, retesting its 2021 highs.

-

Bullish Case: If Horizon exceeds its $1 billion RWA target and the Aave App hits its user milestones, AAVE could see a price explosion toward $800 - $1,200.

-

Revenue Capture: Aave already accounts for 52% of all DeFi lending fees. With the proposed "token alignment" (potentially allowing AAVE holders to capture protocol revenue), the token could become one of the most productive assets in the crypto space.

To trade this volatility and monitor the trend, visit https://www.kucoin.com/trade/AAVE-USDT and https://www.kucoin.com/price/AAVE the for real-time market data.

Conclusion: Beyond a Lending Protocol

The end of the SEC investigation marks the end of Aave's "early stage" and the beginning of its era as global financial infrastructure. By combining V4’s technical scalability, Horizon’s institutional depth, and the Aave App’s consumer reach, Aave is positioned to dominate the next decade of finance.

For investors, 2026 isn't just about a price target; it's about Aave becoming the "on-chain Fed" of a new, transparent financial system.

Risk Warning: While regulatory risks have decreased, investors should remain aware of smart contract risks, cross-chain security, and general market volatility.