KuCoin Ventures Weekly Report: The Rise of Payments and the Setback of InfoFi — Safe-Haven Flows and K-Shaped Capital Divergence Amid Macro Turbulence

2026/01/20 03:51:02

1. Weekly Market Highlights

Public Chain Competition Shifts: From “Performance Arms Race” to “Cash-Flow Arms Race,” with Payments as One Potential Next Battleground

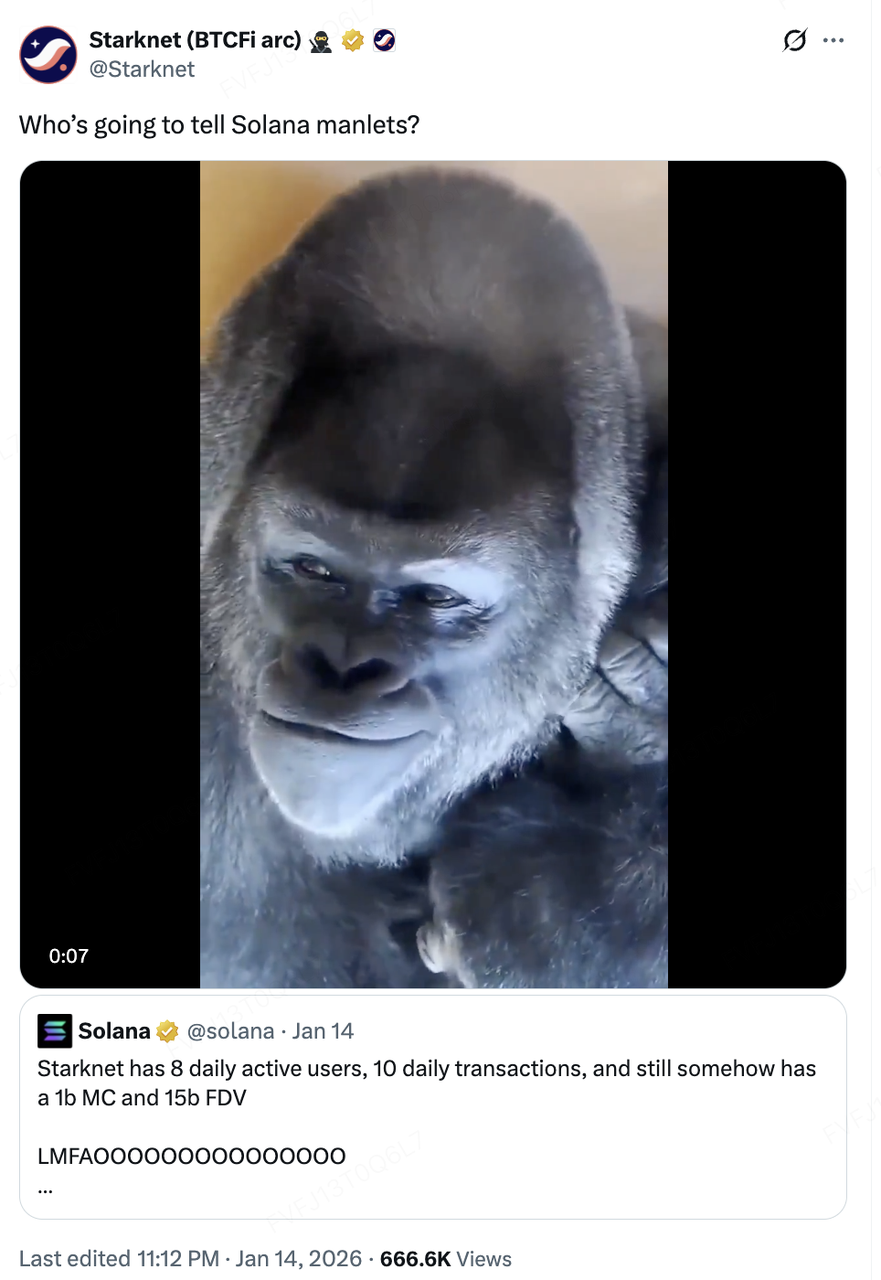

Last week, Solana and Starknet engaged in a public back-and-forth on X over “on-chain activity, valuation, and ecosystem competitiveness.” Solana’s official account mocked Starknet by contrasting “high FDV vs. low activity,” triggering widespread community attention and secondary amplification. Starknet responded with memes, and the discussion quickly expanded into broader debates around L1/L2 product experience, shipping cadence, and differences in capital narratives. The episode later “reversed” into cross-ecosystem collaboration teasers—effectively turning a public dispute into a visibility and narrative amplifier. In practice, this type of inter-chain “beef” is increasingly becoming a common tactic for public chains to compete for attention, developers, and capital, while the focal point shifts from pure technical metrics toward whether “delivery and usage can justify valuation.”

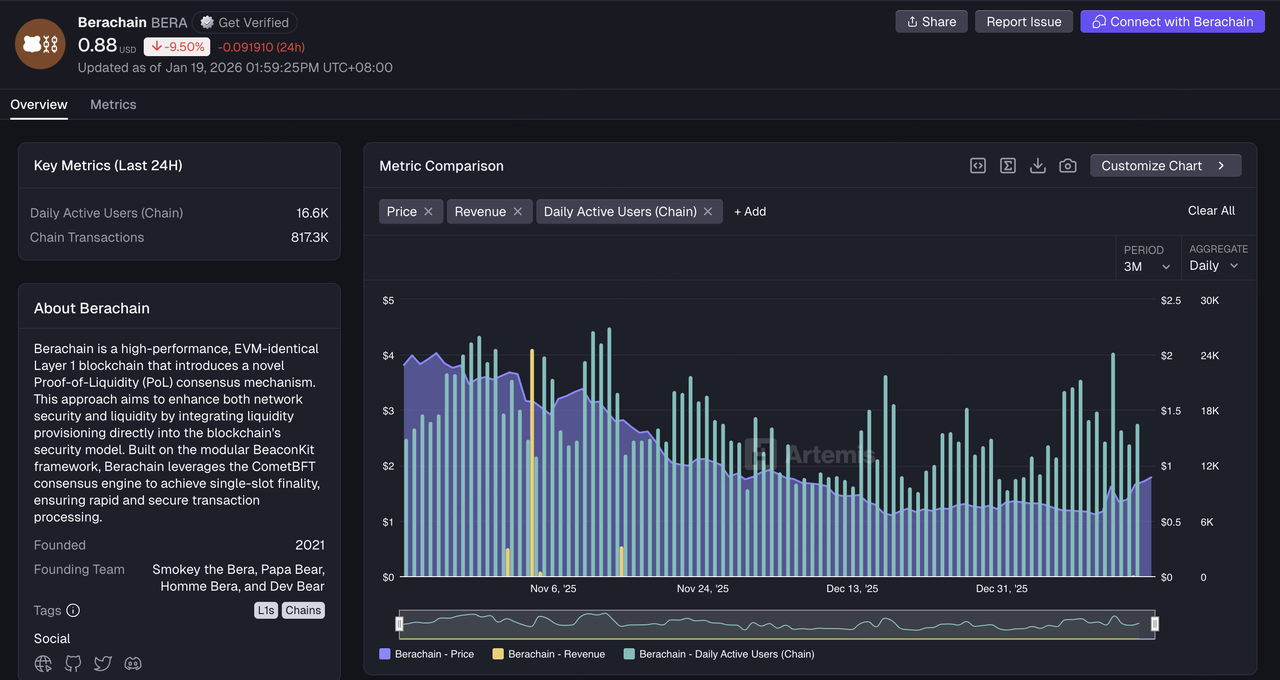

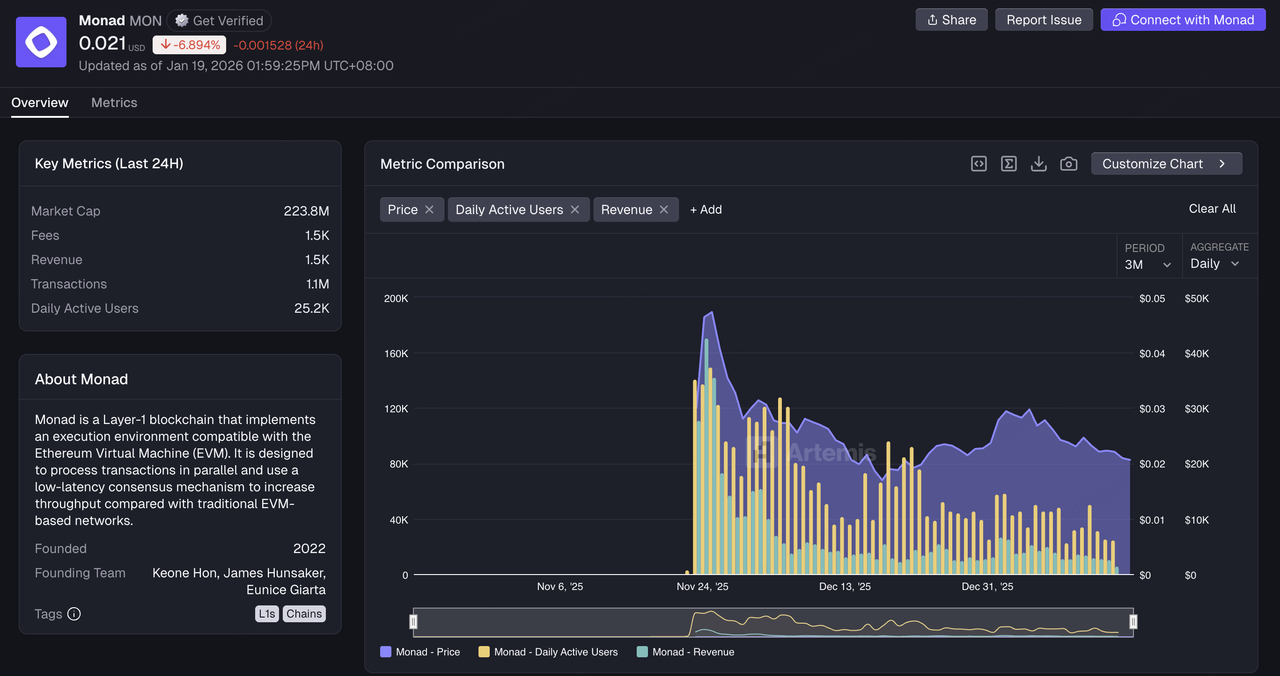

Data Source: X

A more fundamental tension sits underneath: after “high-performance narratives” became abundant, multiple new chains and new scaling narratives are facing the same constraint—DAU and revenue (Fees/REV) are not providing sufficient support for valuations, and this is not an isolated case. Starknet being singled out is only one visible slice of the issue. Similar pressure shows up across other high-expectation ecosystems: when narratives lead with “high FDV / large funding / high buzz,” but on-chain revenue, sustainable fees, and verifiable user retention do not keep pace, market pricing becomes more prone to prolonged valuation discounts and amplified volatility. Berachain is an illustrative example: data points such as capital outflows and weakening activity have fueled market skepticism around “growth quality,” often centering on the gap between short-term incentive-driven usage and long-term cash-flow capacity (e.g., ~16.6K 1D DAUs, ~817K 1D transactions, with daily revenue recently approaching zero). Starknet, meanwhile, was used in the debate as a shorthand case study of “FDV vs. activity mismatch.” Looking further out, chains like Monad—where expectations and valuation are often priced in ahead of full mainnet and ecosystem maturation—naturally face the same question: once narrative premiums fade, how does “performance/experience” translate into “sustainable monetizable scenarios and durable revenue structure”?

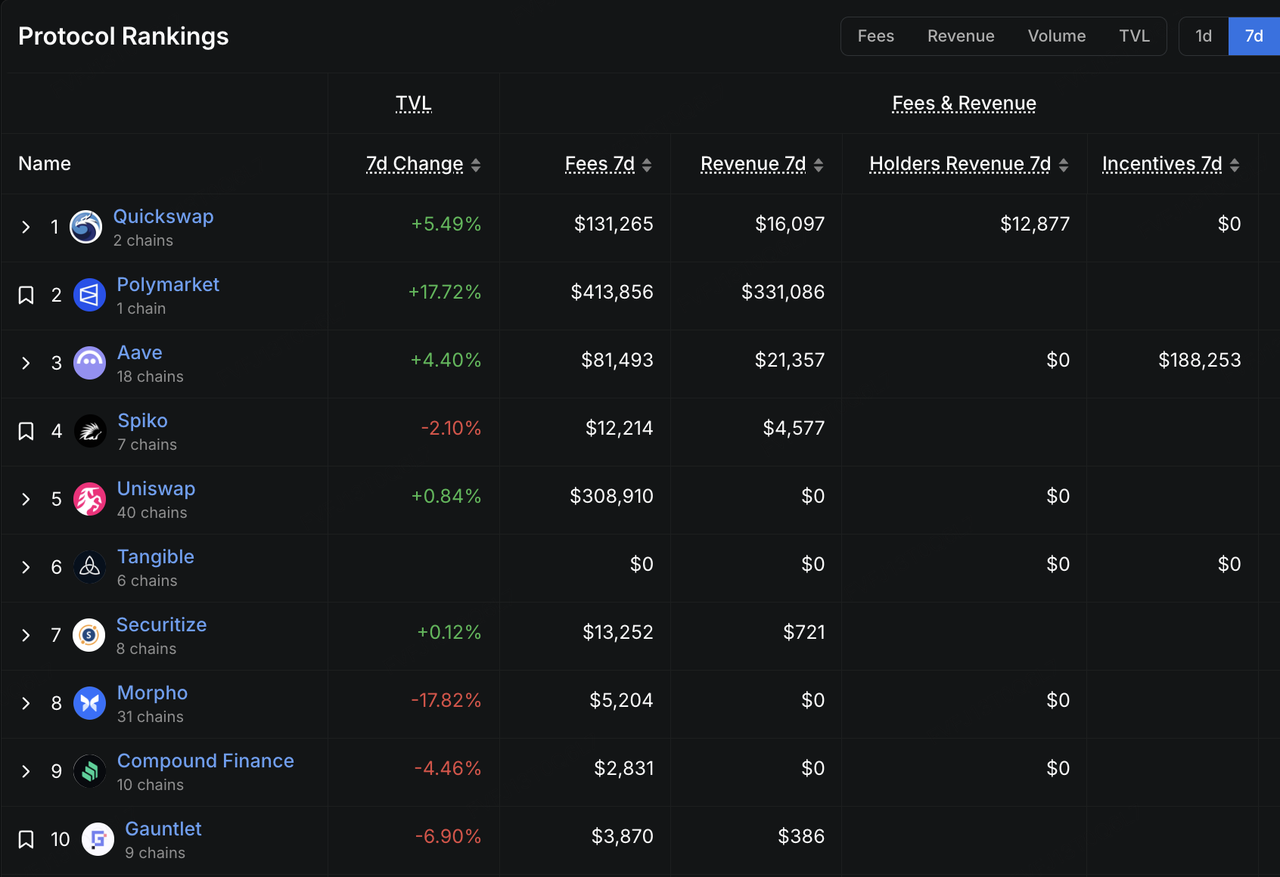

Data Source: Artemis Analytics

Against this backdrop, incumbent chains are also undergoing “value-capture repricing.” On one hand, leading applications such as Polymarket are increasingly signaling a preference for owning their execution path—dedicated settlement, more controllable end-to-end economics—especially for businesses that are high-frequency and heavily compliance/payment-adjacent. On the other hand, infrastructure layers are accelerating strategic pivots via M&A and organizational restructuring. Polygon, for instance, has reportedly pursued acquisitions totaling over $250M (Coinme and Sequence), while refocusing its narrative toward payments and other cash-flow-adjacent directions, alongside team adjustments. These moves are different expressions of the same underlying question: if “chain narratives” alone no longer suffice, what can rebuild revenue and distribution in the next phase?

Data Source: https://defillama.com/chain/polygon

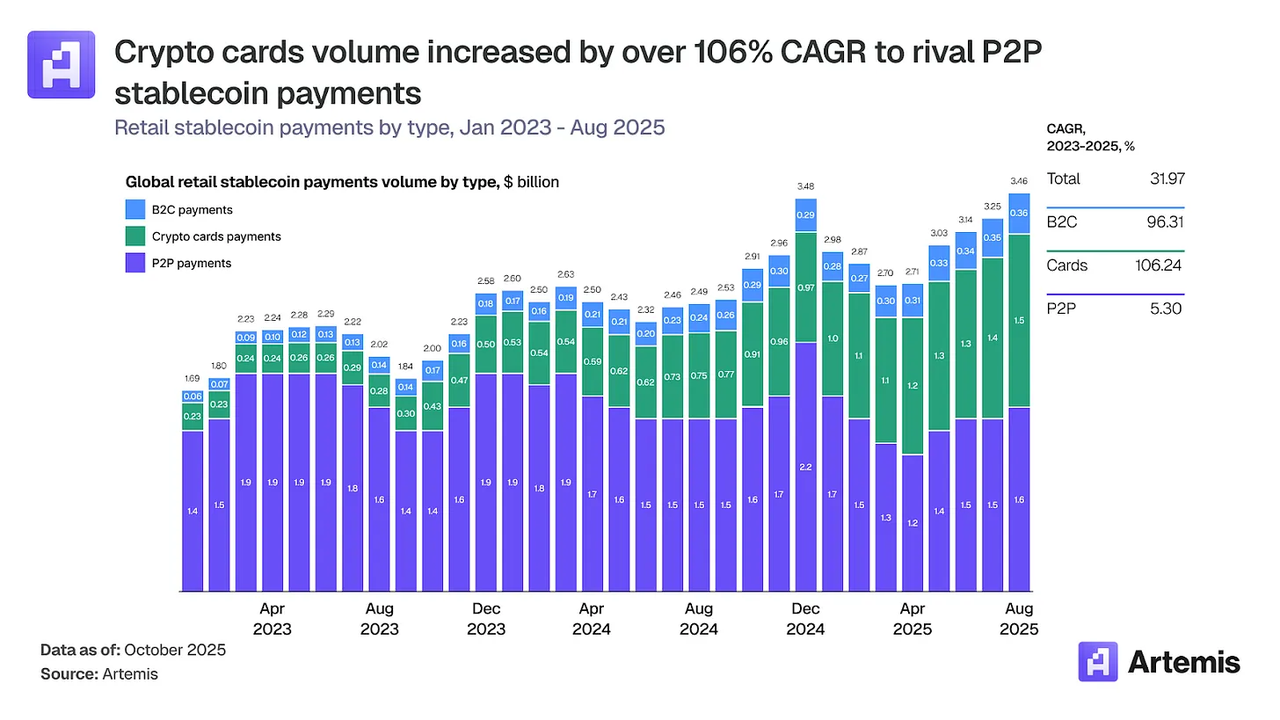

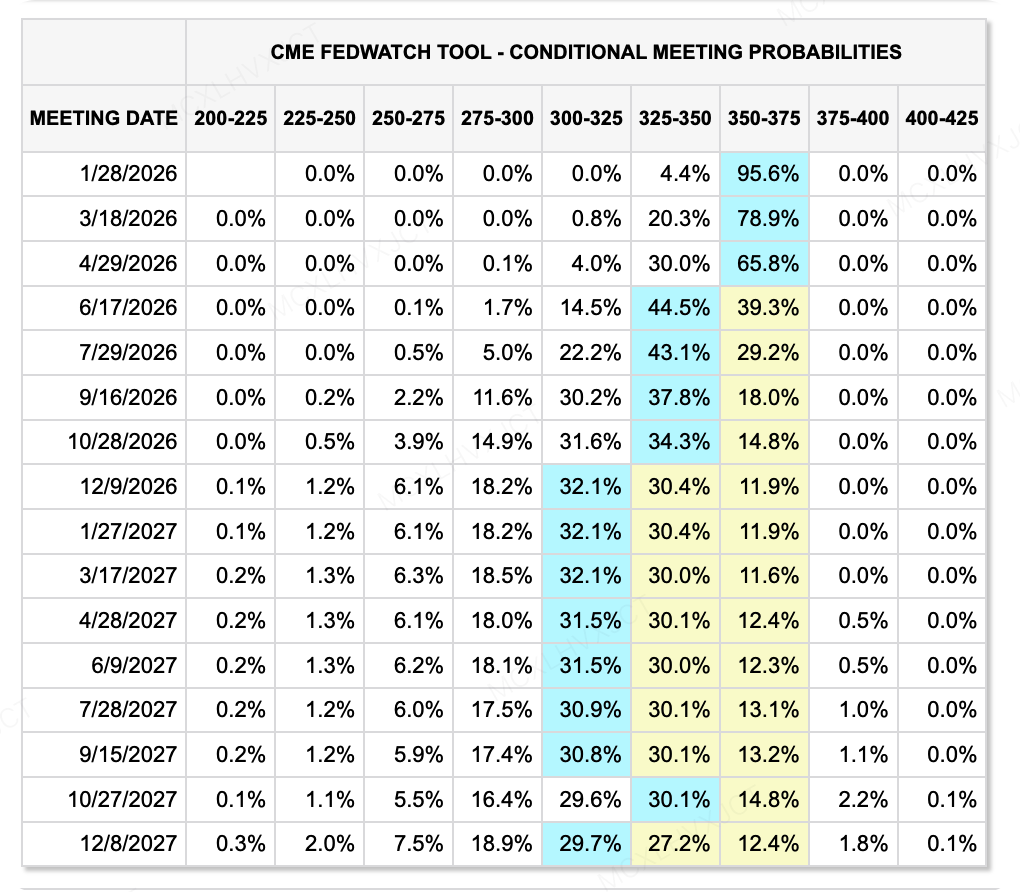

Among potential new narratives, Payments is being pulled to the foreground not because it is “easier to market,” but because it is closer to a verifiable business loop. Stablecoins naturally serve settlement demand, while “payment entry points and distribution networks” determine whether stablecoin usage can move from on-chain transfers into real-world commerce and enterprise settlement. In Stablecoin Payments at Scale, Artemis emphasizes the practical path of “productizing” stablecoin payments—such as using crypto debit cards to convert stablecoin balances into widely accepted payment-network spending power; clarifying the division of labor across payment participants (issuance, acquiring, clearing/settlement, compliance); and highlighting how scaling depends on regulatory and clearing infrastructure. This also helps explain why some chains are reallocating resources toward payments: relative to “TPS competition,” payments can more reliably accumulate sustainable fees, merchant networks, and funding rails—forming a steadier cash-flow narrative. One datapoint cited is that on-chain settlement volume tied to stablecoin card transactions grew from roughly $100M per month in early 2023 to roughly $1.5B per month by end-2025—an annualized market scale of about $18B.

Data Source: Artemis Research (Stablecoin Payments at Scale)

It is important to note that Payments may become one major battleground, but it does not exclude other directions (AI, RWA, prediction markets, etc.) from producing new value-capture opportunities. The distinction is that as the market increasingly evaluates public-chain competitiveness through “fees—retention—distribution channels,” the decisive edge becomes closer to a commercialization contest: whoever can convert ecosystem traffic into repeatable settlement scenarios—and convert scenarios into sustainable fees and balance-sheet stickiness—will be more likely to earn pricing power in the next stage of competition.

2. Weekly Selected Market Signals

Order and Chaos: Silver Surges, A Hawkish Dark Horse at the Fed, and Institutional Contrarian Accumulation

The core narrative of the macro market last week validated Ray Dalio's concerns in his latest article regarding "disorder in internal order." The market is currently undergoing a trade based on a "crisis of confidence in fiat currency." The most dramatic change mid-week was the US Department of Justice opening a criminal investigation into Fed Chair Powell, though President Trump subsequently stated he has "no immediate plans to remove Powell." However, this unprecedented intervention, superimposed with geopolitical noise (Trump threatening to take over Greenland, the situation in Iran), has kept global capital's confidence in the US Dollar as a neutral reserve currency weak.

Data Source: TradingView

The resulting market reaction presented distinct "dual-track" characteristics: on one hand, US stocks fell slightly across the board due to declining risk appetite (Dow down 0.29%, Nasdaq down 0.66%), with traditional risk assets performing flatly; on the other hand, the precious metals market welcomed an astonishing valuation re-rating. COMEX gold futures broke through $4,600/oz, while silver prices skyrocketed in a single week, breaking through $90/oz to hit a historic high. More symbolically, the gold-silver ratio plummeted to 50.57, hitting a 13-year low. Typically, a repair in the gold-silver ratio accompanies a rebound in the manufacturing PMI, yet the US December PMI was only 47.9%, in contraction territory, while silver surged against the trend. This indicates that the logic for silver's rise has switched from the "industrial cycle" to "strategic resource shortage." Currently, global capital is betting on silver's irreplaceability in AI data centers, photovoltaics, and electric vehicles; the logic behind the silver surge remains an AI narrative. However, on the flip side, due to the excessive gains in gold and silver, the Bloomberg and S&P GSCI indices face annual rebalancing, which may subject the precious metals market to significant short-term selling pressure.

Meanwhile, US economic fundamentals displayed a grotesque sense of "overheating." The Q3 GDP revision was as high as 4.3%, far exceeding expectations. This strong growth keeps near-term expectations for continued rate cuts low. This means we will remain in a complex environment of "high growth + high rates + high inflation" for a longer period. This is fatal for assets lacking cash-generating capabilities, but a boon for core hard assets.

Bitcoin briefly broke through the 96,000 mark but failed to stabilize. Recently, BTC's correlation with gold/silver is weakening, gradually showing independent momentum. The market did not crash due to regulatory setbacks. Last week, Coinbase publicly opposed the Senate's "CLARITY Act" (accused of overly expanding SEC power and banning stablecoin yields), likely causing the bill's deliberation to be postponed, with market predictions pushing potential passage to late January or later. Although this is a blow to the compliance process, the market reaction was flat with extremely low volatility, demonstrating desensitization to regulatory noise.

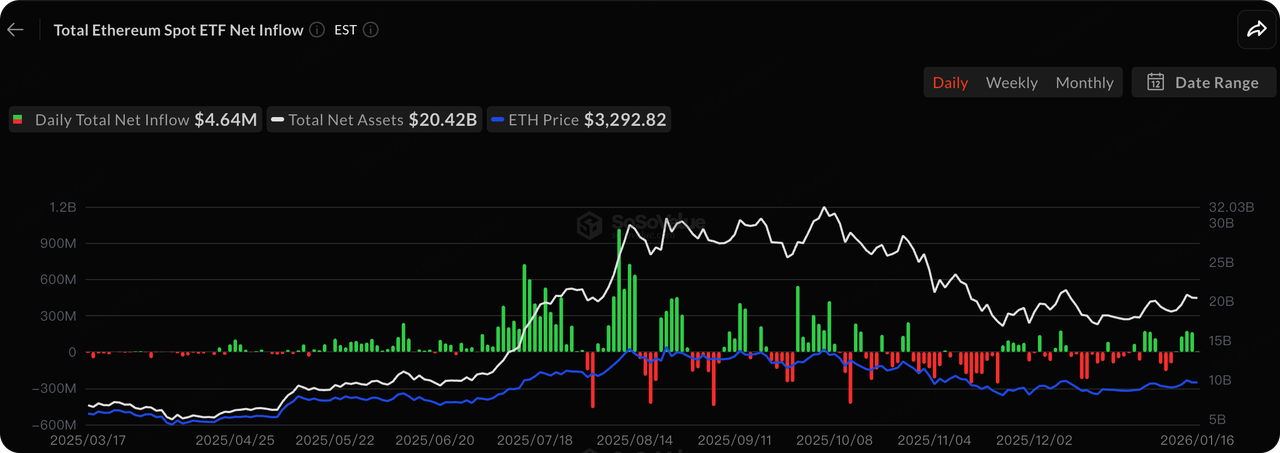

Data Source: SoSoValue

Regarding spot ETFs, the overall trend returned to an upward trajectory last week. Bitcoin ETFs saw a net inflow of $1.416 billion, and Ethereum ETFs saw a net inflow of $479 million. The latest 13F filings revealed a critical trend: during the correction in Q4 2025 when Bitcoin fell from 126k to 90k, institutions did not panic-sell but instead accumulated against the trend. A total of 121 institutions net increased their holdings by approximately 890,000 ETF shares. Notably, the Dartmouth College endowment allocated capital to IBIT and ETHE in Q4. Long-term capital, including top academic institutions, is successively incorporating crypto assets into strategic allocations rather than short-term swing trading.

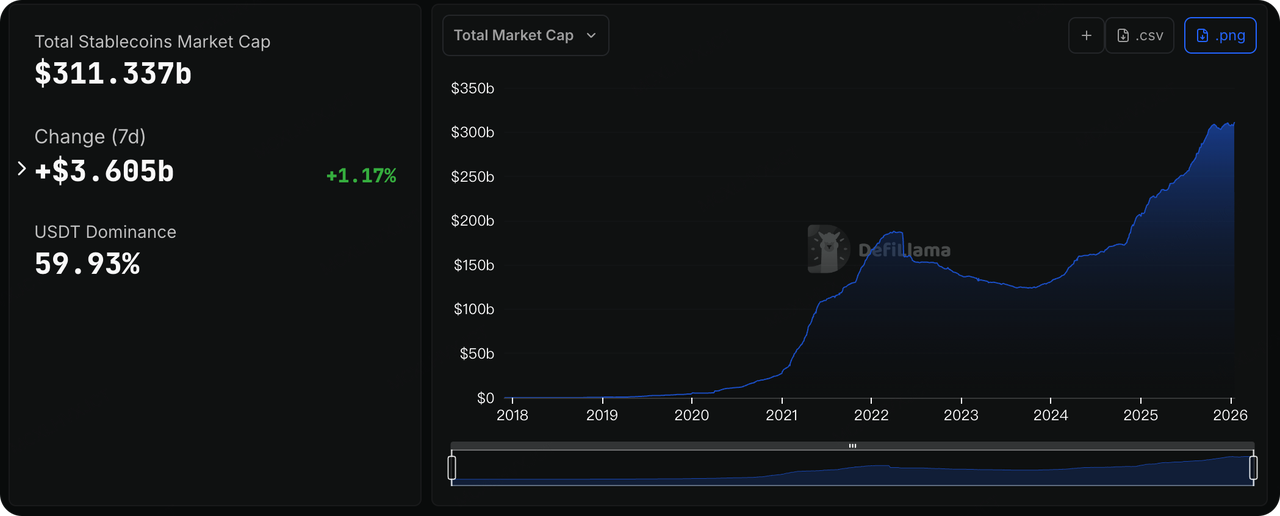

Data Source: DeFiLlama

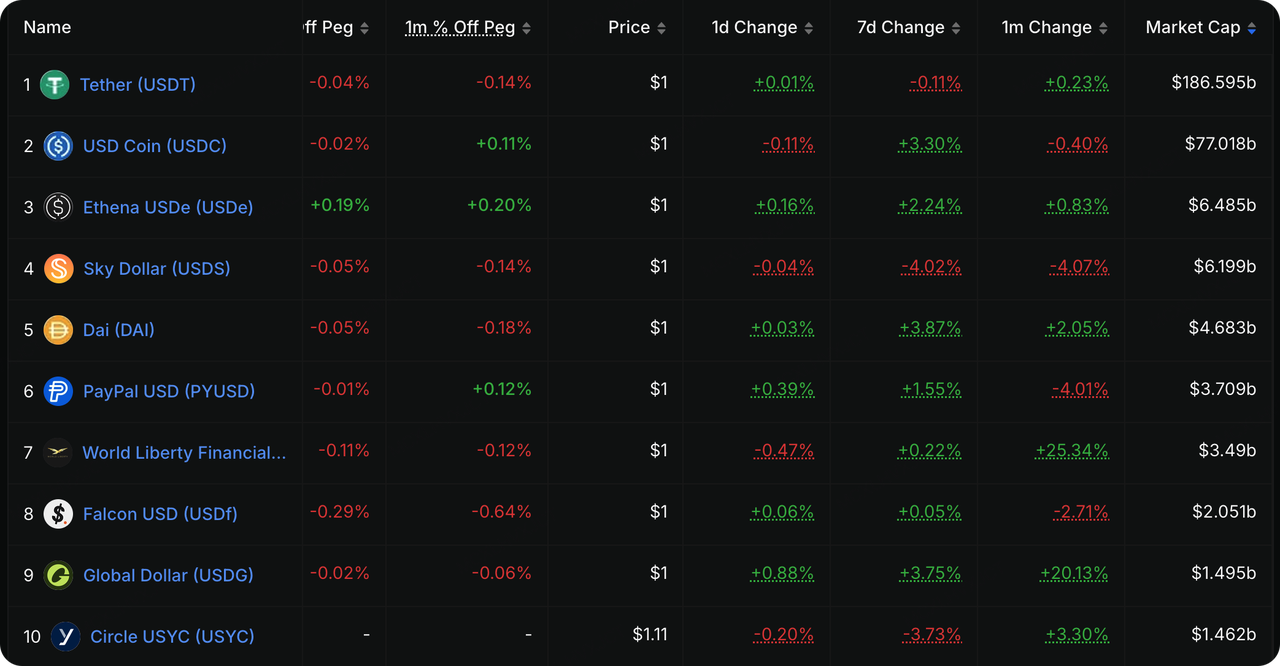

On the macro liquidity front, the market is pricing in "higher for longer." Although US inflation data (CPI/PPI) appears mild, strong GDP (4.3%) and unemployment at historic lows leave the Fed lacking urgency for immediate rate cuts. Based on this week's CME FedWatch data, expectations for liquidity over the next quarter remain relatively cautious. Current trading results indicate that the risk-free US dollar rate will likely maintain above 3.5% until at least June 2026.

Additionally, there were some shifts regarding the new Fed Chair candidate last week. Trump wavered on the front-runner nomination of Kevin Hassett, inclining to keep him in the White House. This directly led to a significant rise in the probability of Kevin Warsh and BlackRock executive Rick Rieder becoming the new Chair. If Kevin Warsh takes the position, his policy inclination is distinctly different from Hassett's "massive liquidity injection" approach. Warsh emphasizes "market discipline" more, advocating for the elimination of the "Fed Put" (Federal Reserve put option)—meaning not easily bailing out the market when stocks fall, but allowing deleveraging and market clearing. This personnel change and its final settlement will also directly affect subsequent Fed monetary policy and requires continued attention.

Data Source: CME FedWatch Tool

Major Events to Watch This Week:

-

January 19: Davos World Economic Forum opens, featuring speeches by a series of national leaders.

-

January 22: US November PCE, Initial Jobless Claims, Q3 GDP, and other important data releases.

-

January 23: Japan Core CPI, Japan Economic Development Report.

Primary Market Financing Observation:

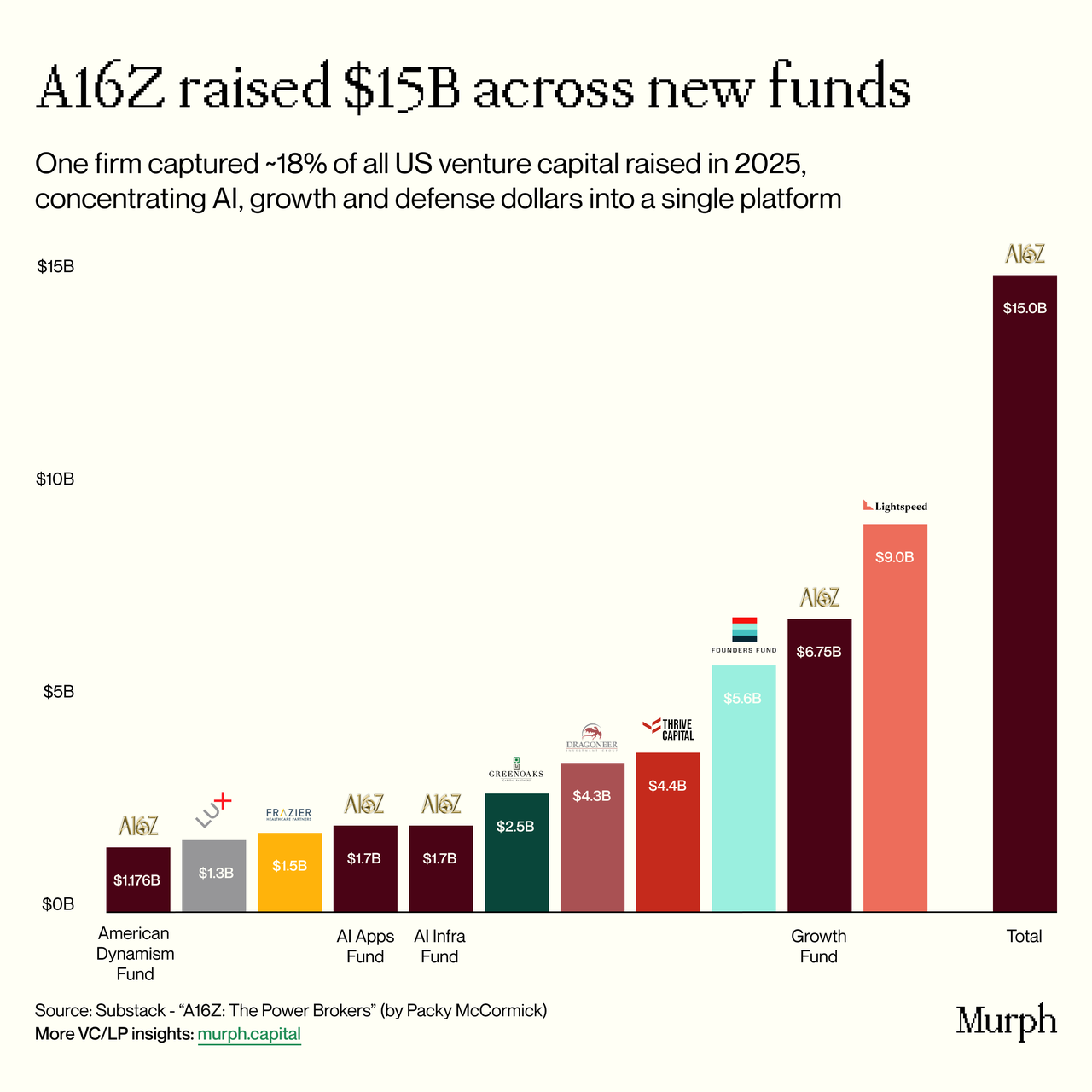

Data Source: Murph.Capital

a16z recently announced the successful raising of $15 billion, and the subtext of Ben Horowitz's manifesto is worth repeated savoring. From an investment strategy perspective, this massive capital, accounting for 18% of the total US VC fundraising in 2025, is clearly directed not only toward high-growth sectors favored by traditional VCs but also toward "American Dynamism," AI applications, and infrastructure. The implication for the crypto field is that against the backdrop of current macro turbulence and geopolitical gaming, capital is no longer paying for a pure "decentralized utopia," but for "digital infrastructure that enhances American competitiveness." This means that only Crypto projects that serve compliant finance, enhance USD liquidity, or integrate with AI computing power can receive the tilt of this "patriotic capital." The primary market is experiencing a brutal K-shaped divergence: projects fitting the "Empire Narrative" enjoy liquidity surplus, while ordinary projects face a harsh winter.

Other Hot Primary Projects:

Project Eleven: Last week, the project completed a $20 million Series A financing round, led by Castle Island Ventures with participation from Coinbase Ventures and others. With the approach of quantum computing, assets based on elliptic curve cryptography, such as Bitcoin, face a "Grey Rhino" style survival crisis. Project Eleven is not telling a growth story, but a "survival story"—providing post-quantum cryptography migration solutions for digital assets worth over trillions of dollars. Beyond contributing academic papers, the project is also building a series of tools and products to help users/institutions conduct anti-quantum computing engineering:

-

Yellowpages: A production-grade registry. It allows BTC holders to generate "post-quantum keys" and cryptographically link them to existing Bitcoin addresses. This essentially adds a future "quantum lock" to current Bitcoin accounts without requiring an immediate complex on-chain hard fork or migration.

-

PQC Testnet (Solana): The project team has built and open-sourced a Solana post-quantum testnet, replacing standard EdDSA signatures with ML-DSA (Module-Lattice Digital Signature Algorithm) compliant with NIST standards. This is the industry's first combat-grade post-quantum blockchain environment.

-

Migration Orchestration: Addressing the "turning a big ship is hard" problem for Layer 1 public chains (the so-called collective action problem), providing a full suite of tools from "readiness assessment" to "deployment sequencing" to ensure no forks or asset losses occur during upgrades.

YZI Labs Invests in Genius, a Privacy Execution Layer Based on MPC

Last week, YZi Labs announced an investment in Genius, rumored to be in the "tens of millions of dollars," with CZ simultaneously joining the project as an advisor. Genius Trading is not merely a transaction aggregator serving the BNB Chain ecosystem like Axiom or Gmgn; it attempts to solve the long-standing transaction pain points on-chain—"privacy and transparency." For large capital and institutions, current on-chain transactions are transparent, meaning positions, strategies, and timing are completely exposed to counterparties (MEV bots and copy-traders), and there have been multiple incidents of concentrated hunting of whale transactions. Genius aims to build an "on-chain Binance," possessing CEX speed and privacy while maintaining non-custodial decentralized attributes.

Ghost Orders: This is Genius's most compelling feature. It uses MPC technology to generate temporary, ephemeral wallet clusters to achieve transaction privacy. The core mechanisms are as follows:

-

Breaking into Parts (Disaggregation): When placing a large order, the system does not broadcast directly through your main wallet but splits the order and executes it simultaneously through hundreds of temporary wallets (up to 500 wallets).

-

Severing Links: The funding links between these temporary wallets are confidential to the public (but cryptographically auditable), making it impossible for outsiders to trace the original trading entity through on-chain data. This means whales can build positions on-chain while "invisible."

-

Signature-Free Trading: Adopting an intent model, users only need to specify "what to buy," and the terminal automatically completes complex routing and execution through aggregators and native cross-chain bridges without frequent signing.

-

Omni-Chain Coverage: Supports 10+ public chains including BNB Chain, Solana, and Ethereum, truly realizing the management of all on-chain assets within a single terminal.

3. Project Spotlight

X Bans InfoFi: A Direct Clash Between Attention Finance and Platform Governance

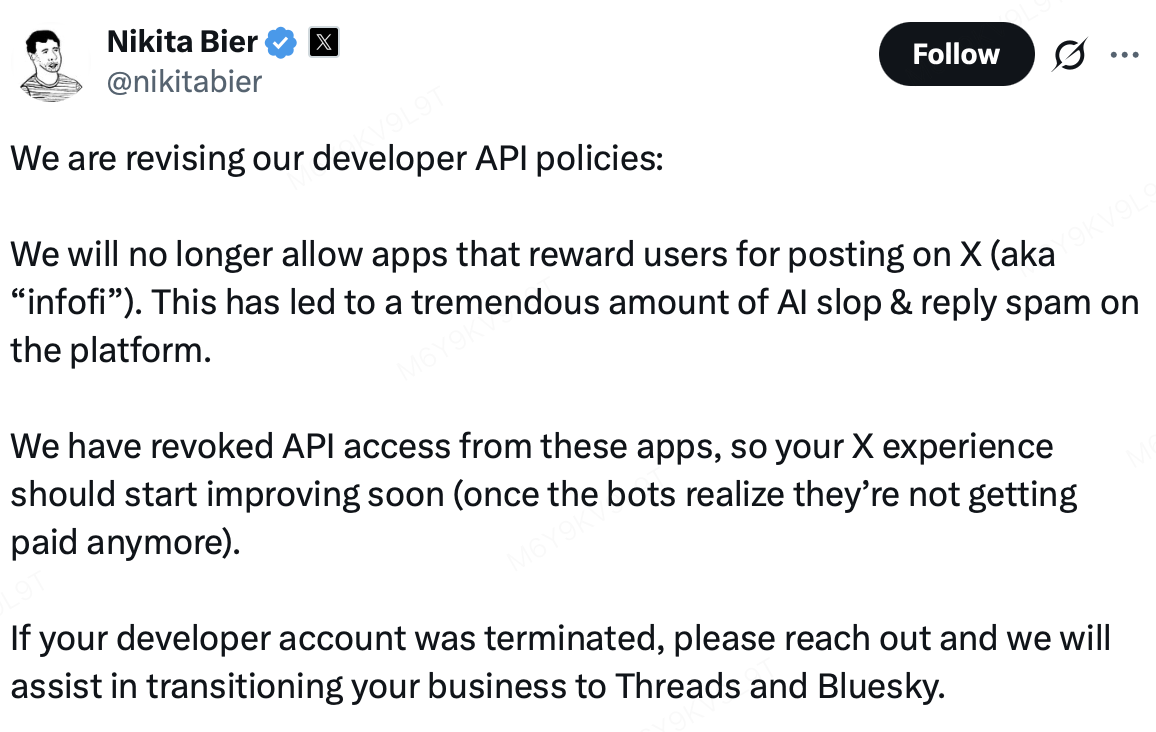

Last week, X (formerly Twitter) imposed restrictions on a group of third-party protocols classified as InfoFi, including reducing account visibility, banning official accounts, and cutting off certain data interfaces. The market reacted swiftly: the InfoFi sector's market cap dropped about 11.5% in a single day, with leading token $KAITO falling from 0.70 USDT to 0.54 USDT within hours (a decline of over 20%), and $COOKIE experiencing a roughly 15% pullback during the same period. Overall, this action was not an isolated penalty against a single project but rather X's systematic rejection of this product paradigm. X's Product Head, Nikita Bier, stated publicly that even if these projects paid substantial API fees, they would no longer be considered acceptable third-party forms on the platform.

Nikita Bier Announces Restrictions on InfoFi

Source: X Platform

Following the restrictions, InfoFi platforms responded swiftly. Kaito founder Yu Hu announced the shutdown of the "Yaps" incentive program and its leaderboards shortly after the measures were enacted; Cookie DAO followed suit by terminating its "Snaps" platform and all active campaigns. Prior to this, Kaito’s core mechanism involved quantifying posting, interaction, and discussion heat on X into "Yaps" points, which the market widely regarded as a key reference for future token distributions. While user behavior occurred on X, the value settlement took place within the Kaito ecosystem—essentially created an "attention re-pricing mechanism" built on top of X. In contrast, Cookie DAO leaned more toward an "attention measurement layer," with products that analyze content propagation paths, influential nodes, and narrative diffusion efficiency to provide data services such as KOL identification and sentiment analysis for projects and institutions.

Looking back at 2024–2025, Kaito also faced multiple account bans or API restrictions, but the conflicts at that time primarily centered on commercial access issues. X viewed certain projects as circumventing expensive Enterprise API and Premium restrictions through unofficial interfaces or account clusters, eroding the platform's business model. Those disputes still allowed room for negotiation, and most projects regained operations after purchasing enterprise-level API access.

This round of restrictions, however, shows clear differences. Previously, X's approach was largely a fee-based commercial game—“use the data, pay the price.” The current logic has shifted to platform-ecosystem trade-offs. Nikita Bier publicly noted that the massive automated interactions and low-quality content induced by InfoFi mechanisms are undermining user experience and advertising value. Under this assessment, X is inclined to block the spread of such product forms even at the cost of forgoing potential API revenue.

At a deeper level, the conflict is not solely about AI-generated content or declining user experience, but about control over incentives and traffic allocation. InfoFi protocols guide user behavior through their own point systems, leaderboards, and weighting algorithms, diverting engagement away from X’s native recommendation and incentive structures. In this setup, X bears the infrastructure costs of content production and distribution, while the financialized returns on attention are captured by external protocols. In essence, these projects convert social activity on X into “attention mining” for external token systems. From a platform governance perspective, X does not want to evolve into a traffic source or incentive substrate for third-party token economies, and instead prefers creators to operate within its native monetization frameworks, including ad revenue sharing, subscriptions, and platform-native products. In parallel, X is accelerating the rollout of its own creator incentive programs, seeking to attract top global creators through high ad revenue sharing and so-called “Grok premium content rewards.” Against this strategic backdrop, the low-quality AI-driven interactions induced by InfoFi not only divert traffic but also dilute the visibility and relative weighting of top-tier creators in the feed, directly impacting X’s core interests.

Against this backdrop, InfoFi projects have initiated emergency strategic pivots. Kaito has shut down Yaps-related incentives and shifted toward Kaito Studio, focusing on cross-platform creator distribution and AI-driven data analytics in an effort to move away from the “post-to-mine” model. Cookie DAO has repositioned around Cookie Pro, emphasizing B2B analytics and KOL intelligence services. In the short term, with their primary growth engines disrupted, the valuation frameworks of related tokens are undergoing reassessment, while community confidence has come under pressure. Over the medium to long term, it remains highly uncertain whether these projects can transition from attention incentive layers dependent on a single social platform into more independent AI data and analytics infrastructure. Following the loss of X as a high-density traffic source, customer acquisition costs, data timeliness, and long-term commercial sustainability will all face material challenges. Secondary market participants may wish to focus on on-chain fundamentals rather than social noise, and diversify exposure to mitigate platform policy tail risks.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.