KuCoin Ventures Weekly Report: Decoding the Downturn: Market Panic, Shifting ETFs, and Uniswap's Value Reformation

2025/11/17 08:36:01

1. Weekly Market Highlights

Bitcoin Breaches Key $100K Support as Bear Market Shadow Looms Over Crypto

The crypto market experienced a bloodbath last week, with BTC prices plunging below $96,000 to their lowest levels since early March. This resulted in an evaporation of approximately 5.8% from the total crypto market capitalization within a single week. The sustained market decline confirms previous pessimistic forecasts, indicating that the crypto market has entered a technical bear market, driven by a confluence of negative factors and amplified by structural liquidity shortages.

Data Source: https://www.coinglass.com/pro/i/FearGreedIndex

Market panic has reached an extreme, with key indicators and on-chain data painting a picture of a complete collapse in confidence. The "Fear & Greed Index," a measure of investor sentiment, once dropped below 9 into the "Extreme Fear" territory, a reading that surpassed the low point recorded during the depths of the 2022 bear market. From a technical perspective, the sell-off has been exceptionally destructive. Bitcoin not only lost the crucial psychological level of $100,000 but also decisively broke below its 52-week moving average—widely regarded as the bull-bear demarcation line—with a solid red candle. Coupled with the renewed discourse around the "Bitcoin four-year cycle" theory, it raises the suspicion that this may not be the prelude to a bear market, but a signal that we are already in its initial stages.

Data Source: TradingView

In addition to selling pressure from long-term holders, a significant number of new investors were pushed into a loss-making position as the market price fell below the cost basis of short-term holders. This triggered a chain reaction of stop-loss orders and panic selling, forming a classic capitulation-style decline that rapidly intensified downward momentum.

A deeper issue lies in the severe structural weaknesses the current market has exposed, namely the persistent depletion of liquidity. Since the massive crash last October, the order book depth on major exchanges has failed to recover effectively, meaning the market's capacity to absorb sell orders is extremely fragile. This low-liquidity environment has significantly amplified market volatility, allowing even medium-sized sell-offs to cause drastic price drops. Against a backdrop of shattered confidence and a lack of clear positive catalysts, this structural vulnerability suggests that the market's bottoming process is likely to continue, and it may be entering a prolonged W-shaped consolidation phase rather than the swift V-shaped recovery many had hoped for.

2. Weekly Selected Market Signals

Global Risk Appetite Freezes: Hawkish Signals + a Data Vacuum Turn Friday into a “Black Friday” for Assets

Last week, a hawkish tone from Federal Reserve officials—combined with a publication “data vacuum” and mounting concerns about an AI bubble—pushed global risk assets and precious metals lower on Friday. Blue-chip indices from Tokyo to Paris and London fell broadly, with the U.K. underperforming amid fresh budget-uncertainty worries. U.S. equity futures extended losses, pointing to a weak open after Thursday’s sell-off. With the U.S. government shutdown now over but some key macro releases still queued for rescheduling, markets fear the Fed may prefer to wait for clearer data, leading to a marked cooling of bets on another rate cut this year.

Data Source: TradingView

Crypto markets moved into risk-off mode in tandem. Over the weekend, Bitcoin broke below the key $94,000 level, erasing its year-to-date gains and entering a technical bear market. The earlier support from “pro-crypto policy + steady ETF buying + portfolio diversification” narratives faded, leveraged liquidations amplified volatility, and smaller-cap tokens fell even more. On sentiment, risk appetite slid from “cautious” to “downbeat,” visible in weaker on-chain activity and thinner flows.

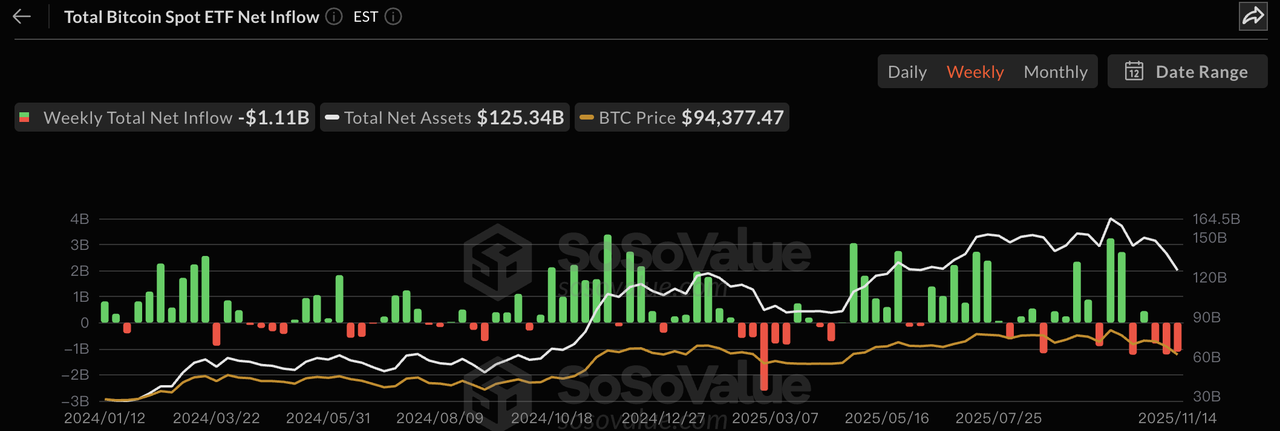

Data Source: SoSoValue

A drop in marginal institutional participation has been a major driver of this drawdown. Earlier this year, cumulative net inflows into spot ETFs significantly lifted AUM and helped position BTC as a broader portfolio allocation tool. According to Bloomberg data, Bitcoin ETFs have taken in over $25 billion year-to-date, pushing combined AUM to around $169 billion.

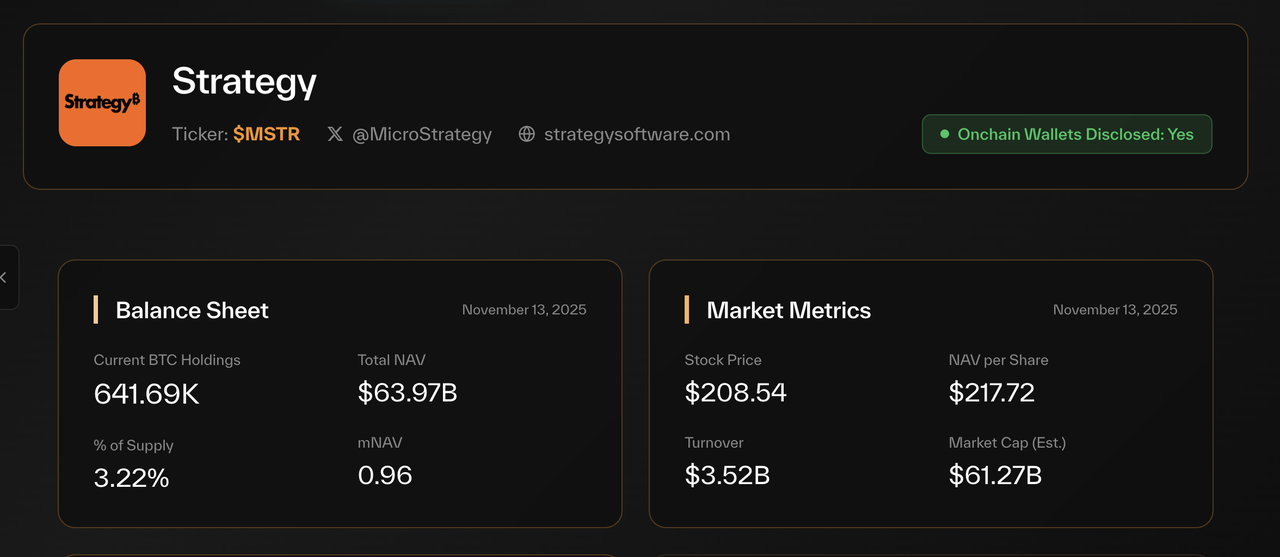

Recently, however, ETF net flows have softened while corporates and long-horizon allocators have turned more cautious—making the “hedge/diversifier” narrative fragile again. A telling sign: MicroStrategy (MSTR) at times traded near, or even below, the implied value of its underlying BTC holdings, indicating investors’ reduced willingness to pay a premium for equity-based, high-beta BTC exposure.

Data Source: https://datboard.panteraresearchlab.xyz/

On the ETF flow front, weakness persisted: last week BTC ETFs saw ~$1.11B in net outflows, marking a second straight week above the $1B mark; ETH ETFs recorded ~$729M in net outflows. Notably, XRP / SOL / LTC products that were approved more recently still posted net inflows, suggesting some rotation toward relatively stronger themes.

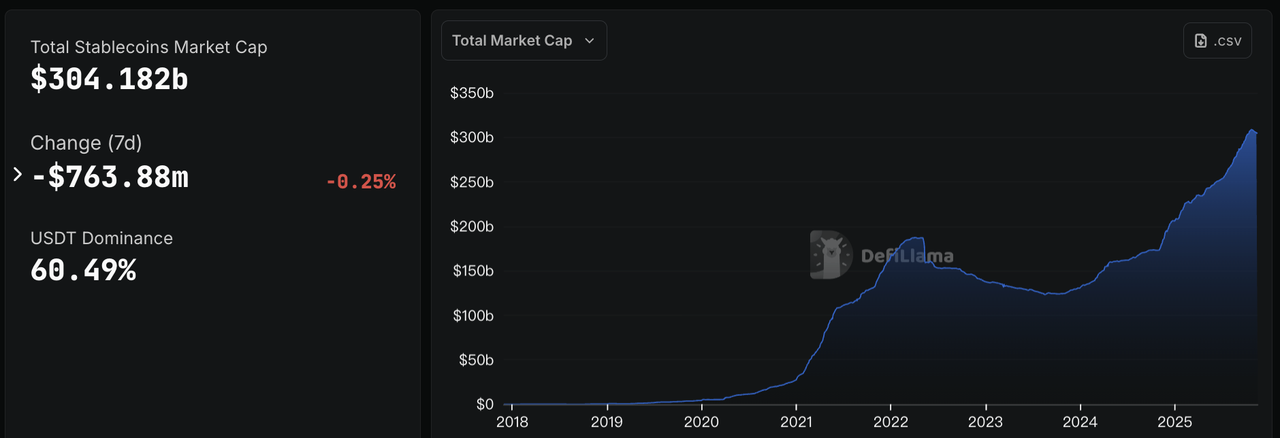

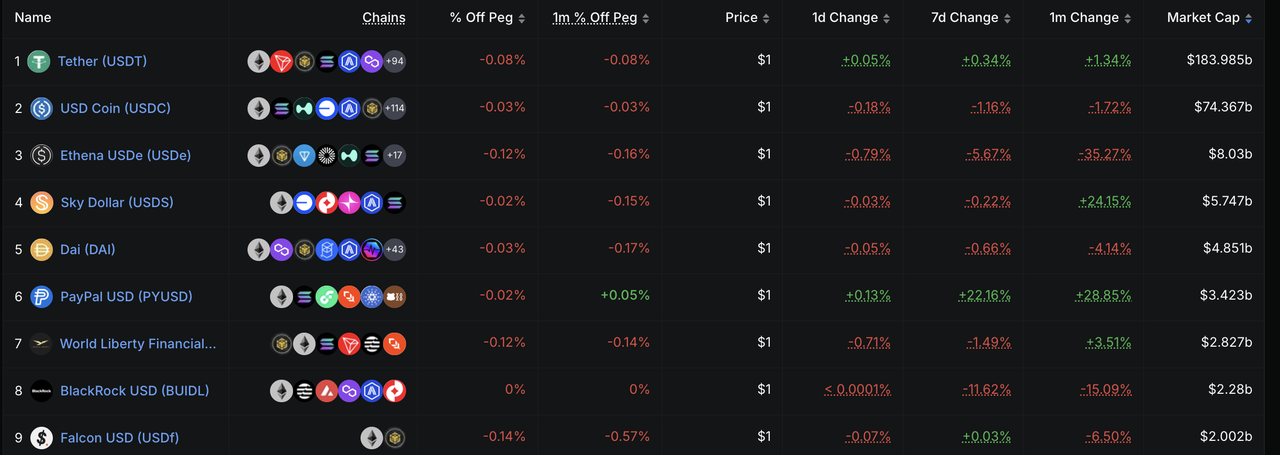

Data Source: DeFiLlama

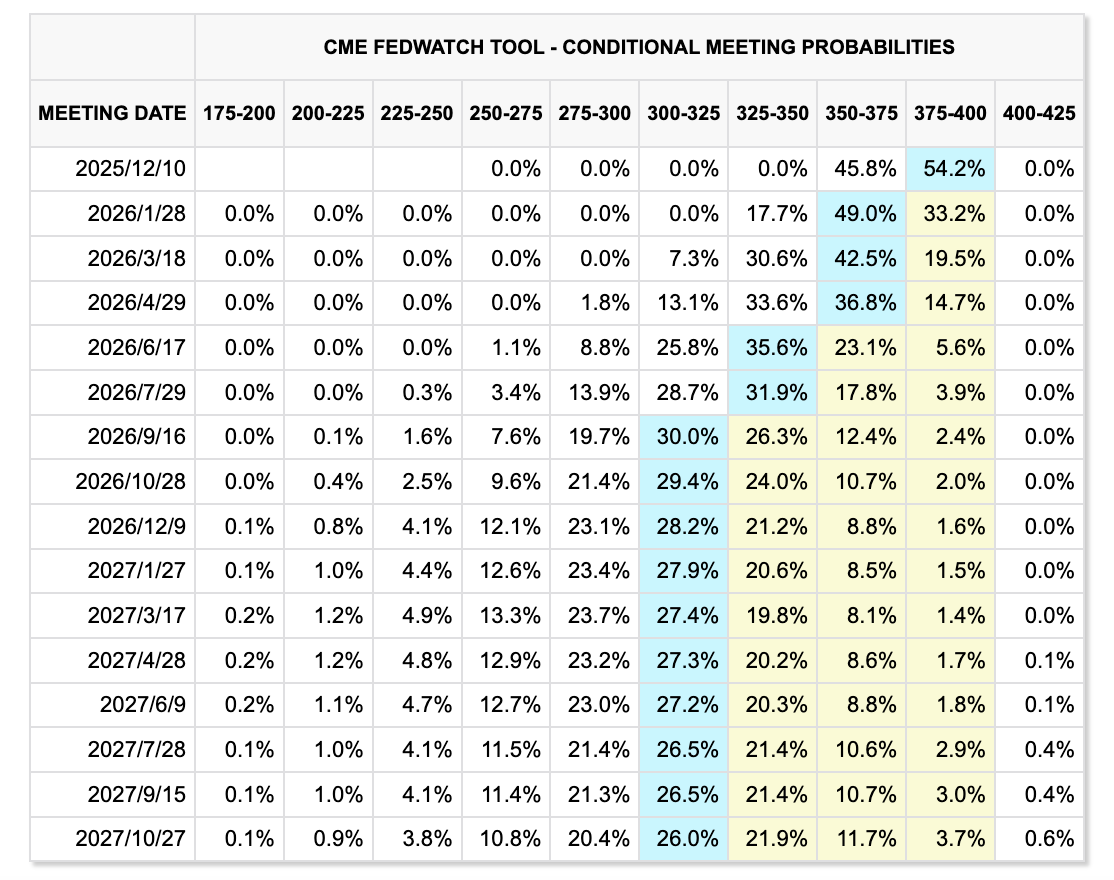

Stablecoins and rate expectations also point to caution. Total stablecoin supply continued to edge lower, with the exception of USDT (about +0.34%), while other large issuers contracted. On rates, CME FedWatch shows the probability of another cut this year falling to 54%—and fluctuating—underscoring a “data-first, then re-price” stance in rate markets.

Data Source: CME FedWatch Tool

Key Events to Watch This Week:

-

Backlog macro data returns after the shutdown: Sept. nonfarm payrolls on Nov 20, followed by Sept. real wages on Nov 21.

-

FOMC Minutes: The Oct. minutes will be released on Nov 20, potentially signaling a more hawkish path for rate cuts.

-

AI catalysts: NVIDIA reports fiscal 3Q’25 after the close on Nov 19, widely viewed as pivotal for AI-linked equities. Prediction markets also lean toward a Google Gemini 3.0 release this week; insiders describe it as “striking,” with expected step-ups in coding and multimodal generation.

Primary Market Observations:

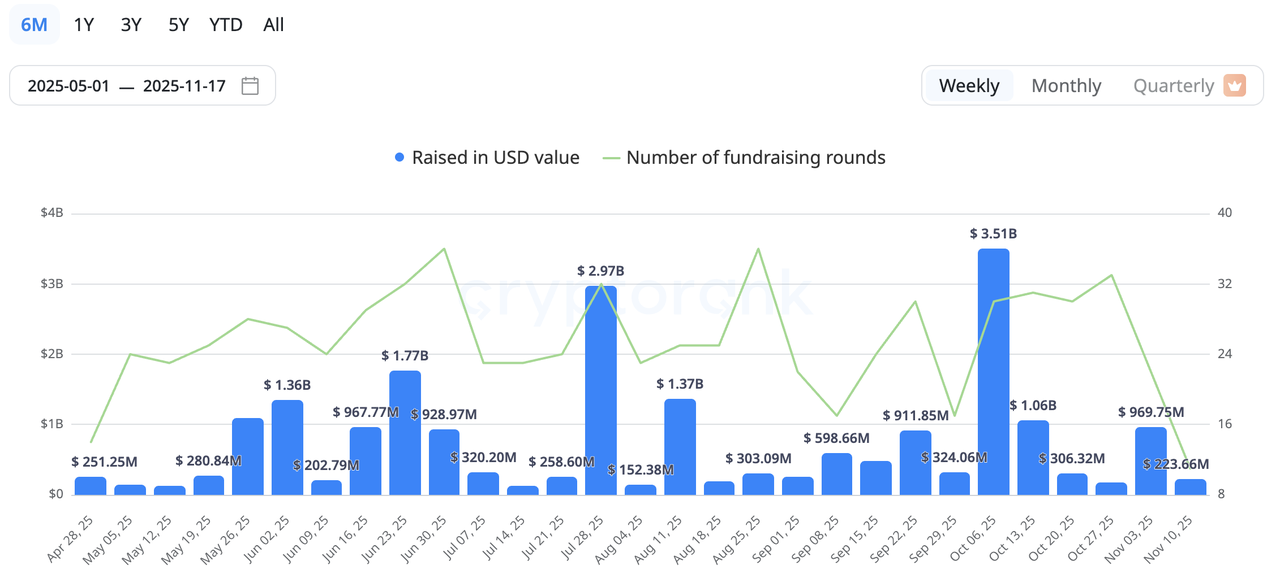

Crypto primary-market activity remained subdued at about $223M last week. Highlights include YZi Labs investing in regenerative-medicine firm RenewalBio (developing transplantable cells and tissues from advanced stem-cell tech to ease donor shortages), and Seismic raising $10M (led by a16z crypto, with Polychain, Amber Group, dao5, and others), focused on fiat on/off-ramps and crypto card services—bringing total funding to $17M.

Data Source: CryptoRank

Grayscale Files for a U.S. IPO: A “Public Turn” Under Fee Pressure

The primary-market spotlight last week: on Nov 13, Grayscale publicly filed its S-1 registration statement, targeting a NYSE listing under the ticker GRAY. The underwriting syndicate includes heavyweights such as Morgan Stanley, BofA Securities, Jefferies, and Cantor, among others. No offering size or price range was disclosed. The prospectus notes $318.7M in revenue (-20% YoY) and $203.3M in net income for the first three quarters of 2025, with ~$35B in AUM across 40+ products. With the U.S. government shutdown over and the SEC back to normal operations in mid-November, Grayscale’s Q3-updated filing effectively moves it to the front of the queue, improving execution visibility and investor attention.

This “public turn” blends push and pull factors. On one hand, fee compression and net outflows in the ETF arena are feeding through to revenues, slowing the margins of the high-fee “cash-cow” model in 2025. On the other, a listed-company profile means more frequent disclosure and tighter governance, nudging Grayscale toward a new balance among lower fees, broader product lines, and more active strategies. With flagship funds (e.g., GBTC/ETHE) under pressure, new products and strategy diversification become key to sustaining scale and earnings resilience.

Bottom line, this is less a simple “capital-raising event” and more a repricing window for product mix and valuation. Near-term, a public listing plus a top-tier brand and distribution footprint may help tap deeper institutional pools (advisors, pensions). Looking ahead, the core valuation anchors will be Grayscale’s ability to stabilize ETF net flows, manage margin pressure from lower fees, and add growth via multi-asset and active products. Watch three data lines: (1) net creations/redemptions and fee moves in core ETFs; (2) the revenue mix from new products; and (3) post-listing cost structure and the boundaries on M&A/proprietary investing. Together, these signals will determine how quickly Grayscale can rebalance from a “high-fee era” to one driven by scale + product strength.

3. Project Spotlight

Uniswap's Reformation: A Meticulously Planned Breakthrough in Architecture and Protocol Value Re-creation

Hayden Adams, founder of the leading DEX project Uniswap, along with Uniswap Labs, has formally submitted the "UNIfication" governance proposal, the core of which is to activate the protocol's "fee switch." The move instantly ignited the market, causing UNI—long considered a "valueless governance token"—to surge by nearly 40% within 24 hours. This finally enables UNI to evolve from a symbolic governance token into one capable of capturing more of the protocol's value. However, this is not merely a simple adjustment to its economic model, but rather a meticulously orchestrated legal breakthrough and political game that has been two years in the making.

In fact, discussions about the fee switch have been ongoing for a long time but were repeatedly stalled. The crux of the issue was a16z, one of UNI's largest token holders, which feared that if the protocol began distributing profits to holders, the UNI token would likely be classified as a "security" by the U.S. SEC, leading to catastrophic legal and tax risks. However, things took a turn in 2025. First came the establishment of Uniswap's DUNA (Decentralized Unincorporated Nonprofit Association) legal entity. This solution, tailored for DAOs by the crypto-friendly state of Wyoming, provides limited liability protection, allowing the DAO to safely engage in for-profit activities. Second, the U.S. regulatory environment has eased; a change in the SEC chairmanship and a shift in the overall political climate cleared the final external obstacles. With the legal shield in place and regulatory clouds parting, activating the fee switch became a natural course of action.

The "UNIfication" proposal is carefully designed to transform UNI from a governance tool into a deflationary asset in two steps. The first step is a straightforward, direct burn: the proposal suggests a one-time burn of 100 million UNI (10% of the total supply) from the Uniswap treasury as a "retroactive compensation" for fees the protocol could have captured but didn't since its inception. This creates scarcity at the source and was the primary driver behind UNI's price surge.

Data Source: https://gov.uniswap.org/t/unification-proposal/25881

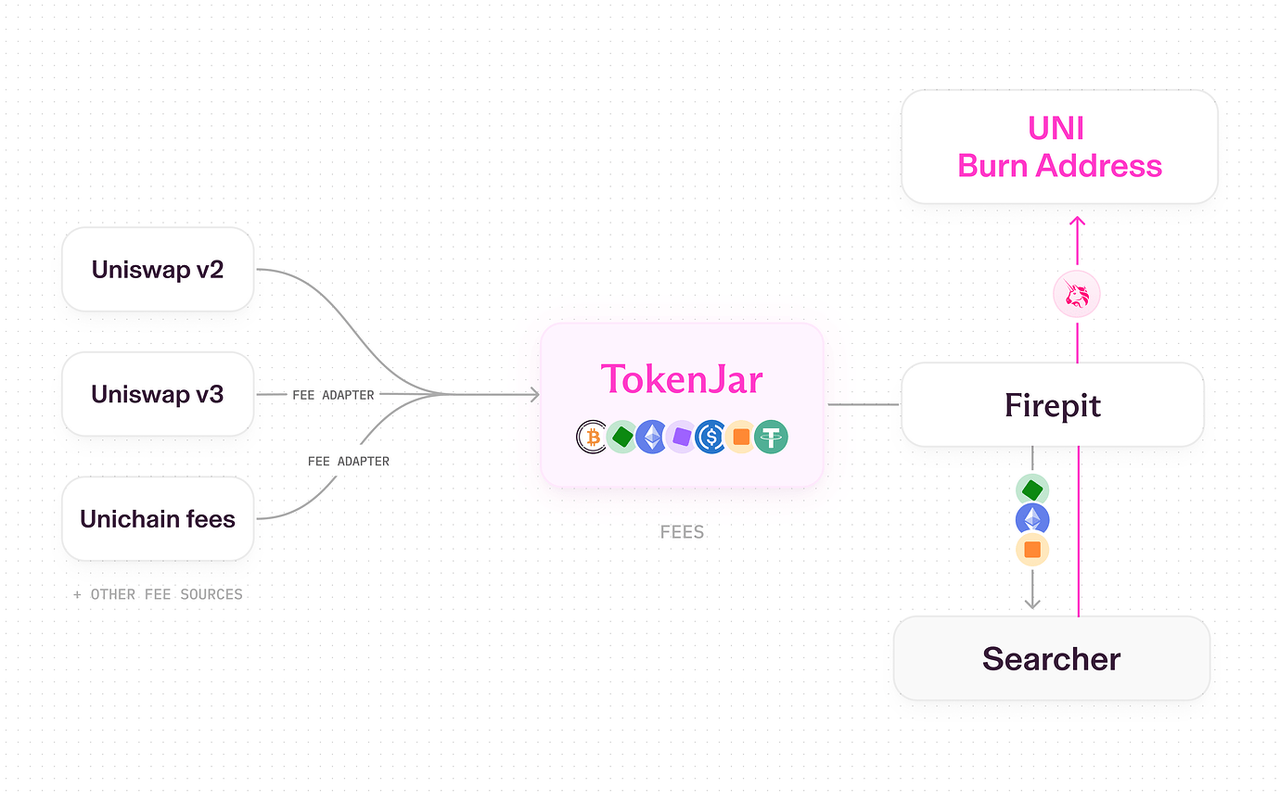

The second step, which is the core of the plan, is to initiate a long-term deflationary program for UNI. The proposal would activate fees on v2 and v3 liquidity pools, taking a cut of 1/6 to 1/4 from the trading fees earned by LPs. It's estimated that this would generate approximately $460 million to $500 million in annual revenue for the protocol. This income will not be distributed directly to UNI holders as dividends. Instead, it will be deposited into a smart contract called TokenJar. To claim a proportional share of the assets in TokenJar, UNI holders must actively burn their UNI tokens in another contract named FirePit. This creates both arbitrage opportunities and an alternative exit path for UNI holders.

Of course, this move is not without its costs. Turning on the fee switch means a direct reduction in LP earnings, which could lead some profit-seeking liquidity to migrate to competitors offering higher incentives. However, this is likely a calculated gambit by Uniswap. By creating the pain point of reduced income on v2/v3 while tying compensation mechanisms (like Aggregator Hooks) and new features to the not-yet-fully-adopted v4, one of Uniswap's objectives may be to steer the entire ecosystem toward a mass migration to its more defensible V4 platform.

In summary, this proposal is essentially a high-stakes bet for Uniswap. Organizationally, it merges the Foundation into Labs to concentrate its efforts. Strategically, it is betting that its powerful brand moat and the technological advantages of V4 will be sufficient to offset the short-term pain of liquidity loss. The ultimate goal of this strategic play is to propel Uniswap's transformation from a single leading product into a platform-level powerhouse with network effects and technological lock-in.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.