KuCoin Ventures Weekly Report: Regulatory Storm Hits DATs Amid WLFI's Blacklist Drama as the Market Consolidates in Search of a New Lead

2025/09/09 03:42:01

1. Weekly Market Highlights:Nasdaq Tightens Oversight as U.S. DAT Valuations and Premiums Face Pressure

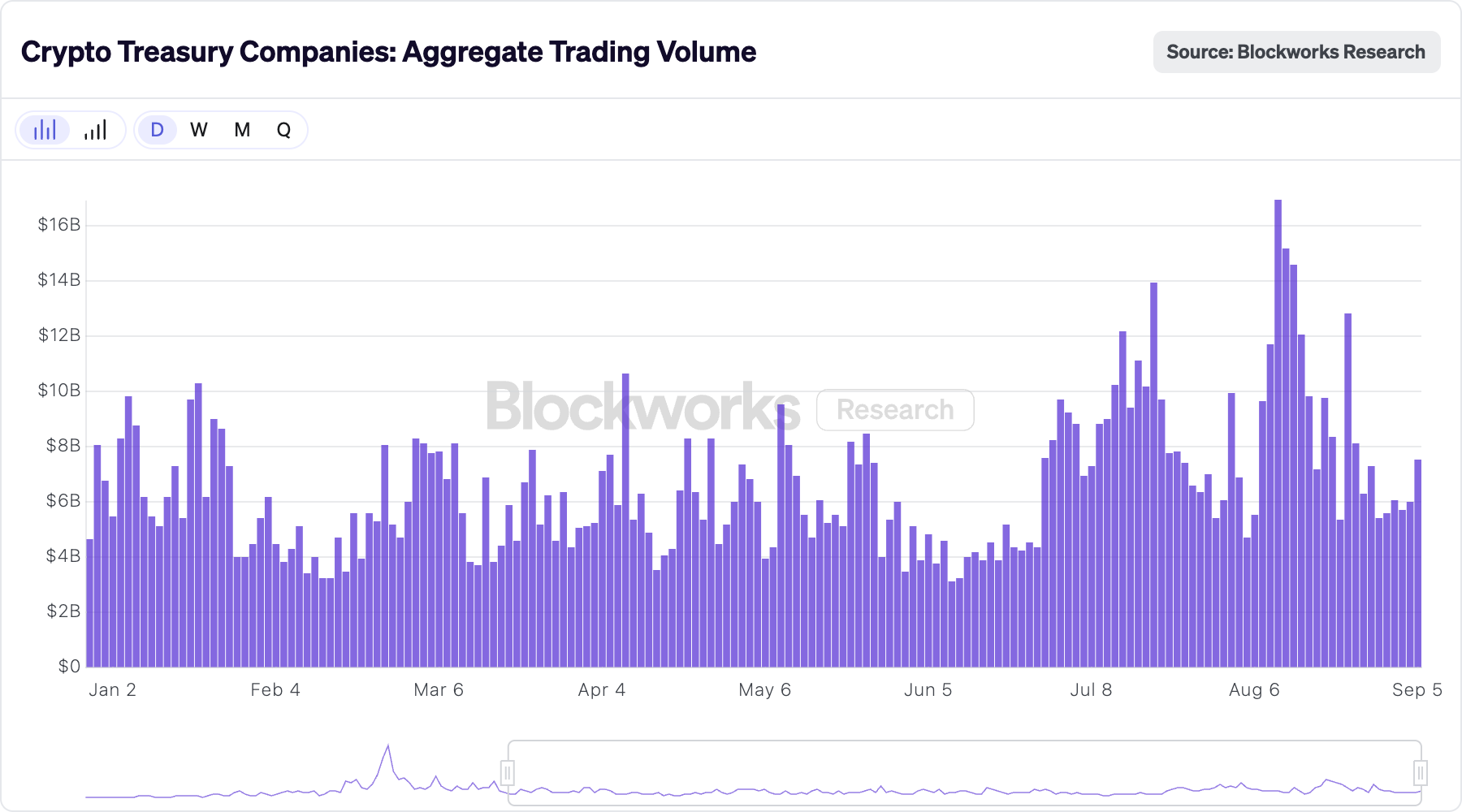

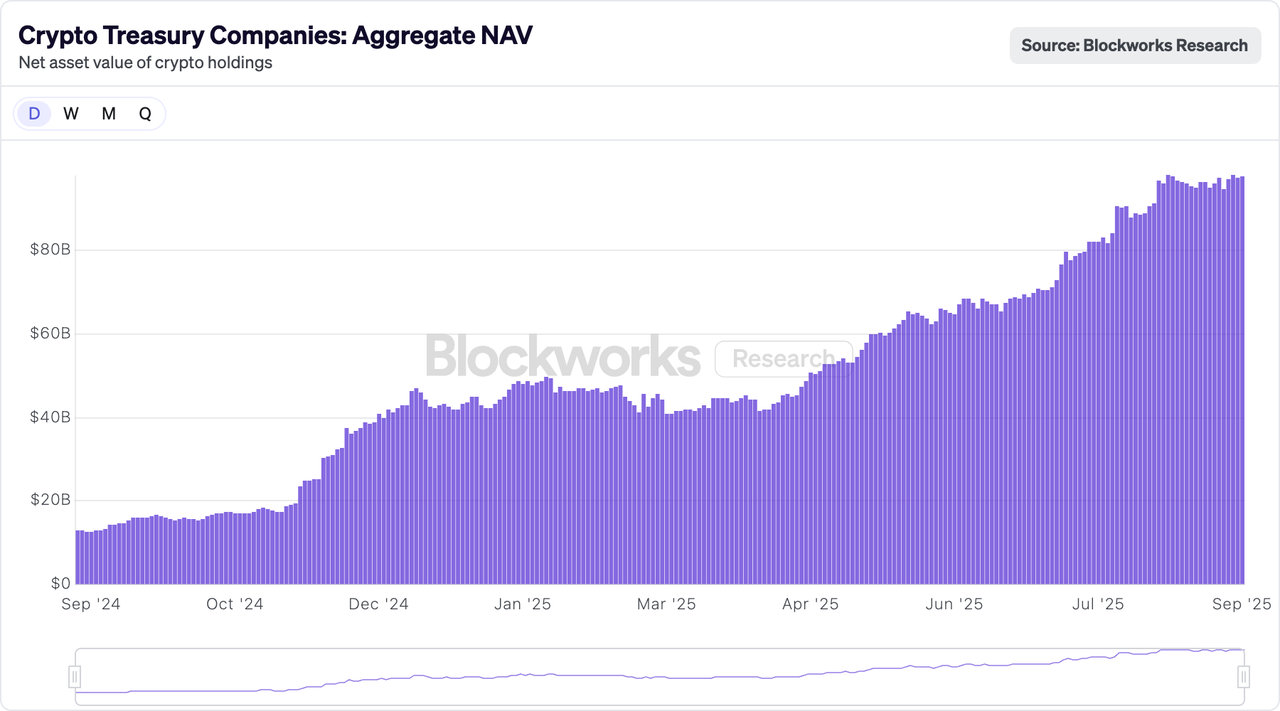

In H1 2025, the Digital Asset Treasury (DAT) strategy has become a focal narrative across capital markets. According to Architect Partners, at least 154 U.S. publicly listed companies have added crypto assets to their balance sheets since January, positioning themselves as part of a new "crypto-native treasury" paradigm. The U.S. leads this trend with 61 participating companies, far ahead of other markets such as Canada, the UK, and Japan. Meanwhile, Hong Kong-listed stocks have also made headlines—most notably Yunfeng Financial, indirectly controlled by Jack Ma, which recently purchased 10,000 ETH (~$44M), drawing significant attention.

Data source: https://blockworks.com/analytics/treasury-companies

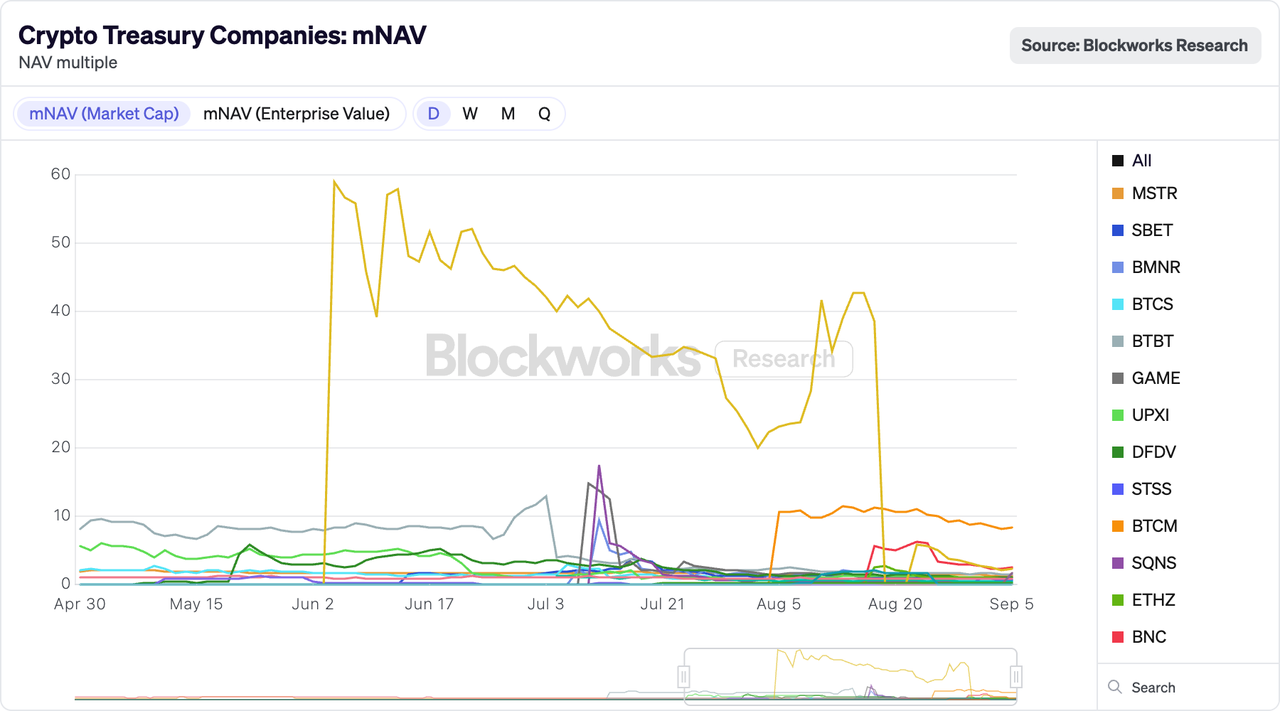

Under the DAT model, corporate treasuries have expanded beyond BTC and ETH to include a wide range of altcoins such as SOL, HYPE, BNB, and CRO. However, as these portfolios scale up and investor expectations become saturated, the market NAV (mNAV)—the ratio of a firm’s market cap to the mark-to-market value of its crypto holdings—has started trending back toward 1.0, indicating shrinking valuation premiums and weakened market confidence in DAT-based equity stories.

At the same time, regulatory scrutiny has notably intensified. This week, reports emerged that Nasdaq plans to ramp up its oversight of crypto-holding companies. Market speculation suggests the measures may include requiring shareholder approval for stock issuance intended to fund crypto purchases and more stringent disclosure on capital use of proceeds. These regulatory expectations have triggered widespread pressure across the DAT cohort: stock prices and valuation premiums are declining, mNAVs continue to fall, and the prior “liquidity buffer effect” derived from crypto appreciation is rapidly fading.

As previously discussed, while the "Equity-Crypto-Bond linkage" narrative holds appeal, the expansion of asset types and uneven qualifications of participants make the model highly prone to manipulation and speculative behavior. Regulatory intervention has become a matter of “when,” not “if.” Future rules may require DAT firms to disclose investment size, strategy, and risk exposure, and even subject high-frequency trading behavior to special reviews. Non-compliant firms could potentially face trading halts or delisting.

Looking forward, tightened regulation will likely reshape the DAT landscape:

-

On one hand, firms will be forced into greater transparency and risk management discipline, leading to more conservative strategies.

-

On the other, leading firms and major assets (BTC, ETH) will continue to dominate market share, while weaker players focusing on niche or illiquid altcoins may face elimination due to valuation compression and compliance hurdles.

2. Weekly Selected Market Signals

BTC and ETH Consolidate at Highs, Institutional Momentum Wanes, Can Altcoins Take the Lead?

BTC and ETH are stuck in high-level consolidation, with only about 5%-6% volatility over the past week, showing limited price action. Some traders may have shifted to chasing higher-volatility markets like A-shares or U.S. stocks. Meanwhile, institutional participation is weakening. BTC ETF saw a modest net inflow of $246 million last week, while ETH ETF recorded its largest single-week net outflow at $788 million.

Additionally, Nasdaq’s new regulations aim to tighten scrutiny on companies with DAT (Digital Asset Treasury) strategies. According to Fortune, over 100 listed companies have purchased nearly $132 billion in cryptocurrencies this year. However, Fortune also noted suspicious stock price movements in some smaller firms before their DAT announcements, raising concerns about potential insider trading or “front-running.” As Nasdaq is the primary market for DAT-listed companies, this news has led to widespread declines in related stock prices.

Data: SoSoValue

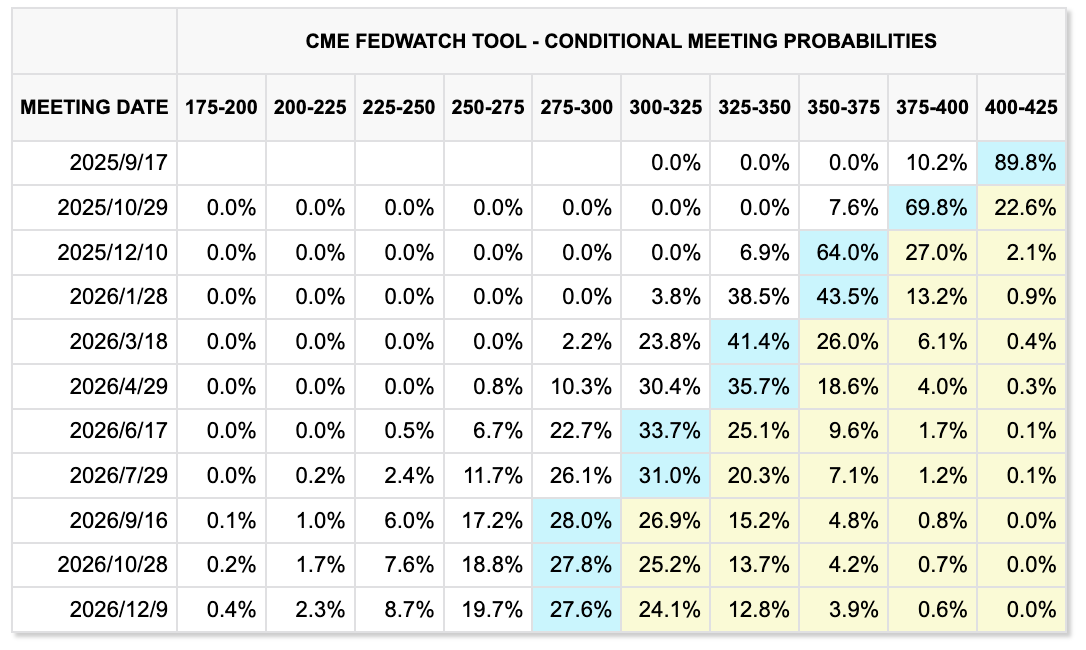

Market expectations for a September rate cut continue to heat up, with no predictions remaining for unchanged rates. The CME FedWatch tool currently shows an 89.8% probability of the Federal Reserve cutting rates to 400–425 basis points at the FOMC meeting on September 17. Notably, U.S. non-farm payrolls for August added only 22k jobs (far below the market’s forecast of 76.5k), marking one of the weakest monthly gains since late 2022. The unemployment rate also rose to 4.3%, a near four-year high. The U.S. labor market is showing signs of weakness, though Trump sacked the Bureau of Labor Statistics chief last month, alleging data manipulation.

Data: CME FedWatch

Key Macro Events to Watch This Week

September 9

-

22:00: U.S. Non-Farm Employment Change Initial Value (August 2025)

September 10

-

China M2 Money Supply YoY (August)

-

01:00: Apple Fall Product Launch Event

-

09:30: China CPI YoY (August)

-

20:30: U.S. PPI YoY (August)

September 11

-

20:15: European Central Bank Interest Rate Decision

-

20:30: U.S. Seasonally Adjusted CPI YoY (August)

-

20:30: U.S. Initial Jobless Claims for the Week Ending September 6

Stablecoin Market Continues Strong Growth

The total stablecoin market cap is approaching $300 billion. Over the past week, USDT supply grew steadily by $864 million, USDC increased by $967 million, and the emerging yield-bearing stablecoin USDe, now exceeding $10 billion, rose by $419 million.

Data: CMC

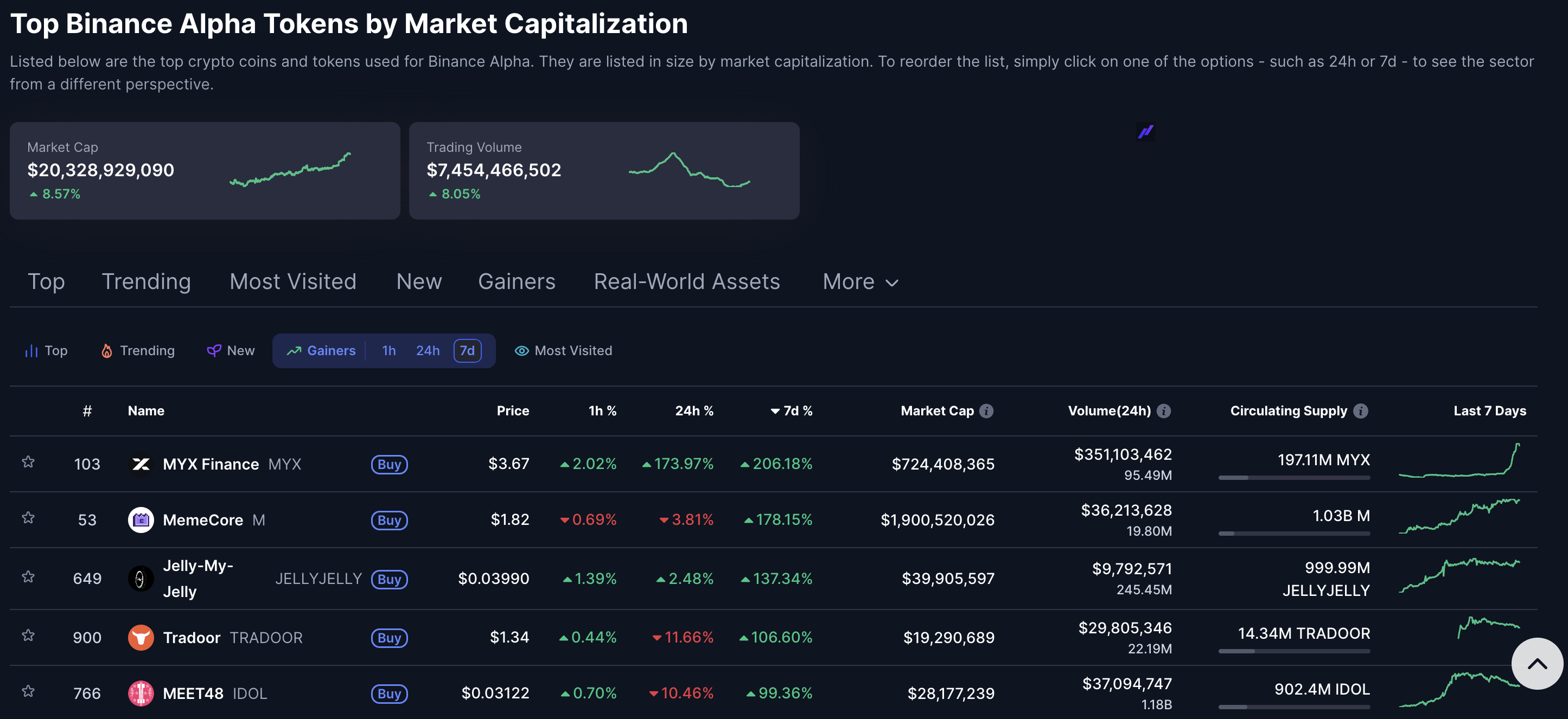

Alpha Sector BSC Asset Movements; Solana Whale Activity Stable, Retail Strength Continues to Wane

The total market cap of the Alpha sector tokens has surpassed $20 billion, with several BSC assets doubling in value over the past week, led by standout performers MYX and M. Alpha assets are characterized by requiring an upfront cost for user airdrops and a high degree of token concentration, typically resulting in low circulating supply in the first few months after launch. On-chain data shows that even for high-market-cap tokens, addresses with significant profits are relatively few, indicating that trading is largely concentrated within the Alpha ecosystem and hard to trace, providing a strong shield for project teams to control token supply. Overall, Alpha assets are suited for second-stage opportunities: low initial circulation, gradual reclamation of airdropped tokens over time to further tighten control, followed by price surges driven by market momentum or positive news.

Data: CMC

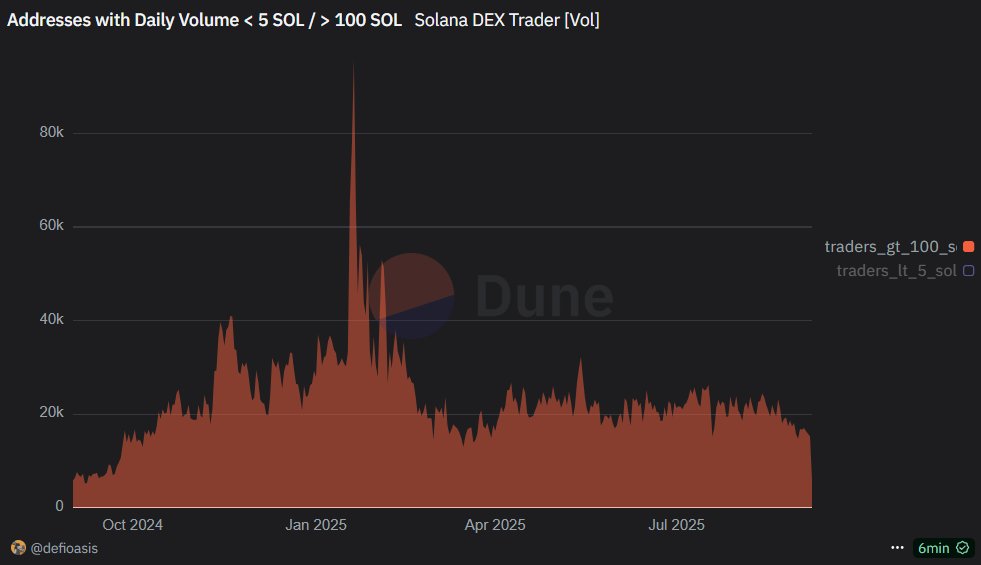

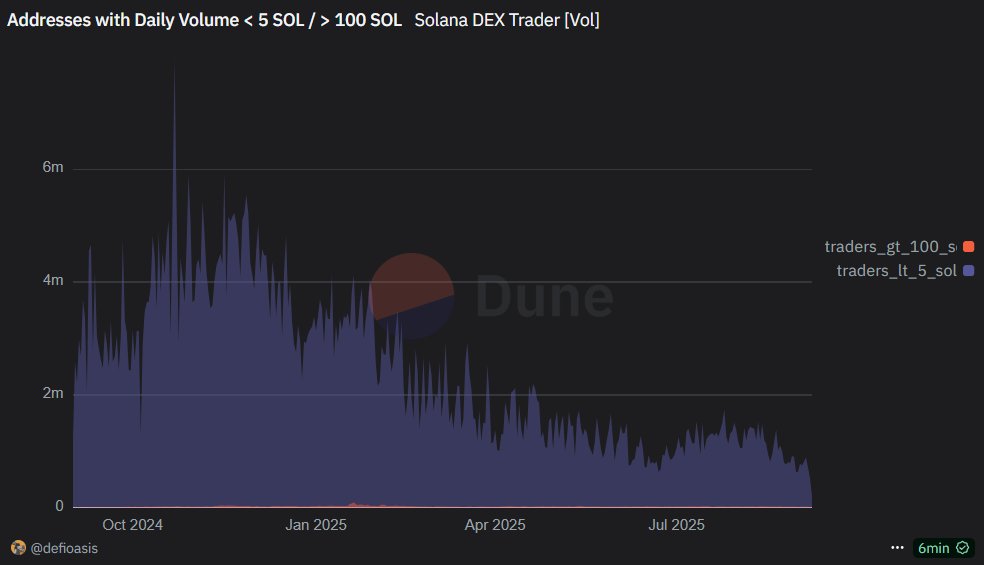

The number of Solana DEX traders with daily volumes exceeding 100 SOL has remained stable, consistently hovering around 20k addresses since last October. In contrast, the number of trader addresses with daily volumes below 5 SOL has been steadily declining since October-November last year, dropping from over 5 million to roughly 1 million with minor fluctuations. On-chain buying power from Solana whales remains intact, while retail momentum continues to weaken.

Data: Dune

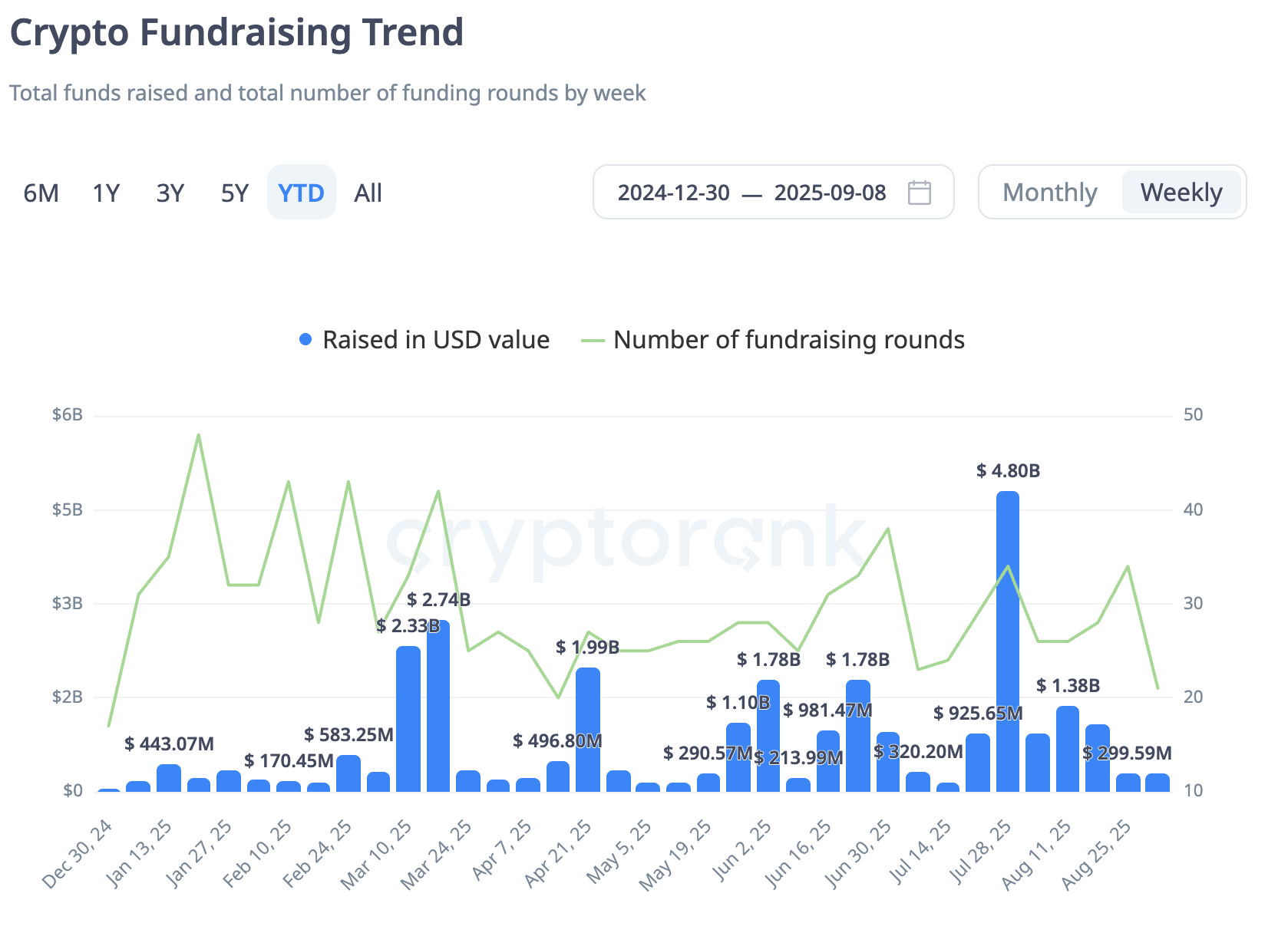

Primary Market Funding Overview:

Last week, the crypto primary market funding remained subdued, totaling just $292 million. The focus continues to be on Real-World Assets (RWA), with leading VCs Paradigm and Polychain each announcing a new RWA funding project.

Data: CryptoRank

Renewable Energy RWA Project Plural Secures $7.13M in Funding Led by Paradigm

Plural, a project focused on tokenizing clean energy assets such as solar, battery storage, and data centers, has raised $7.13 million in a funding round led by Paradigm. The tokenization process at Plural involves several stages, from asset selection to token issuance:

-

Asset Screening and Due Diligence: Plural evaluates renewable energy assets based on technical specifications, equipment quality, developer track record, meteorological data, interconnection agreements, and long-term operational plans. It also assesses project compatibility with the platform, ensuring geographic diversity, technological balance, and revenue structure alignment.

-

Cash Flow Analysis and Modeling: Plural models the financials of energy projects, reviewing power purchase agreements, tax incentives, and operational costs. Scenario stress tests are conducted to verify return stability and identify value-add opportunities.

-

Tokenized Issuance: For instance, revenue from solar projects is divided into token shares. Plural’s commercial-scale solar installation, Ace Portfolio, has secured contracts with universities and municipalities. Plural integrates tokens with off-chain databases through an on-chain/off-chain system, ensuring regulatory compliance.

-

Dividends and Services: Token holders receive automated on-chain dividends. For example, Plural’s Ace Portfolio generated 340,783 kWh of electricity in November-December 2024, with dividends executed automatically via smart contracts.

-

Trading and Liquidity: These revenue-share tokens can be traded and circulated on secondary markets in the future.

Compared to traditional clean energy investments, which often require millions of dollars and involve complex intermediaries, Plural’s tokenization model allows retail investors to participate with smaller amounts. By directly connecting investors to project cash flows, it eliminates layered fees that dilute returns. Additionally, Plural addresses the financing challenges of long-tail energy assets. Smaller-scale energy projects, often below $1 million, struggle to secure funding or bank loans, but tokenization enables efficient handling of numerous small projects.

Story Ecosystem IP Tokenization Project Aria Raises $15M at $50M Valuation, Backed by Polychain and Story Protocol

Aria primarily transforms iconic cultural IPs—such as music and art—into on-chain tradable assets. In June this year, Aria completed a $10.95 million public sale of its first IPRWA asset, APL token, via Stakestone’s LiquidityPad. APL represents partial revenue rights to 47 songs, including tracks by artists like BLACKPINK and Justin Bieber; users staking APL can earn proportional royalties. On-chain data shows the APL token's FDV at around $10 million, with 77% of tokens staked; there are only 438 holder addresses, and it's essentially in a dormant trading state.

Overall, Aria tokenizes revenue-generating IPs into Story chain assets. Users stake these IPRWA tokens to receive stIPWA tokens, which serve as proof-of-share for real-world yields. Aria collects these royalty revenues off-chain and periodically uses them to repurchase APL, adding the repurchased tokens to the staking contract. This boosts the redemption ratio between stAPL and APL, reflecting the yields earned by users. In reality, users have no way to verify the exact revenues Aria derives from the underlying assets—like music royalties—and must rely on the protocol's periodic repurchases and distributions.

Notably, Story co-founder Jason Zhao recently announced his departure from full-time involvement, while lavishly praising the experience, sparking community skepticism. Critics argue that Story has failed to create any tangible product, with unclear technical and ecosystem prospects. Some users cited DeFiLlama data to slam Story for raising over $100 million in funding while generating only a few hundred dollars in daily chain revenue.

3. Project Spotlight

WLFI Goes Live: A Drama of Wealth Surrounding a Presidential Concept and an On-Chain Blacklist

Last week, World Liberty Financial's token, WLFI, was officially unlocked for trading. Its special connection to a U.S. presidential family, its first large-scale token unlock, drastic price volatility, and the subsequent dramatic event of blacklisting the wallets of well-known investors like Justin Sun, quickly made it the absolute focus of the market.

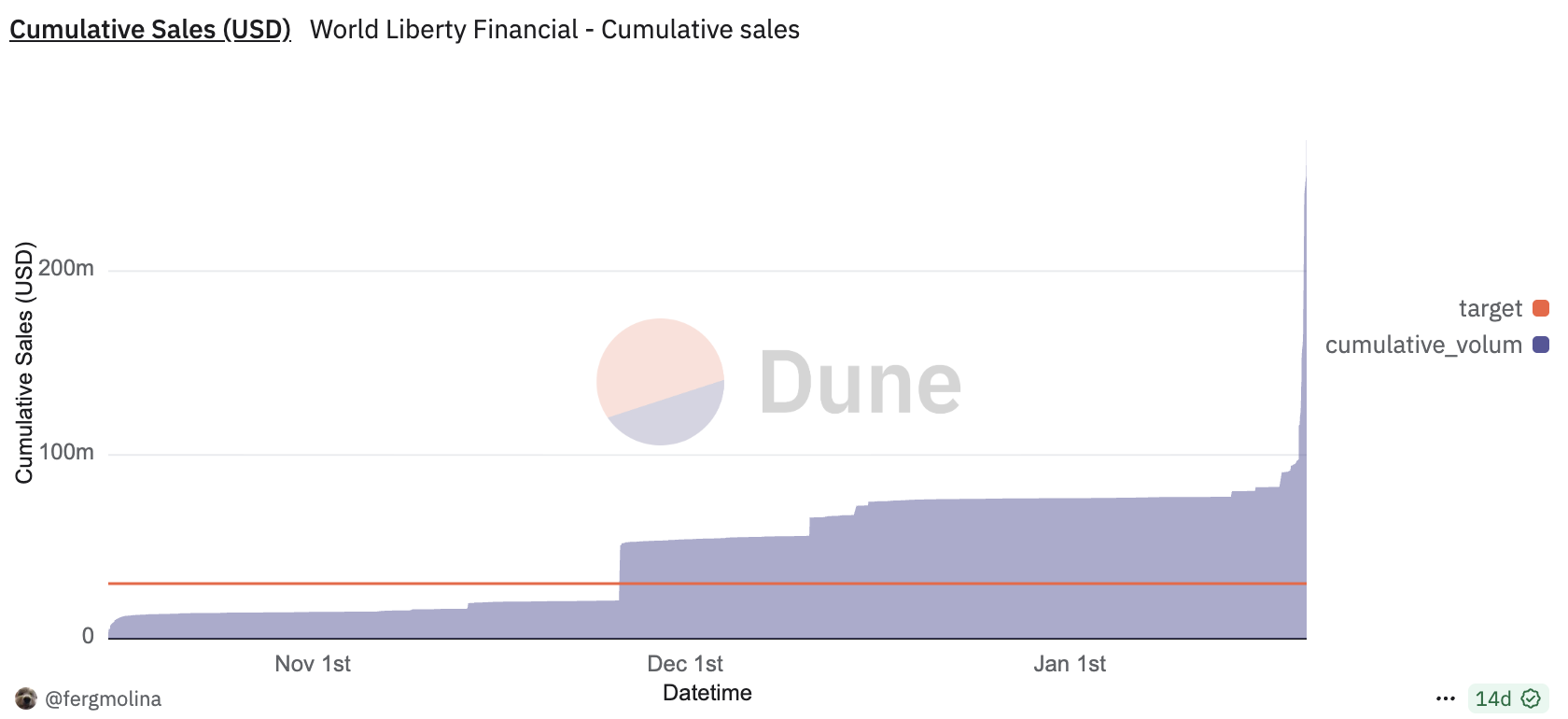

WLFI's fundraising journey was full of twists and turns. The project launched its first round of token presale in October 2024, aiming to raise $300 million. However, with the U.S. presidential election just weeks away, market uncertainty was high. Coupled with high participation barriers (such as requiring U.S. users to be accredited investors and making the tokens non-transferable), the initial response to the presale was lackluster.

The turning point came after Trump's election. His friendly stance towards the crypto industry completely changed the tide, and a large amount of capital began to flow in. During this period, TRON founder Justin Sun made a high-profile entry, investing a cumulative total of $75 million in November 2024 and January 2025 through his HTX-affiliated wallet and TRON DAO. He became the project's largest single investor at one point and was invited to serve as a project advisor. Ultimately, the project successfully raised $550 million through two presale rounds, attracting participation from over 34,000 wallets.

World Liberty Financial Fund Inflow

On September 1, WLFI began trading, with 20% of tokens allocated to early investors unlocked. After listing on several centralized and decentralized exchanges, WLFI's spot circulating market cap once surged to $32 billion, but the price saw a significant correction in the following days. On September 4, according to on-chain data, the WLFI project team blacklisted one of Justin Sun's wallet addresses, freezing over $100 million worth of unlocked tokens in the address, as well as billions of tokens still in a locked state.

On September 6, WLFI officially announced via a tweet that a total of 272 wallet addresses had been blacklisted. The official explanation stated that the move was aimed at protecting user assets. A categorization of the reasons for the freeze was published, but it did not specifically mention Justin Sun's situation, sparking intense discussion in the market.

WLFI Blacklisted Wallet Details:

-

215 (79.0%): Frozen preemptively to protect users from a phishing attack.

-

50 (18.4%): Frozen at users' request to protect their compromised accounts.

-

5 (1.8%): Flagged for high-risk exposure and are under review.

-

1 (0.4%): Under internal review for suspected misappropriation of funds from other holders.

From its origins as a lending protocol, World Liberty Financial has now expanded into a comprehensive DeFi platform integrating a stablecoin (USD1), trading, and payments. There are even reports that it is planning to raise $1.5 billion to establish a WLFI public company treasury (DAT).

In the current market environment, where narratives of institutionalization and compliance run parallel with the attention economy, WLFI, with its high-profile nature, is expected to remain a focal point that secondary market traders and observers cannot ignore for a long time to come.

A New Play in RWA: The Surge of $CARDS, Fusing Physical Card Trading with an On-Chain Gacha Machine

Last week, a token in the Solana ecosystem, CARDS, shot to prominence with a stunning performance, surging over 10x in a matter of days. Its current FDV has reached $500 million, driving a significant wealth effect in the secondary market and drawing market attention.

$CARDS is the native token of Collector Crypt, a physical trading card game (TCG) on Solana. Conceptually, it taps into the high-profile RWAsector but cleverly bypasses traditional assets like real estate and treasury bonds. Instead, it focuses on physical Pokémon cards, which have a massive global fanbase. This "collectible RWA" narrative makes it stand out among the many RWA projects that have already launched tokens.

Collector Crypt's Gacha machine system is the platform's core gameplay. Users spend about $50 or $200 for a chance to draw Pokémon NFT cards of varying tiers and values. According to the official probabilities, users have about an 80% chance of drawing a card worth less than or equal to the cost, but there is also a small chance of pulling a rare card worth thousands of dollars. This "small stake, big win" mechanism is highly appealing. The platform has designed an efficient value-recycling loop: if users draw a card they are not satisfied with, they can immediately sell it back to the platform for 85% of its value, getting funds to continue playing. This greatly increases user engagement and capital turnover. If users want the physical card, they can redeem it by burning the NFT and paying a handling fee.

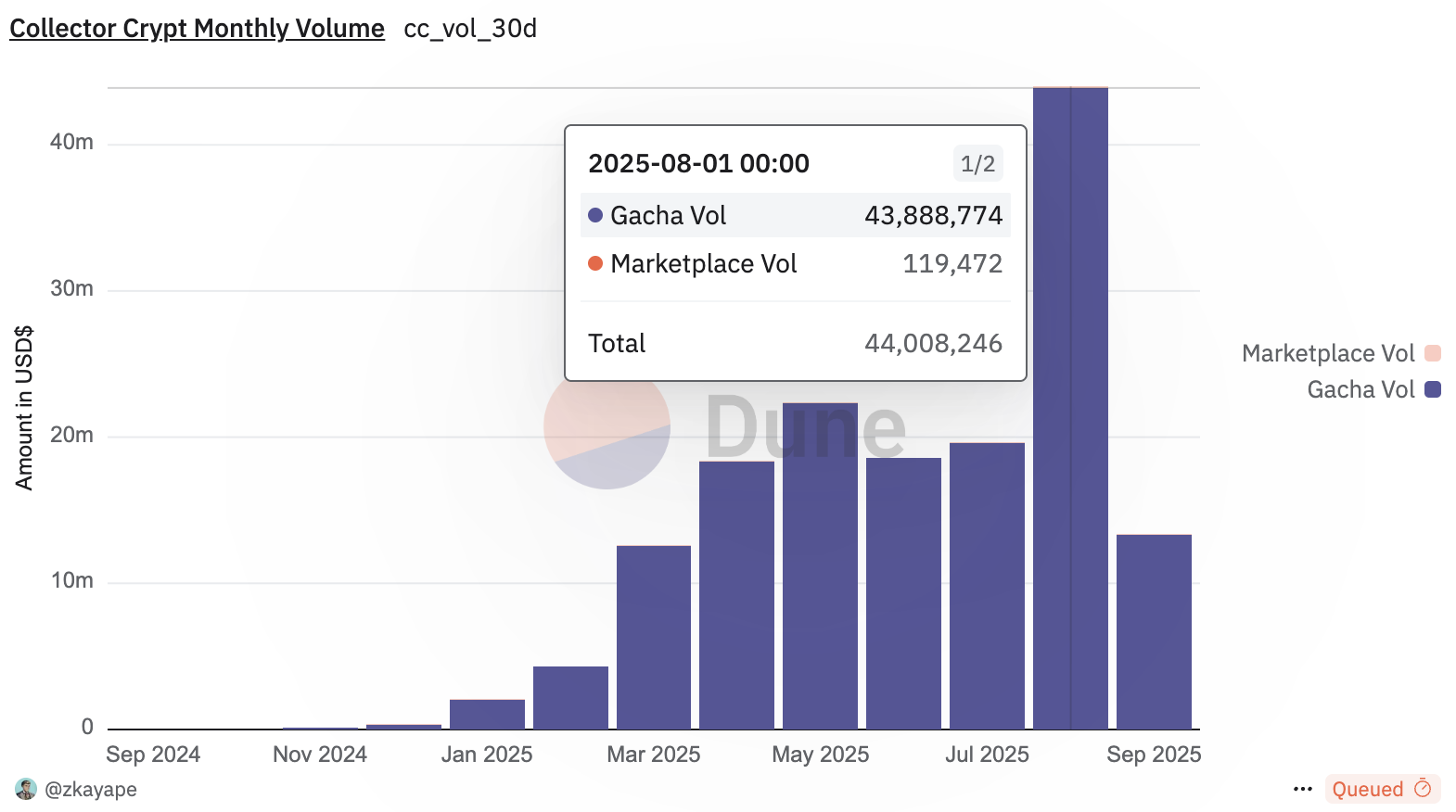

This model's revenue-generating ability is astonishing. Since its launch in January of this year, Collector Crypt's total monthly sales have soared from $2.07 million to $44 million in August. The Gacha business contributed $43.88 million of this, accounting for the absolute majority. In contrast, its secondary card marketplace had a monthly trading volume of only $119,000, which is almost negligible.

The Gacha System is Collector Crypt's Absolute Revenue Pillar

Collector Crypt has a market-tested Gacha business model that is highly profitable with strong cash flow, which serves as a solid foundation for its valuation. As a pioneer in the "collectible RWA" sector and the first leading project to issue a token, it enjoys a scarcity premium in the market. However, this recent surge was clearly driven by promotion from key KOLs (Key Opinion Leaders) and market FOMO (Fear Of Missing Out), and it may face significant selling pressure from profit-takers in the short term. In the future, whether the project can stabilize its cash flow and continue to innovate in the face of fierce competition after the market sentiment cools down, while also driving vitality in its secondary market and achieving a value capture cycle for its token, will be the key determinants of CARDS' long-term value.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.