DTCC 2026 Roadmap Deep Dive: How U.S. Treasury Tokenization is Reshaping Global Clearing and the Crypto Ecosystem

2025/12/18 13:15:02

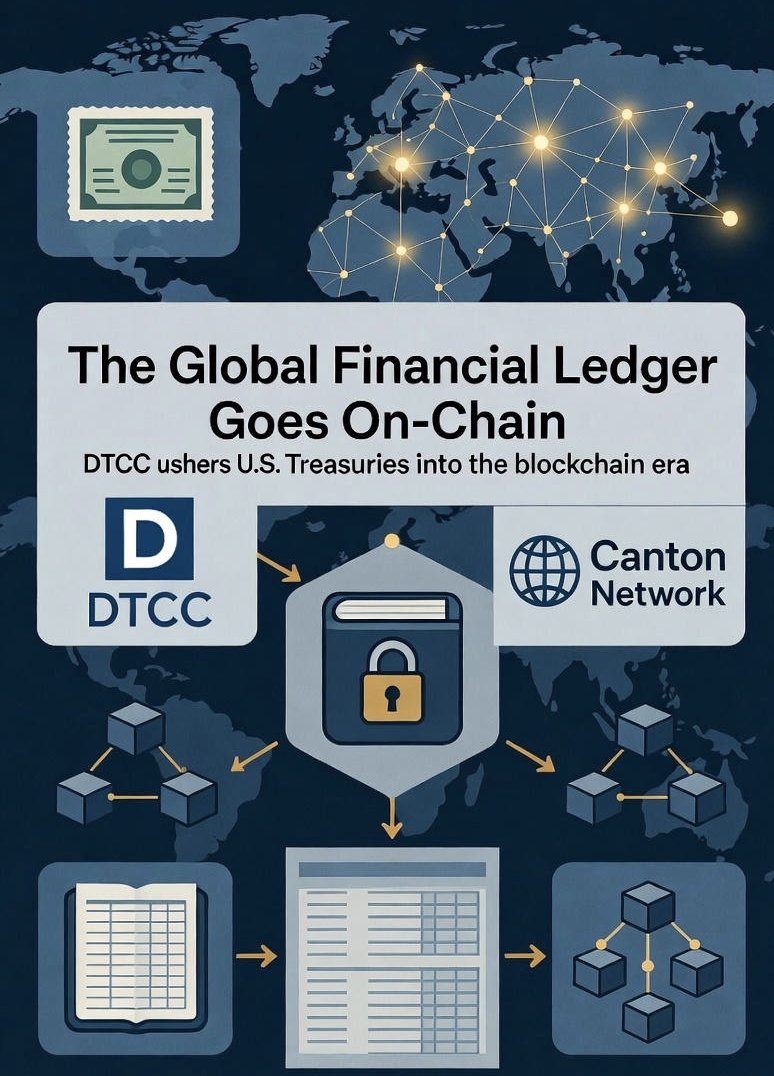

Introduction: The Paradigm Shift of the Global Financial Ledger

On December 17, 2025, the powerhouse of global financial infrastructure—the Depository Trust & Clearing Corporation (DTCC)—dropped a bombshell: it has formally partnered with the Canton Network to launch a pilot program for the on-chain tokenization of U.S. Treasury securities.

This announcement didn't just trigger a market-wide rally for privacy tokens (such as CC, H, FHE, and NIGHT); it signaled that tens of trillions of dollars in traditional financial (TradFi) core assets have officially entered a "2026 Roadmap" for migration to distributed ledgers. For investors, this represents more than a technical evolution—it is a revolution in the efficiency of wealth mobility.

-

Technical Core: Why Canton Network and Privacy Computing?

In the deep waters of financial clearing, the DTCC’s choice reveals the true requirements for institutional entry into the crypto sphere.

Institutional-Grade Privacy: The "Invisibility Cloak" of Wall Street

Unlike the total transparency of public chains like Ethereum, the Canton Network employs a unique privacy architecture. It allows financial institutions to achieve atomic settlement across ledgers while keeping sensitive data—such as positions, counterparties, and trading strategies—private. For the DTCC, which processes transaction activity measured in quadrillions of dollars annually, this privacy computing capability is the cornerstone of compliance and the primary draw for top-tier investment banks like Goldman Sachs and JPMorgan.

The Leap from T+1 to T+0: Atomic Settlement

While the U.S. market successfully transitioned to T+1 settlement in 2024, a one-day window of risk exposure still exists. By "minting" tokens on the Canton chain that represent U.S. Treasuries held in DTC custody, the system can achieve Instant Settlement. This elevates the speed of collateral mobility from days to seconds, potentially releasing billions of dollars in dormant capital currently trapped in the banking system’s margin requirements.

-

Roadmap Insights: From 2026 MVP to Full Asset Coverage

The DTCC 2026 Roadmap is not merely an experimental project; it is a phased production deployment plan:

-

H1 2026: Launch of the Minimum Viable Product (MVP). The DTCC will allow participants to convert DTC-custodied Treasuries into on-chain tokenized entitlements within a controlled production environment.

-

H2 2026: Expansion of Asset Classes. Under the SEC’s approved pilot framework, the scope is expected to expand from Treasuries to Russell 1000 index components and major ETFs.

-

Digitalization of Global Clearing Nodes: The DTCC will serve as co-chair of the Canton Foundation alongside Euroclear, defining industry standards for digital assets and building an interoperable global digital financial network.

-

Deep Impact on the KuCoin Ecosystem: "Dimensional" Asset Upgrades

As a leading global digital asset exchange, KuCoin sits at the forefront of the bridge between traditional capital and on-chain liquidity. The DTCC's move will reshape the strategies of KuCoin investors in three key dimensions:

Trust Upgrades for the RWA Sector

Previously, most RWA projects were in the early stages of decentralized protocol exploration. Now, with "original-factory" tokenized assets from the DTCC entering the market, RWA tokens traded on platforms like will be backed by Treasury positions directly regulated and legally protected by the DTC. This sovereign-level credit rating will significantly enhance the risk-resistance of crypto portfolios.

Valuation Re-rating of Privacy Tokens

This news has already sparked a sector-wide rebound for privacy computing. When investors , they will find that privacy technologies (such as Full Homomorphic Encryption - FHE) are no longer just abstract concepts—they are "entry tickets" for institutional giants. This shift from speculation to essential utility is the core logic behind the valuation explosion of privacy tokens. For those looking to capture this sector's dividend, using the is the first step toward positioning in the 2026 institutional narrative.

New Yield Opportunities in the "Great Convergence"

The DTCC’s ultimate vision is a single liquidity pool spanning TradFi and DeFi. By introducing these compliant underlying assets into , users may soon enjoy "low-risk, stable yields" backed by the U.S. Treasury, bringing a new level of depth to digital wealth management.

-

Strategic Analysis: The "Digital Sovereignty" Game

The DTCC’s transformation is not an isolated event. As global regulators embrace RWAs, the U.S. is leveraging blockchain to reinforce the global "moat" of the digital dollar and digital Treasury.

-

For TradFi: This is a self-revolution through technology, aimed at solving inefficiencies in cross-border payments.

-

For Crypto Investors: This is an "onboarding" of elite assets. Future wealth growth will be concentrated in infrastructures that can seamlessly link DTCC on-chain assets with decentralized protocols.

-

Conclusion: How to Capture the 2026 Financial Mega-Trend?

The partnership between the DTCC and Canton Network is the most significant financial infrastructure news of late 2025. It cements the dominance of privacy computing in the RWA sector and sets the tone for the "Great Convergence" of global assets in 2026.

Whether you are bullish on the stability of Treasury tokenization or the explosive potential of privacy protocols, early positioning is key. If you don't yet have a crypto account, now is the optimal time to join this revolution: click the https://www.kucoin.com/ucenter/signup to begin your digital wealth journey. At this junction of financial restructuring, gaining immediate access to digital assets backed by the world's top clearing house will be the core wealth logic for the next decade.