BTC a Dolar: In-Depth Analysis of Macro Opportunities and Challenges in H2 2025

2025/11/04 02:33:02

Introduction: BTC a Dolar — The Ultimate Contest Between Digital Gold and Fiat Currency

Source:Bitcoinsit

For global cryptocurrency investors, BTC a Dolar (Bitcoin to USD) is more than just a pricing metric; it represents the shifting balance of power between digital assets and the traditional fiat currency system. Currently, a complex global macroeconomic environment—marked by the US Federal Reserve's shifting policy outlook, strong US stock market performance, and Bitcoin's successful rebound to the 111k level—makes the future trajectory of BTC/USD a central focus for the investment community.

This article aims to provide investors with an in-depth analysis of the core drivers and potential risks for BTC a Dolar in the second half of 2025, covering macro cycles, market dynamics, the latest data, and professional strategies, to help investors seize opportunities.

I. Macro Environment Analysis: Fed Policy Pivot and the USD Outlook

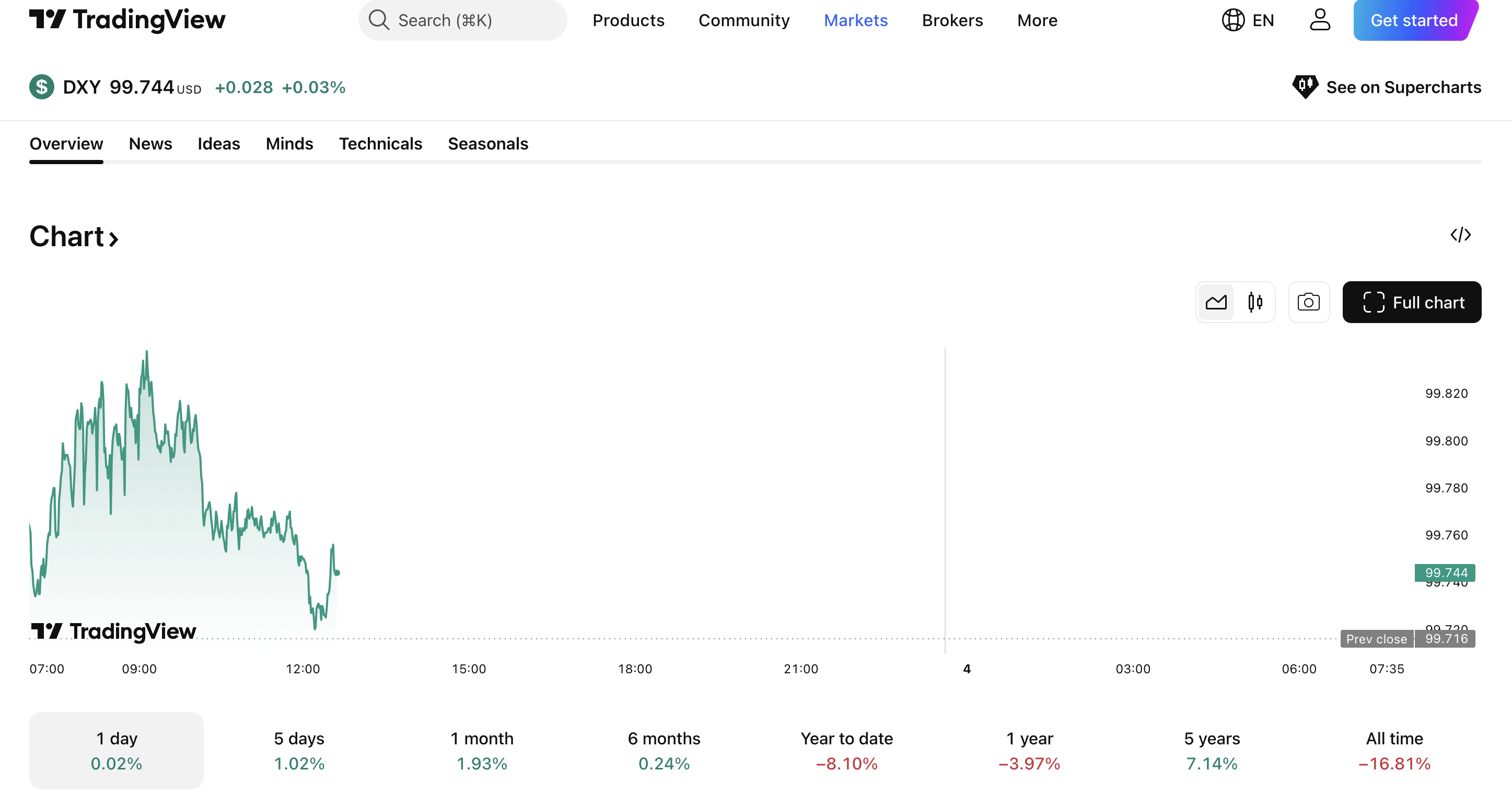

US Dollar Index (DXY) Trend Chart|Source:Trading View

A chart showing the recent trend of the US Dollar Index (DXY), highlighting its volatility amidst changing Fed policy outlook.Bitcoin, as a global risk asset and store of value, is highly correlated with the liquidity environment of the US Dollar. Uncertainty in Rate Cut Prospects and its Correlation with Bitcoin

The latest market dynamics show that the US stock market, driven by robust tech company earnings, closed October with at least six consecutive months of gains, indicating a partial return of risk appetite. However, the Fed officials' opposition to an October rate cut, coupled with delayed economic data releases due to the government shutdown, has caused uncertainty regarding the rate cut prospects to surge (with the probability of a December cut dropping to 63%), reaching a new high.

-

Impact Logic: Uncertainty surrounding the rate cut outlook directly impacts the US Dollar Index (DXY). If the Fed maintains high rates due to persistent inflation, the dollar may remain strong, potentially capping the upside for BTC a Dolar. Conversely, if economic data suggests the need for rate cuts to stimulate growth, global liquidity will be released, which historically serves as a powerful catalyst for Bitcoin price increases.

-

BTC's Hedge Attribute: Amidst this uncertainty, Bitcoin's attribute as a non-sovereign, scarce store of value and a hedge against fiat debasement is emphasized, attracting long-term capital seeking shelter.

Short-Term Correlation or Decoupling Between US Stocks and BTC

The sustained rally in US stocks has temporarily synchronized with Bitcoin's rebound, suggesting that overall investor enthusiasm for risk assets has not faded. However, investors need to watch for a potential decoupling: if Fed policy triggers a US stock market correction, whether Bitcoin can maintain an independent rally—supported by its post-halving scarcity and institutional ETF inflows—will be the biggest question mark for H2 2025.

II. Market Dynamics Review: Support from Halving Effects and Institutional Capital

Beyond the macro economy, the cryptocurrency market's intrinsic cyclical events and changes in funding structure are core supports for the BTC a Dolar price.

Mid-to-Late Stage Effects of the Halving Cycle

The Bitcoin Halving event, which occurred in early 2024, is now over a year old. Historical data indicates that the supply shock and price effects triggered by the halving often peak within 12 to 18 months after the event. This means H2 2025 is positioned in the potential high-point window of this cyclical upswing. As the scarcity of new coin supply reaches its maximum, any significant surge in demand could have an explosive impact on the BTC/USD price.

Latest Data Analysis: Rebound and Capital Concentration

How much is 1 BTC in USD? | Source: Kucoin

The provided chart illustrates the recent BTC/USD price action.

-

BTC Price Performance: Bitcoin has successfully rebounded for three consecutive days, reaching a high of 111.2k, demonstrating strong short-term resilience amid macro headwinds. This rebound suggests significant buying support from institutions and long-term investors within this price region.

-

Market Dominance and Capital Flow: Bitcoin's market dominance remains high at 60%, a crucial indicator. It signifies that during this market recovery and rebound phase, major capital is still concentrated in Bitcoin, the most liquid and consensual crypto asset. While the resurgence in altcoin trading volume is typically a sign of improving market confidence, the capital concentration indicates that BTC a Dolar remains the preferred asset for core allocation.

-

Market Sentiment: Despite the price rebound, market sentiment remains in the fear zone. This is a notable contrarian indicator: when prices rise while sentiment remains low, it often suggests the market has not yet reached a euphoric peak, potentially offering further upside for disciplined investors.

III. Investment Strategy and Risk Management: Navigating BTC/USD Volatility

In this pivotal period of 2025, investors should adopt prudent yet flexible investment strategies.

|

Strategy Name |

Purpose & Suitable Audience | Specific Operational Guidance |

| Dollar-Cost Averaging (DCA) | Long-term value investors aiming to smooth costs | Action: Maintain consistent, periodic investments of a fixed USD amount. In the current environment of high Fed policy uncertainty and market volatility, DCA effectively mitigates the risk of buying at short-term highs and captures the long-term growth trend. |

| Key Level Swing Trading | Traders familiar with technical analysis seeking short-term gains | Action: Closely monitor BTC/USD real-time rates. Use the 111.2k area as a short-term resistance reference and long-term moving averages (e.g., 200-day MA) to identify support levels. Strictly implement Take-Profit and Stop-Loss orders to manage risks associated with sharp price fluctuations. |

| Portfolio Rebalancing | Professional investors pursuing stable returns | Action: Treat Bitcoin as a high-growth asset, controlling its reasonable proportion (typically 5%-15%) within the total investment portfolio. Partially realize profits when Bitcoin prices surge and re-accumulate during pullbacks to maintain the desired risk exposure. |

Conclusion and Outlook: Transcending Uncertainty, Anchoring Digital Value

The trajectory of BTC a Dolar in H2 2025 will be dominated by two major narratives: the uncertainty of Fed policy and the continued maturation of Bitcoin's post-halving effects.

Bitcoin's successful rebound to 111k, coupled with its sustained high market dominance, strongly confirms its position as a solid global digital store of value. Investors should not be distracted by short-term macro noise but should focus on the long-term scarcity of Bitcoin's supply and the structural shifts in institutional capital allocation.

Strategically, maintaining patience, adhering to the DCA principle, and closely monitoring the Fed's actions rather than short-term rumors will be key to navigating market uncertainty and ultimately capturing the long-term growth opportunity of BTC a Dolar.