KuCoin Ventures Weekly Report: Trillion-Dollar Perps vs. ETF Euphoria, Andre Cronje's Principal-Protected Play and the New NFT Meta

2025/10/06 07:42:01

1. CLOB Wars: Perp DEX Monthly Trading Volume Surpasses $1 Trillion, Prediction Markets Hit Highest Level Since Last Election Month

On-Chain Order Books: Migrating CLOB logic to the blockchain for decentralized execution, key features include: transparent order book data stored on-chain; order creation, matching, and execution via smart contracts; and direct on-chain order matching and trade settlement.

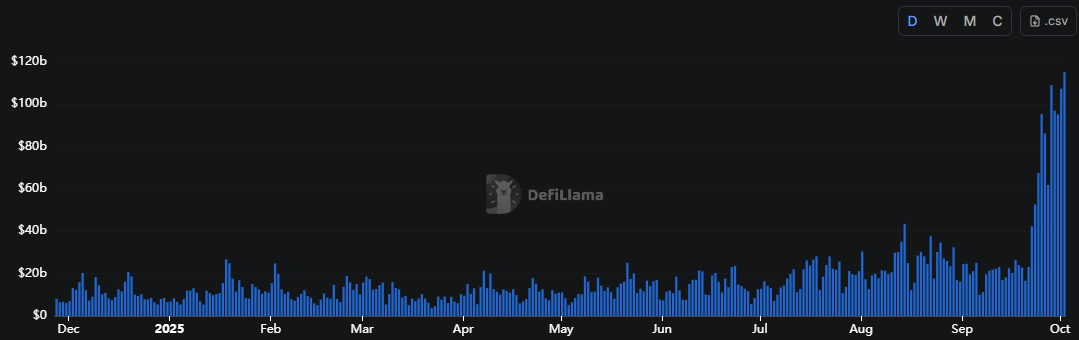

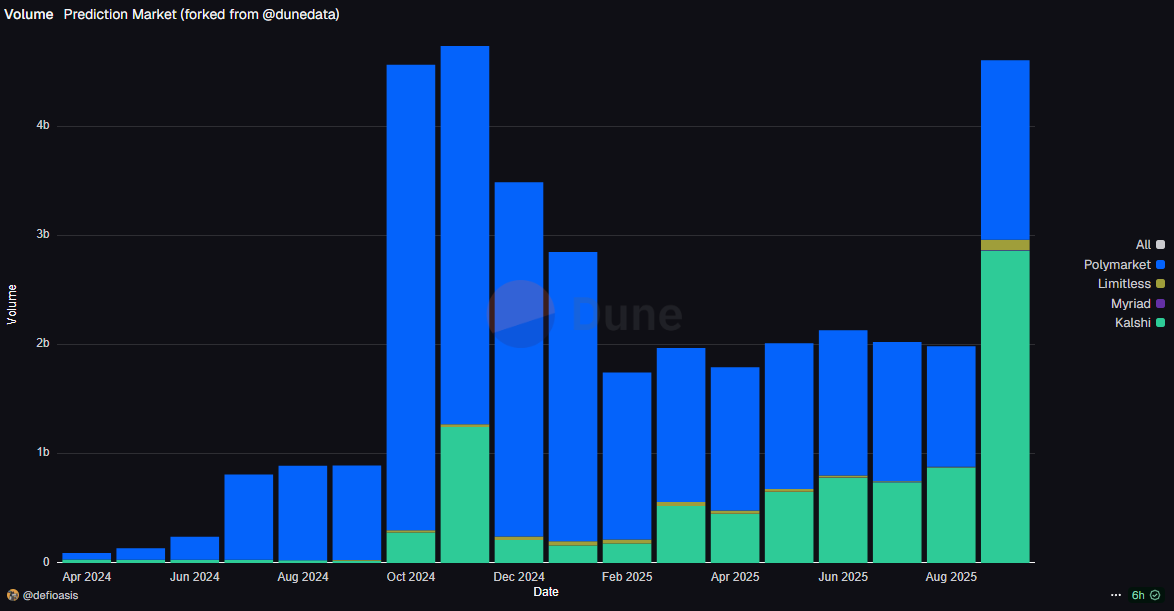

In September, the on-chain order book sector saw explosive growth, with Perp DEX and prediction markets leading the charge. Perp DEX platforms like Hyperliquid, Aster, and Lighter smashed a historic $1 trillion in monthly trading volume, while prediction markets, led by Polymarket and Kalshi, hit their highest levels since last election month. Competition among protocols in these subsectors intensified, with Aster and Lighter surpassing Hyperliquid—fueled by points incentives and soaring token expectations—reaching daily trading volumes of tens to hundreds of billions of dollars. Second-tier platforms like edgeX, Pacifica, and Paradex also saw massive growth, with daily volumes surging past $1 billion. Prediction markets shifted from an oligopolistic landscape to a fierce Polymarket-Kalshi rivalry, with both rolling out ecosystem incentive programs to capture market share. As the top two eye potential IPOs, the third-largest prediction market, Limitless, seized the token issuance opportunity, raising 200x its target on Kaito Launchpad, setting Kaito’s highest fundraising record.

Data Source: DeFiLlama & Dune

In AMM DEXs, trading relies on the size of liquidity pools. For assets with market caps ranging from millions to billions, pool sizes typically don’t exceed one-tenth of the asset’s value, leading to significant slippage for large trades, especially in low-liquidity pools where potential swap losses are even higher. On-chain order books, driven by limit orders from buyers and sellers, allow market makers to participate more easily and efficiently beyond basic market supply and demand, resulting in better market depth and price dynamics. Additionally, on-chain order books are crucial for accommodating diverse player types. As blockchain infrastructure improves, high-frequency traders and those with customized strategies are increasingly prevalent, and AMMs struggle to meet their varied needs. Newer users, often entering the on-chain space via CEXs, are accustomed to CEX order book systems and find AMM’s high slippage and trading discrepancies jarring. As CEXs accelerate their on-chain expansion—integrating wallets and on-chain trading—the trading logic and front-end interfaces of on-chain platforms are aligning closely with CEX conventions, making the rise of on-chain CLOBs unstoppable.

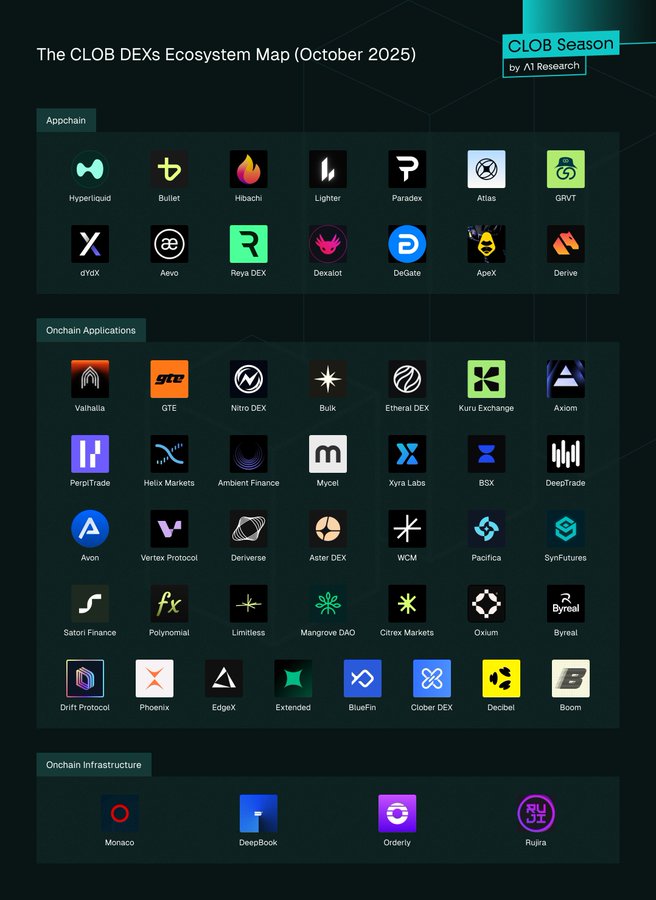

According to AI Research’s classification, the CLOB sector can be divided into three subcategories: Appchain, Onchain Applications, and Onchain Infra. Appchain includes platforms like Hyperliquid, Bullet, Hibachi, and Lighter; Onchain Applications include Valhalla, GTE, Aster DEX, edgeX, and BlueFin; and Onchain Infra includes DeepBook and Ordely.

Source: A1 Research

Of course, while many Perp DEXs and prediction markets claim to be CLOB markets, a significant portion don’t fully qualify. Apart from Hyperliquid, many Perp DEXs still rely on off-chain matching, making it impossible to verify specific trading orders and forcing dependence on API data, which can be heavily inflated. For instance, Aster, which has seen rapid trading volume growth, faced skepticism from DeFiLlama’s co-founder. Due to Aster’s inability to provide deeper data validation—such as who is placing and executing orders—DeFiLlama has delisted its data. A similar situation has emerged with the prediction market Kalshi, where some community members suspect significant volume inflation, artificially boosting its nominal trading figures.

2. Weekly Selected Market Signals

Macro Fog vs. Crypto Frenzy: ETFs Rake in Billions as AC Debuts a 'Principal-Protected' Play

The market sentiment is currently being pulled apart by two extreme forces: on one side, immense optimism within the crypto world; on the other, a dense fog of macroeconomic uncertainty.

Bitcoin surged past $125,000 today, shattering its all-time high once again. Fueling this momentum is the formidable performance of the U.S. spot crypto ETF market. Last week, Bitcoin ETFs saw a staggering $3.24 billion in single-week net inflows, marking the second-highest record in history. Concurrently, Ethereum ETFs pulled in an impressive $1.3 billion. The market frenzy is far from over, as the SEC is on deck for a final verdict on at least 16 new spot crypto ETFs in October, featuring prominent tokens like SOL, XRP, and LTC. To fast-track this process, the SEC recently adopted universal listing standards that could slash review times to under 75 days. Bloomberg ETF analysts are so confident that they predict the approval odds for a SOL spot ETF are now "basically 100%."

Data Source: SoSoValue

However, shifting our gaze to the macro landscape paints a less rosy picture. The Trump administration is leveraging the government shutdown crisis to push a second wave of massive federal employee layoffs, with 100,000 employees cut this week and the White House hinting at further permanent reductions. To make matters worse, this month's critical Non-Farm Payrolls (NFP) report was not released due to the shutdown, sparking serious concerns that the Federal Reserve will be forced to make monetary policy decisions without key data.

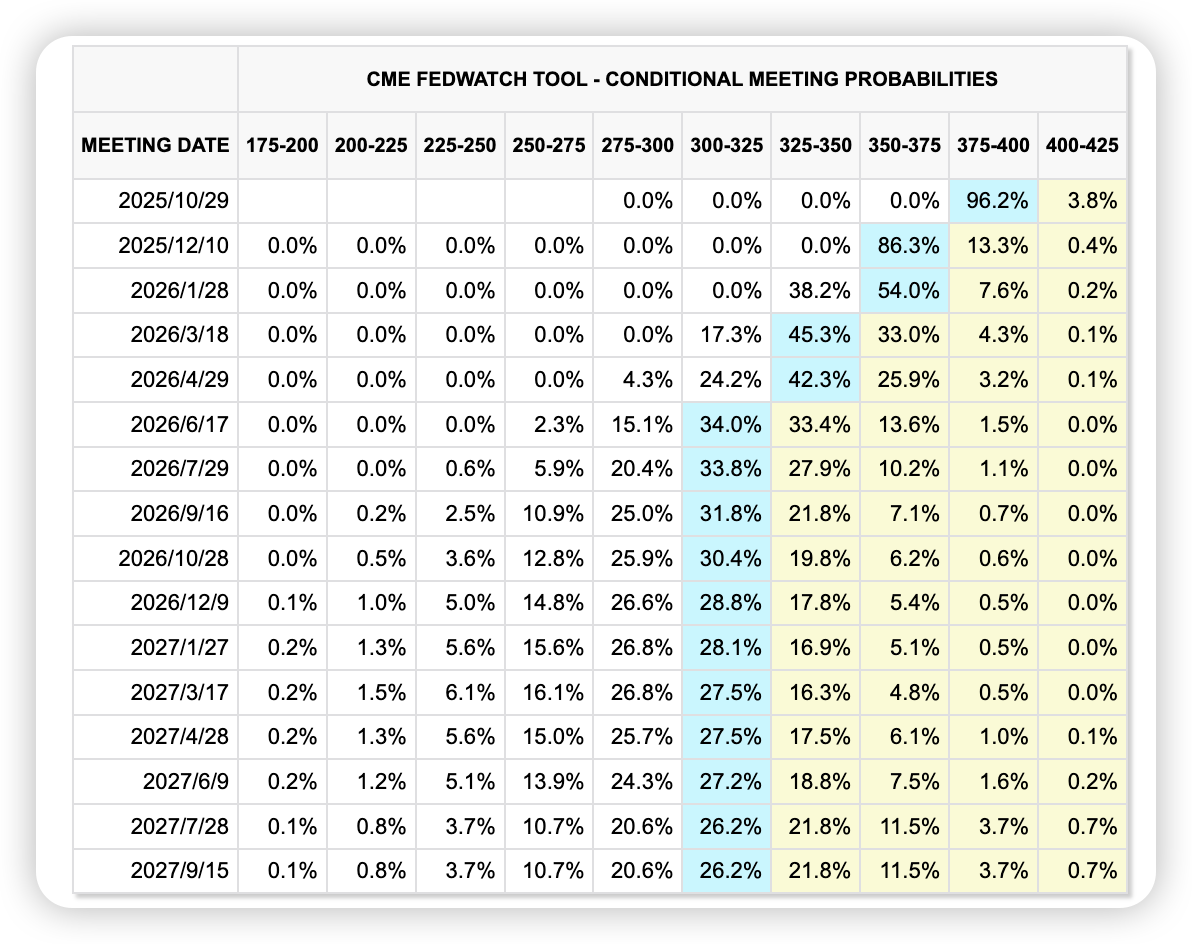

In response, Wall Street is turning its attention to "alternative data." A private-sector NFP report from the data firm Revelio showed a 60,000 increase in jobs for September, making it the best-performing month this year. If this data becomes the Fed's basis for decision-making, hopes for an October rate cut look incredibly slim. Interestingly, despite this hawkish data, the CME FedWatch Tool shows that traders are stubbornly betting on another 25-basis-point rate cut at the end of the month.

Data Source: CME FedWatch

This macroeconomic uncertainty hasn't seemed to dampen market enthusiasm. Last Friday, major U.S. stock indices hit new intraday highs, gold futures closed at a new peak for the fourth day in a row (rising for seven consecutive weeks), silver rallied over 3% to a fourteen-year high, and New York copper rose over 7% for the week.

What to Watch Next Week:

-

Data Vacuum: The government shutdown has not only delayed the NFP report but may also affect the release of the September CPI data, scheduled in two weeks. The market will be flying blind without these key economic indicators for a while.

-

Powell Takes the Mic: Federal Reserve Chairman Jerome Powell is scheduled to speak next week. The market will be hanging on his every word for clues about his views on the shutdown and any hints about future policy.

-

Nobel Prize Week: The announcement of Nobel Prize winners could reignite narrative hype and discussions around AI and DeSci (Decentralized Science) concepts.

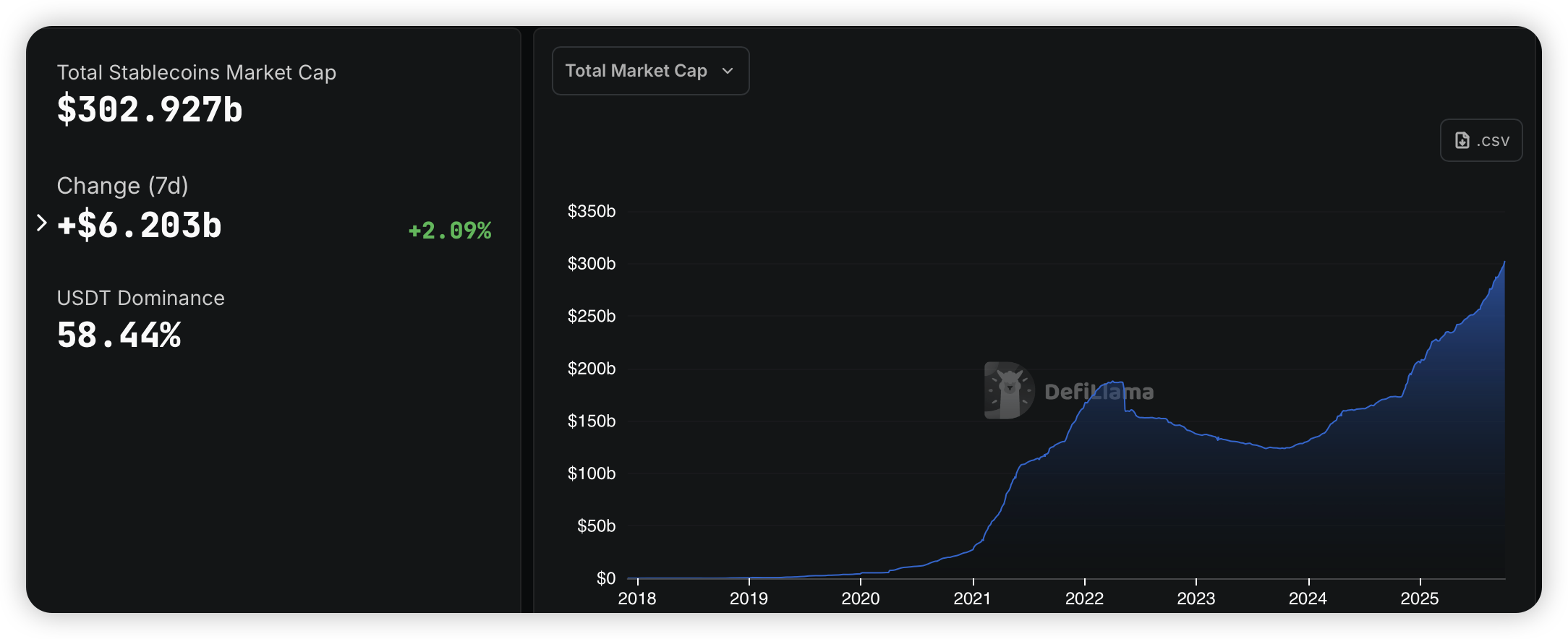

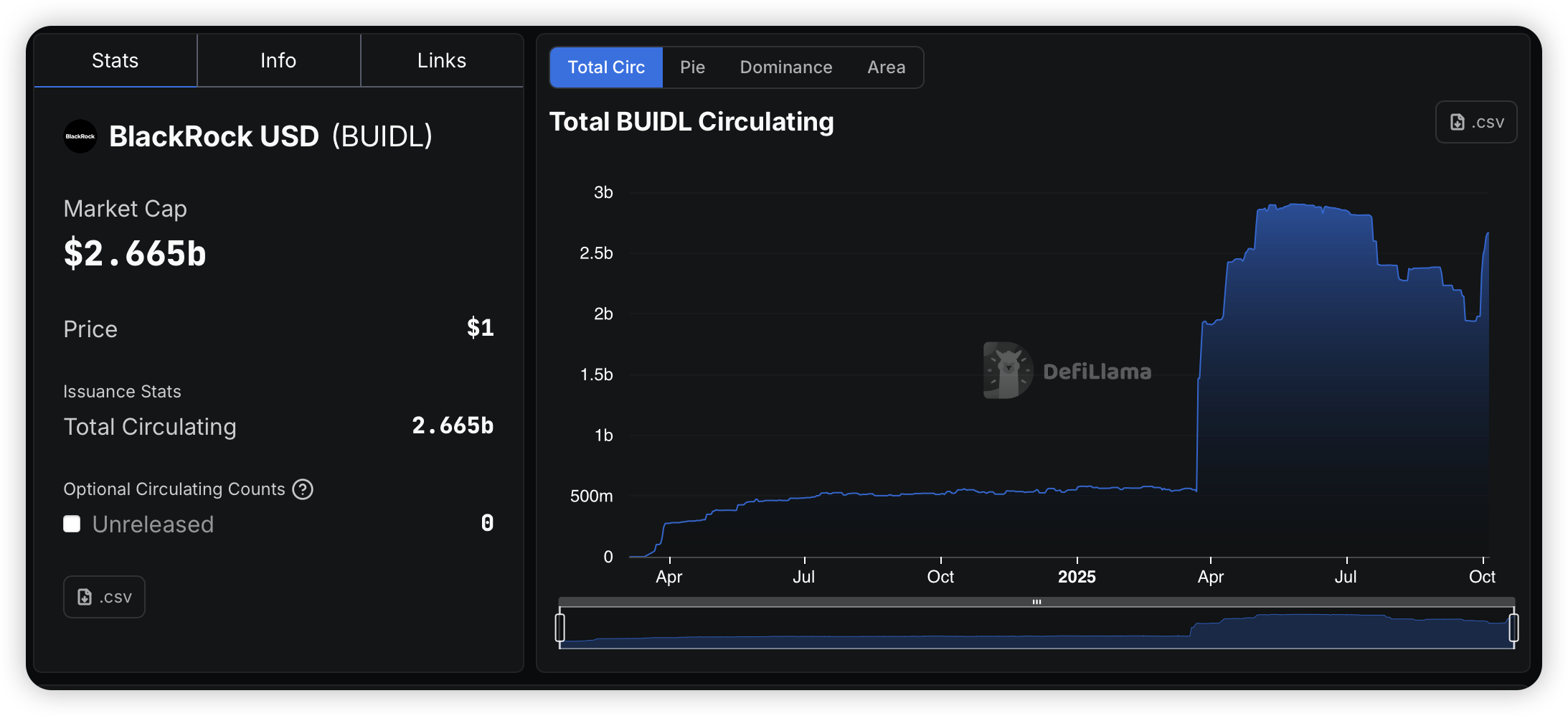

According to DeFiLlama, the total market cap of stablecoins has surpassed $300 billion. Over the past week, USDT, USDC, and USDe have all seen growth. BlackRock's BUIDL fund saw its circulating supply soar from $1.979 billion to $2.665 billion after September 27th, with the vast majority of this growth originating on Ethereum.

Data Source: DeFiLlama

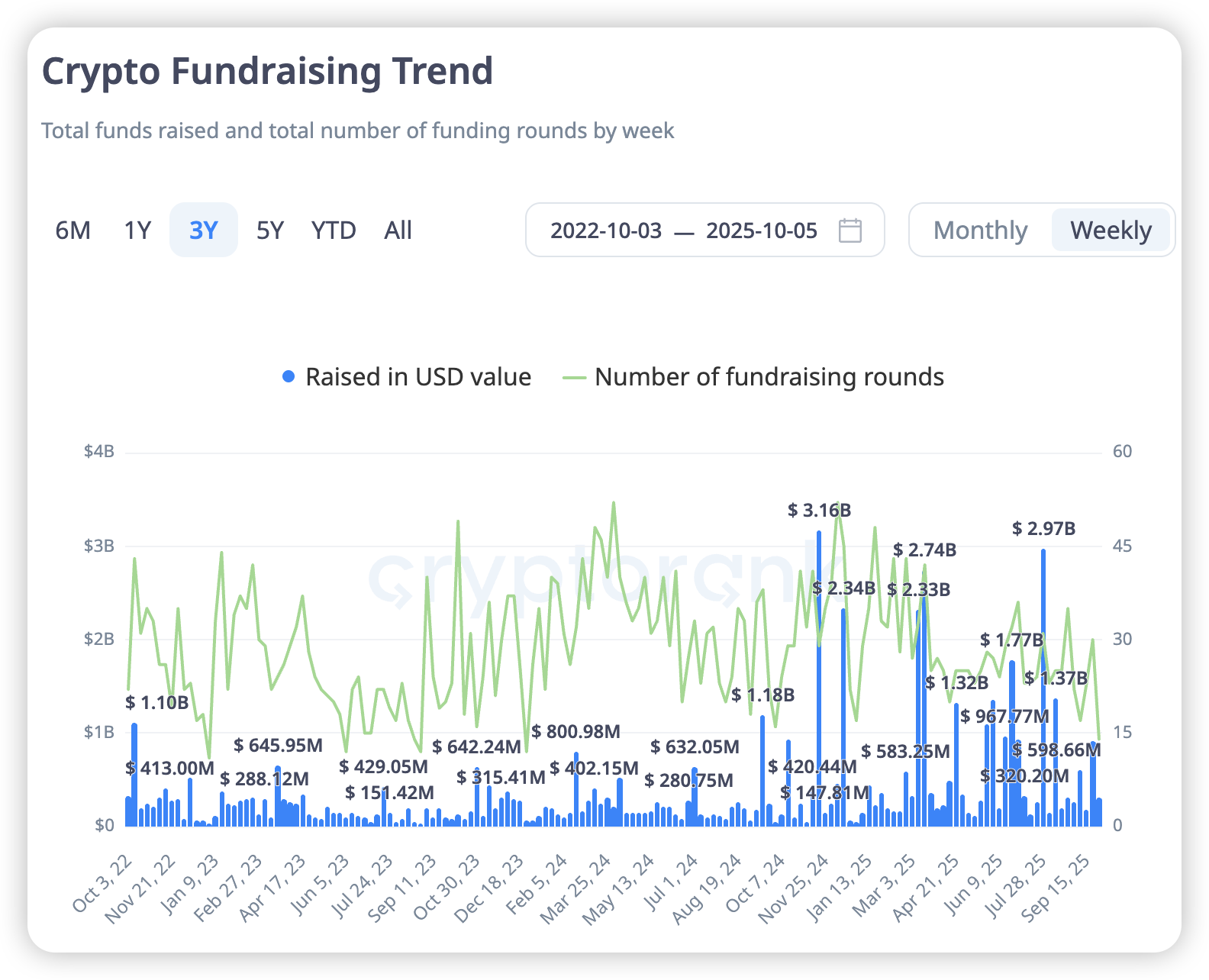

VC Funding Watch

While overall funding in the primary market was relatively subdued last week, there were several bright spots. Kraken reportedly closed a $500 million funding round at a $15 billion valuation at the end of September as it continues its push for an IPO. Bit Digital (BTBT) raised another $135 million through a convertible note offering, primarily to purchase Ethereum and for other corporate purposes. Payments company RedotPay completed a $47 million strategic round, with previous investors like Galaxy Ventures and Vertex Ventures doubling down, and Coinbase Ventures joining to lead the round.

Data Source: CryptoRank

AC's New Playbook: Flying Tulip's $200M Raise and 'Zero Pre-Mine' Model Are Reshaping the Game

The most captivating narrative in the primary market this week undoubtedly belongs to Andre Cronje and his new project, Flying Tulip.

The project just announced the completion of a $200 million raise at a $1 billion valuation, with participants including CoinFund, DWF Labs, and other notable firms. Flying Tulip aims to build a full-stack exchange covering a wide range of services, and its core philosophy of "execution-aware risk pricing" directly addresses a major pain point in DeFi. It employs a dynamic AMM mechanism that adjusts to real-time market volatility to automatically optimize capital allocation for LPs, aiming to drastically reduce impermanent loss and lower the barrier to entry for DeFi.

For its liquidity design, the project uses the decentralized stablecoin ftUSD as the ecosystem's lifeblood, featuring an expected 8-12% APY. This yield is derived from real on-chain activities such as lending, delta-neutral hedging strategies, and staking. This approach not only boosts the ecosystem's capital efficiency but also empowers its core products, including lending and perpetuals.

However, Flying Tulip's most disruptive innovations lie in its tokenomics and investor protection. The project offers investors a "perpetual put option" wrapped in an NFT. This allows holders to not only redeem their tokens for their original principal at any time but also to trade this NFT, which contains the "protection rights." The team's incentive model is also uniquely structured: at launch, the team and foundation have zero tokens. All future protocol revenue will first be used to buy back FT tokens from the market. Only then will these repurchased tokens be distributed according to a fixed ratio (40% Foundation, 20% Team, 20% Ecosystem, 20% Incentives). This "buy-then-distribute" model creates an unprecedented alignment of interests between the team and investors—the team only gets rewarded if the protocol succeeds and generates real revenue.

Of course, this doesn't mean the investment is risk-free. Flying Tulip's vision is incredibly ambitious, posing a significant execution risk for the team. And while investors' principal is protected, they will bear the opportunity cost of not deploying their capital in other high-yield investments if the project's token performs poorly over the long term. Nevertheless, with its unique innovations, Flying Tulip has firmly established itself as one of the most compelling projects to watch in the current market.

3. Project Spotlight

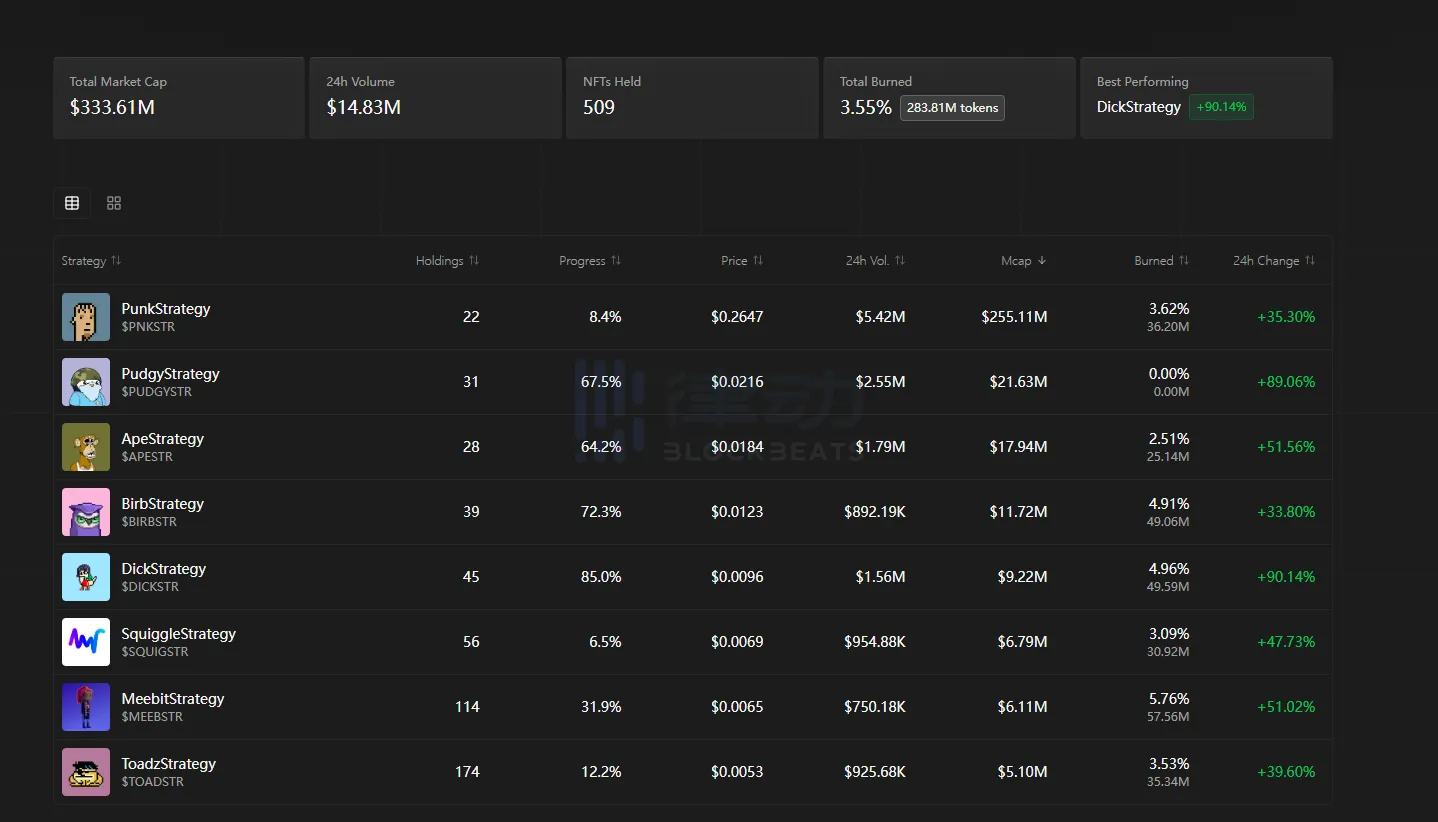

OpenSea Launches NFT Strategy Tokens, PunkStrategy Leads Sector Surge

On September 30, OpenSea announced support for trading “NFT Strategy” tokens, igniting a surge of interest in the sector. PunkStrategy (PNKSTR) took the lead, fueling attention toward similar tokens such as PudgyStrategy (PUDGYSTR), ApeStrategy (APESTR), and Solana-based Madlads Strategy (MLSTRAT). As of October 5, PNKSTR's market cap broke through $250 million.

Data Source: https://www.nftstrategy.fun/strategies

Take PNKSTR as an example: each transaction incurs a 10% fee, with 8% funneled into a protocol fund pool. Once the pool has enough to purchase a floor-priced NFT, the contract auto-buys and relists the NFT at roughly 1.2x the floor price. Profits from resale are then used to buy back and burn tokens, forming a flywheel of “Buy NFT → Resell → Buyback & Burn.” PunkStrategy, the first to adopt this model, leveraged the CryptoPunks IP and its first-mover advantage to capture the highest market cap and liquidity. Other strategy tokens typically retain the same 10% fee structure and allocate 1% to buy back and burn PNKSTR, giving it a “meta-token” role and fostering internal sector linkage.

The rapid inflow of capital into NFT strategy tokens reflects a confluence of market logic and sentiment. First, blue-chip NFT floor prices and transaction volumes have shown signs of recovery, laying the groundwork for the narrative of “using NFT trading profits to support token value.” Second, strategy tokens are tradable on DEXs and composable with DeFi, enhancing the indexability and utility of NFT exposure. Third, early-stage supply is limited, leading to concentrated speculation across a few tokens and magnified price volatility.

However, this model shows inherent fragility. It relies heavily on the liquidity and price stability of the underlying NFTs. If NFTs become illiquid or drop in value, the protocol may fail to profitably resell them, collapsing the buyback loop. Moreover, the 10% tax causes constant dilution for holders unless new capital flows in continuously—echoing Ponzi-like mechanics. These tokens are often controlled by a few large holders who drive up prices to trigger FOMO before profit-taking. PNKSTR has already exhibited boom-and-bust cycles, with signs of centralization among a small number of wallets.

While NFT strategy tokens have become a short-term market focus and sparked discussions on “NFT index investing,” their long-term value remains uncertain. Without sustained real revenue from NFT trading, speculation-driven momentum may be short-lived. Once sentiment cools, these assets could see sharper and faster declines than traditional tokens. Investors should remain aware of their liquidity risks and structural flaws. In essence, NFT strategy tokens turn “blue-chip NFT trading profits → token buyback and burn” into a tradable index, offering both innovation and reflexivity. In the short term, they present speculative and sector rotation opportunities, but long-term viability depends on real NFT income and the fine-tuning of parameters like fees, listing multipliers, and buyback transparency.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.