Beginner’s Guide to Trading Crypto Futures: Best Leverage Strategies and Liquidation Prevention Tips

2025/08/18 09:27:02

Cryptocurrency futures trading attracts countless investors with its potential for high returns. However, the accompanying high risks also deter many newcomers. Among these, one of the most fundamental and confusing questions is: "What is the best leverage for crypto futures?"

This article will provide a comprehensive breakdown of this concept, dispel the myths surrounding "best leverage," and offer a safe, practical guide for market newcomers to help you start your futures trading journey on a stable footing while controlling risk.

What is Leverage? Why It's a Double-Edged Sword of Opportunity and Risk

Simply put, leverage is a financial tool that allows you to control a position of much greater value with a small amount of capital. For example, if you have 100 USDT in your account and choose 10x leverage, you can open a position worth 1,000 USDT (100 USDT x 10).

-

The Allure of Amplified Gains: If you go long (bet on a price increase) and the coin's price goes up by 10%, your profit will be 1,000 USDT x 10% = 100 USDT. This means you’ve doubled your initial principal.

-

The Perilous Risk Trap: What if the price moves against you by 10%? Your loss would also be 1,000 USDT x 10% = 100 USDT, which would wipe out your principal and cause your position to be forcefully liquidated, commonly referred to as "getting liquidated."

Leverage is not magic; it simply amplifies both gains and losses proportionally. Especially in the highly volatile crypto market, this amplification effect can determine your success or failure in just a few minutes.

Leverage Multiplier and Liquidation Price: A Concrete Case Study

Beginners often overlook the decisive impact of the leverage multiplier on the liquidation price. The liquidation price is the point at which an exchange is forced to close your position when your account's funds are insufficient to maintain it.

Let's use a long BTC/USDT position as an example, assuming you open a position with a 100 USDT principal when the price is 60,000 USDT:

|

Leverage Multiplier

|

Position Value

|

Maintenance Margin Rate

|

Estimated Liquidation Price

|

Percentage Price Drop Needed

|

| 5x |

500 USDT

|

0.5%

|

48,000 USDT

|

-20%

|

| 10x | 1,000 USDT |

0.5%

|

54,000 USDT

|

-10% |

| 20x | 2,000 USDT |

0.5%

|

57,000 USDT

|

-5% |

| 50x |

5,000 USDT

|

0.5%

|

58,800 USDT

|

-2% |

| 100x |

10,000 USDT

|

0.5%

|

59,400 USDT

|

-1% |

As the table shows, the higher the leverage, the closer your liquidation price is to your opening price. In a highly volatile market, a drop of 1% or even less can instantly trigger liquidation, leaving you no time to react.

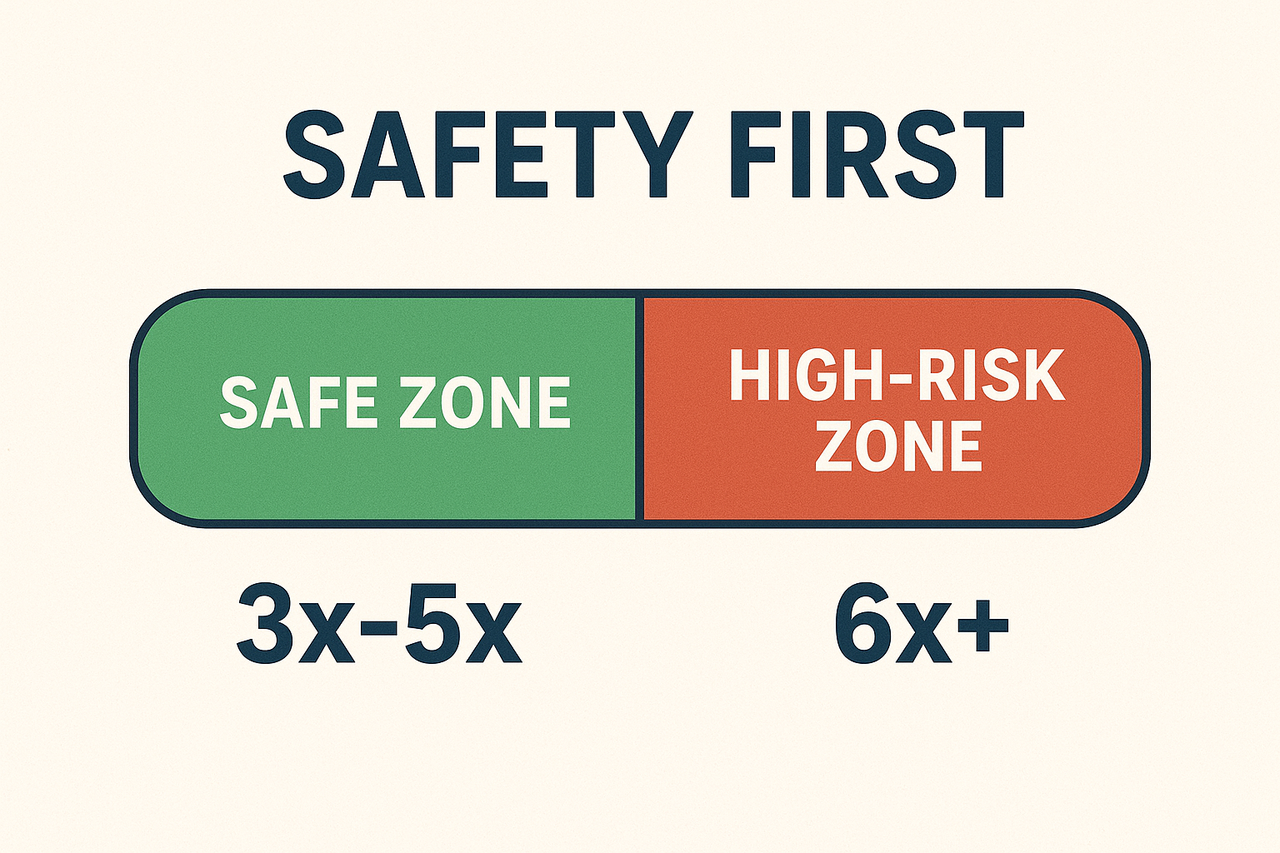

Advice for Beginners: How to Choose the Safest Leverage?

For those of you new to futures trading, we strongly advise you to prioritize safety. The safest leverage is the one that allows you to withstand the most market volatility without being easily liquidated.

-

Recommended Range: 3x to 5x

-

This multiplier provides your position with enough buffer space. Even if the market experiences a sudden downturn, you will have time to add margin or set a stop-loss, preventing instant liquidation.

-

It gives you valuable "trial and error" and "learning" space, allowing you to familiarize yourself with the trading process and market dynamics without losing your entire principal.

-

-

First-Time Trading: If you just want to get a feel for it, you can even start with 1x or 2x leverage. This allows you to experience leveraged trading with almost no liquidation risk.

Remember, your goal is not to get rich overnight, but to survive in the long run.

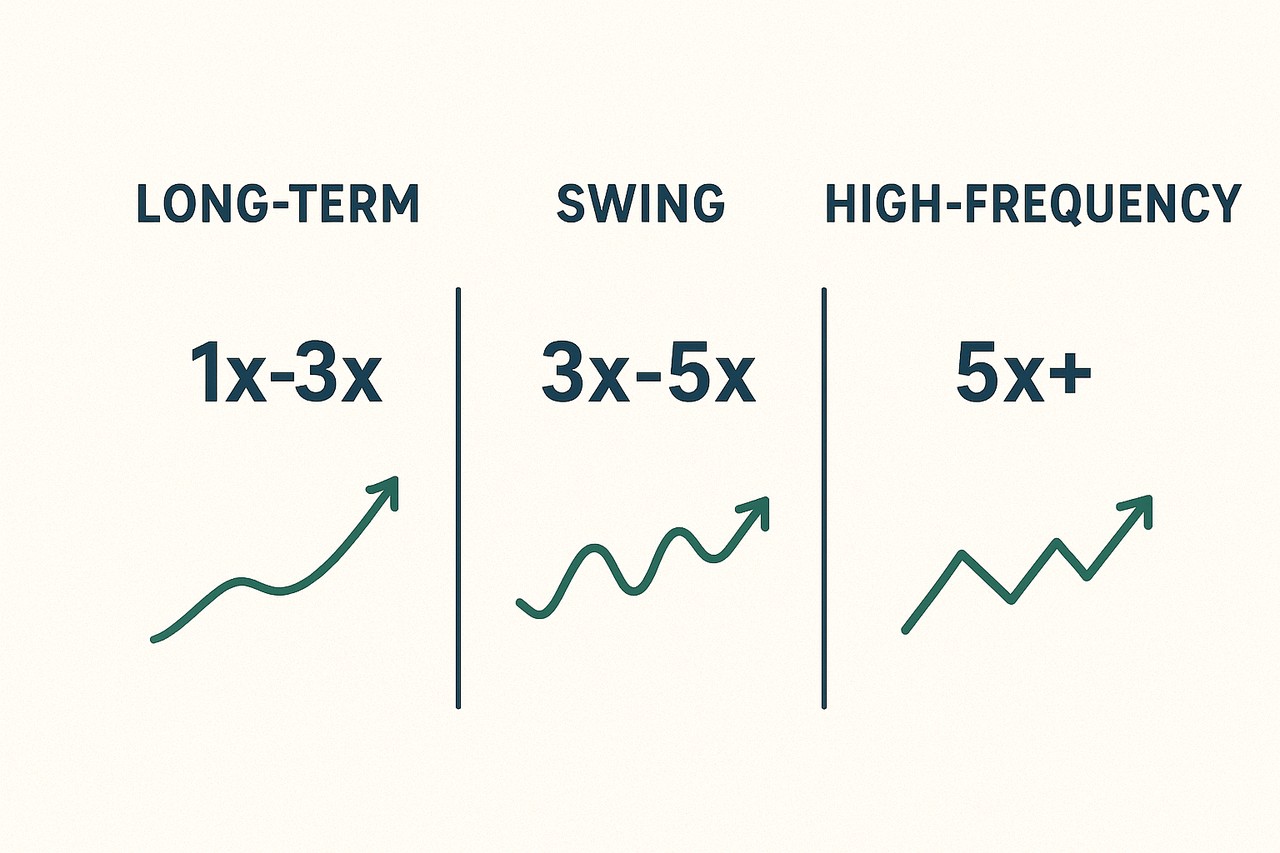

Beyond Beginners: Leverage Choices for Different Trading Styles

Once you have mastered the basics and risk management, you can adjust your leverage according to your trading style:

Long-Term Investors or Hedgers (3x - 5x):

Goal: To use leverage to amplify returns, but primarily relying on major market trends rather than short-term fluctuations.

Strategy: Suitable for holding positions for a longer period with low leverage, allowing them to withstand larger market pullbacks.

Swing Traders (10x - 20x):

Goal: To capture mid-term trends and earn profits from price swings.

Strategy: Requires more frequent stop-losses and take-profits, demands higher market analysis skills, and uses medium leverage to amplify gains.

Scalpers (20x - 125x):

Goal: To capture extremely small price movements by opening and closing positions quickly.

Strategy: This approach demands extremely high levels of technical skill, discipline, and execution speed. It is only suitable for a very small number of professionals and requires strict stop-loss orders.

More Important Than Leverage: Advanced Risk Management Tools

Simply choosing the right leverage is not enough. Professional traders also excel at using the following tools:

-

Set a Stop-Loss: Never trade naked! Set a maximum acceptable loss point when opening a position. Once the price hits that point, the system will automatically close your position, preventing further losses. This is the last line of defense for your principal.

-

Trailing Stop: As the price moves in your favor, dynamically adjust your stop-loss price to lock in a portion of your profits.

-

Margin Management: When the market falls, you can add margin to lower your liquidation price to ride out the downturn. When the market rises, you can partially close the position to reduce leverage and lock in profits.

Conclusion:

In the crypto futures market, only those who survive can win in the end. For beginners, your primary task is not to chase high returns, but to build a sound trading system and risk awareness.

Always remember: start with low leverage, strictly set your stop-loss, and control your position size. Only after you can consistently profit and establish your trading discipline in a low-leverage environment should you gradually explore higher leverage. This is how you truly turn leverage into a powerful tool, not a fatal trap.

Further Reading:

Adjusting Maximum Leverage in Futures Trading: https://www.kucoin.com/support/44191167275801

How to Calculate Trading Fee: https://www.kucoin.com/support/26686077277721

KuCoin Futures - 9 Principles for Futures Trading: https://www.kucoin.com/support/900004200166

KuCoin Futures Products and Features Overview: https://www.kucoin.com/support/26683745436441