KuCoin Ventures Weekly Report: The Narrative Shift: Capital Chases Solana Treasuries and Prediction Markets as BTCFi Seeks a New Path

2025/09/01 10:33:01

1. Weekly Market Highlights:Solana Treasury Strategy Spurs Public Company Surge

Last week, several companies announced plans to establish Solana treasuries. Galaxy Digital, Multicoin Capital, and Jump Crypto are collaborating to raise approximately $1 billion to build Solana treasuries through public company vehicles; crypto fund Pantera is seeking to raise $1.25 billion to convert a Nasdaq-listed company into a Solana treasury; Nasdaq-listed Sharps Technology raised $400 million in a one-time effort to establish a Solana treasury and reached an agreement with the Solana Foundation to purchase $50 million worth of SOL at a discount of 15% off the 30-day average price.

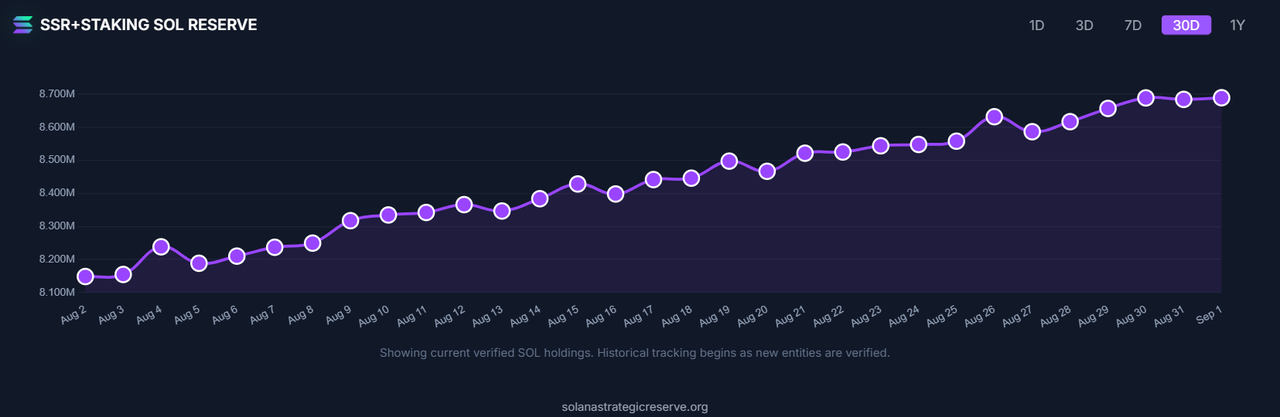

Currently, the REX-Osprey SOL + Staking ETF (SSK) has launched in the U.S. and is actively traded, while several institutions are continuously updating their spot SOL ETF filings. The explosion of SOL DAT is in line with the ongoing advancement of SOL ETFs and the evolving institutional narrative. According to SSR data, 13 disclosed public companies or institutions collectively hold 8.689 million SOL (1.51% of the total supply), valued at approximately $1.72 billion. Of these, 585k SOL are staked, earning an average yield of about 6.86%. Sharps Technology and Upexi alone hold over 2 million SOL.

Data source: https://www.strategicsolanareserve.org/

Similar to BTC and ETH treasury companies, the typical fundraising paths for SOL treasury companies include private placements, convertible bonds, and equity credit lines. The raised funds are then used to buy SOL in batches. What's different is that some companies disclose that they acquire locked SOL at a discount to the spot price, thereby reducing on-book risk and minimizing the impact of secondary market volatility. For example, Sharps Technology purchases SOL from the Solana Foundation at a 15% discount to the 30-day average price, and Upexi disclosed that about 57% of its SOL was bought at around a 15% discount to the spot price and was immediately locked. In this process, the Solana Foundation acts as the counterparty—a solution the community proposed in response to the Ethereum Foundation’s regular token sales on the secondary market. Whether through discounted locked SOL purchases or active staking, SOL treasury companies can earn rewards from network inflation and on-chain activity, and may even operate their own validator nodes to profit from MEV sharing, effectively turning the treasury into another revenue stream for the company. Additionally, SOL treasury companies typically help traditional investors price shares by disclosing SOL per share (SPS) and its equivalent value in USD in company announcements.

The concept of crypto treasury companies continues to spread to more public chain assets and altcoin sectors, attracting more celebrity involvement. Trump family business Trump Media reached a business merger agreement with Crypto com and SPAC company Yorkville to jointly establish Trump Media Group CRO Strategy Inc, aiming to raise about $6.42 billion to build a CRO treasury company. Elon Musk’s private lawyer Alex Spiro has been appointed chairman of a proposed Dogecoin treasury company, which plans to raise $200 million and has received authorization from House of Doge, the official entity under the Dogecoin Foundation responsible for Dogecoin development and promotion.

2. Weekly Selected Market Signals

Fed Officials Frequently Signal Rate Cuts as Spot ETF Inflows Slow

Last week, a late-session sell-off in U.S. stocks erased earlier weekly gains, but from a medium-term perspective, the S&P 500 and Nasdaq Composite marked their fourth consecutive month of increases. However, recent inflation data has raised concerns for some market participants. U.S. consumer spending in July saw its largest increase in four months, while the core Personal Consumption Expenditures (PCE) price index also rose, indicating persistent inflationary pressures.

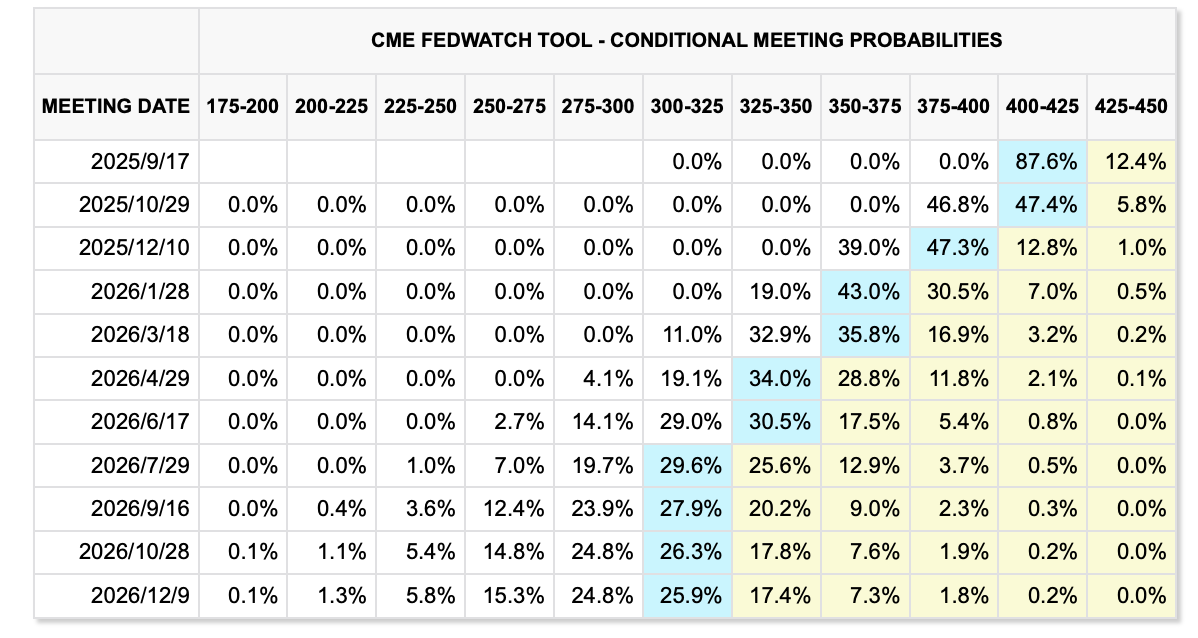

Fortunately, against the backdrop of strengthening inflation-related data, Christopher Waller, a Federal Reserve Governor and a popular candidate to succeed Jerome Powell, once again called for an interest rate cut. He stated he would support a rate cut at the September policy meeting. While a sharp reduction isn't necessary, he anticipates further adjustments over the next three to six months to prevent a collapse in the labor market. Although the inflation figures are not ideal, Waller believes the inflationary impact of tariffs is "transitory."

From a market impact perspective, a subsequent rate cut by the Fed could indeed suppress short-term interest rates, but long-term rates currently remain high. The future pace of rate cuts will continue to be influenced by economic data and changes in the international landscape; under normal circumstances, rapid and drastic cuts are unlikely.

Data Source: FedWatchTool

Concurrently, major indices in China's A-share market continued to rise. As of the last trading day of the week, the total market turnover exceeded 2 trillion yuan for 13 consecutive days, with turnover surpassing 3 trillion yuan on three of those days. Investor sentiment in this market is generally optimistic.

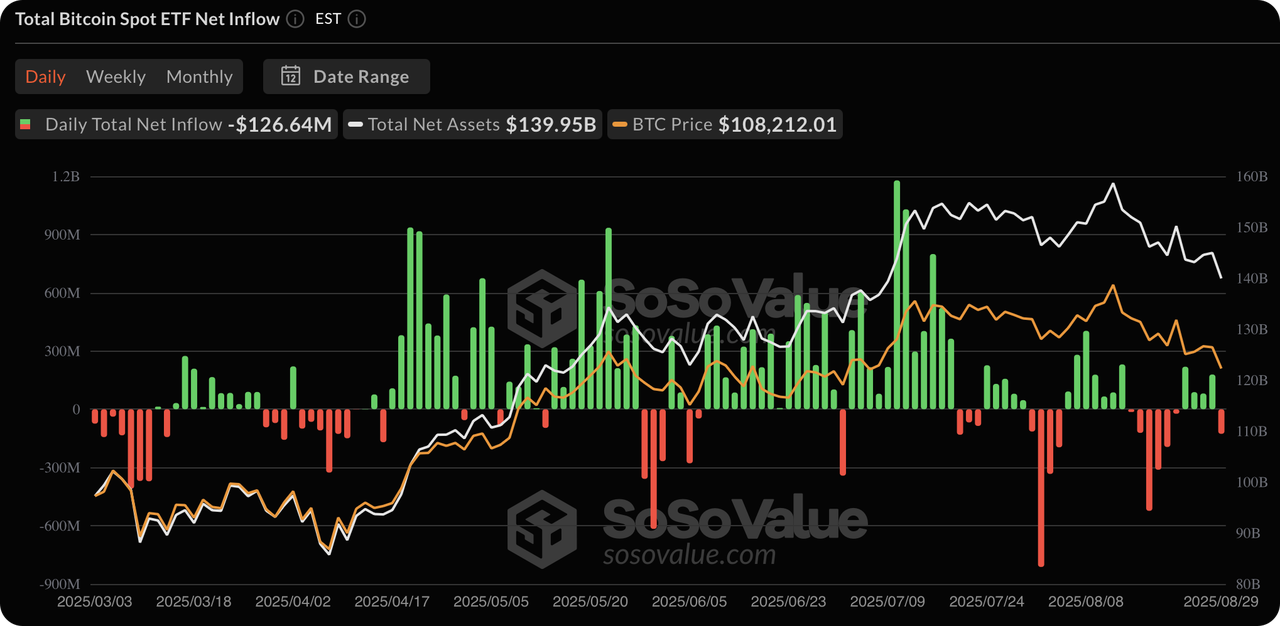

In the crypto space, both the Altcoin Season Index and the Fear & Greed Index have pulled back, with overall crypto sentiment shifting towards a neutral to cautious stance. This comes as Bitcoin's price continues to correct while Ethereum shows relative strength. In the spot ETF market, net inflows into Bitcoin ETFs are still weakening, and net inflows into Ethereum ETFs have also slowed compared to previous periods.

Data Source: SoSoValue

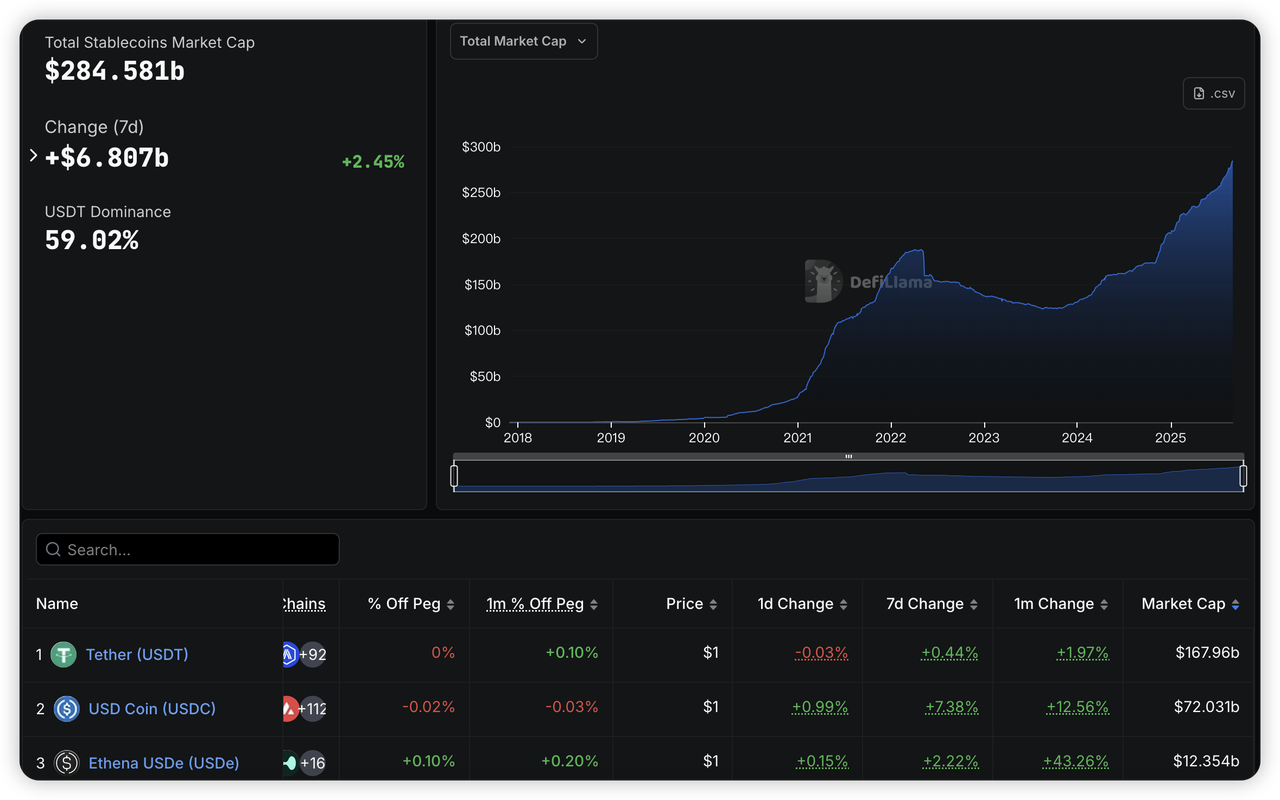

Stablecoins continue to maintain strong upward momentum, with USDe remaining robust, although its growth rate has begun to slow. Many institutions remain very optimistic about the future of stablecoins, believing their total issuance will reach the trillions of dollars in the coming years.

Data Source: DeFiLlama

Key Macro Events to Watch This Week:

-

Major economies will release their latest PMI data.

-

The Federal Reserve will publish its Beige Book on economic conditions midweek.

-

Non-farm payroll and unemployment data will be released this Friday, with speeches from officials at the European Central Bank and the Federal Reserve also scheduled.

Primary Market Financing Observations:

Last week, overall financing activity in the crypto primary market slowed, with a total of $226 million raised. Excluding a few large transactions (such as capital operations related to Trump Media & Technology Group), market enthusiasm was noticeably subdued. Notably, the treasury financing for DeFi Development Corp, a publicly listed company in the Solana ecosystem, accounted for half of the total amount, highlighting the current market's core trends:

-

Significant Polarization: Capital is increasingly concentrating in two main areas. On one hand, treasury financing for public companies and M&A activities by top-tier projects continue to be active, securing large-scale funding.

-

Clear Investment Themes: Popular narratives such as stablecoins, RWA (Real World Assets), AI, and prediction markets continue to attract attention. In contrast, startups in other sectors are facing financing difficulties, with investment institutions becoming generally more cautious.

Data Source: https://cryptorank.io/funding-analytics

Trump Family Narrative Spreads in Primary Market, Prediction Markets Gain Traction

The prediction market sector has seen unusually active capital movement recently, becoming a new highlight in the primary market:

-

Last week, Polymarket received a multi-million dollar investment from 1789 Capital, a fund where Donald Trump Jr. is a partner. Trump Jr. will also join its advisory board.

-

According to Bloomberg, prediction market platform Kalshi recently hired crypto influencer John Wang as its head of crypto to deepen its presence in the digital asset space. It is worth noting that Trump Jr. was also hired as a strategic advisor to Kalshi earlier this year.

-

Meanwhile, The Clearing Company, a prediction market platform founded in March 2025 by former Polymarket and Kalshi Chief Growth Officer Toni Gemayel, announced last week the completion of a $15 million seed round led by Union Square Ventures.

As Polymarket, which previously received a warning from the CFTC, prepares to return to the U.S. market, coupled with the active positioning of mainstream platforms like Coinbase and Robinhood, the prediction market sector is entering a key development period. In the future, this sector is expected to deeply integrate with major political and business events, attracting broader mainstream user attention and participation.

3. Project Spotlight

Football.Fun Goes Live: A Capital Game in Web3’s Football Stock Market

Football.Fun has recently gained traction on the Base chain as a Web3 football manager game, attracting players and liquidity through its "virtual football stock market" design. Unlike traditional sports prediction markets, Football.Fun tokenizes real-world football stars, allowing users to engage in value speculation by trading player "shares." The price fluctuations are driven by a combination of player performance, social sentiment, and on-chain liquidity dynamics, creating a hybrid market that merges real-world sports variables with Web3 trading mechanisms.

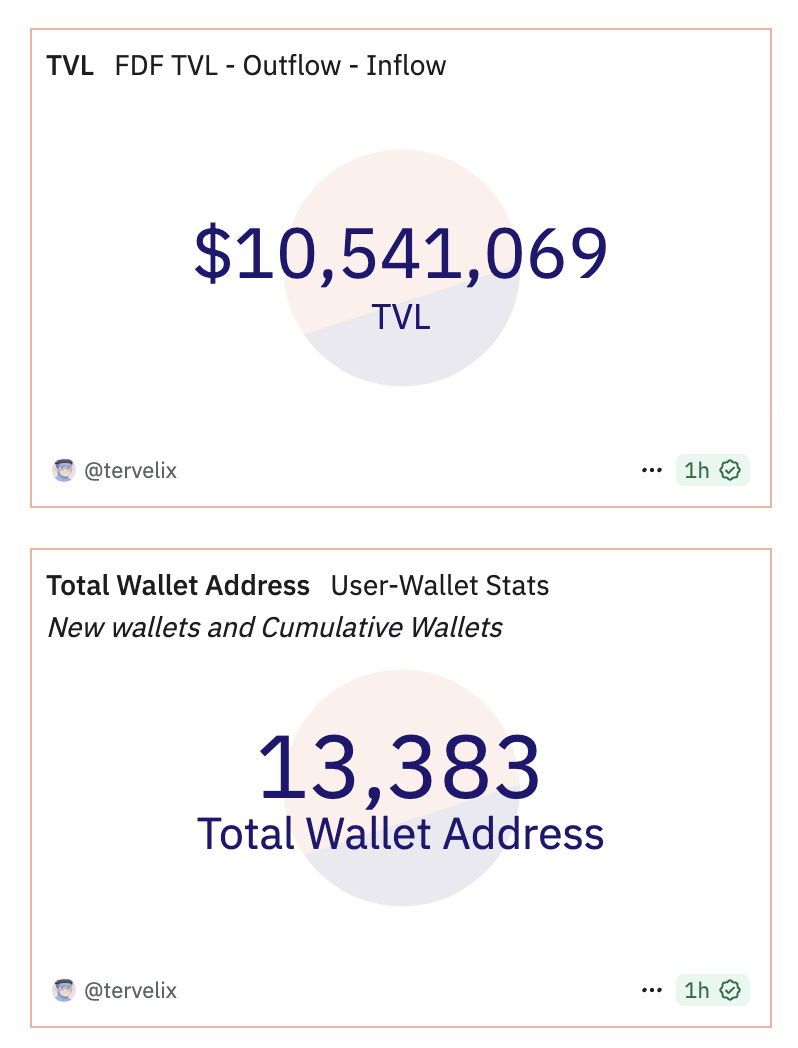

As of now, the project’s TVL has surpassed $10 million, with 13.3K unique wallet addresses and a cumulative trading volume nearing $39.69 million. Total platform fees have exceeded $2.65 million, and the single-day trading volume peaked at $14.85 million on August 24. Users purchase limited player shares using in-game currency "Gold" (anchored to USDC) and freely trade in the “Player Market.” All earnings are determined by dynamic market pricing. Although trading activity has cooled slightly in recent weeks, the project may still experience a resurgence as major tournaments like the UEFA Champions League, World Cup Qualifiers, and European Top 5 Leagues progress.

Football.Fun combines three key elements: "Fan Cards + Market Trading + Match-Based Rewards"

-

Users receive player shares via card packs and buy/sell using Gold. The platform charges a standard 5% transaction fee, which can go up to 25% during volatile periods.

-

While holding player shares, users receive point-based rewards based on real match performance.

-

The project raised $2 million in a seed round and partnered with renowned sports VC 6th Man Ventures for go-to-market initiatives.

This game mode bears strong resemblance to Friend.tech by encouraging players to identify high-potential athletes early and profit from both social sentiment and real-world data. The game is still in its early phases, with player shares being released in waves and a strong influence from short-term capital flow dynamics. Its blend of fan engagement and speculative investing is highly appealing, but future growth hinges on gameplay stickiness and sustained liquidity inflow.

While Football.Fun introduces a novel approach to Web3 prediction markets by combining sports × financialization × social speculation, several structural risks remain:

-

Lack of long-term value capture: There is currently no dividend or protocol revenue-sharing model. Token value depends entirely on market expectations and user growth.

-

Spiral model concerns: If new player issuance slows or fresh capital inflows decline, the prices of popular players may become overinflated, triggering market corrections.

-

Manipulation and asymmetric game dynamics: High-frequency trading and referral-based mechanisms may lead to whale-driven manipulation or Ponzi-like concerns, potentially eroding trust.

In summary, Football.Fun functions more like a short-term capital experimentation arena, prone to episodic hype around major sports events (e.g., World Cup, Derbies), rather than a sustainable, long-term Web3 sports-finance platform.

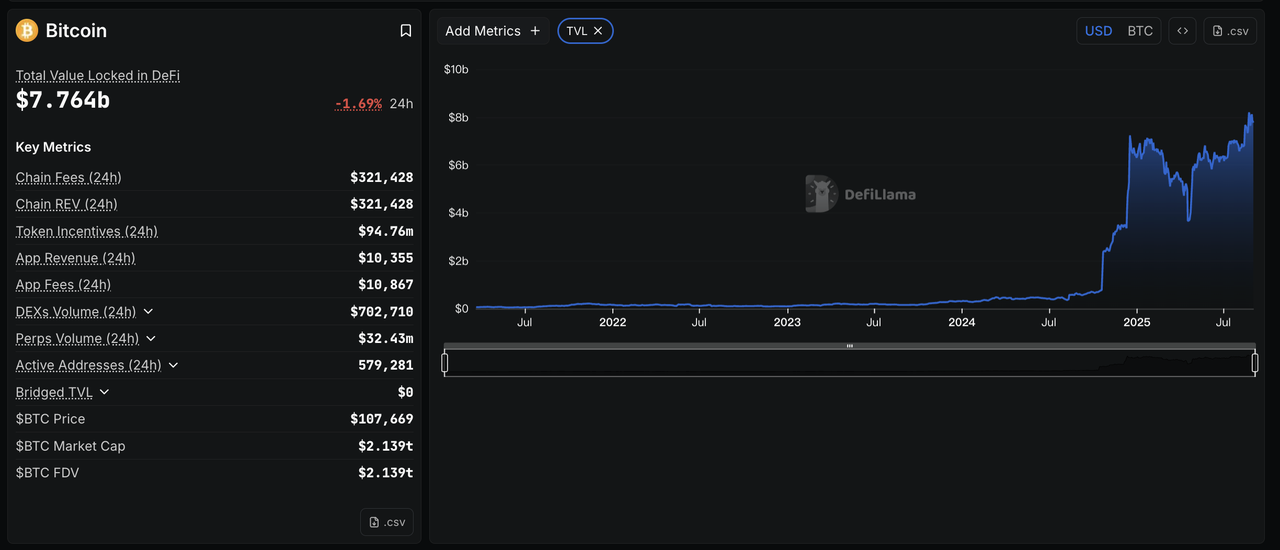

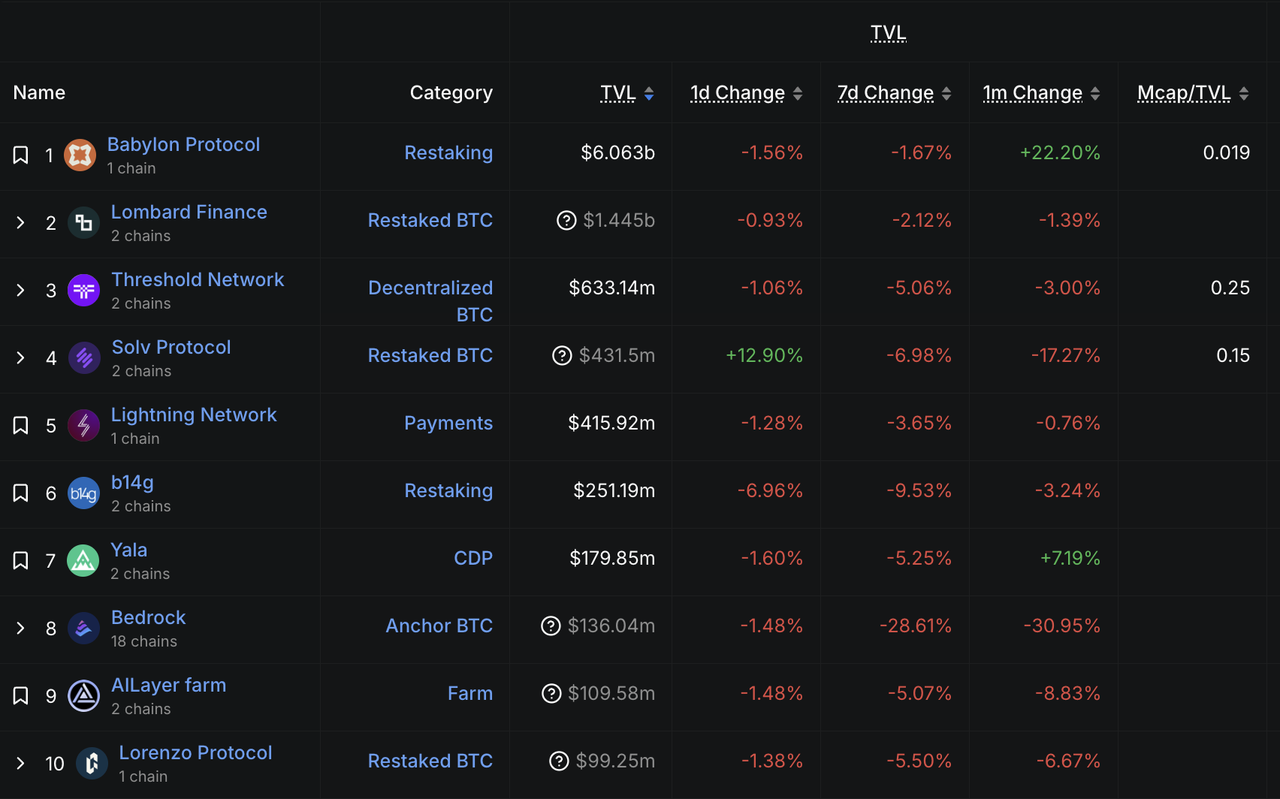

BTCFi Narrative Breakdown: From "TVL Wars" to Sustainable Pathways

Bitcoin Asia 2025 took place this week in Hong Kong, but the response to the BTCFi ecosystem was notably muted compared to the previous year. Despite drawing over 15,000 attendees, making it one of the largest Bitcoin-focused events in Asia, the overall industry tone has shifted from “tech hype” to “revenue and profitability execution.”

-

The number of exhibiting projects dropped sharply, and topics gradually shifted away from innovation narratives to more traditional metrics like financial returns and business models.

-

Most BTC ecosystem projects showed weak on-chain activity, and their tokens performed poorly. Even Bitlayer, a BTC L2 project with nearly $30M in funding, saw lackluster enthusiasm post-TGE.

-

BTCFi is increasingly seen as a “TVL vanity game”: whether it's BTC L2, Restaking, or Liquidity Staking, most activities now resemble yield-maximizing pools dominated by whales. The typical user behavior is deposit → withdraw → sell, failing to engage retail users or establish real-world utility for BTC-based DeFi.

Data Source: https://defillama.com/chain/bitcoin

These trends reflect both structural limitations in the ecosystem and the market’s reevaluation of BTCFi’s practical use cases. Bitcoin, with its time-tested role as “digital gold,” doesn’t necessarily need complex applications to justify its value. Traditional BTCFi use cases have struggled to drive sustained on-chain activity or real utility.

What deserves more attention now may be narratives that better align with Bitcoin’s core identity—such as integrations with Real World Assets (RWA) or financial primitives like equity-linked vaults or treasury-based mechanisms. These approaches could offer more sustainable value propositions and rebuild long-term ecosystem momentum, rather than relying on speculative inflows and inflated TVL metrics.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a top 5 crypto exchange globally. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.