BTC Price Prediction 2025–2030: Can Bitcoin Reach New Highs?

2025/11/28 09:57:02

As Bitcoin continues to shape the global crypto market, traders and long-term investors are increasingly searching for reliable btc price prediction 2025 insights. With rising institutional adoption, expanding ETF inflows, and a maturing digital asset ecosystem, Bitcoin’s long-term outlook remains one of the most discussed topics in the financial world.

Whether you’re actively trading Bitcoin or planning your first investment, understanding the potential price trajectory of BTC can help you make more informed decisions. In this comprehensive guide, we analyze market trends, on-chain data, macroeconomic factors, and historical performance to forecast Bitcoin’s potential price range from 2025 to 2030.

Before diving in, you can check Bitcoin’s real-time price on KuCoin here: 👉 BTC Live Price

BTC Price Prediction 2025: Key Factors to Watch

When estimating a realistic btc price prediction 2025, several catalysts stand out:

Bitcoin Halving Impact

The 2024 Bitcoin halving reduced block rewards from 6.25 BTC to 3.125 BTC, historically triggering major bull markets 12–18 months later. If past cycles repeat, BTC may enter its strongest growth phase in mid-2025.

Institutional Capital & Spot ETFs

Since 2024, Bitcoin ETFs have attracted tens of billions in inflows. This new layer of demand could push prices toward new all-time highs.

Macro Environment

Lower inflation, interest rate cuts, and increasing global liquidity could create ideal conditions for crypto risk assets.

Growing Global Adoption

Emerging markets continue using Bitcoin as a hedge against currency devaluation and capital restrictions, boosting long-term demand.

Exchange Liquidity & Supply Shock

Long-term holders currently control over 70% of all circulating BTC. Reduced exchange supply increases upside volatility during bullish periods.

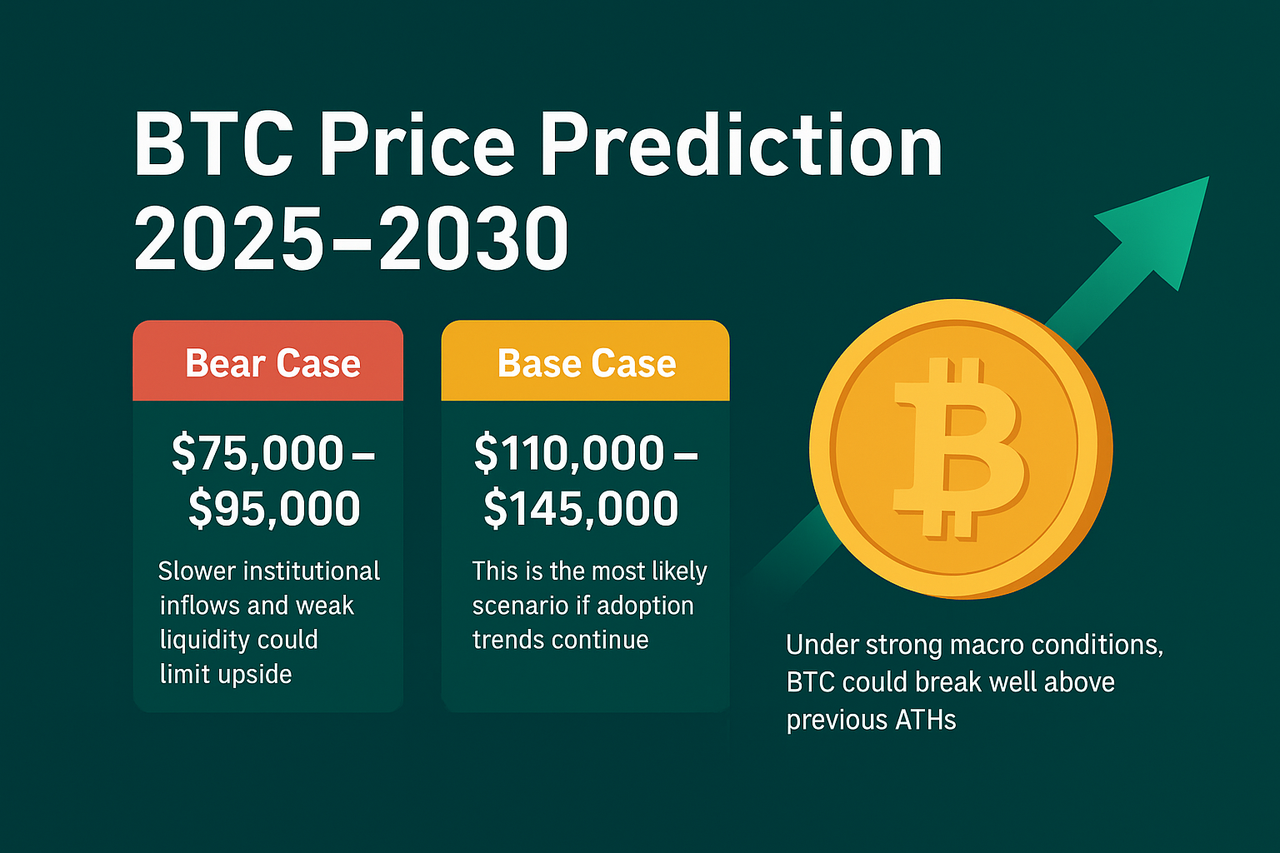

BTC Price Prediction 2025: Expected Range

Based on technical patterns, historical post-halving performance, and macroeconomic forecasts, our btc price prediction 2025 estimates the following potential ranges:

Bear Case (Global Recession)

$75,000 – $95,000 Slower institutional inflows and weak liquidity could limit upside.

Base Case (Steady Growth)

$110,000 – $145,000 This is the most likely scenario if adoption trends continue.

Bull Case (Excessive ETF Demand + Strong Liquidity)

$160,000 – $210,000 Under strong macro conditions, BTC could break well above previous ATHs.

If you want to trade Bitcoin as market conditions evolve, you can do so on KuCoin: 👉 Trade BTC/USDT: https://www.kucoin.com/trade/BTC-USDT

BTC Price Prediction 2026–2030

BTC Price Prediction 2026

Expected Range: $95,000 – $170,000 A post-bull market correction is common historically, though institutional demand may soften the decline.

BTC Price Prediction 2027

Expected Range: $120,000 – $185,000 Sideways accumulation and preparation for the next halving cycle.

BTC Price Prediction 2028

Expected Range: $140,000 – $240,000 Driven by the 2028 halving and increasing scarcity.

BTC Price Prediction 2029

Expected Range: $180,000 – $300,000 A potential new macro bull market peak if cycle timing aligns.

BTC Price Prediction 2030

Expected Range: $220,000 – $350,000+ With accelerating global digital asset adoption, BTC could achieve widespread recognition as digital gold.

You can explore Bitcoin spot market charts here: 👉 KuCoin Spot Market (BTC): https://www.kucoin.com/markets/spot/BTC

Technical Analysis: Is Bitcoin Positioned for Growth?

A technical look at BTC charts reveals:

Long-Term Uptrend

Bitcoin remains within a multi-year ascending channel. Higher lows continue forming even during bear markets.

RSI Indicates Accumulation Zones

Post-halving periods often show mid-range RSI levels—typically a strong continuation signal.

Moving Averages Support Momentum

If BTC holds above the 200-day moving average, upside continuation into 2025 is statistically favored.

On-Chain Strength

Metrics such as MVRV, Net Unrealized Profit/Loss (NUPL), and long-term holder supply remain bullish for the coming cycle.

How to Buy Bitcoin Before the Next Price Move

If you’re planning to invest in BTC ahead of potential 2025 growth, KuCoin offers multiple beginner-friendly options including credit card purchases, P2P trading, and bank transfers.

👉 How to Buy Bitcoin: https://www.kucoin.com/how-to-buy/bitcoin

Will BTC Reach $200,000 in 2025?

A question closely related to any btc price prediction 2025 analysis is whether Bitcoin can reach $200K by the next bull cycle. While this represents the upper end of our projection, it becomes possible under conditions such as:

-

Strong ETF inflows

-

Post-halving supply shock

-

Weakening USD

-

Global liquidity expansion

-

Regulatory clarity in major markets

While no prediction can be guaranteed, the combination of scarcity, adoption, and institutional demand puts BTC in a historically strong position.

Final Thoughts: Is Bitcoin a Good Investment for 2025?

Our overall btc price prediction 2025 outlook remains bullish. With halving effects, growing adoption, and global interest from institutions, Bitcoin is well-positioned for potential new highs between $110,000 and $145,000 under typical market conditions.

As always, investors should consider risk tolerance and market volatility. Bitcoin remains one of the most asymmetric opportunities in modern finance—but also one of the most volatile.

If you want to monitor BTC closely or trade as the market evolves, KuCoin offers real-time price charts and deep liquidity for BTC/USDT.

👉 Check Real-Time BTC Price on KuCoin: https://www.kucoin.com/price/BTC 👉 Trade BTC Spot on KuCoin: https://www.kucoin.com/trade/BTC-USDT

FAQ Section

What is the BTC price prediction for 2025?

Most analysts expect Bitcoin to trade between $110,000 and $145,000 in 2025 under a normal market scenario, with higher potential if institutional inflows accelerate after the 2024 halving.

Can Bitcoin reach $200,000 by 2025?

Yes, Bitcoin reaching $200,000 in 2025 is possible in a bullish scenario driven by ETF demand, strong global liquidity, and reduced post-halving supply. It represents the upper end of most price forecasts.

What affects Bitcoin’s price between 2025 and 2030?

BTC’s price will be influenced by halving effects, macroeconomic conditions, institutional adoption, global regulations, and long-term investor accumulation patterns.

Is Bitcoin a good long-term investment?

Bitcoin is widely considered a strong long-term asset due to its fixed supply, increasing institutional adoption, and role as digital gold. However, BTC remains volatile, so investors should assess risk tolerance.

Where can I check the real-time BTC price?

You can track real-time Bitcoin price charts and market data on KuCoin: 👉 https://www.kucoin.com/price/BTC

How can I buy Bitcoin before 2025?

KuCoin offers multiple BTC purchase options including credit card purchases, P2P trading, and spot trading. 👉 https://www.kucoin.com/how-to-buy/bitcoin