BTC a Dolar: Real-Time Bitcoin to USD Price & 2025 Market Outlook

2025/11/18 10:57:01

As Bitcoin continues gaining global adoption, the term “BTC a dolar” has become one of the most searched queries among traders wanting to track the Bitcoin-to-USD exchange rate. Whether you’re a beginner or a professional trader, understanding BTC/USD is essential for evaluating Bitcoin’s value, forecasting market movements, and making informed trading decisions.

This guide breaks down what BTC a dolar means, why it matters in 2025, how to check the price in real time, and how to trade Bitcoin against the U.S. dollar securely.

What Does “BTC a Dolar” Mean?

The phrase “BTC a dolar” translates directly to “Bitcoin to dollar”, referring to the exchange rate between 1 BTC and the U.S. dollar (USD).

Why People Search for BTC a Dolar

Users search this term because:

-

BTC/USD is the most liquid pair in the market

-

It serves as Bitcoin’s global benchmark

-

It helps traders compare Bitcoin’s real-world value

-

Many regions prefer “dolar” over “dollar” in local languages

How BTC to Dollar Became a Global Benchmark

The BTC/USD pair is the foundation of the crypto economy. It reflects:

-

Market demand

-

Liquidity

-

Trading activity

-

Institutional interest

Today, 85%+ of Bitcoin trading volume is priced in dollars, making BTC a dolar a universal indicator of Bitcoin’s health.

Why the BTC to USD Exchange Rate Matters in 2025

2025 is a pivotal year for Bitcoin. Multiple factors significantly influence the btc a dolar trend.

U.S. Monetary Policy & BTC Price

When the U.S. Federal Reserve:

-

Cuts interest rates → BTC/USD rises

-

Tightens monetary policy → BTC/USD weakens

Dollar strength directly shapes Bitcoin performance.

Bitcoin Halving Impact on BTC a Dolar

The 2024 Bitcoin halving reduced block rewards to 3.125 BTC, historically leading to:

-

Lower sell pressure from miners

-

Higher price appreciation

-

Stronger BTC/USD growth within 12–18 months

Institutional Adoption & ETF Demand

Spot Bitcoin ETFs have become key BTC/USD drivers, with billions in daily flows.

Inflation and Global Dollar Weakness

As more investors hedge against inflation, Bitcoin becomes a stronger store of value, boosting btc a dolar deman.

How to Check BTC a Dolar in Real Time

For the most accurate and liquid Bitcoin pricing, you can use KuCoin’s live price chart:

👉 Live BTC Price Page: https://www.kucoin.com/price/BTC

Live Bitcoin Price Charts

Real-time BTC/USD charts allow you to monitor:

-

Price movements

-

Market trends

-

Volume spikes

-

Volatility cycles

Technical Indicators Traders Use

Most BTC a dolar traders rely on:

-

Moving Averages (MA/EMA)

-

RSI

-

MACD

-

VWAP

-

Fibonacci levels

Best Platforms for Tracking BTC/USD

KuCoin provides:

-

Deep liquidity

-

Accurate real-time pricing

-

Beginner-friendly interface

-

Professional-grade charting tools

BTC a Dolar — Historical Trends and 2025 Price Forecast

Bitcoin’s Long-Term Growth Against the Dollar

Over the last decade:

-

Bitcoin rose from under $500 to over $70,000

-

BTC/USD outperformed every major asset class

-

Each halving cycle drove exponential price growth

Bullish Outlook for BTC in USD

Analysts project BTC to reach:

-

$100,000–$120,000 in a moderate bull market

-

$150,000+ if ETF inflows accelerate

-

$200,000 in the strongest adoption scenario

Neutral & Bearish Scenarios

Sideways or declining BTC a dolar trends may occur if:

-

Interest rates rise

-

Regulations tighten

-

Liquidity contracts

Key Market Signals to Watch

Important indicators include:

-

Miner outflows

-

ETF net flows

-

On-chain accumulation

-

Exchange reserves

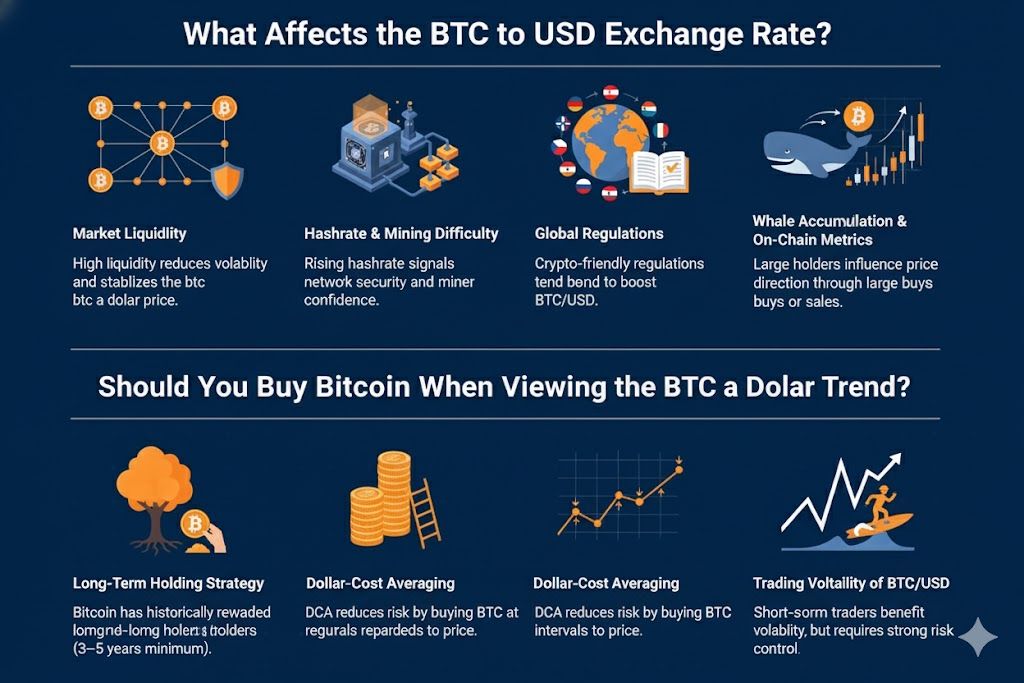

What Affects the BTC to USD Exchange Rate?

Market Liquidity

High liquidity reduces volatility and stabilizes the btc a dolar price.

Hashrate & Mining Difficulty

Rising hashrate signals strong network security and miner confidence.

Global Regulations

Crypto-friendly regulations tend to boost BTC/USD.

Whale Accumulation & On-Chain Metrics

Large holders influence price direction through large buys or sales.

Should You Buy Bitcoin When Viewing the BTC a Dolar Trend?

Long-Term Holding Strategy

Bitcoin has historically rewarded long-term holders (3–5 years minimum).

Dollar-Cost Averaging

DCA reduces risk by buying BTC at regular intervals regardless of price.

Trading Volatility of BTC/USD

Short-term traders benefit from volatility, but it requires strong risk control.

How to Convert BTC to USD on KuCoin

The fastest way to trade Bitcoin against the dollar is through USDT stablecoin pairs.

👉 Trade BTC/USDT Here: https://www.kucoin.com/trade/BTC-USDT

Simple Steps to Trade BTC/USDT

Create or log in to KuCoin

Deposit crypto or buy with a card

Open the BTC/USDT trading pair

Place a market or limit order

Convert BTC to USD-equivalent instantly

Fees, Liquidity, and Convenience

KuCoin offers some of the lowest fees and deepest liquidity for BTC a dolar traders.

Why KuCoin Is Ideal for BTC a Dolar Users

-

Fast execution

-

Deep order book

-

Low fees for active traders

-

Advanced tools for analysis

Final Thoughts on BTC a Dolar Future

In 2025, Bitcoin’s role in the global financial landscape continues to expand. The btc a dolar exchange rate remains critical for traders, institutions, and everyday users evaluating Bitcoin’s real value.

With rising adoption, maturing regulations, and decreasing supply post-halving, Bitcoin remains one of the strongest assets to watch against the U.S. dollar.

FAQ About BTC a Dolar

Is BTC a dolar the same as BTC to USD?

Yes—it's simply the price of Bitcoin measured in U.S. dollars.

Why does the BTC/USD price fluctuate so much?

Because Bitcoin trades 24/7 and reacts quickly to supply, demand, macro events, and liquidity.

Where can I check BTC a dolar instantly?

KuCoin’s real-time price page provides instant BTC/USD data.

Can Bitcoin reach 100,000 USD?

Many analysts believe BTC could surpass $100k in the 2025 cycle due to ETF flows and reduced supply.