What are limit orders and market orders?

1. Limit Order:

A limit order is an order to buy or sell an asset at a specific price or better.

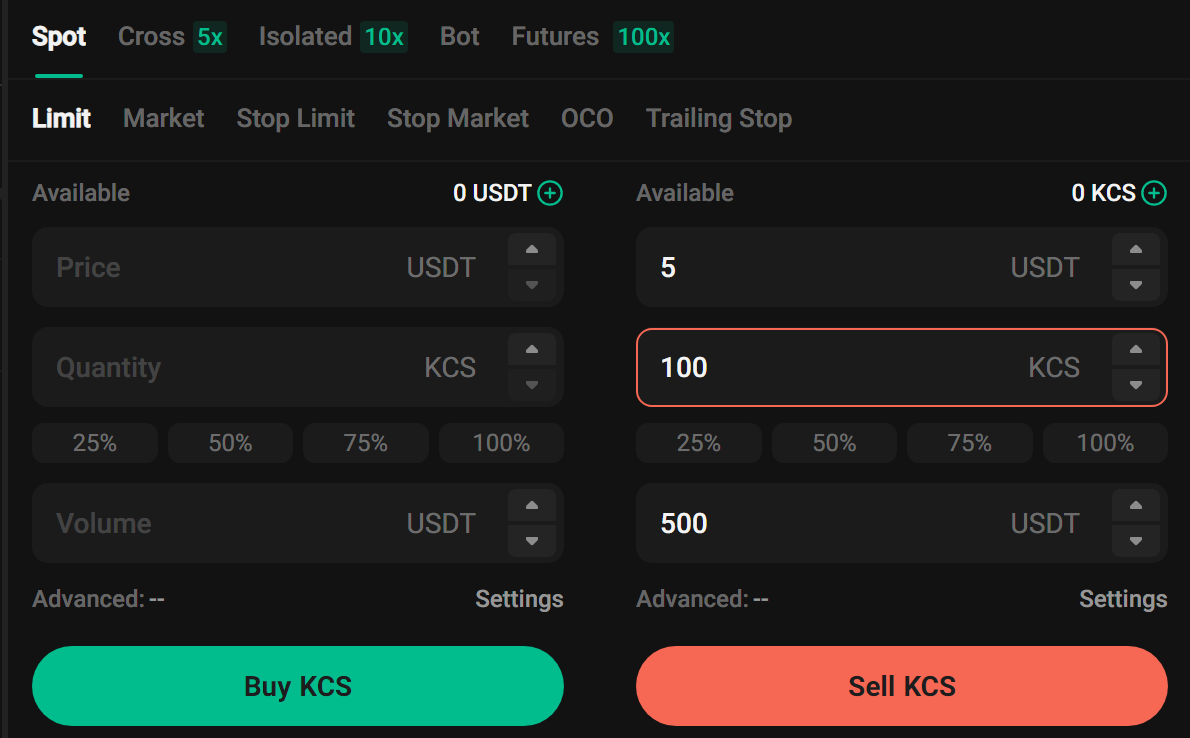

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4.1 USDT, and you wish to sell 100 KCS at a price of 5 USDT each. To do this, you can place a limit order.

To place such a limit order, you would select Limit, set Price to 5 USDT, set Quantity to 100 KCS, and click Sell KCS to confirm the order.

2. Market Order:

A market order is an order that buys or sells an asset at the best available price on the market.

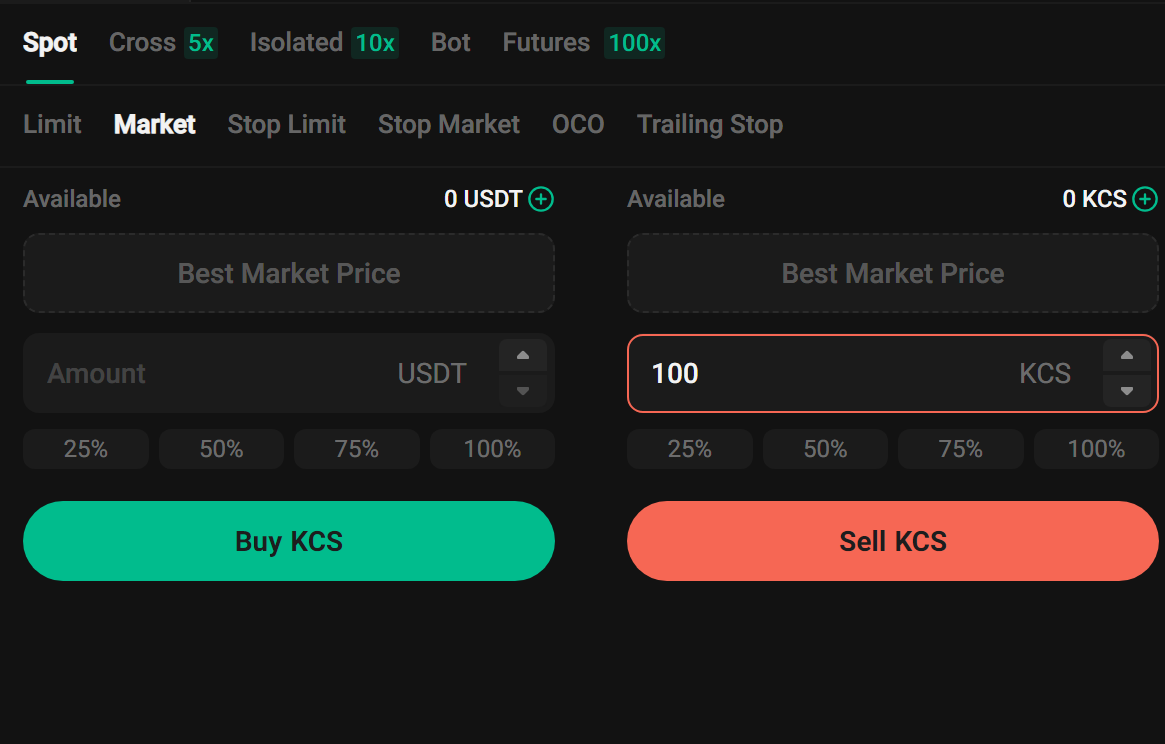

Take the KCS/USDT trading pair for example. Assuming the current price of KCS is 4.1 USDT, and you wish to quickly sell 100 KCS. To do this, you can use a market order. When you issue a market order, the system matches your sell order with the existing buy orders on the market, ensuring a swift execution of your order. Market orders are the best way to quickly buy or sell assets.

To place such a market order, you would select Market, set Quantity to 100 KCS, and click Sell KCS to confirm the order.

Please note: Since market orders are immediately filled, they cannot be canceled. You can review order and transaction details in your Order History and Trade History. Market orders are matched with the best available maker order price in the market at the time and may be influenced by market depth. As such, please be mindful of market depth when placing market orders.