What Is DualFutures AI Bot and How Does It Work

Part 1 - What is KuCoin DualFutures AI Trading Bot?

1. What is DualFutures AI?

The DualFutures AI is a high-frequency contract trading strategy capable of adapting to fluctuating market conditions. Using strategy signals, it can stay in tune with market trends and swiftly react to trend reversals, thereby facilitating precise and flexible automated trading.

2. Applicable Market Conditions for DualFutures AI

The DualFutures AI strategy is very suitable for handling rebound and pullback market conditions. This strategy can not only trade along with market trends but also quickly adjust the trading strategy when the market trend reverses, achieving precise and flexible automatic trading.

In general, this strategy can take advantage of two main market conditions: one is the trending market, where it trades along with the trend; the other is the volatile market, where it quickly responds to trend reversals to seize trading opportunities.

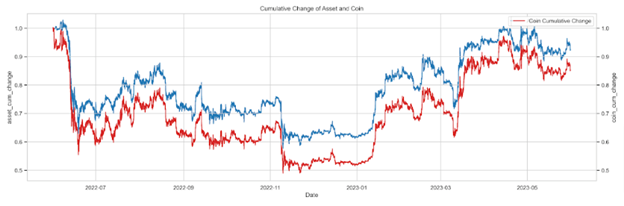

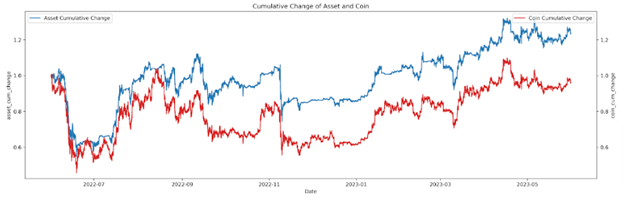

3. Backtesting Data and Results

We have conducted extensive backtesting on the DualFutures AI strategy. In the past year's downward, volatile, and upward market conditions, both BTC and ETH performed better with the AI Win Two Way strategy than with spot holding.

Compared to spot holding, the DualFutures AI strategy is more adaptable to market fluctuations, and therefore, it can achieve better returns in most situations.

4. Three Major Advantages of DualFutures AI

The DualFutures AI strategy has three major advantages:

Adaptability: The DualFutures AI strategy can automatically determine trading strategies based on the market volume and signals, such as long and short-term support and resistance. Therefore, when market conditions change, it can quickly adapt and adjust the strategy to maximize profits.

Profitability in Both Directions: The DualFutures AI strategy can profit not only when the market is rising but also when it is falling. This ability to profit in both directions allows the strategy to achieve stable returns under any market conditions.

Risk Management: The DualFutures AI strategy automatically sets take-profit and stop-loss orders to manage risk.

5. The DualFutures AI Strategy Solves Two Pain Points for Users

As traders, we often face two problems:

Most traders usually cannot accurately predict market trends. When you predict that the market will rise, you leverage and go all-in on contracts, only to get trapped as soon as you enter the market. You can't bear to close positions and stop losses, resulting in a blown account and losing all your principal.

Most traders also cannot avoid emotional trading. When you see the coin price continuously rising, you can't help but enter the market, only to see it suddenly fall. You don't know when the fall will stop, and in a panic, you sell your coins, only to find that the market suddenly reverses and rises, and you miss out on huge profits.

The DualFutures AI strategy can help you avoid these two problems, as the strategy doesn't pick market conditions and will strictly execute trading strategies whether the market is rising or falling. When the rising trend tops out and there are signs of a pullback, the robot will open short positions to earn short-selling profits. Conversely, when the falling trend bottoms out and there are signs of a rebound, the robot will open long positions to earn long-buying profits. It executes trades precisely 24/7, freeing up a lot of time. Relying on strict take-profit and stop-loss strategies, it helps you avoid the risk of a blown account to the greatest extent.

Part 2 - How To Create Your First DualFutures AI Bot?

1 How To Start DualFutures AI Bot?

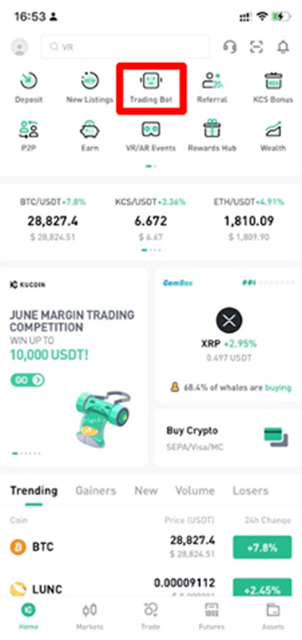

It's very simple to start the DualFutures AI strategy on KuCoin.

1. Open the KuCoin app and look for the "Trading Bot" on the homepage.

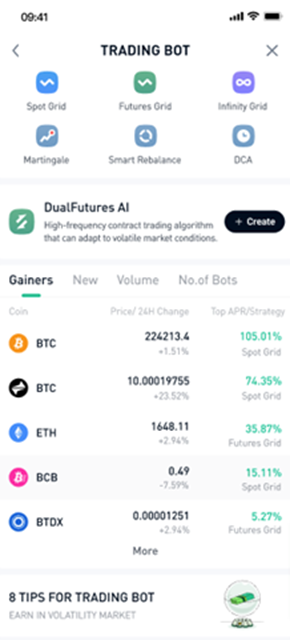

2. Find and choose the DualFutures AI strategy.

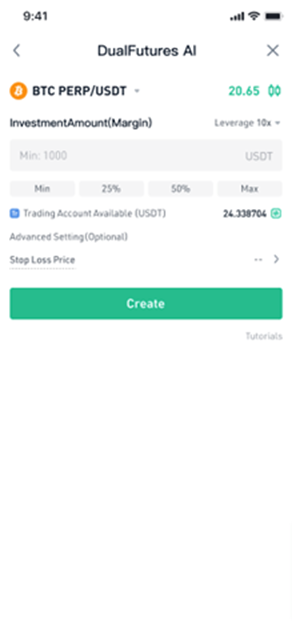

3. There, in the trading interface, you can choose the “DualFutures AI” strategy, and set your trading parameters, leverage, capital ratio, stop loss.

4. Finally, click the "Start Trading" button, and the DualFutures AI strategy will start running automatically.

Part 3 - Key To Maximizing Your DualFutures AI Bot Profits

1. Does the DualFutures AI strategy require me to continuously monitor the market?

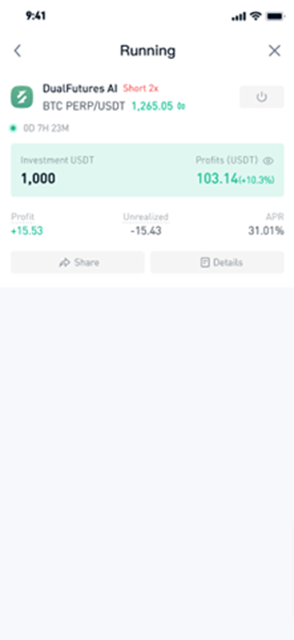

No, the DualFutures AI strategy does not require continuous monitoring of the market. The purpose of the strategy's design is to automate the trading process.

It will automatically determine based on market fluctuations, open and close positions, and trade automatically according to the strategy.

Therefore, once you have set the parameters and activated the strategy, it will run automatically, without the need for you to continuously monitor the market.

2. What trading parameters can I set for the DualFutures AI strategy?

The parameters you can set include:

2.1. Opening ratio: This is the proportion of funds for the currently opened order.

2.2. Leverage multiplier: The multiplier of the opening leverage.

2.3. Stop-loss percentage: The percentage of automatic position closing when the loss reaches a certain ratio.

3. Will the DualFutures AI strategy generate large losses and liquidation?

Risk and capital management are key factors in the DualFutures AI strategy.

If you do not have a proper risk management mechanism, and the market experiences severe fluctuations or continuous one-sided trends, then there is a possibility of liquidation. Liquidation usually refers to the loss of a position exceeding the risk level that the account can bear, leading to the exhaustion of account funds.

To avoid the risk of liquidation and all funds being lost, the following suggestions are provided:

Set reasonable stop-loss levels: You should ensure that you have stop-loss measures in place. The stop-loss level depends on your risk tolerance and the amount of capital you are prepared to lose.

Diversify your portfolio: Avoid investing all your capital in one strategy. Diversification can help to reduce risk and potential losses.

Keep an eye on the market: Market conditions can change rapidly, so it's important to stay informed and adjust your strategy accordingly.

Regularly review and adjust your strategy: As market conditions change, so too should your strategy. Regular reviews will help ensure your strategy stays effective.

Remember, while DualFutures AI can help automate your trading, it's still essential to maintain an active role in managing your investments and understanding the risks involved.

4. How to view strategy floating loss?

When the dual-direction strategy temporarily suffers a loss, it is necessary to evaluate the strategy from the standpoint of long-term performance. Here's how to view the situation of temporary strategy loss:

Comprehensive evaluation: Consider the overall effect of the strategy, including long-term returns, risk control, and stability. A single temporary loss does not mean that the strategy is unworkable or failed.

Long-term observation: Holding a sufficiently long observation period allows the strategy to show stable performance amid market fluctuations. A single loss does not represent the overall effect, and you need to conduct multiple backtests and live verification yourself.

In summary, temporary loss is an unavoidable part of trading. The key is to comprehensively evaluate the long-term performance of the strategy and take corresponding risk management and optimization measures to achieve stable and sustainable profits.

In summary, the DualFutures AI strategy is a powerful trading strategy that can automatically adjust according to the market, thereby achieving relatively stable returns under all market conditions. As a KuCoin user, we highly recommend you to try this strategy.

Bottom Line

So what are you waiting for? Download the KuCoin app, create a DualFutures AI bot, and be a part of 347,000 KuCoin DualFutures AI bot users worldwide.

We hope you found this guide helpful and informative.