What Is Spot Martingale Bot and How Does It Work

The Spot Martingale Strategy reduces average position costs through continual position increases, which is somewhat similar to the DCA (Dollar Cost Averaging) method. However, while DCA increases positions periodically in fixed amounts and in fixed time intervals, the Spot Martingale Strategy increases positions when prices fall. When prices rise to desired levels, the Spot Martingale Strategy will sell the entire position.

Part 1 - What is KuCoin Spot Martingale Strategy?

1. What is KuCoin Spot Martingale Strategy?

Initially developed by Mr. and Mrs. Martingale in a casino, the Spot Martingale Strategy originated as a gambling strategy:

Assuming that the probability of winning a gambling round is 50%, by doubling the wager after each loss, the gambler would recover all previous losses and win a profit equal to the initial stake when a win occurs.

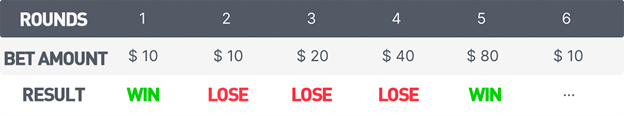

For example:

If I were to bet 10 dollars in the first round and lose, then I would bet 20 dollars in the second round. If I win the second round, I would recover the 10 dollars I lost in the first round plus win a profit equal to the initial 10 dollars that I wagered in the first round. However, if I were to lose the second round, I would bet 40 dollars in the third round ... and so on and so forth. As long as I win once in the end, I would not only recover all losses, but also win a profit of 10 dollars. After making a profit, the same process can be repeated.

2. How does the Spot Martingale Strategy work?

Investing is different from gambling. When gambling, if you lose, you lose the entire wager. But in the investment market, declines occur slowly and in percentages. Therefore, you can choose to increase your positions whenever prices fall by certain percentages. You can also choose to take profit whenever a certain amount of profit is made.

For example:

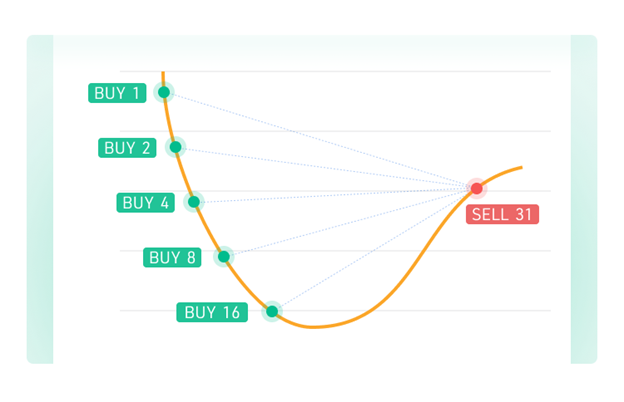

If I were to set the bot to increase my position whenever the cryptocurrency price drops by 1%, to increase my position 4 times, and to take profit at a profit rate of 2%, then my investment amount would be divided into 31 shares, with 1 share being initially invested. If the cryptocurrency price were to fall by 1%, another 2 shares would be used to increase my position. If the price were to fall by another 1%, then another 4 shares would be used to further increase my position. Using this mechanism, the next position increase would use 8 shares. When the cryptocurrency price drops by 4%, 16 shares would be used to increase my position. This amounts to a total of 31 shares. During this process, whenever a profit of 2% is reached, regardless of whether all of the funds have been put in yet, the bot will execute a take profit and then initiate a new round of buying and selling.

3. Advantages of the Spot Martingale Strategy

- Reduction of average position costs through continual increasing of positions.

The Spot Martingale Strategy reduces average position costs through continually increasing positions and sells the entire position when the price rises to a desired level.

4. Limitations of the Spot Martingale Strategy

- Select mainstream cryptocurrencies with good liquidity whose prices are trending upward with a lot of ups and downs.

If you choose a cryptocurrency that continually declines with only very weak rebounds, you may end up using up all of the funds allocated for position increases without ever reaching a take profit situation, in which case you may get stuck for prolonged periods of time.

- Kind in mind that in reality, nobody has unlimited capital. It is therefore important to set the proper percentages for increasing positions as well as a suitable number of position increases.

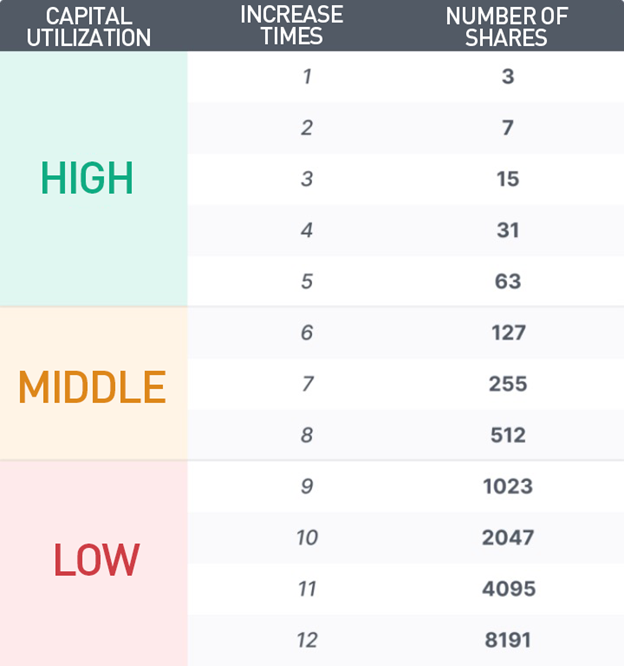

The Spot Martingale Strategy splits your capital into multiple shares, allowing you to increase your position at different points in time. The following table shows the number of total shares for various position increase settings when the position increase multiple is 2. This ultimately affects your capital utilization efficiency.

Part 2 - How To Create Your First Spot Martingale Strategy Bot?

Steps:

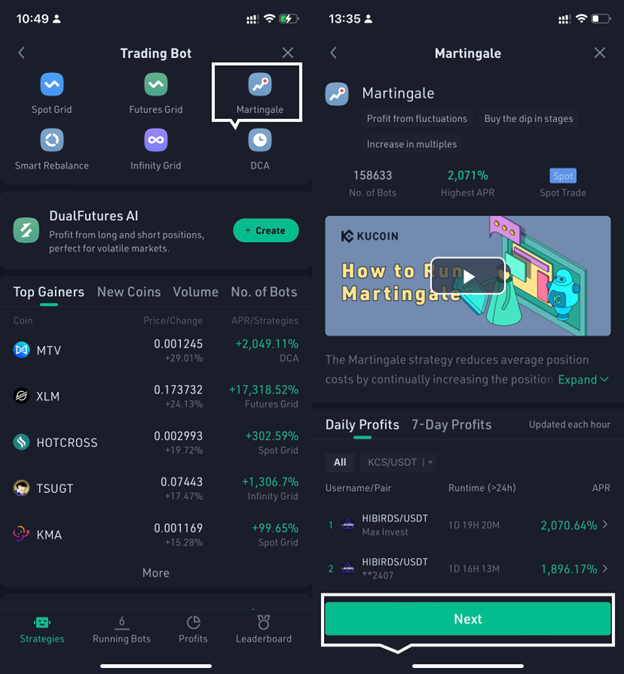

Step 1: Create a Spot Martingale bot. In the trading bot menu, select and create a Spot Martingale bot.

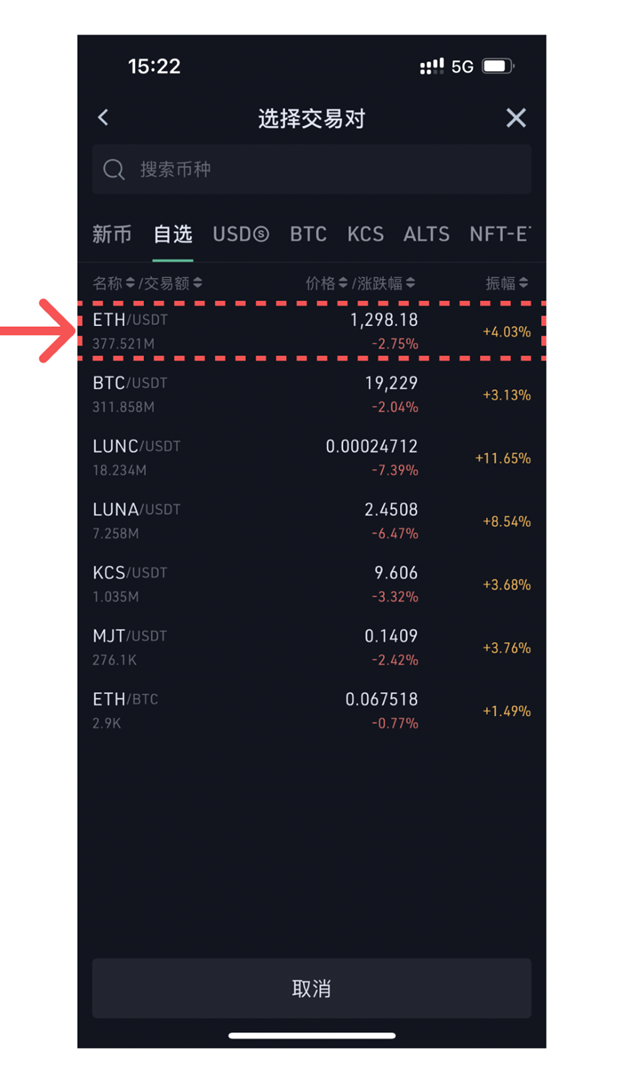

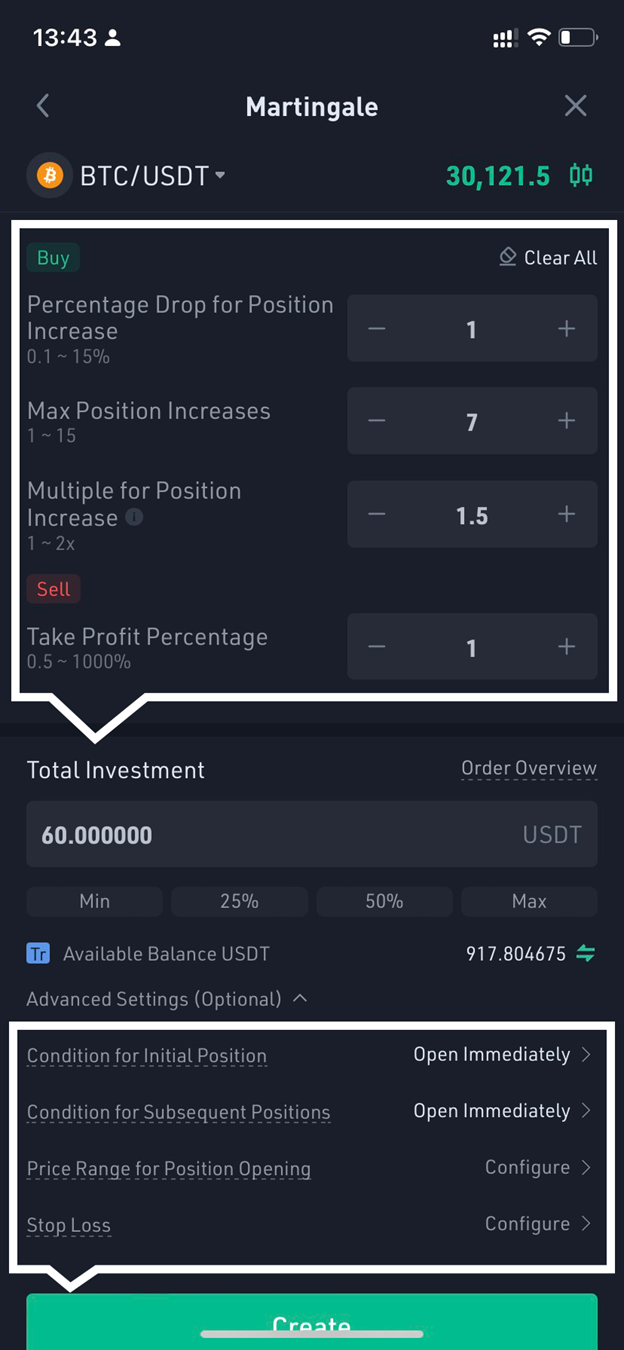

Step 2: Select a trading pair. We recommend selecting a mainstream cryptocurrency with good liquidity whose price is trending upward with a lot of ups and downs.

Step 3: Enter the investment amount and create the bot. You also have the option of adjusting parameters such as price drop for position increases, maximum number of position increases, etc.

Step 4: Enjoy the profits the Spot Martingale bot makes for you.

Part 3 - Key To Maximizing Your Spot Martingale Bot Profits

1.What are the advantages of Spot Martingale and Grid Trading?

The biggest difference between a Spot Martingale strategy bot and a grid trading bot is that the Spot Martingale bot buys in batches and sells all at once, while the grid trading bot buys and sells in batches. Since Spot Martingale buys more quantities during the downturn, the assets held at the first opening are less, whereas grid trading, according to user-set parameters, holds more assets at opening, usually about half of the initial investment. Therefore, when the market goes up, grid trading will gain more trend benefits than Spot Martingale. But if the market goes down, grid trading will also have a larger retracement.

2.When is it suitable to activate the Spot Martingale Strategy Bot?

For arbitrage in oscillating markets, the Spot Martingale strategy yields higher returns with lower risks. In trend markets, Spot Martingale's profits are less than grid trading.

3.How should we choose the multiplier for Spot Martingale investments?

The higher the multiplier chosen, the faster the payback, and the smaller the retracement coverage. The lower the multiplier, the slower the payback, and the larger the retracement coverage.

4.How can the Spot Martingale Strategy be applied in trading?

First, one should choose quality assets. As long as the asset fluctuates and does not keep falling to zero, the Spot Martingale strategy bot can profit. Secondly, the requirement for timing is much lower. In most cases, as long as the market doesn't continue to fall after the Spot Martingale strategy bot is activated, it's highly likely to profit. Based on these two points, it's recommended that users choose mainstream assets and activate the Spot Martingale strategy bot when the asset is not at a high point. This can earn fluctuation profits and reduce volatility to some extent, balancing the risk of falling and reducing capital retracement.

Bottom Line

So what are you waiting for? Download the KuCoin app, create a Spot Martingale bot, and be a part of 377,000 KuCoin Spot Martingale bot users worldwide.

We hope you found this guide helpful and informative.