Original Author: Frank, PANews

Previously, PANews on prediction marketsStrategyExtensive research has been conducted, and one significant finding is that for many arbitrage strategies, the biggest obstacle to their success may not be the mathematical formulas of the strategies themselves, but rather the predictability of market liquidity depth.

Recently, after Polymarket announced the launch of a U.S. real estate prediction market, this phenomenon became even more apparent. After the launch, the daily trading volume of this market series remained at only hundreds of dollars, nowhere near the anticipated level of activity. The actual market interest was far less than the buzz generated on social media. This situation seems both amusing and paradoxical, suggesting that we may need to conduct a comprehensive investigation into the liquidity of prediction markets in order to uncover some key truths about liquidity in these markets.

PANews retrieved historical data from 295,000 markets on Polymarket to date and has drawn the following conclusions.

1. Short-term Market: A PVP Battlefield Comparable to MEME Coins

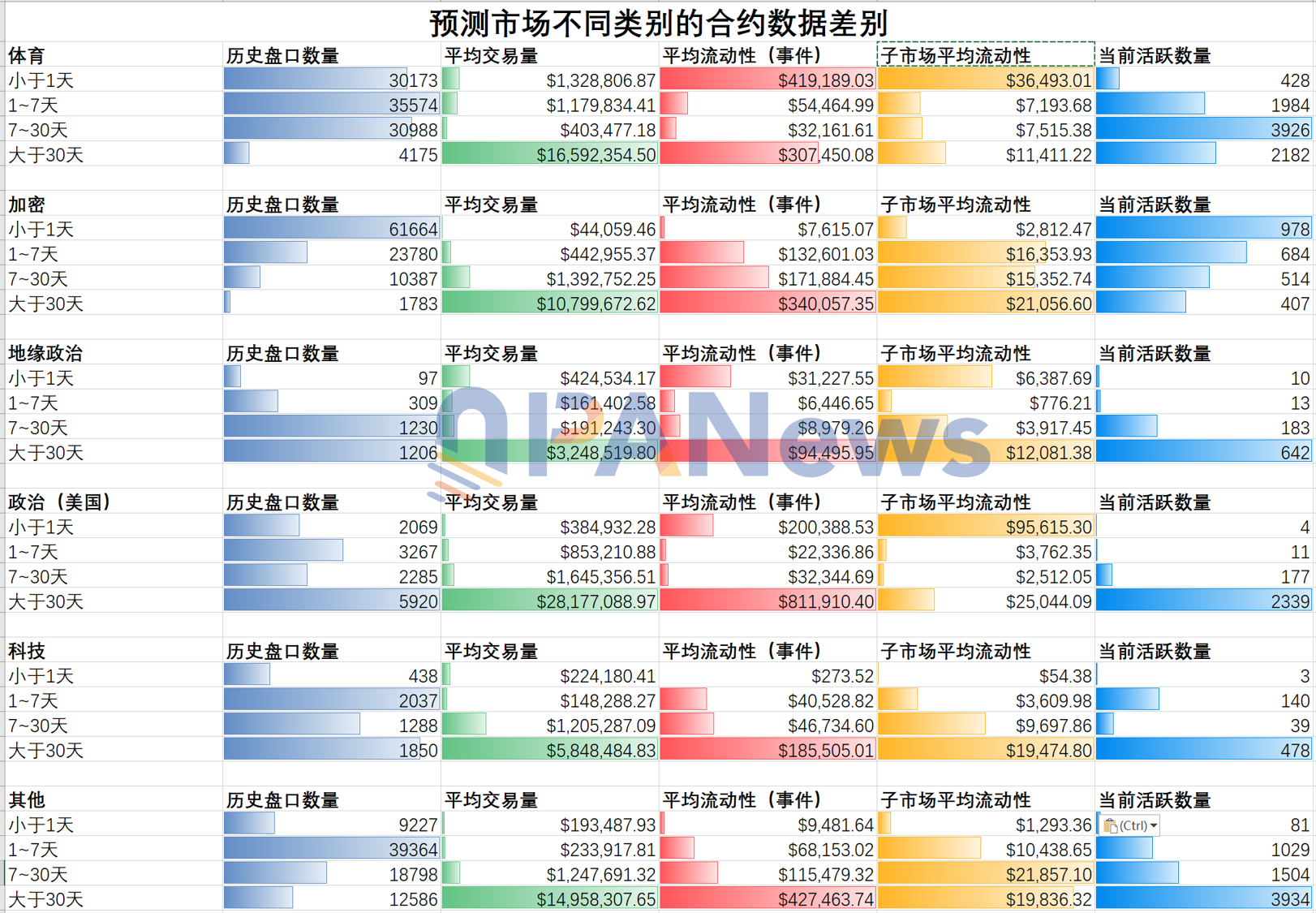

Among 295,000 markets, 67,700 have a cycle shorter than 1 day, accounting for 22.9%. Additionally, 198,000 have a cycle shorter than 7 days, representing 67.7%.

Among these ultra-short-term prediction events, 21,848 are currently active markets, of which 13,800 have zero trading volume within 24 hours, accounting for approximately 63.16%. In other words, there are a large number of short-term markets on Polymarket that are currently illiquid.

Does this situation seem familiar to you?

At the height of the MEME coin frenzy, tens of thousands of MEME coins were also issued on the Solana blockchain. However, the vast majority of these tokens remained ignored or failed within a short period.

Currently, this phenomenon is also observed in prediction markets, but unlike MEME coins, the event lifecycle in prediction markets is fixed, whereas the lifecycle of MEME coins is uncertain.

In terms of liquidity, more than half of these short-term events have liquidity of less than $100.

In terms of categories, these short-term markets are almost entirely divided between sports and cryptocurrency price predictions. The main reason is that the judgment mechanisms for these events are relatively simple and mature, typically involving issues such as whether a certain token rises or falls within 15 minutes or whether a specific team wins. However, perhaps due to significantly worse liquidity compared to crypto derivatives, the cryptocurrency category is not the most popular "short-term champion."

Meanwhile, sports events dominate overwhelmingly. Analysis shows that on Polymarket, the average trading volume for sports events with prediction cycles shorter than one day reaches $1.32 million, while that for cryptocurrency-related events is only $44,000. This also implies that if you hope to profit by predicting short-term cryptocurrency price movements in prediction markets, there may not be sufficient liquidity to support such activities.

2. Long-term market: A pool for large capital accumulation

Compared to the numerous event contracts in short-term markets, there are significantly fewer markets with longer time horizons.

On Polymarket, the number of markets with a cycle of 1 to 7 days has reached 141,000, while markets with a duration of more than 30 days amount to only 28,700. However, these long-term markets have accumulated the most capital. Markets with a duration of more than 30 days have an average liquidity of $450,000, while those with a duration of less than one day have liquidity of only about $10,000. This also indicates that large capital tends to focus on long-term forecasts rather than engage in short-term speculation.

In the long-term market (more than 30 days), excluding sports-related categories, all other categories show higher average trading volumes and average liquidity. The market category that attracts the most capital is the U.S. Politics category, with an average trading volume of $2.817 million and an average liquidity of $81,100. The second most effective category in attracting capital is the "Other" category, which achieves an average liquidity of $420,000 (this "Other" category includes topics such as pop culture, social issues, etc.).

In the field of prediction markets, capital tends to favor a long-term orientation. For example, predictions might focus on whether BTC will break through $150,000 by year-end or whether a certain token's price will fall below a certain level within a few months. In prediction markets, crypto-related predictions function more as simple options for hedging rather than tools for short-term speculation.

3. Polarization of the sports market

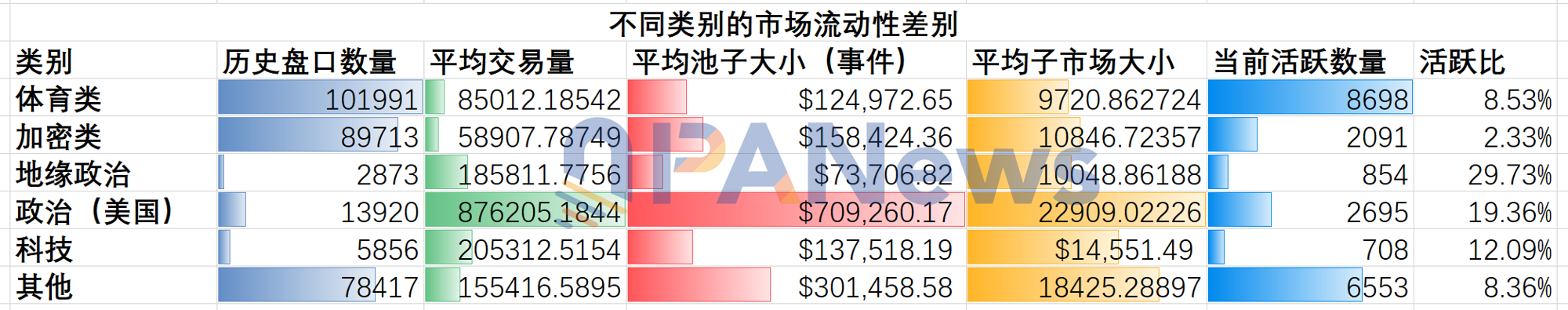

Sports-related predictions are currently one of the main sources of daily active contributions to Polymarkets, with an active count of 8,698, accounting for approximately 40%. However, looking at the distribution of trading volumes, there is a significant difference among sports markets with different time horizons. On one hand, ultra-short-term predictions with less than one day have an average trading volume of $1.32 million. On the other hand, mid-term markets (7 to 30 days) have an average trading volume of only $0.4 million, while ultra-long-term markets (more than 30 days) have an average trading volume as high as $16.59 million.

From this data, users participating in sports predictions on Polymarkets either seek "immediate results" or are making "season-long bets," while contracts for mid-term events are less popular.

4. Real estate forecasting initiatives face "culture shock"

After extensive data analysis, a superficial observation suggests that prediction events with longer time horizons appear to have better liquidity. However, when this logic is applied to certain specific or more refined categories, this characteristic sometimes fails to hold. For example, as previously mentioned, real estate predictions typically represent a market with relatively high certainty and a time horizon exceeding 30 days. Yet, for instance, predictions about the outcome of the 2028 U.S. presidential election lead the entire market in terms of both liquidity and trading volume.

This might reflect the "cold start dilemma" that new asset classes—especially those with niche and specialized characteristics—may face. Unlike straightforward event prediction, participation in the real estate market requires a higher level of professionalism and understanding. Currently, the market seems to be in a "strategy adjustment phase," where retail investors' enthusiasm can only remain at the level of observation. Naturally, the real estate market's low volatility further intensifies this cold start problem. Without frequent event-driven fluctuations, speculative capital also shows less interest. As a result, these relatively niche markets are caught in an awkward situation where professional players lack counterparties, and amateur investors are too hesitant to enter.

5. "Short-term" or "Depositing"?

Based on the above analysis, we can reclassify different market categories for prediction. Markets such as cryptocurrencies and sports, which involve ultra-short-term events, can be categorized as short-term markets. In contrast, categories like politics, geopolitics, and technology tend to be more long-term and accumulative in nature.

Behind these two types of markets are different groups of investors. Short-term markets are clearly more suitable for individuals with smaller capital or those who require higher capital turnover rates. In contrast, "settled" markets are more appropriate for investors with larger capital and a relatively higher demand for certainty.

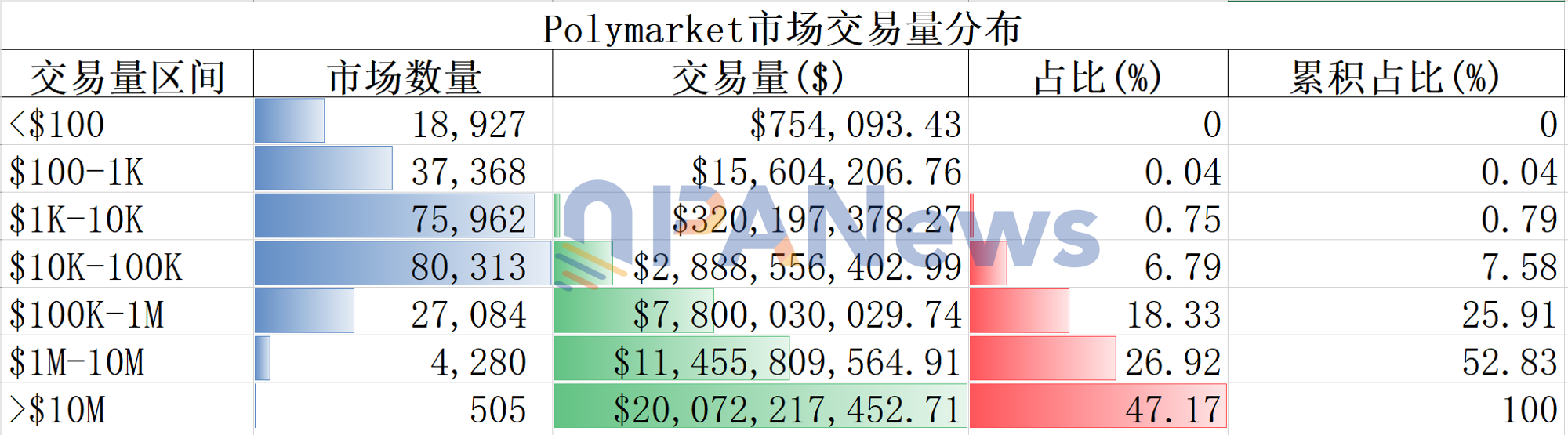

However, when the market is segmented by transaction volume, it becomes evident that markets with significant liquidity (over $10 million in trading volume) account for 47% of the total trading volume, despite having the fewest number of contracts—only 505. In contrast, markets with trading volumes between $100,000 and $10 million make up the majority in terms of quantity, totaling 156,000 contracts, but they contribute only 7.54% of the total trading volume. For the vast majority of prediction contracts that lack compelling narratives, "launching and immediately dropping to zero value" is the norm. Liquidity is not evenly distributed sunshine; rather, it is a spotlight concentrated around a very small number of major events.

6. The "geopolitical" sector is on the rise.

From the ratio of "Current Active Number / Historical Number," we can see the growth momentum of a category. Currently, the segment with the highest growth efficiency is undoubtedly "Geopolitics." The total historical number of events related to geopolitics is only 2,873, but there are currently 854 active ones, resulting in an active ratio of as high as 29.7%, the highest among all segments.

This data indicates that the number of new contracts related to "geopolitics" is rapidly increasing, making it one of the most concerning topics for prediction market users at present. This is also evident from the recent frequent appearances of insider addresses in several "geopolitics"-related contracts.

Overall, in the liquidity analysis of market prediction, whether it is the sports sector as a "high-frequency casino" or the political sector as "macro hedging," their core ability to capture liquidity lies in either providing immediate dopamine-like feedback or offering deep macro-level strategic space. In contrast, those "chicken ribs"—markets that lack narrative density, have excessively long feedback cycles, and exhibit little volatility—are inevitably doomed to struggle in decentralized order books.

For participants, Polymarket is evolving from a utopia of "predicting everything" into an extremely specialized financial tool. Recognizing this shift is more important than blindly chasing the next "100x prediction." In this space, value is only discovered where liquidity is abundant; where liquidity dries up, only traps remain.

This might be the greatest truth about prediction markets that data tells us.