Safeguarding Your Funds: Common Card Fraud Risks and How to Prevent Them

Bank cards are an indispensable part of our daily financial lives. However, behind this convenience lurks the persistent risk of unauthorized transactions. A moment of carelessness with your information or a single click on a cleverly disguised fraudulent link can lead to funds being stolen in an instant. Understanding common fraud tactics and mastering anti-fraud knowledge are essential financial literacy skills for every modern cardholder.

1 Unveiling Common Fraud Traps: Risks Are Everywhere

While fraud techniques are constantly evolving, their core objective remains the same: to illegally obtain your card information or transaction verification codes. Below are the most frequent high-risk scenarios:

1.1 Phishing and Telecommunications Fraud

-

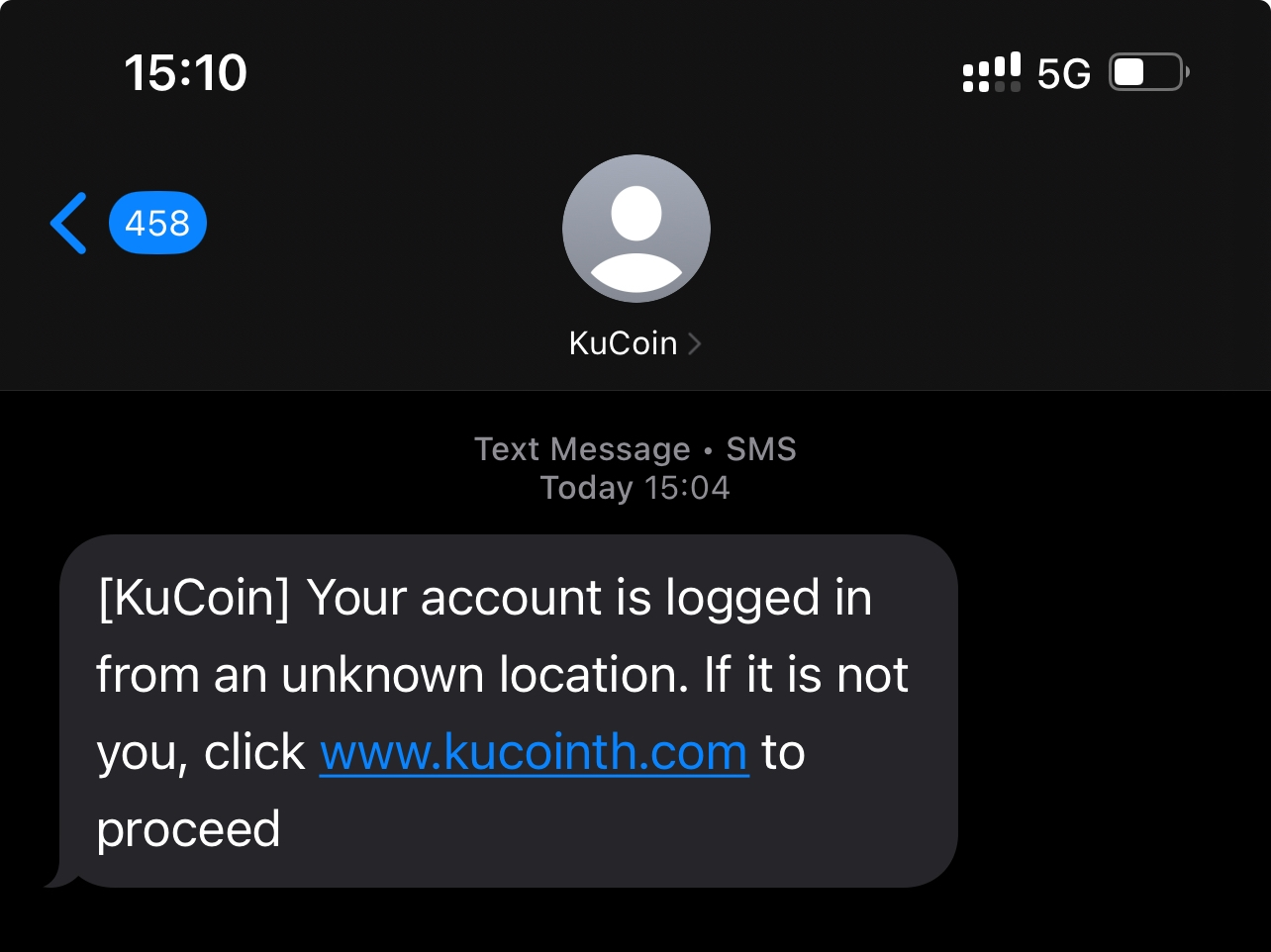

Scenario: You receive a "bank" text message claiming account anomalies and asking you to click a link for verification; or you receive a call from "customer service" requesting your SMS verification code under the guise of processing a refund or increasing your credit limit.

-

Risk Point: Fraudsters use fake websites, calls, and texts impersonating official institutions to trick you into voluntarily revealing core information such as your card number, password, CVV2 (the three-digit code on the back), and SMS verification codes.

Criminals lure users into clicking phishing websites by claiming there are abnormalities in their accounts.

1.2 Counterfeit Card Fraud and Skimming

-

Scenario: You swipe your card at an unregulated small merchant or use a tampered ATM or self-service terminal.

-

Risk Point: Criminals install illegal skimming devices on terminals to steal magnetic stripe data and passwords, which are then used to create counterfeit cards for unauthorized use. Magnetic stripe cards are particularly vulnerable.

1.3 Online Card-Not-Present (CNP) Fraud

-

Scenario: You shop on unsecured websites or apps, or make payments while connected to public Wi-Fi.

-

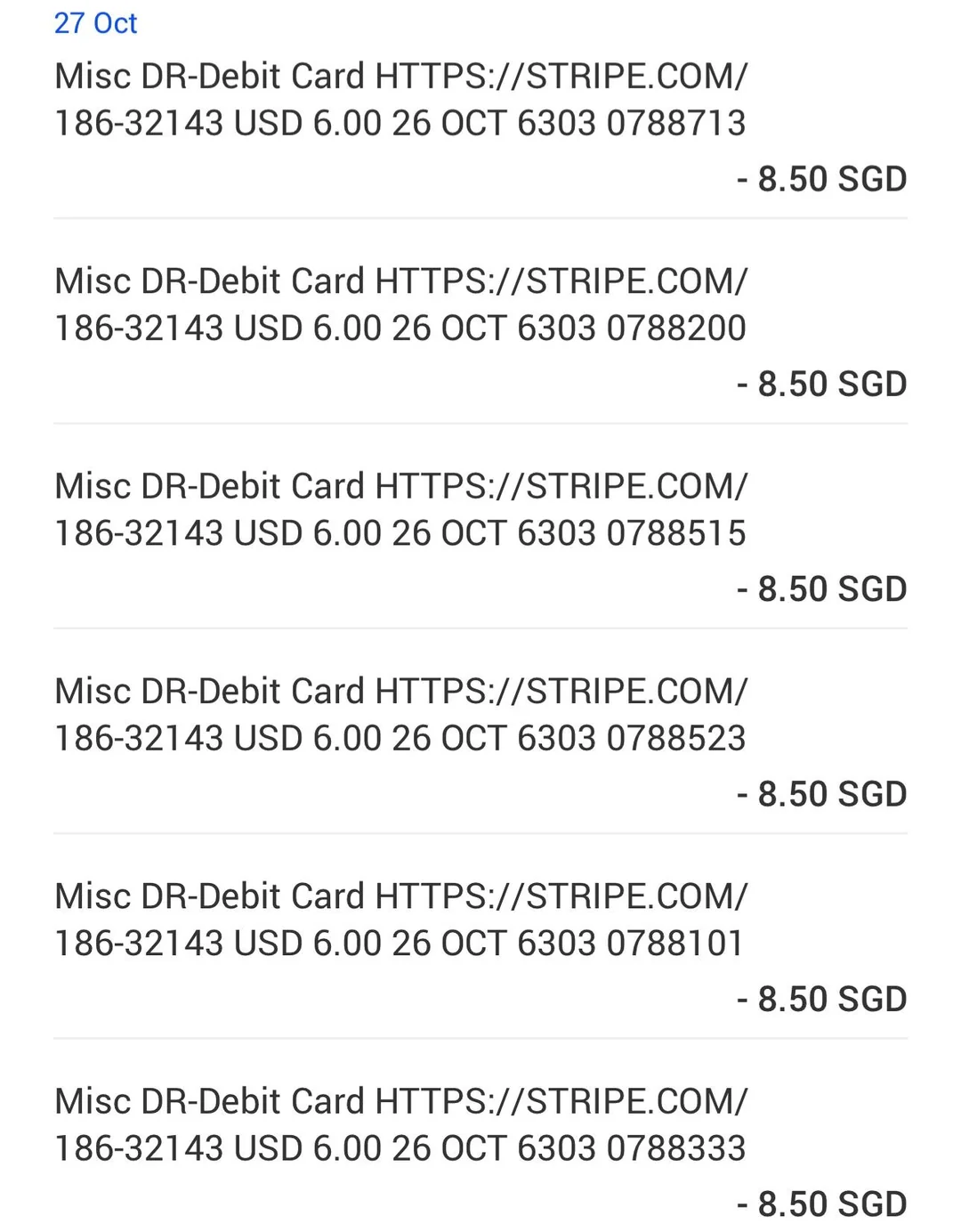

Risk Point: Payment information is intercepted during transmission, or merchant databases are breached by hackers, leading to mass data leaks. Criminals then use the obtained card number, expiration date, and CVV2 code to complete online purchases.

Criminals carry out multiple fraudulent transactions through online card-not-present fraud.

1.4 Lost or Stolen Card Fraud and Card Switching

-

Scenario: Your card is physically lost or stolen, or it is briefly swapped by a criminal during a transaction.

-

Risk Point: Once the card falls into the wrong hands, it can be quickly used for unauthorized transactions, especially if small-amount password-free payment features are enabled.

2 Building a Security Defense: Proactive Prevention is Key

Instead of worrying passively, take proactive steps to defend yourself. Following these measures can greatly enhance the security of your card usage:

2.1 Protect Information Strictly

-

Never Disclose: Legitimate institutions like banks or the police will never ask for your payment password or SMS verification code via phone or text. These are your final line of defense—keep them private.

-

Dispose Properly: Safely store receipts and old cards containing your card number and name. When destroying expired cards, ensure the magnetic stripe and chip are completely ruined.

-

Unique Passwords: Set a strong, dedicated payment password for your bank card. Avoid using the same password as your phone lock or social media accounts.

2.2 Master Usage Habits and Details

-

Upgrade to Chip Cards: Replace magnetic stripe cards with more secure financial IC chip cards as soon as possible.

-

Swipe Cautiously: Try to use your card only at reputable merchants. Keep your card in sight during transactions and shield the keypad when entering your password.

-

Set Limits: Configure single-transaction and daily limits via mobile banking according to your needs, especially for accounts used for online payments.

-

Close Password-Free Payments: Consider turning off "small-amount password-free" features based on your habits to require password verification for every transaction.

2.3 Stay Vigilant with Online Payments

-

Trust Official Sources: Only download banking and payment apps from official app stores. Ensure payment websites start with "https://" and display a security lock icon.

-

Be Wary of Links: Never click on payment links sent via text, email, or unknown websites. Enter the official website address directly into your browser instead.

-

Isolate Environments: Avoid performing payment operations on public computers or public Wi-Fi. Install reliable security software on your mobile phone.

2.4 Leverage Technology and Tools

-

Enable Alerts: Activate SMS or WeChat notification services for account activity to monitor your funds in real-time.

-

Lock Your Card: Use the card lock feature provided by your issuing bank when the card is not in use to prevent unauthorized transactions.

-

Virtual Card Services: For frequent online payments or purchases on foreign websites, consider applying for a virtual credit card (which offers a random card number and independent limit) to effectively isolate risks from your primary card.

3 Emergency Response: What to Do If Fraud Occurs?

Even with thorough precautions, if you fall victim to fraud, remain calm and follow these steps immediately:

-

Lock the Card Immediately: Report the loss or freeze the card instantly via mobile banking or customer service to prevent further losses.

-

Preserve Evidence: Save fraudulent text messages, call records, and screenshots of phishing sites. Note the time, amount, and merchant name of the unauthorized transaction.

-

Report to Police Quickly: Go to the nearest police station to file a report. Detail the fraud process and the amount lost, and obtain a police report receipt.

-

Contact the Bank: Initiate a chargeback request with your issuing bank, cooperate with their investigation, and provide relevant materials. According to regulations, cardholders who safeguard their cards and passwords properly are typically not liable for fraudulent transactions made after reporting the loss.

Using cards securely is both a habit and a skill. As financial technology advances, so do criminal methods. Only by staying vigilant, constantly updating your security knowledge, and integrating prevention measures into your daily routine can you truly safeguard your funds.

If you have any questions, please consult your card-issuing bank directly.