Exploring the Rise of the Agentic Economy: A Deep Dive into CLAWNCH and the AI Agent Sector

2026/02/02 04:18:02

In the cryptocurrency market of 2026, a new sector known as the "Agentic Economy" is rapidly reshaping the industry landscape. Within this space, the CLAWNCH project, built on the Base network, has sparked extensive discussion due to its unique "AI-only" positioning. As a product of the deep integration between blockchain technology and artificial intelligence, such projects are attempting to prove that AI can be more than just an assistant to human traders—it can become an independent market participant.

Key Takeaways

-

Agent-Native Attribute: CLAWNCH is a token launchpad specifically designed for AI agents, autonomously deployed and operated by artificial intelligence.

-

Ecosystem Positioning: Rooted in the Base network, the project leverages low-cost, high-efficiency features to drive decentralized financial (DeFi) interactions between AI agents.

-

Market Activity: These types of projects have demonstrated resilience during broader market volatility, maintaining 24-hour trading volumes in the tens of millions of dollars.

-

Technology-Driven Risk: Due to high reliance on autonomous AI logic, there are inherent risks of sudden volatility caused by code vulnerabilities or a lack of human intervention.

What is an AI Agent-Driven Token Launchpad?

In traditional token issuance models, developers or teams typically write code manually, set up liquidity pools, and conduct market promotion. However, as the application of AI agents on the Base network matures, this process is becoming fully automated.

The core logic of CLAWNCH lies in providing an "Agent-only" launchpad. This means that token creation, liquidity injection, and even early-stage social media operations can be completed independently by AI agents. By reducing human intervention, this model theoretically lowers the probability of traditional "insider trading" or manual manipulation, though it demands extreme rigor regarding the algorithmic security and fairness of the AI.

Deep Analysis of CLAWNCH Market Performance and Data

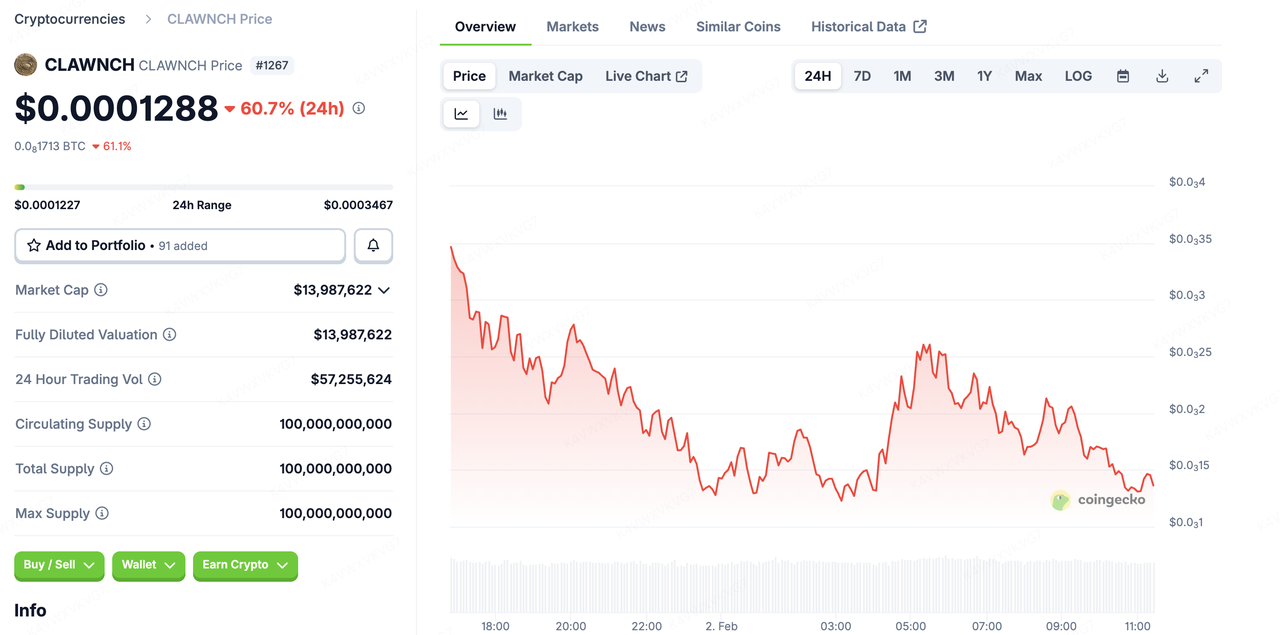

According to monitoring from mainstream data platforms like CoinGecko, CLAWNCH has exhibited high-frequency turnover that is disproportionate to its market cap scale.

Trading Volume and Liquidity Distribution

Over the past 24 hours, the global trading volume for CLAWNCH reached approximately $58.79 million. This figure is exceptionally high for a project with a market capitalization of around $14 million, indicating very active market turnover.

Currently, primary trading activity is concentrated in the V4 and V3 versions of decentralized exchanges (DEXs). Specifically, the CLAWNCH/WETH trading pair on the Base chain carries the bulk of the liquidity. For users, this distribution implies highly transparent price discovery, but it also means being susceptible to gas fees and network congestion on-chain.

Price History and Volatility

Source: coingecko

-

All-Time High (ATH): $0.0003467

-

All-Time Low (ATL): $0.0001227

-

Current Trend: Despite a retracement from its peak, CLAWNCH has maintained a relatively stable trajectory recently, even as the global crypto market fell by approximately 14%. This "decoupled" performance often stems from a holder structure where AI agents and their automated strategies occupy a significant proportion, reducing panic selling triggered by human emotion.

Opportunities and Limitations in the Agentic Economy

When discussing CLAWNCH trading volume trend analysis, one cannot ignore the double-edged nature of the technology.

Potential Technical Advantages

-

Automated Efficiency: AI launch platforms can operate 24/7 without interruption, capturing fleeting liquidity opportunities in a volatile market.

-

Lowering Barriers: Developers can utilize the CLAWNCH protocol to rapidly deploy sub-tokens with specific functions via simple API calls.

-

Ecosystem Synergy: On the Base chain, different AI agents can hold each other's tokens, forming a closed-loop machine economy.

Limitations to Consider

-

Regulatory Ambiguity: Projects run entirely by autonomous AI exist in a legal gray area; in the event of a security incident, determining liability is extremely difficult.

-

Algorithmic Bias: If the AI's predictive models suffer from collective logical errors, it could lead to liquidity pools draining in a very short period.

-

Information Overload: AI can generate thousands of experimental tokens daily, making it difficult for users to filter for projects with genuine long-term value.

How to Engage with the AI Agent Sector?

For users interested in the CLAWNCH future growth forecast, understanding the underlying logic is more critical than focusing on short-term price action.

Step 1: Configure a Wallet Supporting the Base Chain

Since CLAWNCH operates primarily on decentralized exchanges, you need a Web3 wallet that supports the Layer 2 (Base) network. Ensure you have a small amount of ETH to cover transaction fees.

Step 2: Monitor AI Behavior On-Chain

Since the token is issued by AI, monitoring the activity of the underlying AI agent accounts (such as agent bots on Farcaster or Twitter) often provides more valuable information than traditional candlestick charts.

Step 3: Pay Attention to Fully Diluted Valuation (FDV)

Currently, the market cap of CLAWNCH is equal to its FDV at approximately $14.77 million. This means all 100 billion tokens are in circulation, and there is no risk of future price dilution from team token unlocks. This provides a relatively clear financial baseline for long-term observers.

Summary

CLAWNCH and the AI Agent sector it represents mark a shift in cryptocurrency from "human vs. human game theory" to "machine vs. machine game theory." While the sector remains characterized by high volatility and experimentation, its potential for automation is undeniable. Within the fertile soil provided by the Base network, experiments like CLAWNCH may serve as the prototype for future decentralized business logic.

FAQs

What is the full circulation mechanism of CLAWNCH?

The maximum supply of CLAWNCH is fixed at 100 billion tokens, and the current circulating supply is also 100 billion. This means its market cap and Fully Diluted Valuation (FDV) are identical ($14,776,327), eliminating concerns about price dilution from future unlocks.

Why is CLAWNCH trading primarily on the Base network?

As an Ethereum Layer 2, Base offers extremely low transaction fees and millisecond confirmation speeds, making it an ideal environment for AI agents that need to execute high-frequency operations.

How do AI Agent tokens differ from regular meme coins?

While regular meme coins are usually driven by social media hype, projects like CLAWNCH act as "functional tools" that allow other AI agents to pay fees to launch tokens, giving them clearer utility and ecosystem purpose.

What are the risks of investing in AI-concept tokens?

Major risks include security vulnerabilities in the underlying AI algorithms, rapid shifts in market trends leading to liquidity exhaustion, and the potential impact of future regulatory policies on the sector.

Where can I view real-time trading volume for CLAWNCH?

Real-time 24-hour trading volume and liquidity depth across various decentralized exchange pools can be monitored via on-chain analysis tools like CoinGecko, DEXTools, or Basescan.