KuCoin Ventures Weekly Report: Fusaka’s "Silent Upgrade," Wall Street’s 2026 Playbook, and the Real Business of Crypto Infrastructure

2025/12/08 09:51:02

1. Weekly Market Highlights

Fusaka Upgrade: How Ethereum Is Quietly Rewriting the L1–L2 Cost Curve Through “Engineering-Style” Optimizations

On 3 December, the Ethereum mainnet completed the Fusaka upgrade as scheduled. Compared with the Shanghai and Dencun upgrades, Fusaka landed with noticeably less fanfare: market attention was distracted by BTC volatility and BBW-related themes, while ETH’s own price and on-chain activity remained relatively soft, making it harder to build a strong sentiment narrative. At the same time, Fusaka is, by design, a more “engineering-driven” upgrade at the protocol layer—no new buzzword narratives, no paradigm-shifting new gameplay, but a series of structural tweaks around cost, throughput and validation thresholds. In essence, it is laying the groundwork for how L1 and L2 will share responsibilities over the next few years.

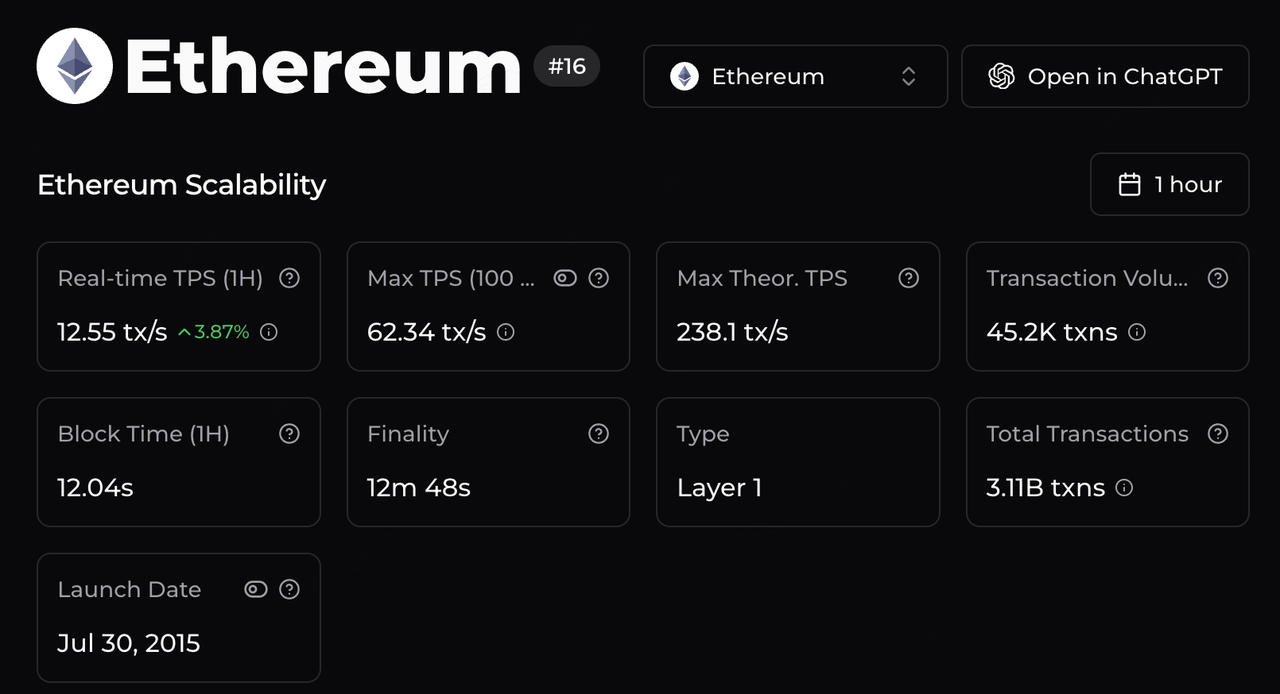

On the execution side, the most visible change comes from the reshaping of throughput and the cost curve. The gas limit has been raised to 60 million, and combined with execution and data-path optimizations, third-party estimates suggest Ethereum’s theoretical peak throughput can now approach ~238 tx/s—an order of magnitude above the early ~15 TPS era. For upstream infrastructure, this opens up more headroom for L2 settlement; for applications, it systematically lowers the expected cost and congestion of “high-frequency on Ethereum”—from RWA infrastructure on Arbitrum, to x402-style payment flows on Base, to high-frequency DeFi and gaming experiments on MegaETH—rather than relying on occasional “low-fee windows.”

Data Source: https://chainspect.app/chain/ethereum

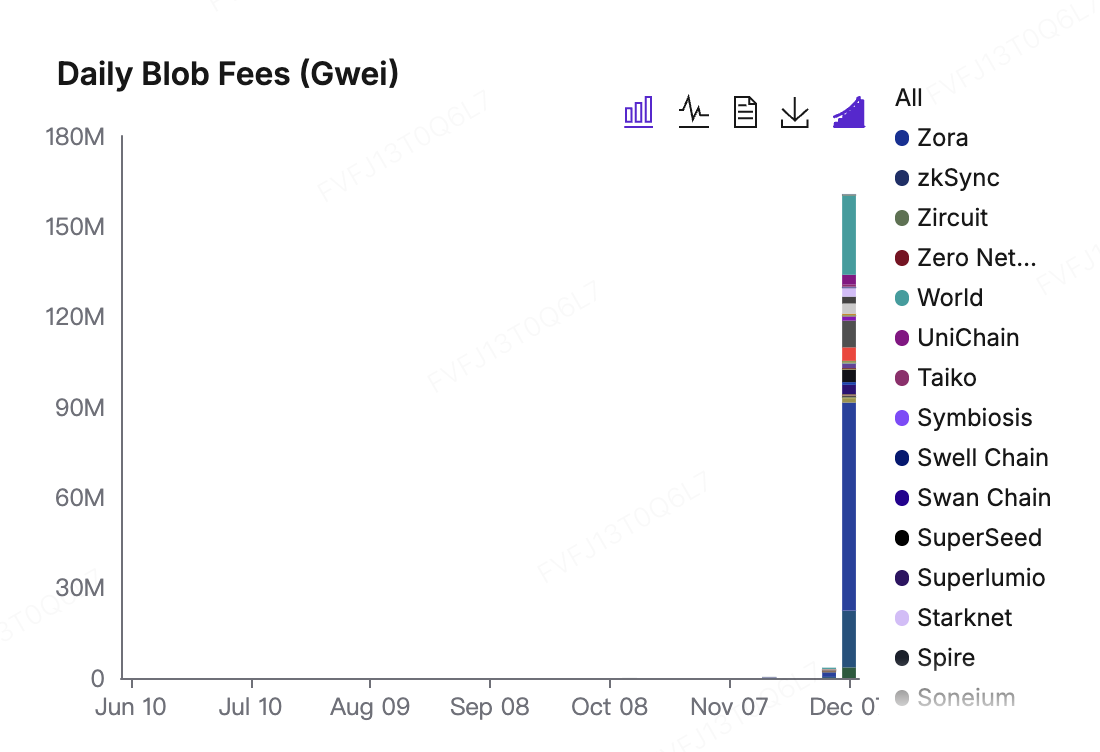

Rebalancing of the fee market is mainly reflected in how EIP-7918 adjusts Blob pricing. After Dencun, Blobs were effectively “almost free”: the minimum fee was just 1 wei, meaning that when demand was low, L2s could occupy data availability bandwidth at near-zero marginal cost. Fusaka introduces a reserve price for Blobs that is tied to the L1 base fee: even in periods of weak demand, L2s must still pay a “toll” proportional to mainnet gas levels. Following the upgrade, the Blob base fee jumped from 1 wei into a new equilibrium range in the tens of millions of wei; daily Blob fees show a clear step-change higher in charts, with Base, World Chain and Arbitrum emerging as the main contributors. On one hand, this means Ethereum DA is no longer a “free good”: L2s now have to continuously pay for the settlement and data capacity they consume. On the other hand, these fees flow into the EIP-1559 framework, translating into validator rewards and ETH burn—reinforcing ETH’s role as the asset that captures value from being the global settlement and data availability layer.

Data Source: https://blobscan.com/stats

PeerDAS, in turn, raises the effective scaling ceiling from the validation side. Under the traditional model, fully verifying L2 data required nodes to download entire Blobs, resulting in high bandwidth and storage requirements that only a small set of “big nodes” could realistically meet. PeerDAS introduces data sampling, allowing validators to download and verify only a subset of data fragments while still achieving high confidence that the full data block is available. This is estimated to reduce bandwidth requirements by roughly 70%–85%. Practically, it lowers the barrier for regular nodes to participate, while also creating room for institutional validators and staking providers to run nodes and offer services within compliant frameworks. More importantly, once the Blob capacity ceiling is lifted and validation costs are spread out, competition among L2s for limited L1 blockspace eases: fee curves become smoother, congestion spikes more manageable, and L1 enjoys a more stable base fee and validator revenue. In this configuration, ETH holders, L1 validators, L2 sequencers and end-users all sit on the same economic pipeline and share in the upside, pushing resource allocation toward a “high-utilization + high-security” equilibrium.

Qualitatively, Fusaka will not reshape the short-term supply overhang the way Shanghai did by unlocking staked ETH, nor will it reproduce Dencun’s immediate “wow effect” of slashing L2 fees overnight. Instead, it is better understood as a set of “slow-moving variable” adjustments aimed at structural bottlenecks: by jointly tuning throughput, Blob fees and validation thresholds, it provides a more sustainable hardware foundation for the division of labor where “L1 handles settlement and data availability, L2 handles user experience and applications.” Going forward, the more meaningful metrics to watch will not be ETH’s price reaction on upgrade day, but rather how the share of Blob fees within ETH revenue and burn evolves, where the average fee level on major L2s stabilizes, how validator and node distributions change over time, and how ETH’s net issuance curve rebalances in a world increasingly driven by high-frequency L2 activity.

2. Weekly Selected Market Signals

Calm Amidst US Stock Euphoria, BTC’s Rare Decoupling, and the Fed’s "Supply-Side" Shift

The defining characteristic of the U.S. stock market last week was not merely the index gains, but a state of extremely compressed volatility. Wall Street appears to have unilaterally declared near-term risks resolved, with the VIX hovering near annual lows and the MOVE index (tracking bond market volatility) touching its lowest level since early 2021. Beneath this calm surface, tail risk hedges have been largely unwound, and capital has flowed net-positive into equity funds for 12 consecutive weeks, indicating extremely high investor conviction in the near term.

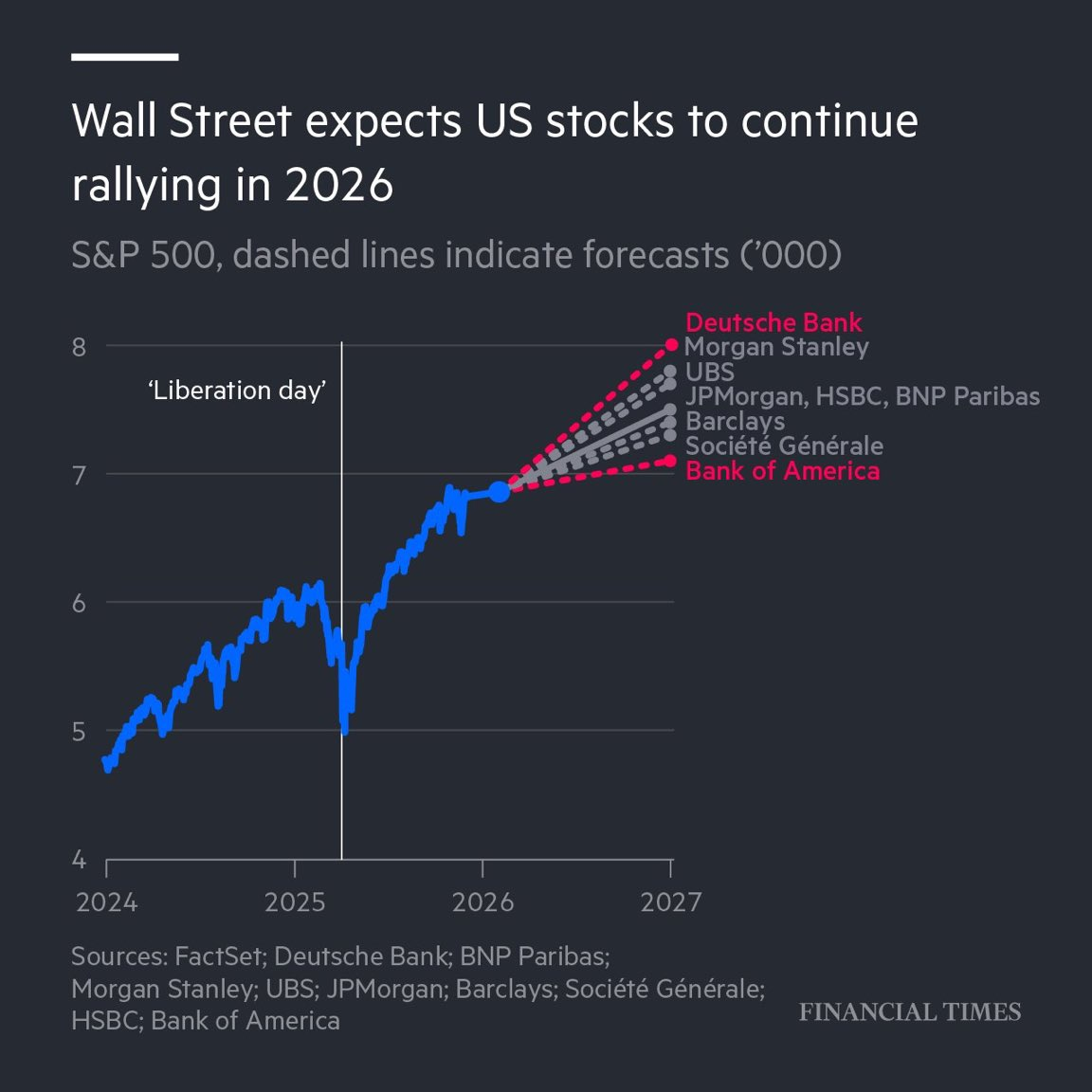

Data Source: Financial Times

The core driver of this optimism has shifted from current economic data to a 2026 macro narrative. Despite sticky recent PCE inflation data and emerging divisions within the Fed, the market has chosen to "turn a blind eye," fully trading on expectations of a 2026 recovery. According to the latest outlooks from major Wall Street banks, the atmosphere is universally optimistic, predicting that U.S. stocks will continue double-digit gains in 2026, with the S&P 500 potentially challenging the 7,500 or even 8,000 mark.

Three main pillars support this logic: First is the pricing of the "Trump Dividend," where the market anticipates a "trinity" of tax cuts, deregulation, and loose fiscal policy to directly boost corporate earnings. Second is the evolution of the AI narrative; institutions like Goldman Sachs note that while AI CapEx growth may slow in 2026, the focus will shift from hardware investment to productivity realization. Companies that can explicitly quantify AI efficiency gains are replacing pure hardware stocks as the new source of Alpha. Finally, there is consumer sector repair, with expectations that real income for the middle class will improve due to falling inflation and tax cuts, offering valuation repair opportunities for consumer goods. In short, the market is currently pricing in a "too good to be true" scenario.

In sharp contrast to the euphoria in U.S. stocks, the crypto secondary market remained lackluster last week. BTC prices briefly dipped below $89,000, creating a historically rare risk of annual divergence and breaking the high correlation seen in recent months.

Data Source: SoSoValue

Data suggests this decoupling is driven more by adjustments in holding structures rather than BTC fundamentals. Part of the cause likely stems from traditional macro hedge funds taking profits and rebalancing portfolios at year-end. However, despite the price pullback, spot ETFs have not seen massive net outflows. Last week, asset management giant Vanguard began allowing clients to purchase third-party managed crypto ETFs (e.g., BlackRock’s IBIT) on its brokerage platform for the first time. This signals that long-term capital can now enter the market more conveniently.

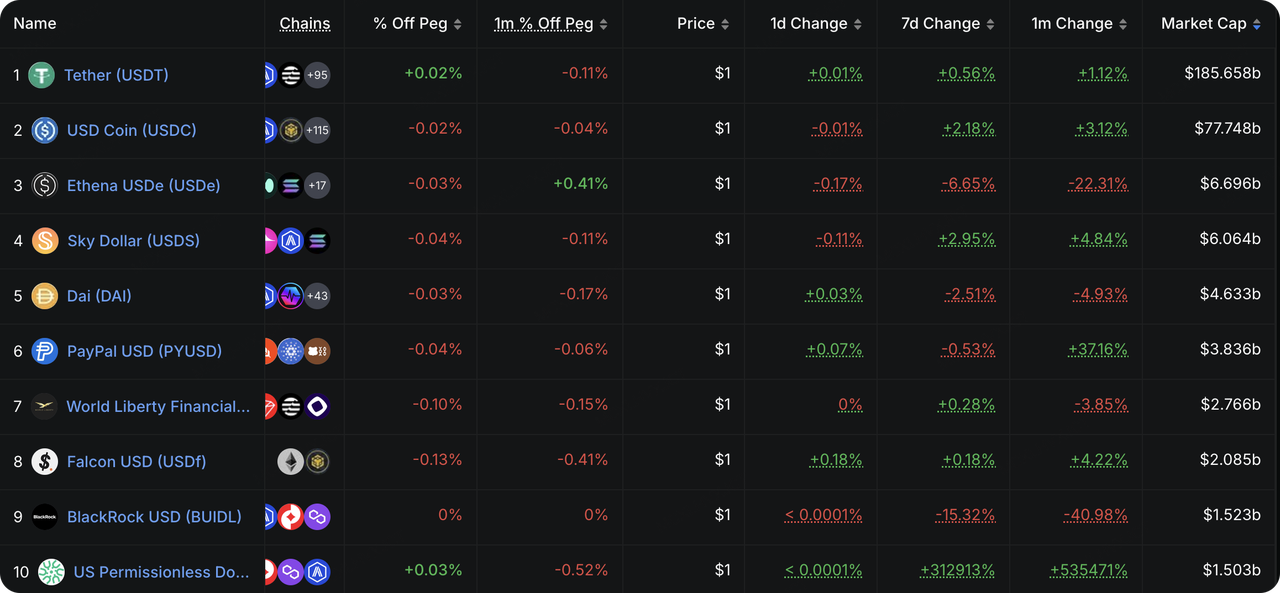

Data Source: DeFiLlama

Regarding on-chain liquidity, total stablecoin issuance stopped falling and rebounded last week. Even excluding the increment from the newly tracked USPD, pure fiat-backed stablecoins are seeing a slow overall increase. On the other hand, USDe and BUIDL continue to shrink, indicating that the alternative stablecoin sector remains in a deleveraging phase.

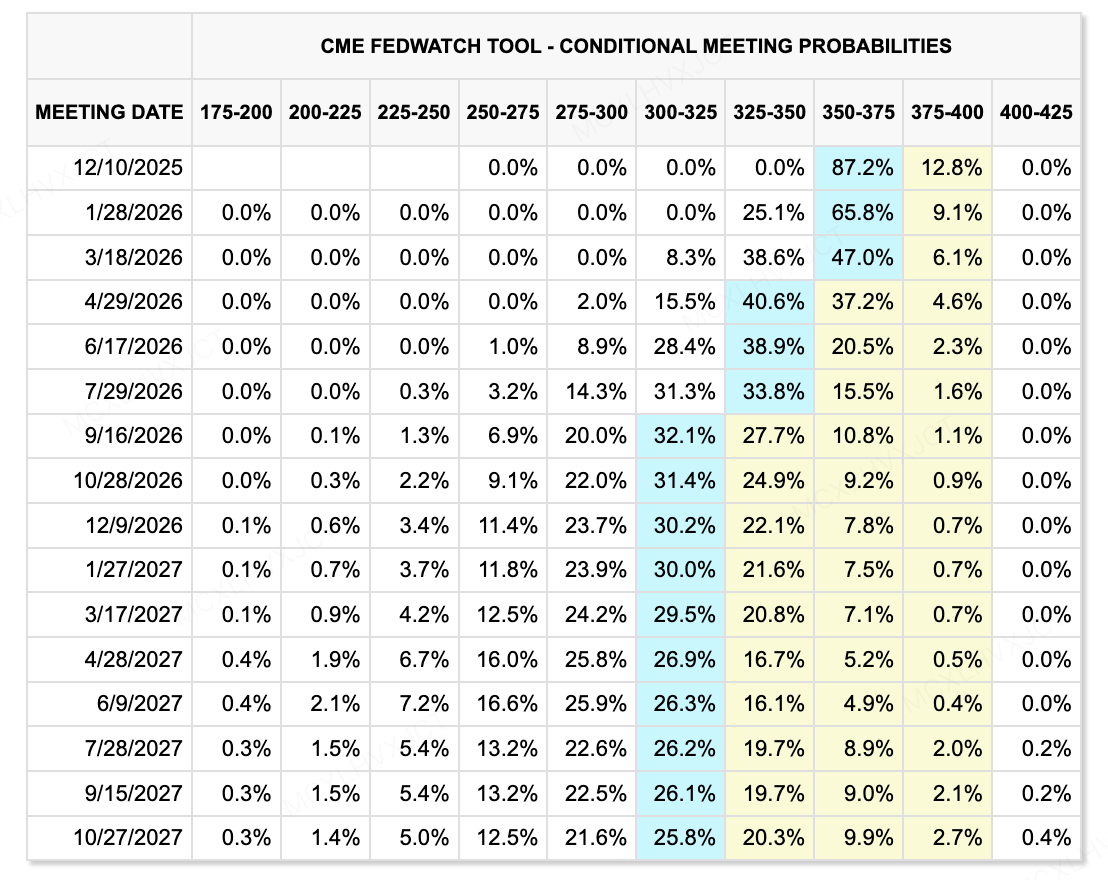

Data Source: CME FedWatch Tool

Looking ahead, the liquidity game is entering a new phase. The biggest variable remains the internal shift at the Fed—Kevin Hassett is highly likely to succeed Powell as the next Chair. This personnel change would fundamentally reconstruct market interest rate expectations. Hassett leans toward a very dovish policy (viewing the neutral rate at 2%–2.5%)(). Contrary to the traditional Fed "demand-side" logic of suppressing demand to control inflation, Kevin promotes a "supply-side economic logic," advocating for low interest rates to stimulate capital expenditure, thereby using productivity bursts from AI and robotics to dilute inflation().

On the other hand, the Bank of Japan's (BOJ) moves warrant continued tracking. Although current rate hike expectations haven't triggered a crash like in July, the narrowing US-Japan yield spread makes the trend of Japanese capital repatriating from US Treasuries irreversible. Long-term, this will weaken demand for Treasuries and potentially push up long-end rates, suppressing global risk asset valuations.

Overall, we see a trend of US easing vs. Japan tightening, creating lingering uncertainty in global liquidity dynamics.

Key Events to Watch This Week:

-

Dec 8: Central bank decisions (Fed, Canada, Australia, Switzerland, Brazil). Will global liquidity ease in sync or begin to diverge?

-

Dec 11: Fed Interest Rate Decision & Jobless Claims. Focus on the Dot Plot.

-

Dec 5: Fed Officials' "Expectation Management." The first speeches post-decision will determine how the market interprets Powell's press conference.

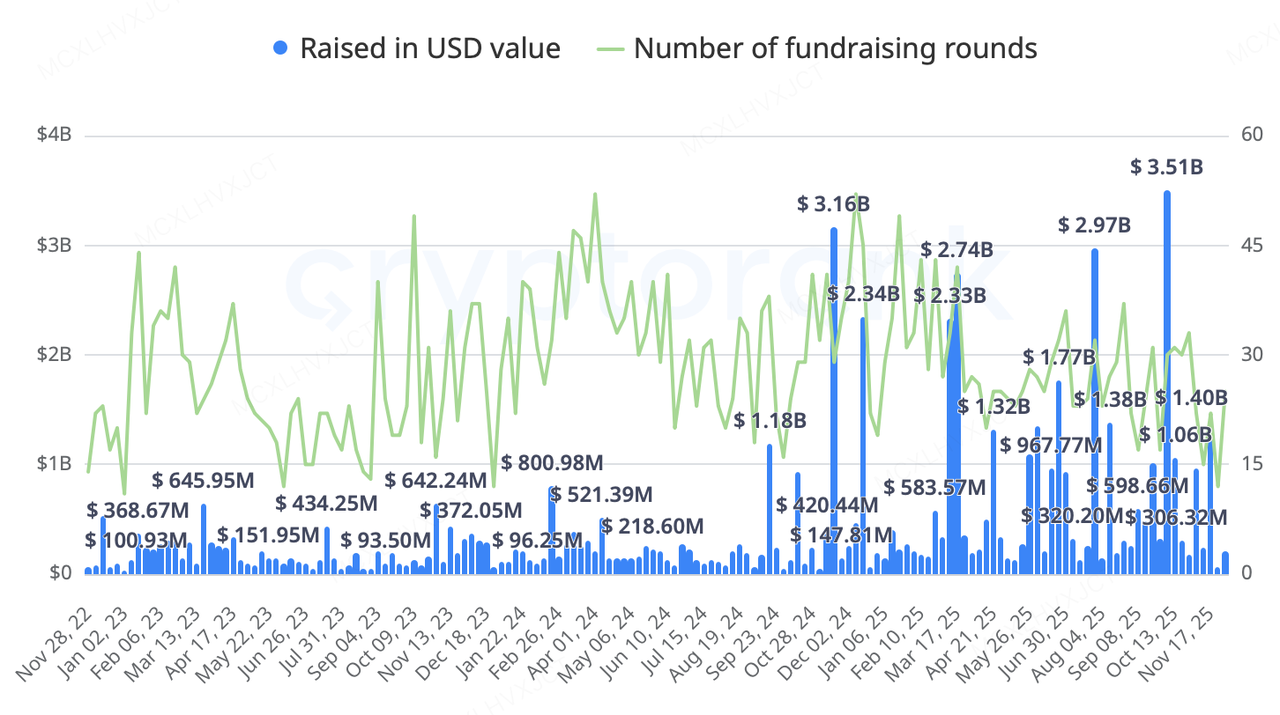

Primary Market Observation::

Recently, the crypto-native primary market has continued a trend toward more pragmatic and strategic financing and M&A, focusing on areas with clear, universal appeal and actual revenue, such as on-chain U.S. stocks, on-chain yields, prediction markets, and cross-border payments/payment infrastructure.

Last week's activity was highly concentrated in "On-chain Equities/RWA," "Payment Infrastructure," and "Quant Yields." Whether it was Kraken acquiring Backed Finance or traditional financial giants (BNY Mellon, Nasdaq, S&P Global) investing in Digital Asset (parent of Canton Network), the signal is clear: Crypto infrastructure is accelerating its integration with traditional finance business logic.

Data Source: CryptoRank

-

Quant Yield Protocol Axis raised $5M in a private round led by Galaxy Ventures, with participation from KuCoin Ventures, Maven 11, and GSR. It aims to provide non-inflationary Real Yield for USD, BTC, and Gold. Against the backdrop of a rate-cut cycle, on-chain structured yield products are becoming key destinations for institutional capital.

-

Decentralized Exchange Ostium announced a $20M Series A led by General Catalyst and Jump Trading's crypto arm, with Coinbase Ventures, Wintermute, and GSR participating. Valuation is approx. $250M. Founded by a Harvard team, it focuses on RWA perpetual contracts (stocks, oil, gold). Its core logic is using blockchain tech to enter the offshore brokerage market, serving non-US investors seeking US equity exposure.

AllScale Enters YZi Labs Incubation Program (EASY Residency) Season 2 Whitelist

As a portfolio project previously backed by KuCoin Ventures, AllScale has reached a significant milestone, officially entering the YZi Labs incubation program (EASY Residency) Season 2 whitelist and deploying on BNB Chain.

AllScale positions itself not as a traditional crypto wallet, but as a "lightweight, self-custody stablecoin neo-bank,"aiming to build a decentralized financial infrastructure for global commercial payments with a Web2-like experience. By providing 1:1 USD-pegged stablecoin payment and collection solutions, AllScale makes high-frequency, small-ticket global transactions as simple as sending an email, directly serving populations underserved by traditional cross-border financial systems.

In terms of commercial adoption, unlike most PayFi projects focused on Crypto-Native companies, AllScale demonstrates a highly differentiated market entry path: it is pragmatically acquiring real customers in the "deep waters" of Web2. Currently, AllScale’s core client base is broad, targeting AI startups with urgent global expansion needs and multinational manufacturing giants. AllScale successfully implants stablecoins into traditional commercial flows purely as an "efficient settlement medium." This "real-economy" customer structure gives it strong anti-cyclical resilience—even if the crypto market enters a winter, the cross-border payroll and settlement needs of traditional enterprises will continue to grow rigidly. This provides the project with blood-forming capabilities independent of the crypto cycle. The team’s goal is to prioritize polishing the business model and revenue balance; this philosophy of long-termism is rare in the current PayFi track and deserves our continued support.

3. Project Spotlight

HumidiFi Public Sale Turmoil: The Tension Between Liquidity and Fairness for a Solana Dark-Pool DEX

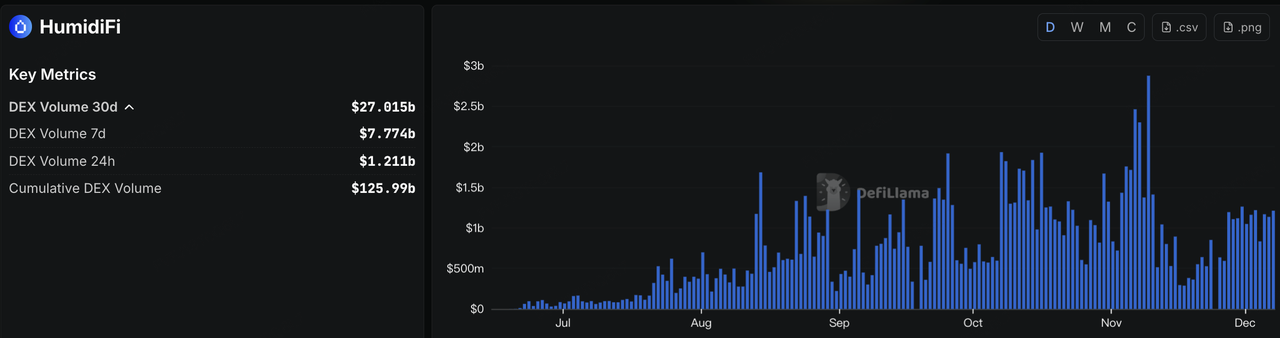

As the crypto market began to rebound from extreme pessimism, on-chain token launches started to heat up again. On 3 December, Solana-based dark-pool trading platform HumidiFi launched its WET token via Jupiter’s DTF (Decentralized Token Formation) platform, bringing its “Prop AMM + dark-pool liquidity” narrative to the forefront. HumidiFi had already scaled rapidly within the Solana DEX landscape: total cumulative trading volume has reached around $125.99 billion, with more than $27 billion traded over the past 30 days, and its market share has formed an almost three-way split with Jupiter and Raydium.

Data Source: https://defillama.com/protocol/dexs/humidifi

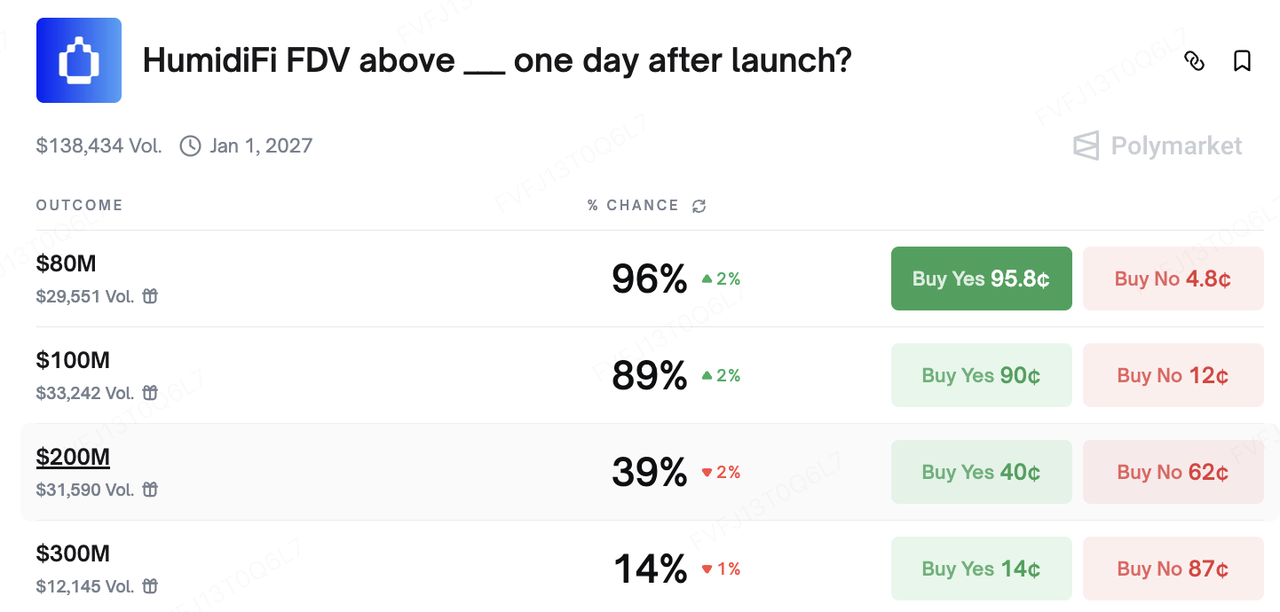

The public sale implied a fully diluted valuation (FDV) of roughly $69 million, significantly below that of leading peer DEXs in the same ecosystem (Jupiter at around $1.57 billion FDV, Raydium at about $639 million). As a result, WET was quickly framed by the market as a high-beta play on “deep liquidity + potential valuation catch-up.” On Polymarket, prediction markets on whether HumidiFi’s FDV would exceed $80 million or $100 million one day after launch have been trading in high-probability ranges for an extended period.

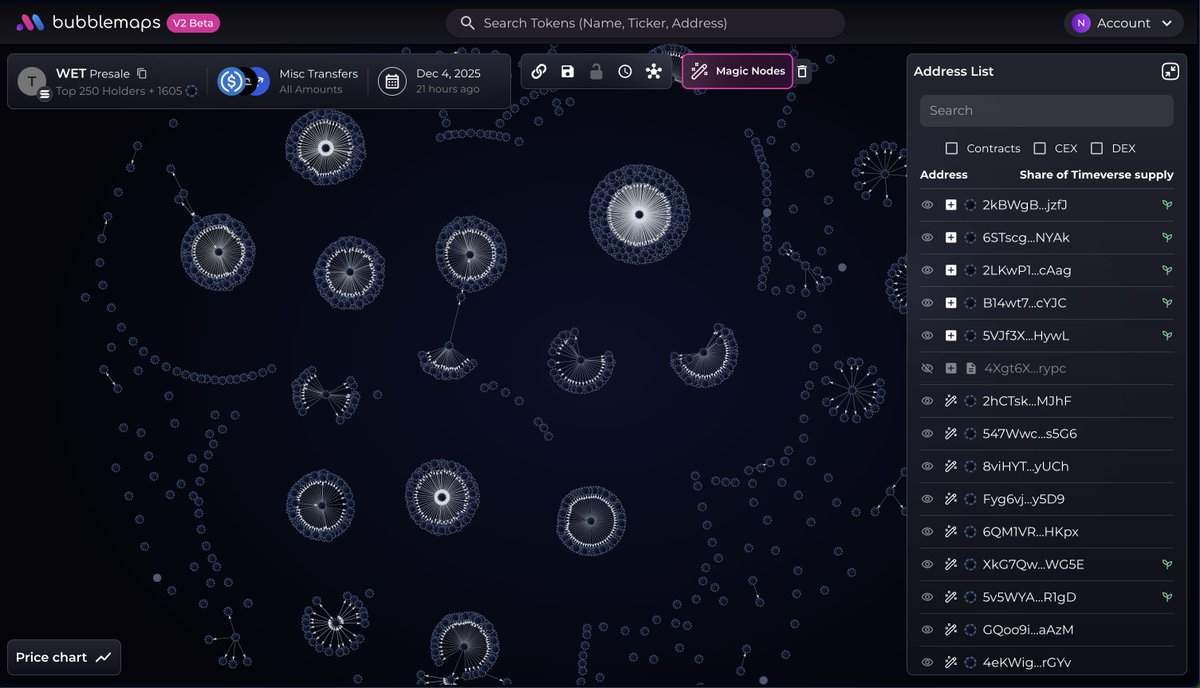

The real controversy, however, came from how the first round of the sale was executed. In the initial design, WET was to be offered primarily to HumidiFi users (the “Wetlist”) and JUP stakers. But on the night of launch, the contract entry point was detected early, and a large number of bots used batches of wallets to submit transactions simultaneously, consuming most of the allocation within a very short time. On-chain analysis indicates that at least several thousand addresses were controlled by a single entity, which in aggregate captured around 70% of the presale allocation: each address had been pre-funded with exactly 1,000 USDC from an exchange, and then collectively submitted subscription transactions to the DTF smart contract. By the time these “scientists” had completed their batch purchases, many regular users’ sale interfaces had not even fully loaded; what was originally framed as a “community-facing public sale” effectively turned into an allocation battle among a very small group of participants.

Data Source: https://v2.bubblemaps.io/map/KrzRTTwcXnIb2VmxswiW

In response to strong community backlash, HumidiFi and Jupiter opted to “reset and restart.” The teams announced that the initial WET sale would be abandoned and no longer supported, and that a new token would be issued with the public sale relaunched. Eligible Wetlist users and JUP stakers will receive new token airdrops and allocation rights based on on-chain records, while addresses identified as bots or Sybil participants will only be able to reclaim their principal and will be excluded from future distributions. The new sale will be conducted using an upgraded, audited version of the DTF contract, with stricter anti-Sybil parameters at both the allocation and address levels. Taken together, this episode has both amplified the visibility of Solana dark-pool DEXs in terms of liquidity and execution structure, and highlighted the structural tension between “high-performance chains + first-come-first-served launches” and “fair distribution.” Whether future public sales can combine tools such as whitelists, raffles/auctions, and on-chain identity weighting in a more mature way will largely determine if this new wave of ICO enthusiasm can evolve from a sentiment-driven spike into a more sustainable upgrade of primary-market infrastructure.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.