Locking in Yield Amid Volatility: A Deep Guide to How to Sell Options Against Bitcoin

2025/11/20 02:18:01

I. Introduction: Generating Steady Returns in a Volatile Market

Source: Bitcoin Sistemi

The Bitcoin market is renowned for its extreme price volatility. While this volatility offers high-reward opportunities for speculators, holding only spot assets often feels passive for investors seeking stable cash flow or risk hedging. This is where Cryptocurrency Options Strategy becomes a powerful tool.

Many investors focus on buying Call or Put options to bet on directional movements, but smart investors know that the real "Alpha" often lies in the role of the Option Seller. Selling options essentially means earning the market's "time value" (Theta) and "volatility premium" (Vega).

This article will comprehensively explore the core strategies, operational steps, advanced concepts, and risk management of how to sell options against bitcoin, helping you convert volatility into a continuous, structured income stream.

II. Fundamentals: Understanding the Crypto Option Seller Role and Pricing Principles

Before diving into the practical execution of how to sell options against bitcoin, we must clearly understand the option seller's role and the composition of option value.

2.1 Option Value Composition and Seller's Advantage

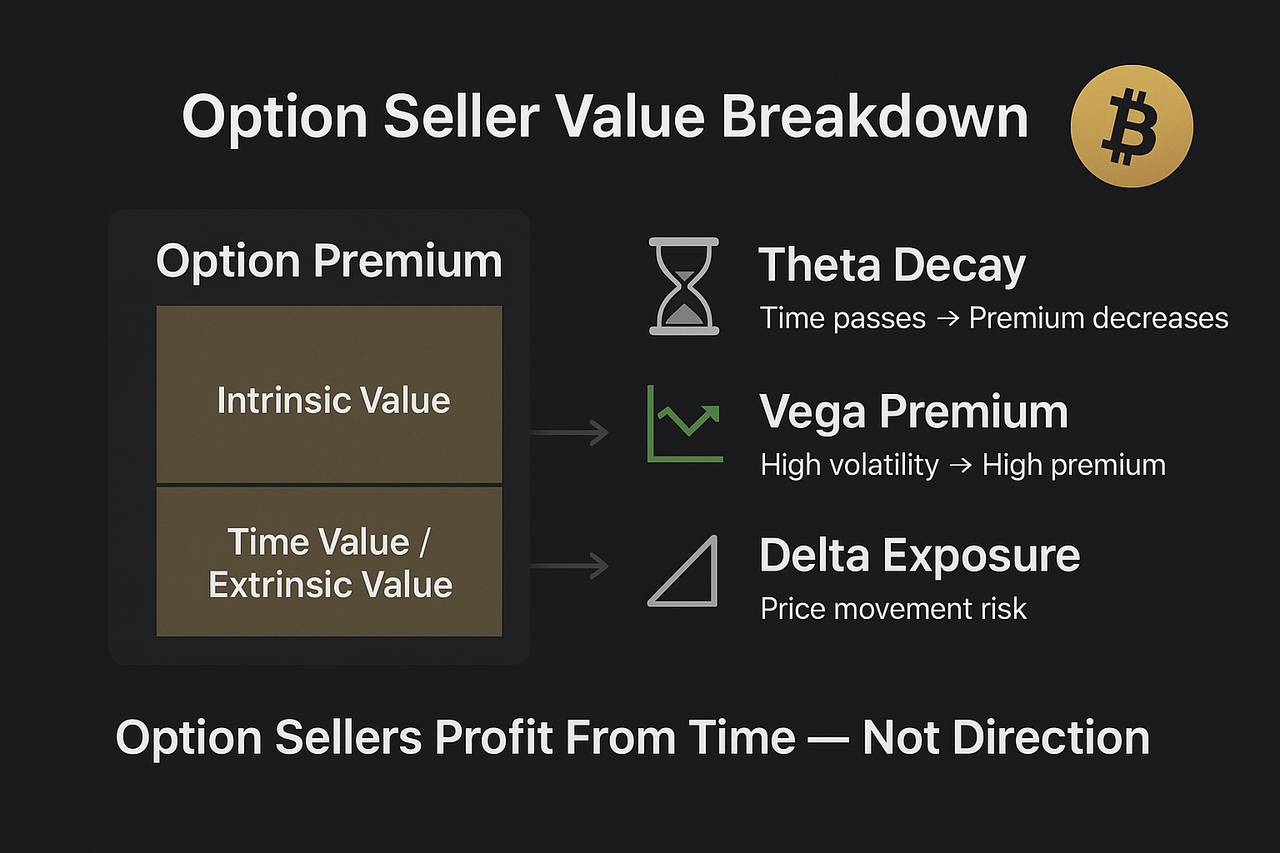

The price (Premium) of any option contract consists of two parts:

-

Intrinsic Value: The profit that would be realized if the option were exercised immediately.

-

Time Value (Extrinsic Value): The additional value assigned due to the potential for the asset to move before the expiration date. This is the seller's primary source of profit.

The advantage of the option seller is that as time passes (Theta decay effect), the option's time value constantly diminishes and eventually expires worthless. As long as the price doesn't change drastically, the option seller is likely to retain all or most of the premium. Therefore, how to sell options against bitcoin is essentially a game of probability, where the seller bets that the market will not experience sudden, unexpected volatility in the short term.

2.2 The Greeks and Seller Risk

Professional option traders must understand the "Greeks" to manage risk:

-

Theta ($\Theta$): Represents time decay. It is positive for the seller; the longer the time, the more beneficial.

-

Vega ($\nu$): Represents the impact of volatility changes on the option price. Increased volatility raises the option price (bad for the seller); decreased volatility lowers it (good for the seller). Option sellers are natural sellers of volatility.

-

Delta ($\Delta$): Represents the change in the option price for every one-unit change in the underlying asset price. A sold Call option has negative Delta, while a sold Put option has Delta close to -1 or +1 (deep in-the-money).

III. Core Strategies: How to Earn Premium by Selling Bitcoin Options?

Among all the strategies for how to sell options against bitcoin, we will focus on two mature and relatively safe approaches.

3.1 Strategy One: Covered Call – Enhancing Returns

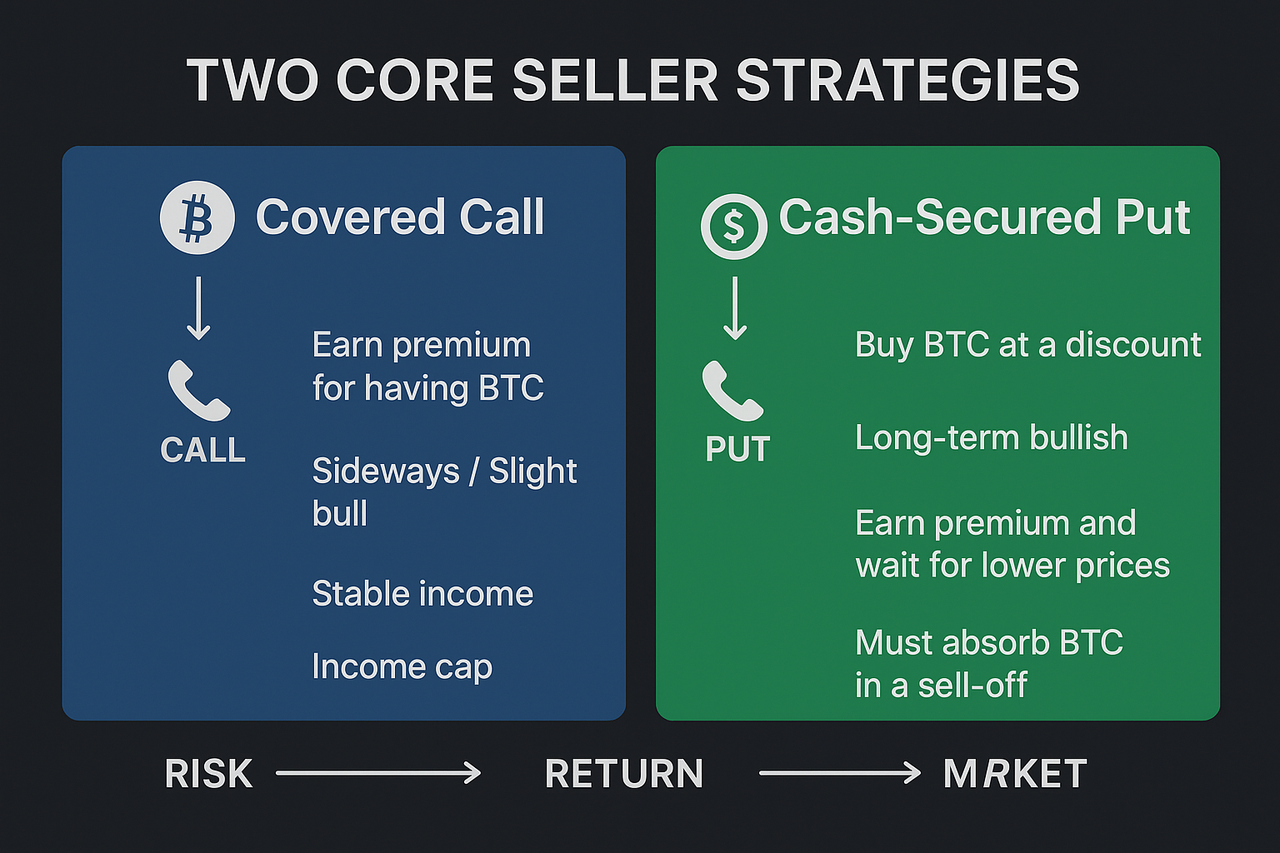

The Covered Call strategy is executed when you already hold spot Bitcoin and sell an equal number of Call options. This is one of the lowest-risk Cryptocurrency Options Strategy because the spot holdings fully collateralize the position.

Income Philosophy: Earn Bitcoin Options Income while hedging against sideways markets or minor price dips.

-

Execution Details: Ideally, sell Slightly Out-of-the-Money (OTM) Call options, where the strike price is slightly above the current Bitcoin market price. This maximizes the premium received and allows the Bitcoin price some room to move up.

-

Advanced Application: Roll Out & Roll Up/Down: If you do not wish to be exercised, you can "Roll Out" the sold option to a further expiration date as the current one approaches, adjusting the strike price (Roll Up/Down) simultaneously.

3.2 Strategy Two: Cash-Secured Put – Building a Position at a Discount

Selling Put options is suitable when you are bullish on Bitcoin long-term and are willing to buy at a lower price. You must deposit sufficient cash (stablecoins) as collateral (Cash-Secured).

Income Philosophy: "Passive Accumulation." If the price drops to your target, you buy at that price; if it doesn't, you keep the premium for free.

-

Execution Details: Sell Out-of-the-Money (OTM) Put options, where the strike price is your desired entry point. This method leverages time value, making it more efficient than simply setting a limit order.

IV. Advanced Concepts: Trading with Volatility

For professional investors seeking higher Bitcoin Options Income, understanding volatility is key.

4.1 Volatility Trading and Vega

Option sellers essentially sell volatility by collecting premium. If the market is currently in a state of High Implied Volatility (IV), the premium will be significantly high. At this time, executing the selling strategy of how to sell options against bitcoin is more attractive, as you believe the market's actual volatility (Historical Volatility) will not be as high as the option pricing suggests.

Golden Rule: Sell when IV is high, Buy to Close when IV is low.

4.2 Introduction to Gamma Scalping

Gamma Scalping is a complex strategy that utilizes the Gamma (the rate of change of Delta) obtained from selling options to hedge and earn additional Delta profits during market chop. This means the option seller can dynamically hedge by buying or selling the underlying spot asset when the price moves against the position, locking in profit. This requires high-frequency trading and an acute sensitivity to market movements.

V. Practical Guide: Platform Selection and Operational Essentials for How to Sell Options Against Bitcoin

Executing how to sell options against bitcoin requires selecting the appropriate Crypto Options Trading Platform.

5.1 Platform Selection and Considerations

-

Regulation and Security: Prioritize platforms regulated by major financial institutions or those with strong reputations, such as Deribit (focused on crypto options), CME Futures/Options (regulated traditional financial derivatives), or the options products offered by Binance/OKX.

-

Liquidity: Ensure that the contracts for your chosen strike price and expiration date have sufficient bid and ask depth to prevent Liquidity Risk that could hinder closing the position.

-

Margin System: Understand the platform's margin requirements and forced liquidation mechanisms, which are central to Option Seller Risk Management.

5.2 Operational Procedure and Tax Considerations

-

Opening the Position: On the trading interface, confirm that the action is "Sell to Open," not "Sell to Close."

-

Contract Units: Note that Bitcoin options contracts are typically denominated in units of 0.1 BTC or 1 BTC.

-

Tax Compliance: Premiums received from selling options are generally considered income, and final expiration or closing may result in capital gains or losses. Investors must consult with a professional tax advisor to ensure compliance with the cryptocurrency tax laws in their jurisdiction.

VI. Risk and Reward Management: Key Points for Option Sellers

While how to sell options against bitcoin offers stable income, Option Seller Risk Management is the key to success:

-

"Black Swan" Risk: Although the Covered Call is relatively safe, extreme market events (e.g., exchange failures, sudden regulatory changes) can cause significant losses to both your spot and options positions simultaneously.

-

Upside Cap: The biggest drawback of the Covered Call is limiting your upside potential (income capped at the strike price). You must accept sacrificing potential massive gains for a certain premium.

-

Dynamic Hedging: Successful sellers don't just sell and forget. They actively manage their Delta by buying or selling small amounts of spot assets to maintain risk neutrality, requiring continuous monitoring and capital deployment.

VII. Conclusion and Outlook: The Long-Term Value of Selling Options

By mastering the core strategies and advanced knowledge of how to sell options against bitcoin, particularly the Covered Call, investors can transform their Bitcoin holdings into a continuous cash-flow generating machine. This not only brings additional Bitcoin Options Income to your portfolio but also allows you to effectively lower your overall cost basis while waiting for the next bull cycle.

For investors who wish to play a more active role in decentralized finance, selling options offers an advanced, complex, yet highly rewarding financial instrument. By skillfully applying this strategy, combined with an understanding of the Options Greeks and Volatility Trading, you will be able to navigate the volatility of the cryptocurrency market and become a smarter, more professional investor.