Bridging Reality to Web3: The Power of Real World Assets (RWA)

2025/08/15 11:39:02

Web3 has long been envisioned as a new, decentralized internet, but its full potential has been constrained by a disconnect from the vast and stable value of the real world. This era of a crypto-native island is now giving way to a new paradigm, anchored by Real World Assets (RWA). These are not just new assets to trade; they are the critical infrastructure that will build the bridge between physical wealth and decentralized innovation. By tokenizing everything from government bonds to real estate, RWA is providing the essential link to create a more robust, stable, and economically integrated digital future. This transformation is not just changing what we can invest in, but how we define value in a global, digital society.

From Digital Tokens to Tangible Value

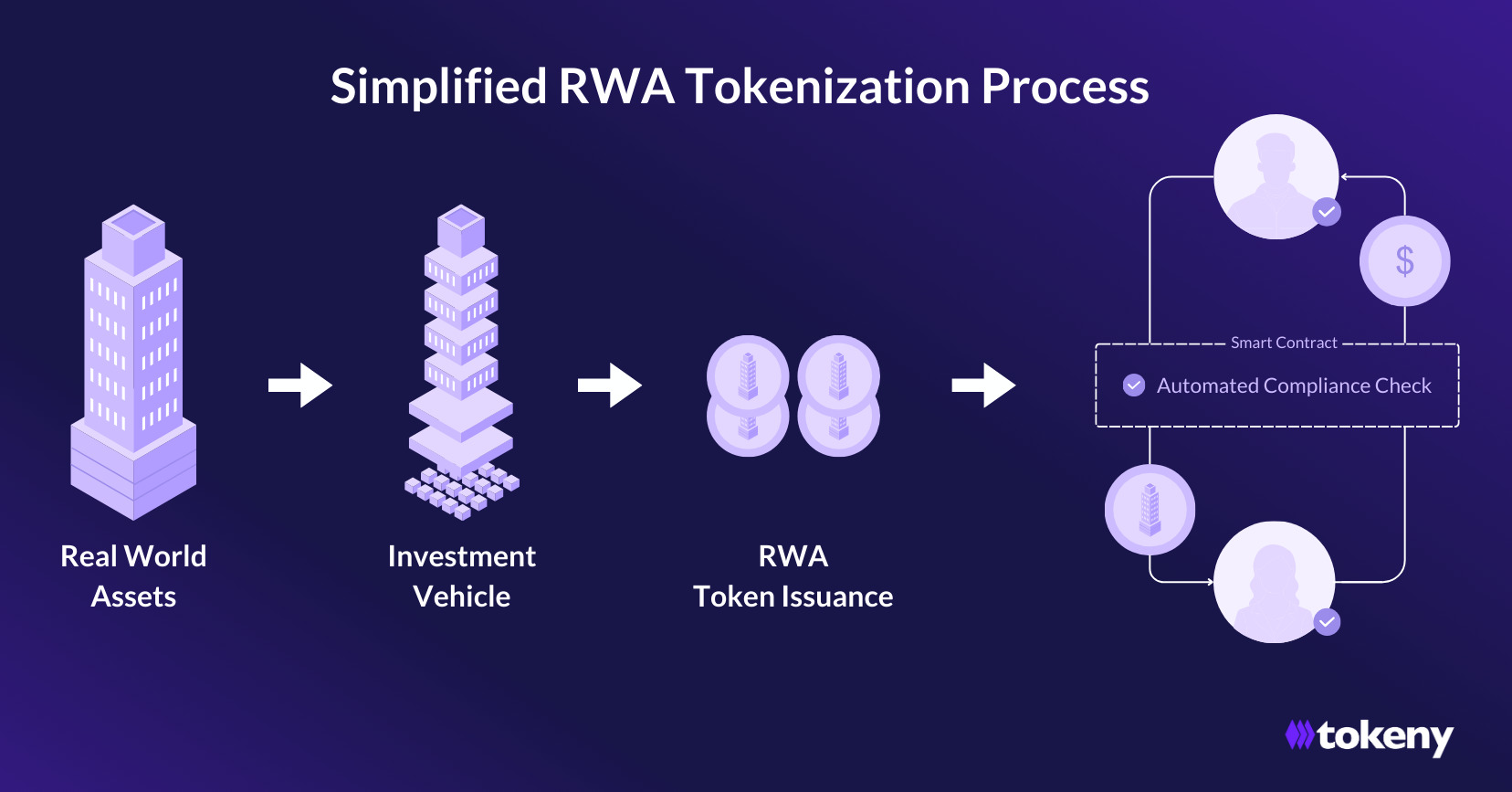

At its core, Real World Assets are any tangible or intangible assets that exist outside the blockchain but are represented on-chain. The process of bringing these assets onto the blockchain, known as tokenization, allows traditionally illiquid assets to be traded with the efficiency and transparency of digital currencies. This process fundamentally transforms their utility within the Web3 ecosystem.

Image: tokeny

For the first time, a decentralized credit system can be built on a foundation of stable, real-world value. Previously, lending in DeFi was heavily reliant on volatile crypto assets, leading to a fragile ecosystem. With RWA, a user can now secure a loan using a tokenized stake in a commercial property, a government bond, or even private credit. This introduces a new layer of stability and capital efficiency, crucial for attracting institutional investment and fostering a more mature financial system.

For tutorials on trading RWA, please visit our how-to-buy page >>>

Anchoring the Web3 Economy

RWA addresses a key limitation of the early Web3 economy, which was rich in speculative tokens but lacked a deep, diversified economic layer. The integration of real-world assets provides a vital anchor, offering stability and utility that goes beyond mere speculation.

-

A Reliable Credit System: RWA enables the creation of a more robust on-chain credit system. Imagine a Web3where your on-chain credit score is built not just on your history of crypto transactions, but on the verifiable value of the RWA you hold. This can unlock a new class of financial services, from under-collateralized loans to more sophisticated lending products.

-

Deeper Economic Layer: By bringing multi-trillion-dollar industries like real estate and private credit on-chain, RWA dramatically expands the economic landscape of Web3. This introduces a diversity of assets that can generate predictable yield, providing a powerful hedge against the inherent volatility of crypto markets.

-

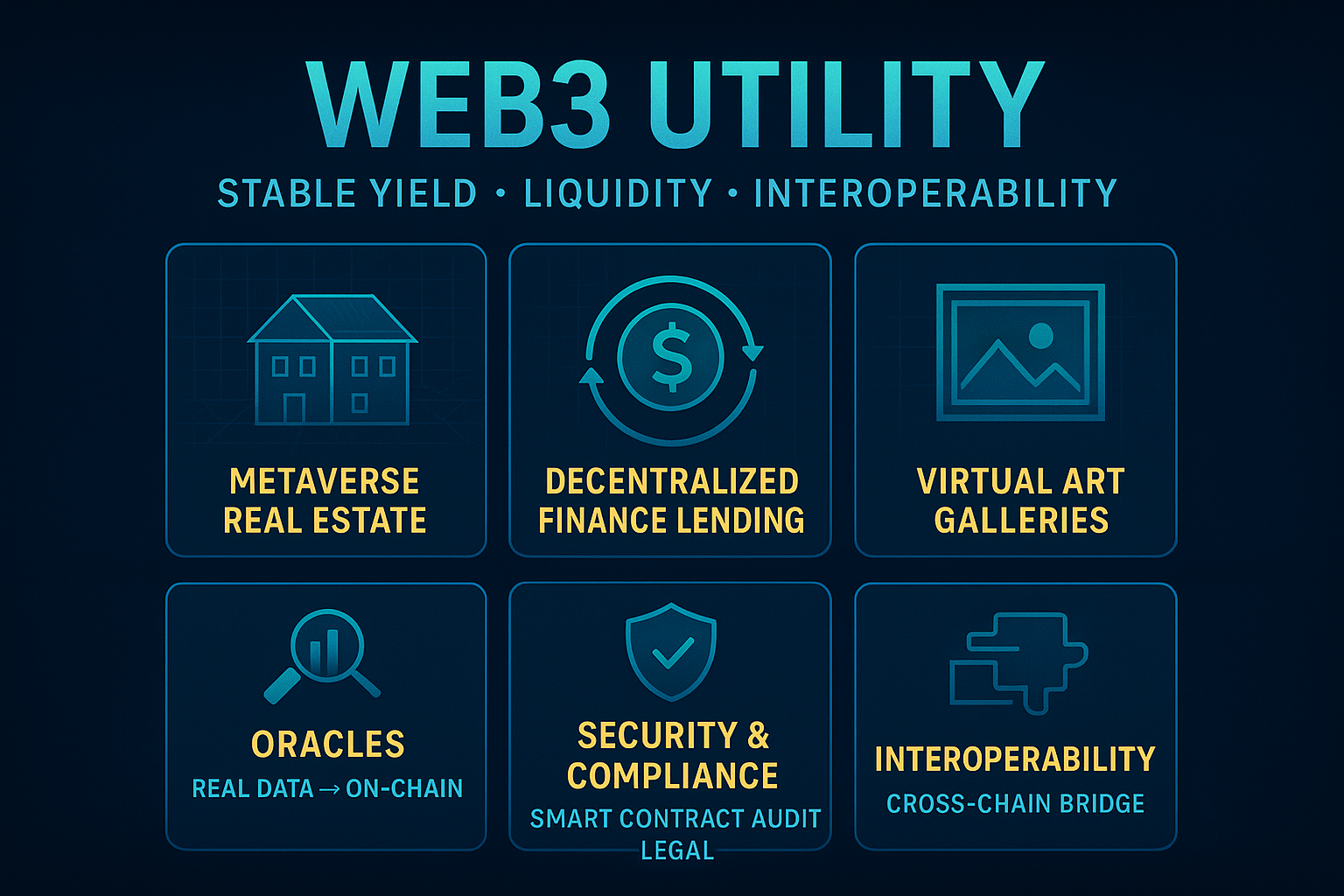

Enhanced Utility in the Metaverse: The metaverse and virtual economies need a solid economic foundation to thrive. RWA provides this by allowing physical assets to have a digital presence and utility. A tokenized piece of real-world land could serve as collateral for a digital land purchase, or a tokenized portfolio of art could be showcased and traded in a virtual gallery. This convergence creates a richer, more interconnected digital world.

The Role of Technology: Securely Connecting Two Worlds

Building this bridge between reality and Web3 requires sophisticated technology and robust security. A primary challenge is ensuring that the off-chain data and legal status of an asset are accurately and securely reflected on-chain. This is where the underlying Web3 infrastructure plays a critical role.

-

Oracles: Reliable oracle networks are essential for securely feeding real-world data, such as asset valuations or interest rates, onto the blockchain. These decentralized data providers ensure that the on-chain representation of an RWA remains a truthful and verifiable reflection of its off-chain value.

-

Security and Compliance: The tokenization of physical assets requires a framework that addresses legal compliance and security. The underlying blockchain protocols and smart contracts must be audited and battle-tested to protect against vulnerabilities. This focus on security is non-negotiable, as the value at stake is not just digital, but tied to tangible, real-world wealth.

-

Interoperability: For RWA to truly be a global bridge, the assets must be able to move seamlessly across different blockchains. Cross-chain interoperability solutions are key to ensuring that a tokenized asset can be utilized in various Web3 ecosystems, maximizing its utility and liquidity.

The Connected Future

The fusion of RWA and Web3 is more than just a passing trend; it is the natural evolution of both traditional and decentralized finance. By using RWA as a bridge, Web3 is moving beyond its self-contained bubble to become a powerful, integrated, and economically diverse digital society. This convergence promises a future where access to global investment opportunities is democratized, financial services are more efficient, and the lines between the physical and digital worlds become increasingly blurred. The bridge is being built, and the future is a connected one.

KuCoin and AlloyX: Forging a New Path with RWA

The financial world is undergoing a quiet but profound revolution. While many exchanges simply add real-world asset (RWA) tokens to their listings, KuCoin is taking a more fundamental and strategic approach. The recent partnership with AlloyX to launch a new RWA collateral initiative is a prime example. This collaboration isn't just about offering more tokens; it's about building the foundational infrastructure to unlock the true potential of RWA in decentralized finance (DeFi).

This partnership with AlloyX, a leading on-chain credit protocol, marks a significant shift. It demonstrates that KuCoin is moving beyond a simple trading platform to become a key player in the RWA ecosystem. By allowing users to lend and borrow against high-quality, tokenized credit and fixed-income assets, KuCoin is not just facilitating trades; it's enabling real-world capital to flow seamlessly into Web3. This initiative answers the crucial question of what RWA is for and sets a clear direction for the industry.

For details, you can refer to: KuCoin Partners with AlloyX to Explore RWA Token Collateral Mechanism Innovation, Enhancing User Asset Security and Liquidity