KuCoin Ventures Weekly Report: Crypto Under the Shadow of Japan's Rate Hike: Machi's Liquidation, Monad's Plunge, and Stablecoins Under Siege in the Liquidity Winter

2025/12/02 02:06:02

1. Weekly Market Highlights

1. Weekly Market Highlights

The Crossroads After a Stalled Rebound: Games and Sentiments in a Volatile Market

Last week, the crypto secondary market experienced several repeated whipsaws. The market did not simply choose a direction between bull and bear; instead, it staged a rollercoaster drama between "extreme fear" and "extreme greed," characterized by a "deep squat followed by a jump," only to face a "sudden blow." On one hand, supported by short-term technical oversold conditions, macro interest rate cut expectations, and the "die-hard bull" faith of institutions like MicroStrategy, BTC completed a V-shaped reversal from the desperate valley of $81,000 to a high of $92,000 in a short period, demonstrating good resilience. On the other hand, the cruelty of on-chain games and the violent fluctuations of individual assets caused aggressive funds attempting to capture excess returns in volatility to pay a painful price.

Data Source: https://coinmarketcap.com/currencies/monad/

In an environment lacking sustained incremental capital, the launch of the high-performance public chain Monad (MON) provided an excellent sample for observing asset pricing differences under different market structures. As a star project debuting on Coinbase, MON's trend also presented dramatic changes.

Since the main liquidity is concentrated on Coinbase, which has strong compliance attributes, the market presented more of a native, retail-dominated state of natural gaming. This structure led to extreme "emotional pricing." At the opening on November 24, under the resonance of airdrop selling pressure and retail panic, MON encountered a classic "Sell the News" scenario. The price fell rapidly, breaking the fundraising price and causing short-term panic of breaking below the public offering price.

In a market lacking strong controlling funds as a buffer, the remarks of opinion leaders were amplified along with emotions. As BTC rebounded, BitMEX founder Arthur Hayes shouted "$MON to $10," pushing MON to complete the final sprint of its V-reversal. However, just 2 days later, when Hayes announced he had "cleared his position," and against the backdrop of a weakening broader market, MON's price quickly returned to the public offering starting point and broke below it once again.

Looking back at last week, accompanied by the TGE and mainnet launches of "King-level" public chains, although on-chain narratives have warmed up to some extent, it is essentially still a rapid rotation and game of existing funds between different sectors. The ups and downs of Monad and the liquidation record of Machi Big Brother remind us of the fragility of market sentiment. However, the key to whether the market can truly step out of the quagmire of volatility lies not merely in the game of existing stock, but in the changes in external macro water levels. With the rising expectations of a Bank of Japan rate hike and new changes in global ETF fund flows, the "macro hand" is preparing to take over the market's pricing power again.

2. Weekly Selected Market Signals

Global Risk Appetite Slams the Brakes Post-Holiday: BOJ Hawkish Signals Trigger Reversal as Crypto Extends Its Decline Amid Shrinking Liquidity

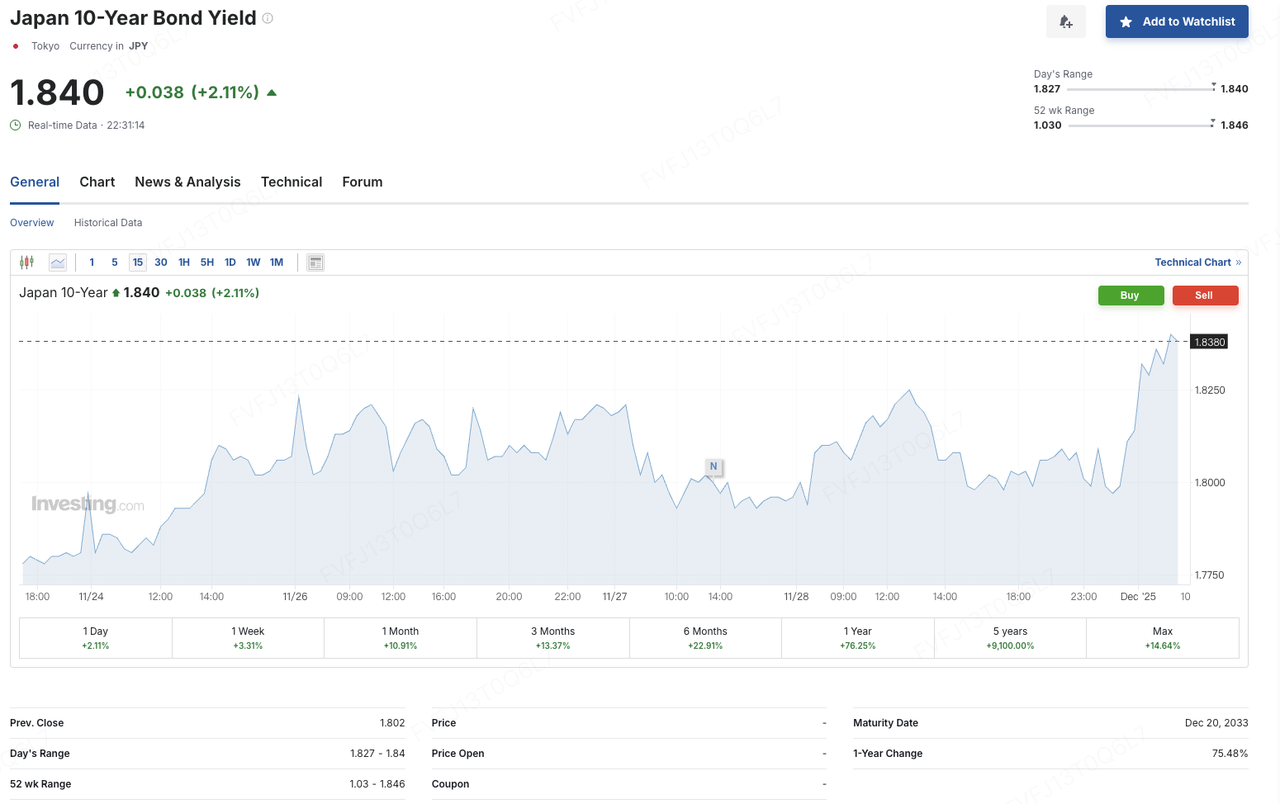

Last Friday, U.S. equities extended their Thanksgiving rally, with the S&P 500 and Nasdaq both logging five consecutive days of gains. The S&P in particular delivered its strongest Thanksgiving week performance since 2008. However, by early Monday, post-holiday optimism reversed sharply. In Japan, a new round of fiscal stimulus reignited concerns over debt sustainability, pushing the 2-year JGB yield to its highest level since June 2008.

At the same time, Bank of Japan Governor Kazuo Ueda delivered a speech in Nagoya and, unusually, provided a concrete time window for potential rate hikes — stating that the BOJ would “consider the pros and cons of raising the policy rate at the next monetary policy meeting” and “make the right decision on interest rates at the December meeting,” while emphasizing that if the economic outlook materializes as expected, the BOJ will start raising rates. Markets interpreted this as a strong signal toward ending the ultra-loose policy regime. Following his remarks, USD/JPY moved lower, the 10-year JGB yield climbed to around 1.84%, the 30-year yield rose to roughly 3.385%, the TOPIX extended losses to about 1%, and risk sentiment weakened across global assets.

Data Source: Investing.com

On top of this “global rate repricing,” the internal vulnerabilities of both equities and crypto were further exposed. MicroStrategy CEO Phong Le recently stated that the company would only consider selling bitcoin if its share price trades below per-share net asset value (NAV) and external funding channels become constrained. With recently issued preferred shares and other instruments gradually entering repayment and buyback windows, the company’s annual funding obligations are expected to reach roughly USD 750–800 million. Management plans to prioritize issuing new equity at prices above mNAV to meet these cash needs. This commentary has reinforced market concerns around a “high-leverage bitcoin treasury + heavy dependence on capital markets refinancing” model, making related assets more vulnerable to de-risking as rate and liquidity expectations tighten.

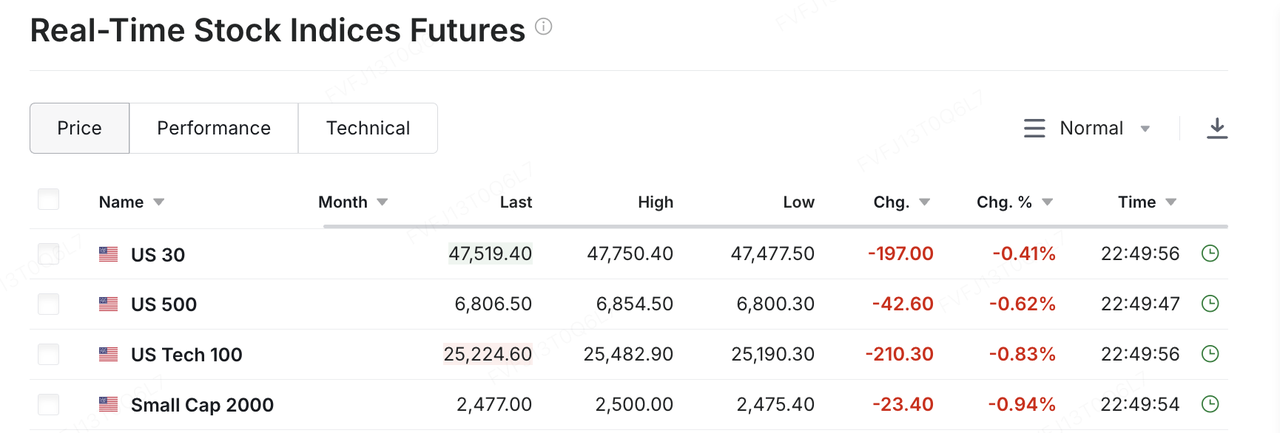

Against this backdrop of combined macro and structural pressures, U.S. equity futures, the Nikkei, and crypto assets all pulled back in early Monday trading. The post-holiday optimism anchored in a “soft landing + rate cuts” narrative quickly gave way to concerns about a policy shift in Japan and a renewed grind higher in global long-term yields — and that transition was immediately reflected in price action. After Thanksgiving, bitcoin briefly and steadily climbed from USD 86,000 to above USD 93,000, but failed to see meaningful follow-through backed by strong turnover.

Around 8:00 a.m. on December 1 (GMT+8), BTC dropped roughly 3.7% within an hour, sliding from near USD 90,000 to below USD 87,000. ETH fell from around USD 3,000 to the USD 2,800 area, and major altcoins saw another broad-based decline. On a monthly basis, BTC fell about 17.67% in November, marking its worst November performance since 2018 (when it dropped about 36.57% in the same month); ETH lost about 22.38% in November, likewise its weakest November since 2018. Bitcoin dominance is holding around 58%, and overall market sentiment remains in the “fear” zone.

Data Source: CoinGlass

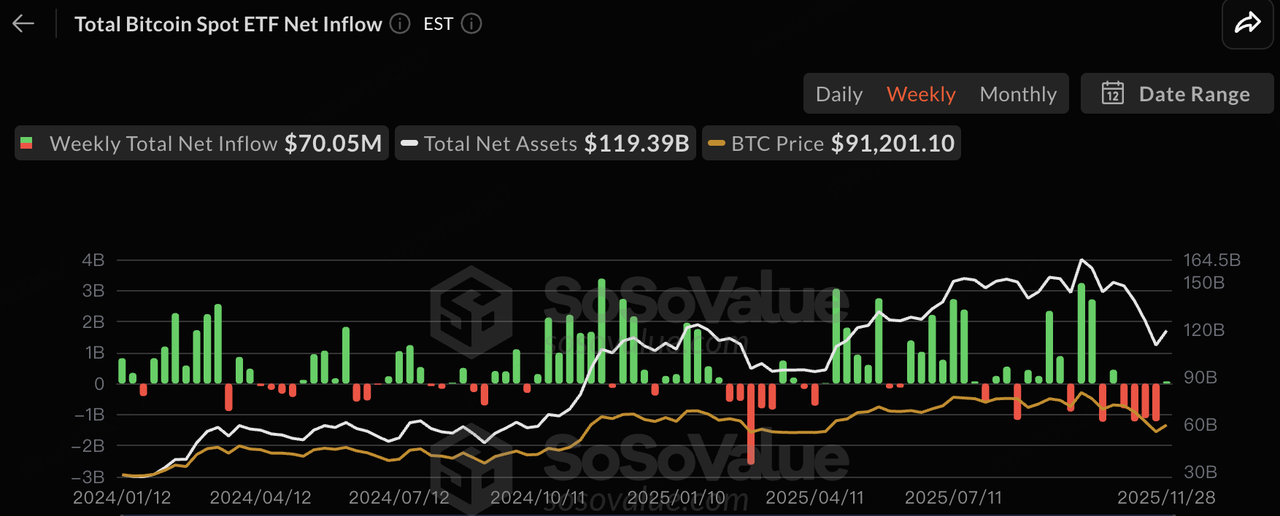

From a volume and liquidity perspective, the crypto market in November effectively moved into a “weak price, weak turnover” regime. According to The Block, total CEX spot trading volume fell to roughly USD 1.59 trillion in November, down about 26.7% from October and at its lowest level since June this year. In parallel, off-exchange “spot-like” channels also saw outflows: U.S. spot bitcoin ETFs recorded net redemptions of around USD 3.48 billion in November, the largest monthly outflow since February.

On a weekly basis, however, pressure eased somewhat. In the latest week, BTC and ETH spot ETFs snapped a four-week streak of net outflows, posting net inflows of roughly USD 70.05 million and USD 312 million respectively. This suggests some medium- to long-term capital is cautiously re-entering at lower levels, though the scale is not yet sufficient to reverse the broader backdrop of tight funding conditions.

Data Source: SoSoValue

In terms of capital structure, divergence within the ETF ecosystem continues to widen. On one hand, Cristiano Castro, Head of Business Development for BlackRock Brazil, noted in an interview that the firm’s bitcoin ETF has become one of its most profitable product lines, with first-year net inflows exceeding USD 52 billion — far outstripping the combined flows into other ETFs launched over the past decade. This provides a tangible example for traditional asset managers considering sustained expansion of their digital asset offerings. On the other hand, under the new rules, a wave of altcoin ETFs (including Solana, XRP, Dogecoin, etc.) has come to market. These products did not go through individualized, case-by-case SEC approvals; instead, they leveraged a unified “generic listing standard” and the little-known Rule 8(a) mechanism to become effective almost automatically, effectively fast-tracking launches under a framework of regulatory acquiescence and accelerating the integration of crypto assets into the traditional ETF ecosystem.

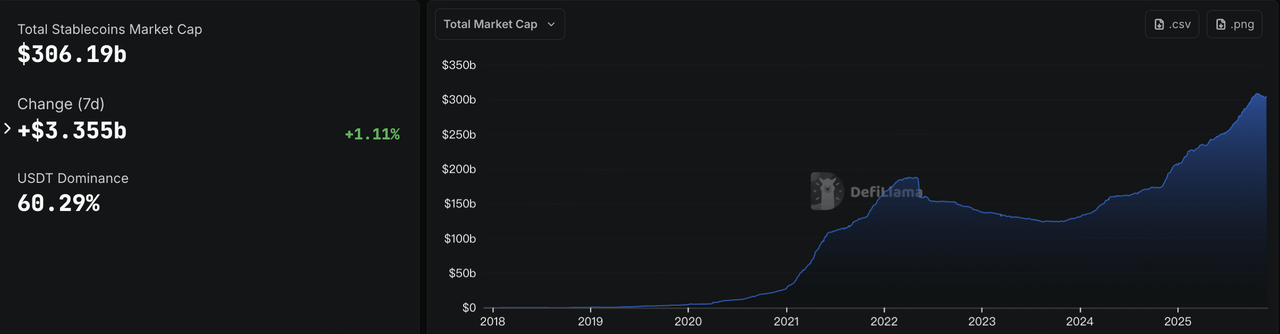

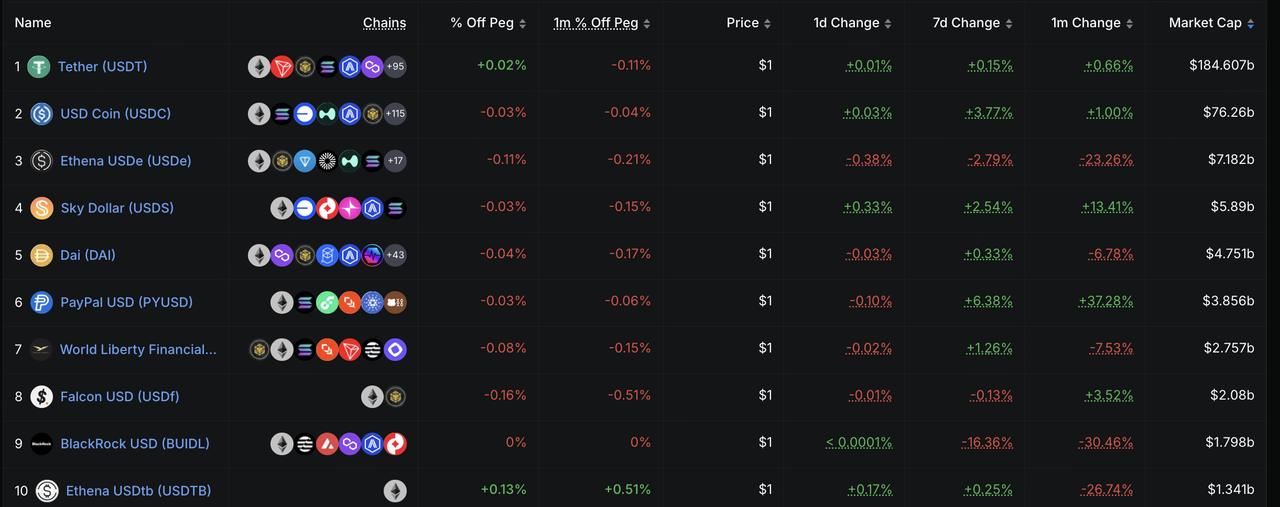

On-chain liquidity tells a similar story. After several consecutive weeks of decline, total stablecoin market capitalization turned higher again this week, climbing back above USD 306 billion. USDC was the primary driver of this rebound, with circulating supply up about 3.77% over the past week. Against the backdrop of weaker CEX spot volumes and drawdowns in BTC/ETH, this stands out as a rare positive signal in a “liquidity winter,” and indirectly suggests that some capital is rotating from risk assets into more neutral stablecoin holdings.

Data Source: DeFiLlama

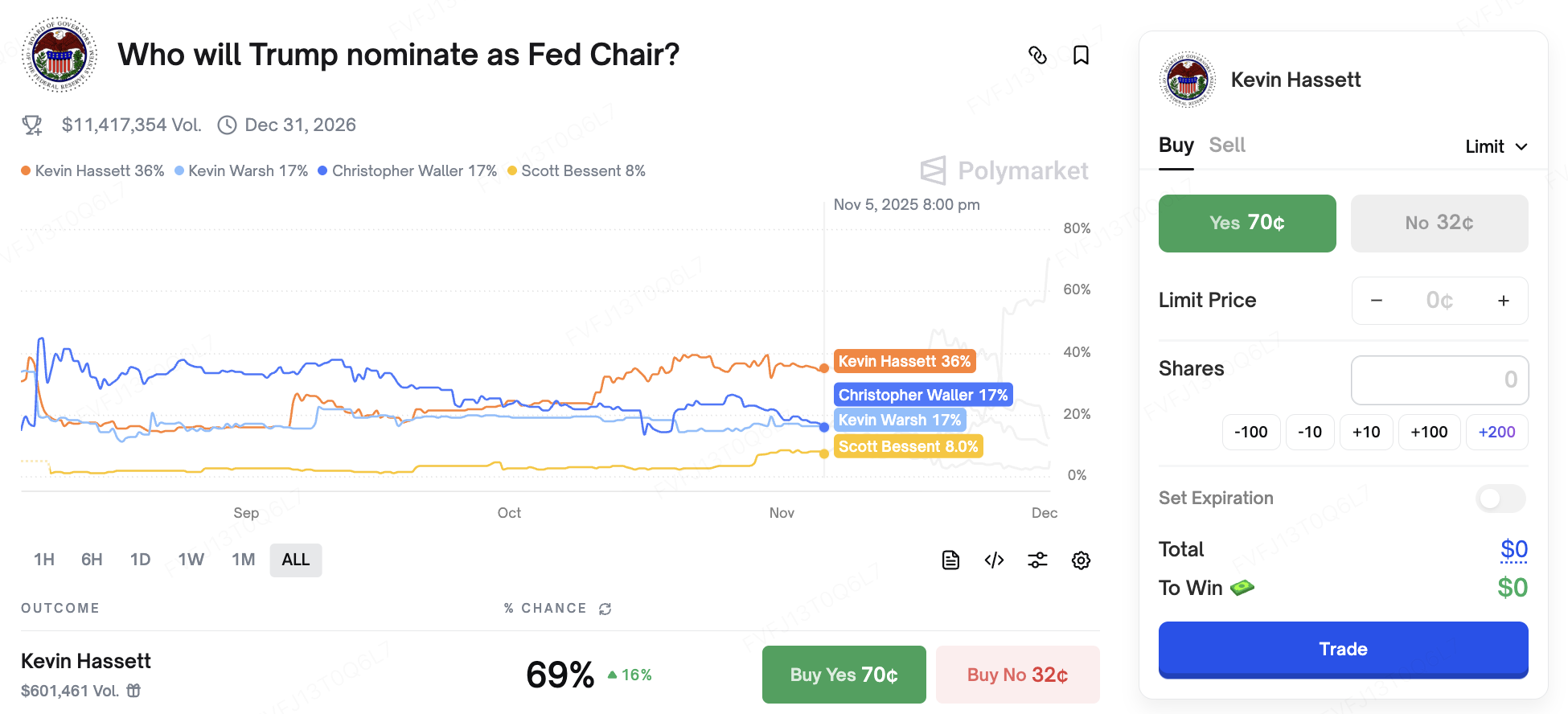

On the rates side, the macro narrative remains volatile. This Tuesday, Fed Chair Jerome Powell will deliver remarks at a commemorative event — the topic has not yet been disclosed, and markets will be watching closely for any hints regarding the December FOMC meeting. Politically, U.S. election-related uncertainty is also starting to feed into rate expectations: in his latest comments, Donald Trump said he has “already decided” who he wants as the next Fed Chair and will announce the pick “very soon.” Markets widely view former White House Council of Economic Advisers Chair Kevin Hassett as one of the leading contenders. On Polymarket, his implied probability of being appointed has at times approached 70%, and he is broadly perceived as a “rate-cut + tax-cut” dove.

Data Source: Polymarket

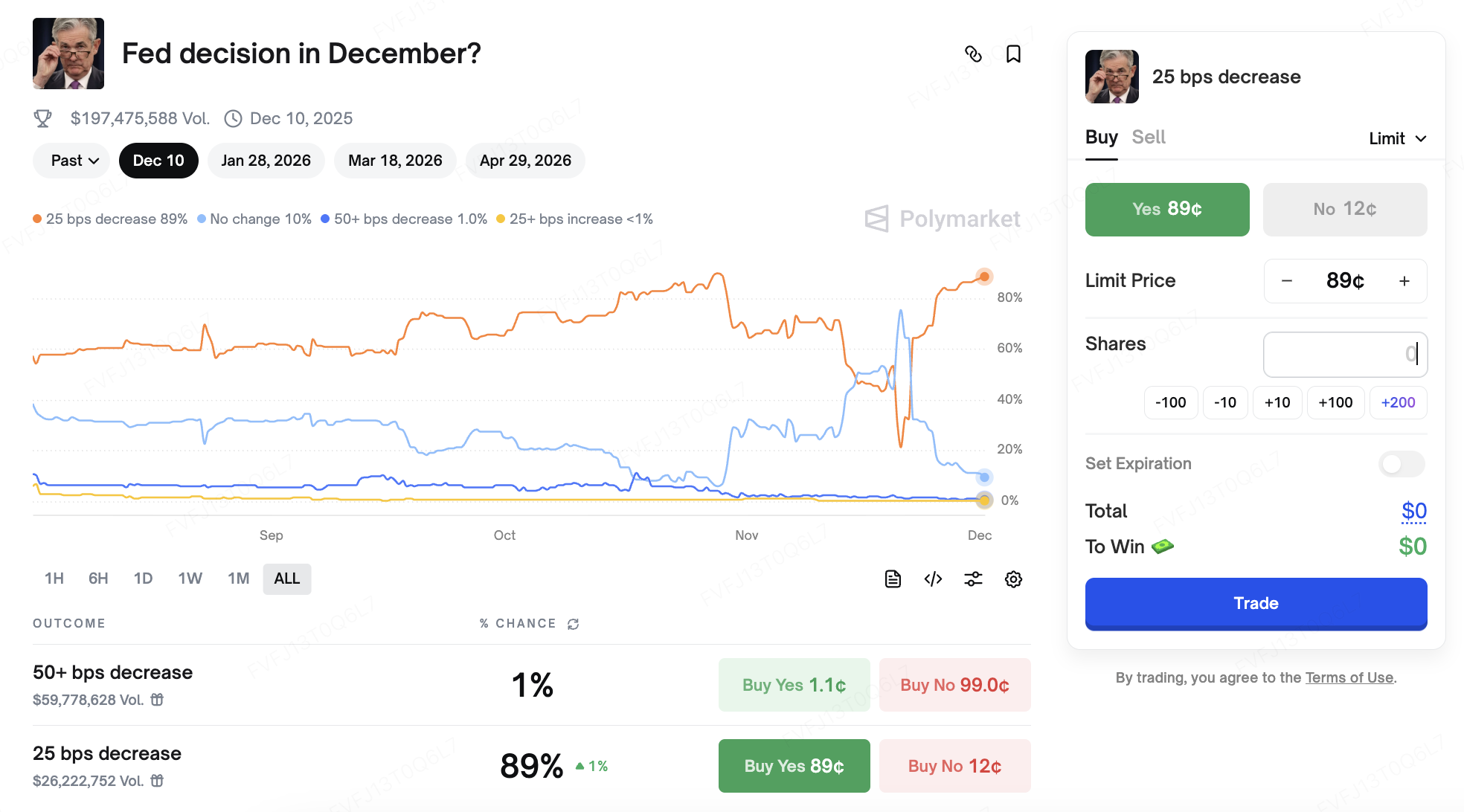

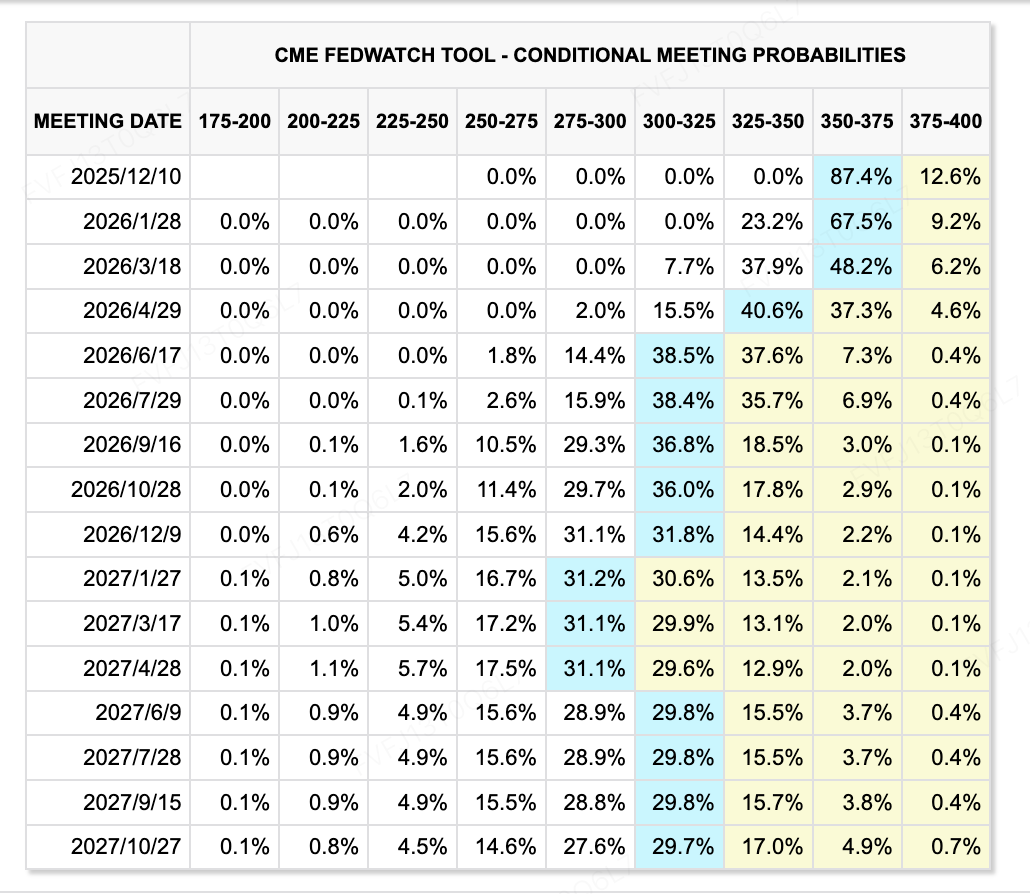

On the data front, November PPI came in significantly below expectations, indicating further easing in inflation pressures. The CME FedWatch tool shows that market expectations for additional rate cuts over the coming period have climbed to around 87.4%. At the same time, the delicate balance between “falling inflation, pressure on asset prices, and the risk of tighter financial conditions” is making forward pricing of the rate path increasingly volatile.

Data Source: CME FedWatch Tool

Key Events to Watch This Week:

-

December 1: China PMI releases; U.S. November ISM Manufacturing Index.

-

December 1: U.S.–Russia talks, with markets watching closely for any signals on the Russia–Ukraine situation.

-

December 5: The U.S. will release previously delayed macro data, including the September PCE report (widely viewed as the Fed’s preferred inflation gauge) and personal income figures. These prints will be key inputs for the December 9–10 FOMC meeting. The Fed has now entered its blackout period.

-

AI catalysts: Amazon will hold a tech conference this week, with focus on the Trainium3 chip and Nova model updates; Nvidia will attend UBS’s Global Technology and AI Conference on December 2, where commentary and guidance could further influence risk appetite in tech and AI-linked assets.

Primary Market Financing Observation:

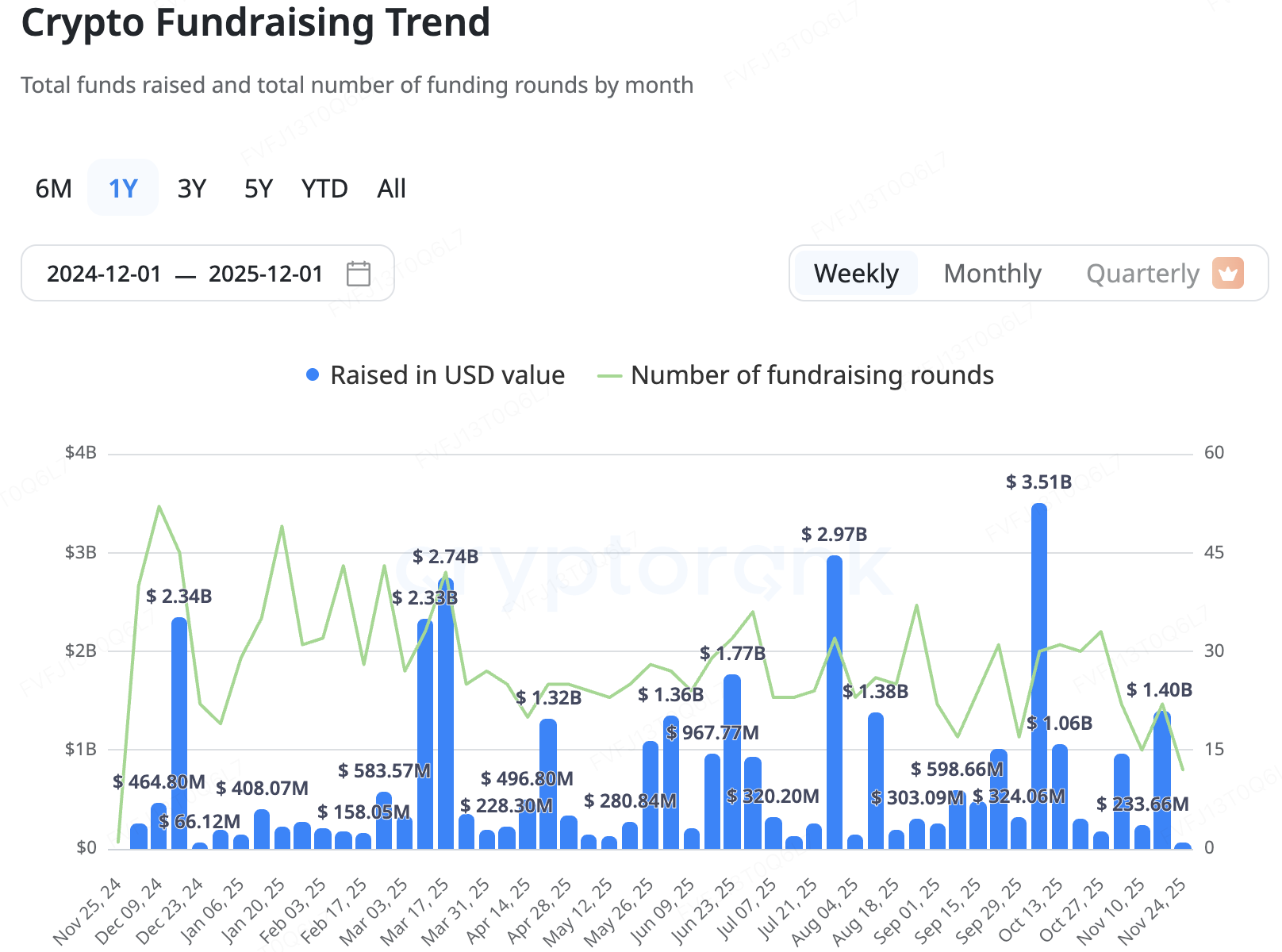

This week, the crypto-native primary market continued to show signs of “cooling.” According to CryptoRank, the total amount of disclosed equity and token financings over recent weeks remains near the lower end of this year’s range. Deals are still happening, but average round size has shrunk, and more incremental activity is now concentrated in IPOs, post-IPO transactions, and M&A — i.e., “late-cycle” deals where capital prefers regulated platforms and core infrastructure assets.

Data Source: CryptoRank

At the regional regulated exchange level, Korea saw a landmark transaction. Upbit’s parent company Dunamu and Naver’s financial subsidiary Naver Financial announced an all-stock deal valued at approximately USD 10.3 billion. Under the terms, Dunamu shareholders will receive 2.54 newly issued Naver Financial shares for each Dunamu share. Legally, Dunamu will become a wholly-owned subsidiary of Naver Financial once the transaction closes. Economically, however, the structure is closer to a “reverse merger”: the substantial new-share issuance means existing Dunamu shareholders will become the largest shareholder bloc of Naver Financial, effectively making Upbit-linked shareholders the key decision-makers behind the combined financial platform. Markets broadly view this as a flagship example of integration between a “domestic internet giant and a leading compliant CEX,” and also as creating a vehicle that could, in the future, evaluate a potential Nasdaq IPO or other overseas listing paths via the combined entity — though management has so far given no formal timetable.

In Hong Kong, HashKey Group has passed the Hong Kong Stock Exchange listing hearing and plans to list on the Main Board. Market expectations put the potential fundraising size in the several-hundred-million-dollar range. If successful, HashKey would likely become one of the first fully compliant digital asset groups to list under Hong Kong’s new virtual asset regime, providing the market with an initial public valuation benchmark for an integrated “exchange + asset management + brokerage” model.

Paxos Acquires Fordefi for Over USD 100 Million to Strengthen Stablecoin and Tokenization Infrastructure

New York-regulated blockchain infrastructure provider Paxos announced the acquisition of institutional-grade MPC wallet provider Fordefi, with multiple media reports citing a deal value north of USD 100 million. Founded in 2021 and operating out of Tel Aviv and New York, Fordefi serves nearly 300 institutional clients with multiparty computation (MPC) wallets and DeFi access infrastructure. Its platform processes more than USD 120 billion in on-chain transaction volume per month, and its 40–50-person team will be retained and further expanded post-merger.

Paxos, for its part, is the issuer of several regulated stablecoins and tokenization products, including USDP, PAXG, and PayPal’s PYUSD. Its underlying infrastructure already powers custody and settlement for large financial and fintech institutions such as PayPal, Mastercard, and Nubank. By integrating Fordefi’s MPC wallet and DeFi connectivity stack, Paxos is effectively packaging “regulated custody + non-custodial institutional wallet + DeFi access” into a single solution: one that simultaneously meets institutional requirements for asset safety and auditability, while enabling controlled participation in DeFi liquidity, lending, and yield strategies.

Structurally, the deal underscores a broader trend toward vertical integration between “stablecoin issuance and wallet infrastructure,” helping traditional financial institutions solve three core pain points — asset custody, key management, and on-chain interaction — within a single vendor ecosystem. At the same time, it sends a clear signal about where the next leg of institutional demand may concentrate: on hybrid models that combine regulated custody with DeFi access, rather than on standalone custody or single-product stablecoin issuance.

Key variables to watch going forward include: the degree of brand and product-line independence Fordefi retains within Paxos; the growth rate of assets under custody and control (AUC/AUM) across the combined custody and wallet businesses; and the share of Paxos-issued stablecoins used in institutional payments, settlement, and DeFi activity. Together, these metrics will determine how much this acquisition ultimately amplifies the “regulated infrastructure” narrative — and how durable that impact proves to be.

3. Project Spotlight

Tether Rated "Junk", Stablecoins Make Waves Again

Last week, two forces from the East and the West coincidentally targeted stablecoins, revealing that both the market and regulators still harbor concerns about this track full of fantasy and hot money.

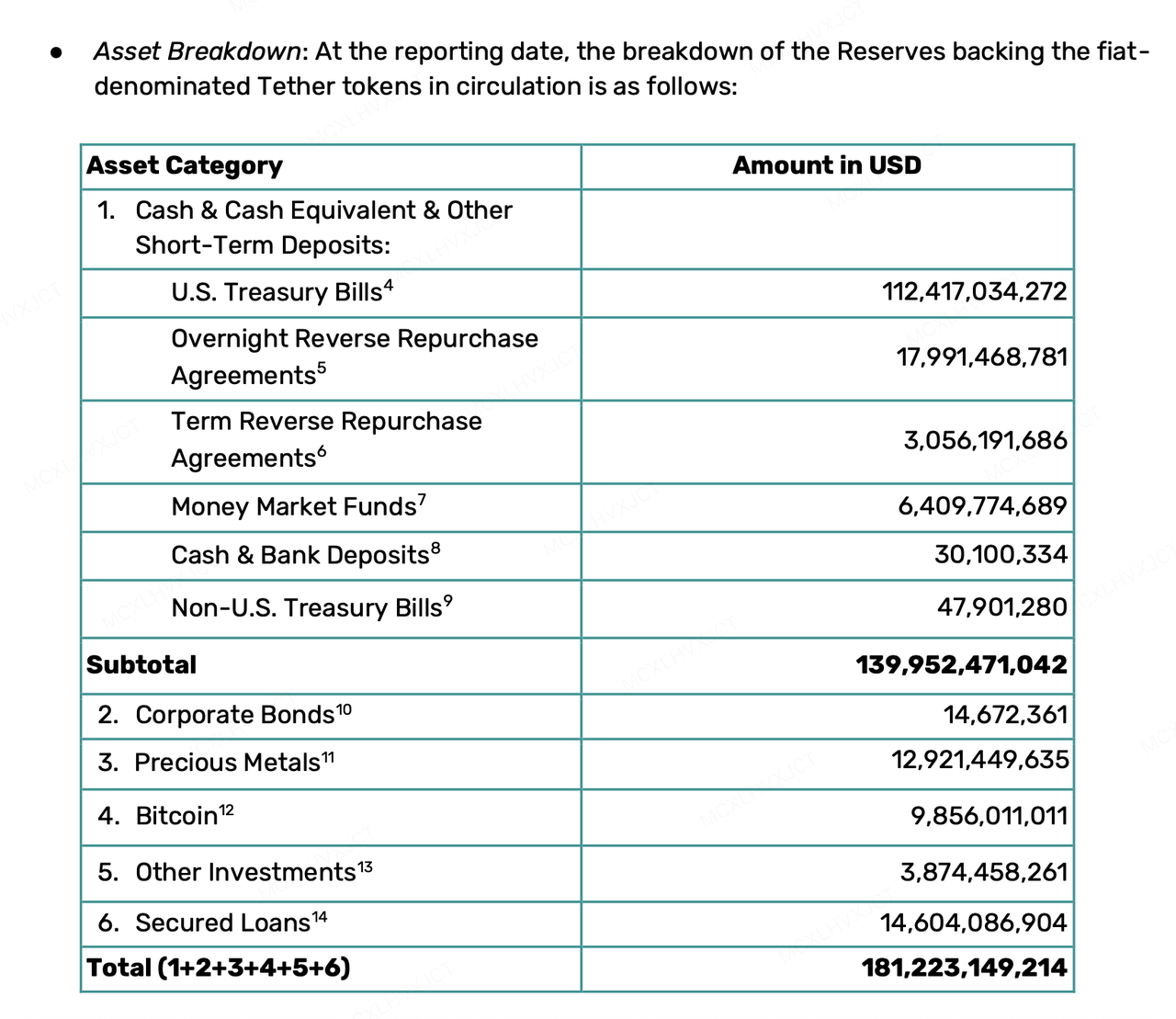

On November 26, S&P Global Ratings launched a fierce offensive against the crypto-native giant Tether. In its latest Stablecoin Stability Assessment: Tether (USDT) report, it downgraded Tether's USDT rating from Level 4 (Constrained) to Level 5 (Weak), the lowest tier in its rating system. According to the original report released by S&P on November 26, this downgrade was not a qualitative judgment caused by simple inherent bias against crypto, but based on quantitative concerns about Tether's increasingly aggressive reserve asset structure:

-

The Mathematical Logic of a Failing "Safety Cushion": The S&P report core points out that as of September 30, 2025, Bitcoin accounts for approximately 5.6% of circulating USDT, while based on a 103.9% collateralization rate, Tether's implied excess collateral margin is only 3.9%. This means that "reserves can no longer fully absorb a decline in Bitcoin's value." Once Bitcoin undergoes a deep correction, combined with the volatility of other high-risk assets, Tether will face the risk of under-collateralization.

-

Aggressive Balance Sheet Restructuring: S&P monitored that over the past year, the proportion of high-risk assets (including corporate bonds, precious metals, Bitcoin, secured loans, etc.) in Tether's reserves surged from 17% to 24%. While these assets can hedge against inflation, they face higher credit, market, and foreign exchange risks, and have limited disclosure transparency.

-

Questions on El Salvador's Regulation: Regarding Tether's move of its registration from the BVI to El Salvador, although S&P considers accepting regulation a positive step, it bluntly stated that El Salvador's regulatory framework is "not robust enough" compared to Europe and the US. This is mainly reflected in the fact that the framework allows high-volatility assets like Bitcoin to be included in reserves and lacks hard requirements for asset segregation, making it impossible to effectively isolate reserve assets from the issuer's bankruptcy risk.

Facing the "junk bond" rating, Tether CEO Paolo Ardoino displayed an extremely combative stance. He bluntly stated that S&P's model was "designed for a broken traditional financial system" and viewed this distaste as a badge of honor. To fight back the doubts with facts, he retweeted Tether's Q3 2025 assurance report, using a set of strong financial data to demonstrate Tether's still formidable financial capabilities:

Data Source:https://tether.to/en/transparency/?tab=reports

-

Huge Reserves and Excess Buffer: As of Q3 2025, Tether's total assets reached $181.2 billion, with circulating USDT at $174.4 billion. On top of 100% liquid asset reserves, it also possesses over $6.8 billion in excess reserves.

-

Treasury Holdings Comparable to Major Nations: Holding over $135 billion in US Treasuries (direct + indirect), it has become one of the world's largest holders of US debt.

-

Astonishing Profitability: Net profit for the first three quarters of 2025 exceeded $10 billion, and the supply of USDT increased by 17 billion in Q3 alone.

On the other hand, the regulatory hammer from the East fell quickly and with more precise targeting. In a meeting last week, the People's Bank of China explicitly defined "stablecoins" as virtual currency for the first time and pointed out their natural defects in AML and KYC. Although Hong Kong is actively promoting a stablecoin sandbox, mainland regulators are determined to cut off any gray paths for speculation or other non-compliant uses through the concept of stablecoins, strictly limiting the application scenarios of stablecoins to the framework of physical trade and payments.

This week's stablecoin turmoil highlights some misalignments between stablecoins in practice and the requirements of traditional ratings and governments. Traditional rating systems require stability in "monetary face value," thus favoring cash and short-term debt, and regulators hope stablecoins fulfill KYC and AML obligations; meanwhile, Tether seems to be pursuing stability in "actual purchasing power," thus hoarding Bitcoin and gold, while various stablecoins and decentralized stablecoins pursue DeFi's permissionless usage and further privacy protection. Under the misalignment of scenario demands and evaluation standards, as well as the mixed reality of private enterprises playing the roles of both issuer and central bank simultaneously, the stablecoin track is destined to face a long-term game of trust and regulation in the future.

About KuCoin Ventures

KuCoin Ventures, is the leading investment arm of KuCoin Exchange, which is a leading global crypto platform built on trust, serving over 40 million users across 200+ countries and regions. Aiming to invest in the most disruptive crypto and blockchain projects of the Web 3.0 era, KuCoin Ventures supports crypto and Web 3.0 builders both financially and strategically with deep insights and global resources.

As a community-friendly and research-driven investor, KuCoin Ventures works closely with portfolio projects throughout the entire life cycle, with a focus on Web3.0 infrastructures, AI, Consumer App, DeFi and PayFi.

Disclaimer This general market information, possibly from third-party, commercial, or sponsored sources, is not financial or investment advice, an offer, solicitation, or guarantee. We disclaim liability for its accuracy, completeness, reliability, and any resulting losses. Investments/trading are risky; past performance doesn’t guarantee future results. Users should research, judge prudently, and take full responsibility.