Easily Understanding 0.001 BTC to USD: Your Beginner’s Guide to Millibitcoin Value and Micro-Investing

2025/11/17 07:57:02

Introduction: The Small Slice of Digital Gold

Introduction: The Small Slice of Digital Gold

Bitcoin (BTC) has dominated global financial discourse since its inception. For many newcomers and those observing from the sidelines, the high price tag of a single BTC unit often creates a misconception that cryptocurrency investment is only accessible to those with deep pockets. However, this view overlooks Bitcoin's crucial feature: its high divisibility. A single Bitcoin can be split into one hundred million units, with the smallest unit known as a "Satoshi."

For practical daily transactions and widespread adoption, a more intuitive intermediate unit is the Millibitcoin, which is precisely 0.001 BTC.

This comprehensive article will delve into the practical value and strategic significance of 0.001 BTC to USD. Whether you are a seasoned cryptocurrency enthusiast, an investor seeking diversification, or a curious observer ready to dip your toes in, understanding this micro-unit of Bitcoin is essential for navigating the future of digital finance.

Ⅰ. Practical Value: What is the Real-Time Value of 0.001 BTC to USD?

The immediate question many ask is, "How much is 0.001 BTC worth in US dollars?" The simple yet crucial answer is: It fluctuates based on the real-time market price. Due to Bitcoin’s characteristic volatility, the exact conversion of 0.001 BTC to USD is constantly changing.

Market Conversion Example and Volatility Assessment

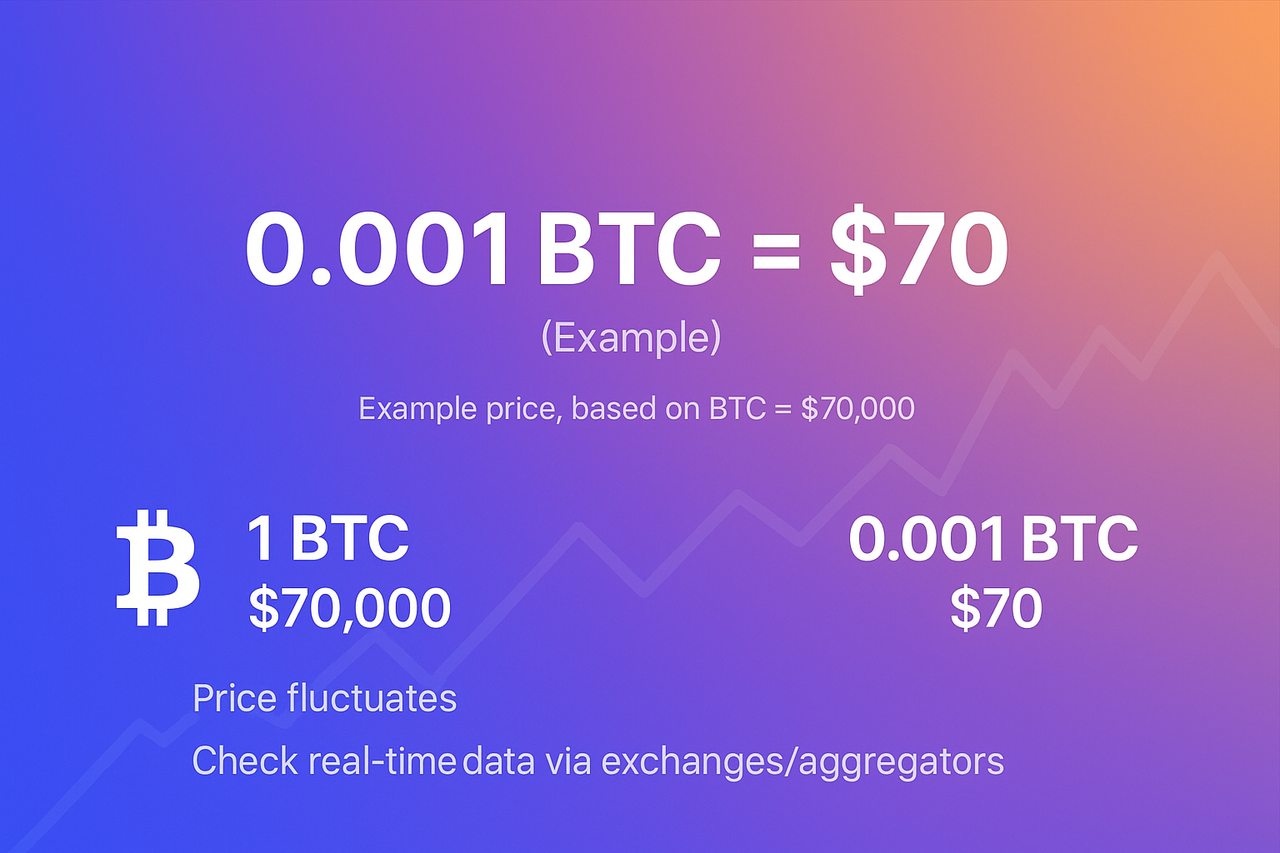

To solidify the concept, let's establish a hypothetical market scenario for calculation (Note: This price is purely illustrative; always refer to live data for actual investment decisions):

Hypothetical Scenario:

The current market price for one Bitcoin (BTC) is $70,000 USD$.

The Calculation:

0.001 BTC to USD = 0.001 x $70,000 USD = 70 USD

In this scenario, 0.001 BTC is equivalent to $70 US dollars$. This amount is substantial enough for a variety of everyday purchases, such as a subscription, a nice meal out, or a small contribution to an online service.

The Investor’s Edge: Why Micro-Value Matters

For astute investors, focusing on small values like 0.001 BTC to USD is crucial for several strategic reasons:

Risk Mitigation and Entry Barrier: New investors can acquire 0.001 BTC to safely familiarize themselves with the processes of trading, wallet management, and market swings without committing a large amount of capital. It’s the perfect testing ground.

Dollar-Cost Averaging (DCA): This is a powerful, long-term strategy. By setting a recurring schedule to automatically buy a fixed dollar amount of BTC—which often equates to recurring fractional purchases like 0.001 BTC or less—investors can smooth out the impact of volatility and reduce the risk of buying at a market peak.

Liquidity and Transaction Fees: Understanding the value of 0.001 BTC helps in estimating transaction fees. Though fees are usually denominated in Satoshis, knowing the dollar value of the small unit is key to evaluating the cost-effectiveness of micro-transactions.

How to Find the Most Accurate BTC to USD Conversion

Given the dynamic nature of cryptocurrency prices, utilize these reliable resources for real-time conversion:

-

Regulated Crypto Exchanges: Platforms like Kraken, Coinbase, or Binance provide accurate, up-to-the-second pricing data.

-

Financial Data Aggregators: Websites such as CoinGecko and CoinMarketCap offer comprehensive price charts and calculators.

-

Search Engines: A direct search for “0.001 BTC to USD” on Google will usually provide an immediate and up-to-date conversion figure.

Ⅱ. Cryptocurrency Metrology: Understanding 1 Millibitcoin Value (1 mBTC)

To satisfy the cryptocurrency enthusiast and provide clarity for technical discussions, it's vital to grasp Bitcoin's system of units. This context makes the concept of 0.001 BTC far more intuitive.

As established, 1 BTC is divisible into 100,000,000 Satoshis. For more manageable small-scale transactions, intermediate units are commonly used:

-

Bit (µBTC): 1 BTC = 1,000,000 Bits (µBTC).

-

Millibitcoin (mBTC): 1 BTC = 1,000 mBTC.

Thus, 0.001 BTC is exactly equal to 1 mBTC.

The Significance of 1 mBTC in Daily Use

-

Intuitive Pricing: Pricing goods and services in mBTC is often more practical than using large BTC figures or tiny Satoshi amounts. 1 mBTC provides a decimal base that aligns better with traditional currency perceptions.

-

Facilitating Micro-Transactions: For peer-to-peer trading, online tipping, or paying for micro-services, 1 mBTC serves as the ideal unit. It emphasizes that you don't need to transact in large amounts, promoting the concept of Bitcoin micro-investing.

-

Bridging the Perception Gap: Using Millibitcoin helps break down the psychological barrier created by the high price of a full BTC, encouraging widespread adoption and enabling individuals to grasp the true value of their small holdings.

The Future of 0.001 BTC as a Digital Currency Unit

As Bitcoin integrates more deeply into daily payment systems—from understanding the Bitcoin value for buying coffee to paying for online services or digital content—0.001 BTC is poised to become the default unit of digital pocket change. This transition signals a move toward a frictionless, globally accessible, and low-entry barrier monetary system.

Ⅲ. Strategic Analysis: Can 0.001 BTC to USD Become Your "Digital Pocket Change"?

For the observers and newcomers seeking a secure entry point, initiating your investment with an amount equivalent to 0.001 BTC is a sound strategy. It serves not only as a key to the crypto world but also embodies a financially prudent approach.

The Low Barrier to Entry for Micro-Investing

The actual investment threshold for Bitcoin is remarkably low. Anyone can purchase fractions of a Bitcoin on compliant exchanges, often starting with just a few dollars, negating the need to buy a whole BTC.

-

Overcoming Fear of Commitment: Understanding the realistic dollar value of 0.001 BTC to USD reassures new users that they are not required to "go all-in." They can safely experiment with buying, holding, and transacting.

-

Experiential Learning: Even a 0.001 BTC purchase requires navigating the entire process: account setup, KYC verification, funding, buying, and secure storage (wallet creation). This hands-on experience is invaluable and supersedes purely theoretical knowledge.

Everyday Use Cases and Purchasing Power

Given the current market value (e.g., $70 USD), 0.001 BTC already possesses tangible purchasing power:

-

Online Subscriptions: Paying for premium annual memberships or SaaS tools.

-

E-Commerce Vouchers: Purchasing a gift card of that value from retailers that accept BTC.

-

Remittances/Cross-Border Payments: Sending a small, rapid, and low-cost transfer to family or friends abroad, highlighting Bitcoin's utility beyond mere speculation.

-

Digital Goods: Buying in-game items, NFTs, or contributing to crowdfunding campaigns.

This demonstrates that 0.001 BTC is a truly functional piece of digital currency, not just a line of code.

Securing Your First 0.001 BTC

To safely acquire and manage your first 0.001 BTC to USD equivalent asset, follow these secure steps:

-

Select a Reputable Exchange: Choose a highly regulated, high-liquidity cryptocurrency exchange in your region.

-

Complete KYC/AML: Fulfill the necessary identity verification requirements.

-

Fund and Purchase: Deposit a small amount of USD and place a buy order for 0.001 BTC.

-

Secure Storage Strategy:

-

Hot Wallets: Suitable for small amounts and frequent transactions (e.g., mobile apps).

-

Cold Storage (Hardware Wallets): Highly recommended for long-term holding of any amount, even 0.001 BTC, to ensure maximum security against cyber threats.

-

Ⅳ. Conclusion and Long-Term BTC Price Prediction

We have thoroughly explored the value and implications of the core keyword, 0.001 BTC to USD. It is more than just a numerical conversion; it is a symbol of Bitcoin's accessibility and the micro-investment model.

From the perspective of the crypto enthusiast, 1 mBTC is the ideal unit for efficient future payments. From the view of the investing observer, 0.001 BTC represents a secure, low-risk, and educational entry point.

Conclusion: Small Starts, Massive Potential

While the current value of 0.001 BTC may seem modest, its future potential is immense. Given rising global inflation and the maturing of digital assets, many analysts hold optimistic BTC price predictions, suggesting that Bitcoin's long-term price as a "digital store of value" could soar to hundreds of thousands or even millions of dollars per coin.

Consider the compounding effect: If, in the coming years, Bitcoin’s price were to reach $500,000 USD$:

Future 0.001 BTC to USD Value = 0.001 x $500,000 USD = 5000 USD

This illustrates the transformative long-term value embedded in today’s small Bitcoin micro-investment.

Regardless of market fluctuations, now is the opportune time to understand, track, and potentially invest in the value represented by 0.001 BTC to USD.