Decoding the Bitcoin Price CAD: A Complete Guide for Canadian Crypto Investors

2025/11/11 02:30:03

For cryptocurrency enthusiasts, investors, and even prospective users in Canada, understanding and tracking the Bitcoin Price CAD (Bitcoin priced in Canadian Dollars) is a vital step into the world of digital assets. Unlike the global market price denominated in US Dollars (USD), the Bitcoin Price CAD is influenced by local market liquidity, exchange rate fluctuations, and the specific Canadian regulatory environment.

This article aims to provide a comprehensive guide for Canadian users, not only helping you keep track of the latest Bitcoin Price CAD movements but also deeply analyzing the factors that affect the price and recommending secure, low-cost domestic trading strategies.

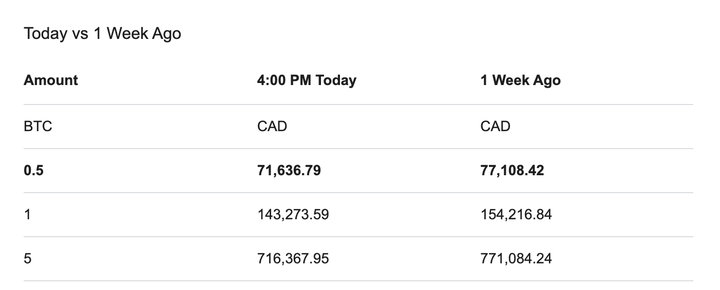

Real-Time Bitcoin Price CAD Today: Market Overview

As of this writing, the Bitcoin Price CAD is exhibiting a volatile trend. The current exchange rate for BTC/CAD is approximately $143,054 CAD (Note: This is an example placeholder price based on the search snippet for context, and actual live prices will vary). We observe that the price has been fluctuating within a tight range, which could be influenced by external factors such as upcoming macro-economic data releases or the anticipation surrounding major regulatory decisions in North America.

Tracking the real-time Bitcoin Price CAD is essential. Newcomers can obtain the most accurate BTC/CAD quotes through the mobile applications or websites of major Canadian-compliant exchanges (such as Wealthsimple Crypto, Newton, or Kraken Canada). Investors, meanwhile, need to monitor daily and weekly charts, analyze trend lines and support/resistance levels, and incorporate the CAD exchange rate movements to hedge potential currency risks.

Tip: Remember that the Bitcoin Price CAD you see on an exchange is the real-time trading price on that specific platform, which may show minor variations compared to global indices or other exchanges due to liquidity differences.

Why Does the Bitcoin Price CAD Differ from the USD Price?

Many Canadian investors new to cryptocurrency notice a subtle difference between the Bitcoin price converted from the USD rate and the Bitcoin Price CAD displayed on local exchanges. This discrepancy is not a simple concept of "premium" or "discount" but is determined by two core factors:

-

Liquidity and Trading Volume

The overall liquidity of the Canadian cryptocurrency market, especially for the BTC/CAD trading pair, is typically lower than the global dominant BTC/USD market. If a Canadian Bitcoin exchange lacks sufficient trading depth, large orders can cause greater price swings to match buyers or sellers, leading to the Bitcoin Price CAD briefly deviating from the international price. Therefore, choosing a Best Canadian Bitcoin Exchange with high liquidity ensures your transactions execute near the optimal price.

-

The Impact of the Canadian Dollar (CAD) Exchange Rate Fluctuation

The Bitcoin Price CAD is determined by two variables: the global US Dollar value of Bitcoin and the immediate CAD-to-USD exchange rate (USD/CAD).

-

When the global Bitcoin price (in USD) rises, the Bitcoin Price CAD will also rise.

-

However, if the Canadian Dollar simultaneously depreciates against the US Dollar (USD/CAD rises), the increase in the Bitcoin Price CAD will be further amplified. The reverse is also true.

Understanding this dual volatility is crucial for investors engaging in cross-border arbitrage or simply assessing their portfolio's value.

How to Get Bitcoin at the Best Price? A Comparison of Canadian Exchanges

In Canada, selecting a compliant and low-cost trading platform is the foundation for successful investment. The following comparison will help you find the best platform for executing "How to buy Bitcoin with CAD":

-

Compliance and Security (Ensuring Fund Safety)

Since 2020, regulatory requirements in Canada have become increasingly strict, requiring cryptocurrency trading platforms to register as Money Services Businesses (MSB) with FINTRAC. Investors should prioritize platforms registered locally that offer robust security measures (such as cold storage and 2FA). Highly compliant platforms are also more likely to adhere to Canada crypto tax guides, simplifying your tax procedures.

-

Trading Fee Comparison (BTC/CAD Trading Fee Comparison)

Trading costs directly impact your long-term returns. When evaluating platforms, do not just look at the trading commission; also consider:

-

Deposit/Withdrawal Fees: Deposits in CAD via Interac e-Transfer are often free, but wire transfers may incur charges.

-

Spread: Some "zero-commission" platforms profit by widening the spread between the bid and ask prices. This hidden cost can sometimes be higher than an explicit trading fee.

| Platform Type | Advantages | Disadvantages | Trading Cost Advice |

| Canadian Local Exchanges (e.g., Newton) | Free CAD deposits, compliant, but spreads might be large. | Limited choice of altcoins. | Suitable for small, beginner purchases. |

| Global Major Exchange Canadian Branches (e.g., Kraken Canada) | High liquidity, low trading fees, professional features. | More complex interface, may require stricter KYC processes. | Suitable for high-frequency or high-volume traders. |

Investor Strategies: Leveraging Bitcoin Price CAD Fluctuations

Tracking the Bitcoin Price CAD is more than just watching numbers; it requires integrating price trends into a long-term investment strategy:

-

DCA Strategy (Dollar-Cost Averaging)

Regardless of the short-term volatility in the Bitcoin Price CAD, Dollar-Cost Averaging (DCA) remains the most robust long-term strategy. By investing a fixed amount of Canadian Dollars into Bitcoin weekly or monthly, you effectively smooth out your average cost basis and reduce the risk of making poor decisions based on short-term market sentiment. Many Canadian exchanges offer automatic DCA features.

-

Strict Adherence to Tax Planning (Tax Implications)

The Canada Revenue Agency (CRA) treats cryptocurrency as a commodity. This means any gains or losses realized when you sell, trade, or use Bitcoin to purchase goods must be reported as a Capital Gain or Loss. Closely following the Canada crypto tax guide and accurately recording your BTC/CAD purchase cost basis is an unavoidable responsibility for every Canadian investor. Failure to properly report can lead to substantial penalties.

-

Monitoring Macroeconomics and its Impact on CAD

As an astute Canadian crypto investor, you must not only focus on Bitcoin's technical analysis but also on the Bank of Canada's interest rate policies and the direction of the Canadian Dollar. If the CAD is expected to weaken, allocating some funds to Bitcoin can serve as a form of hedge against currency debasement.

Conclusion: Tracking the Bitcoin Price CAD to Seize Future Opportunities

The Bitcoin Price CAD is the bridge connecting Canadian users to the global cryptocurrency market. By understanding liquidity, exchange rate differentials, and choosing a secure, compliant, and cost-optimized platform, Canadian investors can maximize their investment potential.

Whether as a tool to fight inflation or as a speculative trading asset, mastering the real-time dynamics and underlying drivers of the Bitcoin Price CAD is key to your success in 2025 and beyond. Start your crypto investment journey today by choosing a reliable Best Canadian Bitcoin Exchange!