Trading 101: What Are Crypto Market Cycles & Why Should You Know About Them?

Market cycles are an inherent part of any market. A market cycle is defined as the period between a high and a low and the phases in between. Given the rapid pace of the cryptocurrency industry, having a firm grasp of the market cycle would be an invaluable asset. However, the researchers were initially unsuccessful in detecting trends owing to the market's novelty and a lack of data.

The cycles have grown more predictable during the last several years. Market cycles are touted to be very common in cryptocurrencies, with Bitcoin price completing a complete cycle five times in its ten-year existence. The advantage of using the historic data and comparing it to market cycles could show us when a bear market may transit to a bull market and vice versa. Whichever market you are referring to, they all go through similar stages and are cyclical. When one market cycle concludes, the next one begins.

The issue is that the majority of investors and traders either fail to understand the cyclical nature of markets or fail to anticipate the conclusion of the present market period. Another major difficulty is that, even if cycles occur, it is virtually impossible to predict their top or bottom. However, if you want to optimize your investing or trading profits, you must understand cycles.

Decoding A Crypto Market Cycle

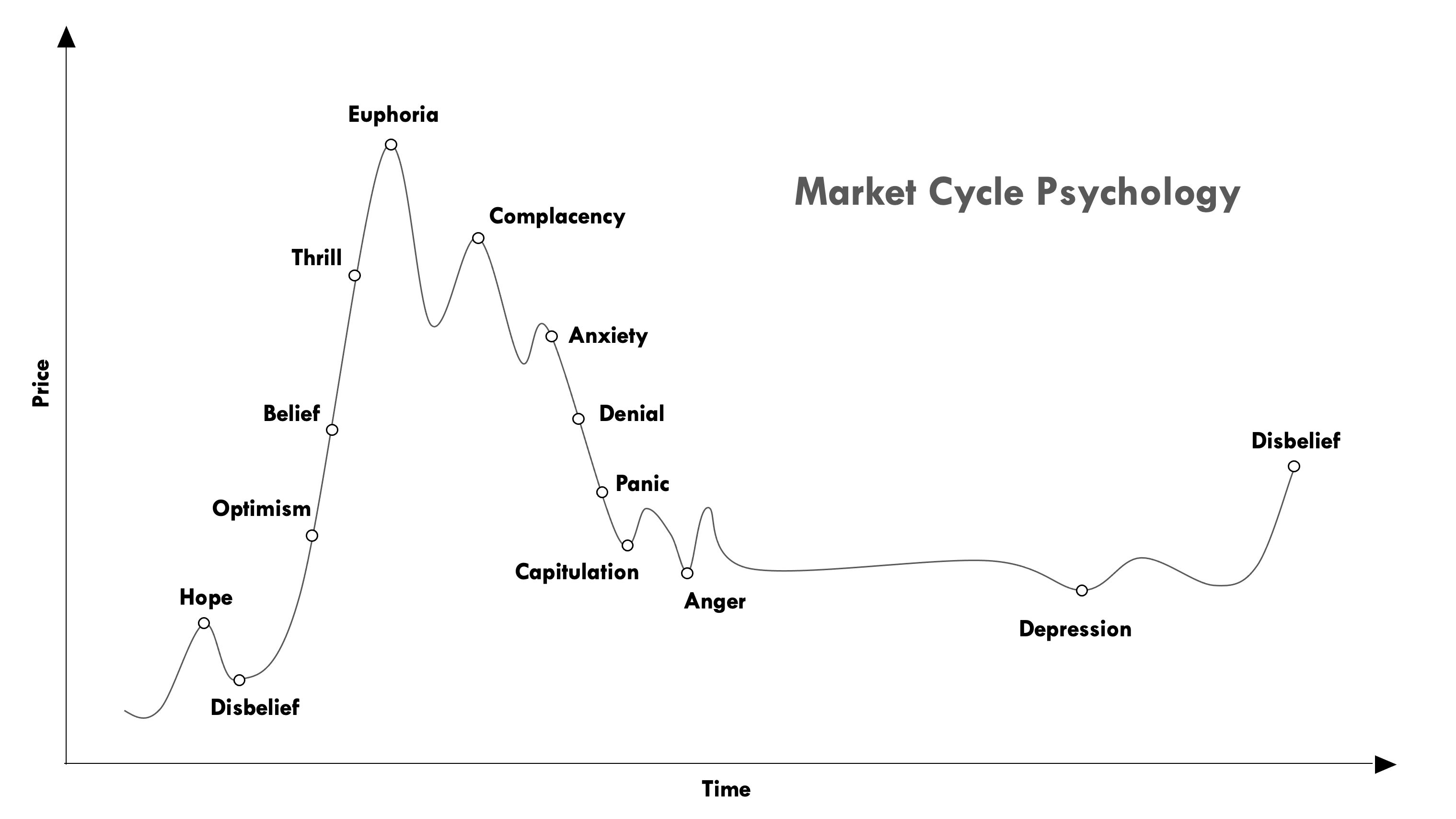

Chart Inspiration - Karen Bennett, cheatsheet.com

Karen Bunnett is a writer at cheatsheet.com who created a Wall Street cheat sheet that summarises different market cycles, each representing an emotion felt by investors. Although this was charted for Wall Street, it equally applies to the cryptocurrency market.

Market cycles, as the term implies, recur in nature. Thus, if we examine the graph above, the first stage, 'Hope,' occurs after the last step, 'Disbelief.' At this point, the market exhibits good signs of a fresh bull run. However, investors continue to exercise caution. Investments are made with little sums of money. The institutional investors and early adopters who held onto their investments from the previous anger and depression cycle benefitted from this.

The next stage is 'Optimism,' in which prices increase as fresh money is invested. This stage occurs after the market has been on an extended upswing for many months. The market is optimistic, and as a result, many investors feel comfortable investing at this point.

What happens when you have a positive outlook about something for a long time? You tend to believe in it. The same holds true for market cycles. When 'optimism' continues over an extended period, it develops into belief. This stage of 'Belief' is considered one of the first indicators of a bull market.

Investors are always on the lookout for fresh possibilities in the market. When they find a bull market, they get thrilled looking at the easy money they have made. This is the stage of ‘Thrill .’ Here, the prices go up by confirming as many thrill-seekers get into the market.

Following this surge in popularity, FOMO creeps in. People look at those who have profited from this run and rush in blindly. Many people may strike it fortunate at first, but this will not last long. This stage, dubbed 'Euphoria,' is when human impulses such as greed take control. Numerous beginners enter the market only to alleviate their FOMO, and most of them will fail to maintain their position in the market. This is the moment at which you will learn about the 'New Young Millionaires' and the ‘Lamborghini-Millionaire-lifestyle' frenzy. This is the phase where the price action peaks and the bull run begins to show weak signs.

The next phase is where the bull run has stalled because people's high expectations are not fulfilled. The first indications of a market reversal begin to appear. This is a particularly hazardous stage since many believe the 'Complacency' stage is just a little pause before the bull-run resumes. Numerous investors are unprepared for the impending market correction.

Finally, people realize that this bull run cannot continue indefinitely. They realize the market is reversing, losing value and money. Fear of loss enables traders and 'Anxiety' to postpone realizing a loss, which results in far larger losses.

However, the value of the assets invested continues to decline, and many investors enter a state of 'Denial,' refusing to sell in the hope of a larger upward reversal. Investors behave defensively because they believe they have made sound investment decisions. However, it is not easy for markets to rebound and bounce back at this point.

The market continues to deteriorate as a bear market has established itself as the new normal. Investors attempt to recoup their money by selling their investments in fear of losing everything. Often, a significant sell-off occurs during this 'Panic' period.

Individuals lose all hope and faith in this particular market circumstance. Stability and consolidation re-emerge at this point. Most of those who wanted to ride the bull run would have left by now, leaving just the experienced traders to dominate the market. This step may take an extended period.

How KuCoin can Help During a Crypto Market Cycle?

Market cycles are common occurrences in the cryptocurrency market. The shift from a bull market to a bear market can happen so suddenly that even seasoned investors meet themselves buying the top.

To guard against losses like this, KuCoin recently introduced trading bot to help remove the fear and emotional form of investing. This bot is smart, easily accessible, convenient, and the only thing you need to do is deposit funds and leave it to do its work. You might not have any more to do later than occasionally stop by to see the profits/losses made. These bots are designed by a team of professional traders, programmers and it is constantly updated with new information by the backend team to keep it up-to-date. More information about the KuCoin trading bot can be found here.

You can also avoid the problem of market volatility by trading KuCoin futures. Normal trading gives us the privilege of unlimited risks and unlimited returns, but it is impossible for anyone to accurately predict the short-term direction during times of intense volatility. Therefore, trading futures turns out to be a form of hedge during any crypto market cycles.

There is also an option to amplify your wins by trading leveraged tokens on KuCoin. KuCoin carefully designs these tokens to give both new and seasoned traders - a sense of security during uncertain market cycles.

Conclusion

Cycles occur in all markets, even though they are not always very obvious and evident. Intelligent investors who understand the many stages of a market cycle are better equipped to benefit from them. Doing this will provide us with an accurate picture of market emotions. Understanding this information will make investors less likely to be duped into purchasing cryptos at the worst possible moment.

Stay tuned and watch the KuCoin Blog for more interesting, educational, and informative content. All the best!

Did you know that KuCoin offers premium TradingView charts to all of its clients? With this, you can step up your technical analysis and easily identify various crypto market cycles.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also Subscribe to our Youtube Channel >>> Listen to 60s Podcast