Order Type

Limit Order

An order that trades at a specified price. For limit buy orders, the final transaction price is less than or equal to the specified price. For limit sell orders, the final transaction price is greater than or equal to the specified price.

Once a limit order is successfully submitted, unfilled orders enter the order book. Traders can view order information in the active order list. These orders provide market liquidity and earn a maker's fee upon transaction.

When placing a limit buy order at or above the current ask price, or a limit sell order at or below the current bid price, the order may be filled immediately. These orders do not go into the order book. Usually, you'll pay a transaction fee as the order taker in these scenarios.

Market Order

A market order is executed at the current market's best available price. Traders can choose this type of order for quick position opening or closing, especially in urgent scenarios. The worst transaction price of a market order is always controlled within a certain range. If the transaction price exceeds this range, the system will automatically cancel the remaining unfilled part of the order.

Market orders extract market liquidity, thus incurring a taker's fee.

Market orders offer the advantage of quick execution. However, traders should pay attention to market depth and price fluctuations to avoid the average execution price deviating significantly from the anticipated price.

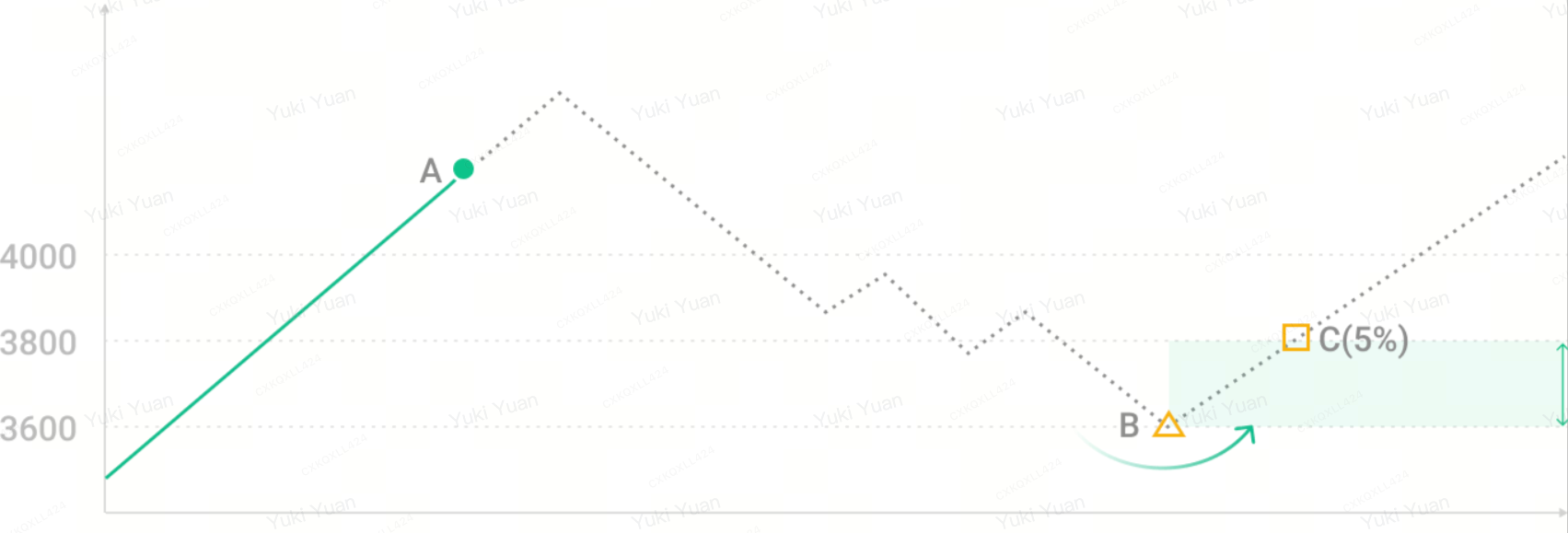

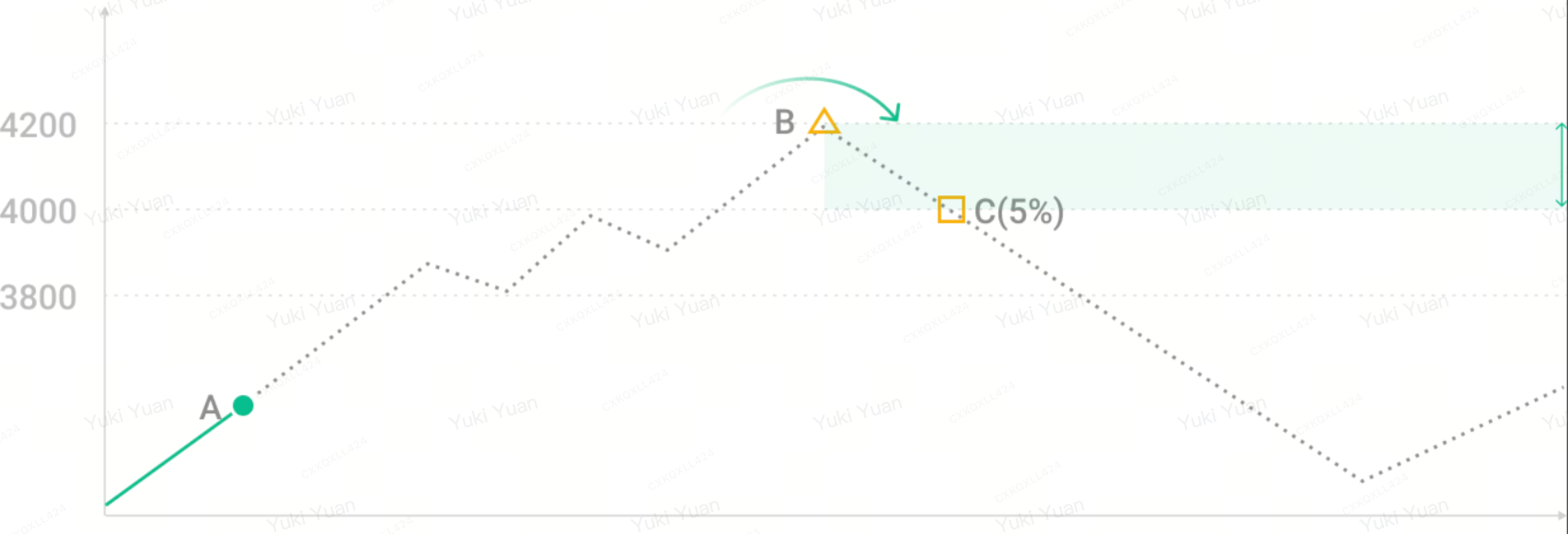

Stop Order

Stop orders serve as either stop-loss or take-profit orders. The order will be triggered when the market price reaches a specified trigger price, entering the market as a limit order or market order.

In KuCoin futures, stop orders can be set with the latest price, mark price, or index price as the trigger type. The order is activated when the trigger type's price reaches the specified trigger price.

Stop orders do not freeze the required margin at the time of placement, but will freeze the necessary funds according to the order and position once the order is triggered.

Advanced Order

Reduce Only

Selecting a Reduce-Only order ensures that the executed trade will only decrease your futures position. The order does not require margin to be frozen. If the order leads to an increase in position, the system will automatically reduce the order size or cancel the order.

Hidden Order

When investors make large transactions, they split the order into several small limit orders to hide the real amount.

The range of hidden order size: no less than 1/20 of the total order size, and no more than the total order quantity.

Iceberg or hidden orders are executed with taker fees.

Post Only

The order will not be matched immediately in the market. Instead, it will enter the order book, ensuring the order is posted to the order book and sits on the order book to be charged maker fees if it is filled. If a matching counterparty order appears in the order book, the order will be automatically canceled by the system.

Time in Force

Limit orders can be set with different time-in-force strategies, including GTC and IOC, with GTC being the default option.

GTC (Good Till Cancel): The order remains valid until fully filled or manually canceled.

IOC (Immediate Or Cancel): The order must be filled immediately at the limit price or better. If the order cannot be fully filled immediately (partial execution allowed), the unfilled portion will be canceled.

KuCoin Futures Guide:

Thank you for your support!

KuCoin Futures Team

Note: Users from restricted countries and regions cannot open futures trading.