Weekly Crypto Analysis: Expected BTC Volatility; KuCoin, Ethereum in Highlights

The crypto market remains fairly stagnant to slightly positive in the past week, with most top100 coins staying within the single-digit profit/loss mark. The slightly positive outlook came as a response to a positive start of the week for the US equities market, which managed to jump up 2-3% week-over-week.

The overall cryptocurrency market volume in the past 24 hours came up to $50.23 billion - just $30 million less than the previous week. The overall crypto market cap has remained above the $900 billion mark, now totaling $935.89. This ended up being an overall decrease of about $40 billion compared to the previous week.

Let's delve deeper and take a quick look at the latest crypto market news and BTC's technical outlook.

Crypto Market Overview

Bitcoin's drop below the $20,000 mark is still proving to be a tough pill to swallow, as the slow market can’t seem to approach this price level with enough confidence. BTC’s dominance is solidifying near the 40% mark, now standing at just over 39%. The most valuable cryptocurrency pair, BTC/USDT, is currently trading at $19,582.28, while Ethereum, the second-largest cryptocurrency by market capitalization, has increased to $1,326.73, up 2.69% in the last week.

The top performers from the previous week were Huobi Token (HT), Casper (CSPR), and Quant (QNT. HT has increased by 46.70%, while CSPR gained 36.48% in the past seven days. Finally, QNT gained 32.09%.

Cryptocurrency Market Heatmap | Source: Coin360

On the other hand, TerraClassicUSD (USTC), Klaytn (KLAY), and ApeCoin (APE) were the worst performers of the week. USTC is down 32.92%; KLAY is down 18.69% in the last seven days; APE is down 13.67%.

Top Altcoin Gainers and Losers

Top Altcoin Gainers:

- Huobi Token (HT) ➠ 42.70%

- Casper (CSPR) ➠ 36.48%

- Quant (QNT) ➠ 32.09%

Top Altcoin Losers:

- TerraClassicUSD (USTC) ➠ 32.92%

- Klaytn (KLAY) ➠ 18.69%

- ApeCoin (APE) ➠ 13.67%

News Highlights

Here are some of the events that made the previous week's crypto news section stand out:

Ethereum Community Debates Over OFAC Compliance

Ethereum validators have come to the public’s eye after a report has shown that over 51% of Ethereum blocks are now complying with the US TornadoCash sanctions after transitioning to a proof-of-stake (PoS) consensus algorithm.

Ethereum co-founder Vitalik Buterin expressed his belief that solo validators can choose what they do and don’t comply with, and that this behavior should be tolerated.

Vitalik Buterin made the comment in reply to a Twitter poll, discussing a hypothetical scenario whereby a validator censors a transaction just because it may not align with their beliefs.

Adding to that, Ethereum bulls have stated that “not even a single” transaction has been censored on the network. Cyber Capital founder and CIO Justin Bons argued that not a single transaction on Ethereum has been stopped as a result of Office of Foreign Assets Control (OFAC) sanctions. In fact, all non-compliant transactions have been processed in around 30 seconds as well, he stated.

KuCoin Exchange Expands its 0-fee Campaign

KuCoin Exchange has announced the extension of its 0-fee BTC & ETH trading event. This means that, until Nov 02, 2022, traders can trade their favorite ETH and BTC pairs with no fees whatsoever.

Updated Event Duration: 10/19/2022 10:00 — 11/02/2022 10:00 (UTC)

As a result of its user-focused business approach, and boosted by incentives such as this promotion, KuCoin Exchange has briefly climbed to the spot of the second-largest spot exchange in the world.

European Union Commissioner Pushes for Faster Crypto Regulation

The European Union has been processing and passing its landmark crypto framework for quite some time now. However, according to the European Commission’s financial services commissioner Mairead McGuinness, global crypto regulation needs to happen faster.

The remarks were made during McGuinness’s visit to Washington DC, where the commissioner stated that the regulatory efforts should take a global character and that she wants to see the regulation happen in other countries as well.

Germany Becomes the Most Favorable Crypto Economy

Germany has managed to become the world’s most favorable economy for crypto in Q2 2022, according to a Coincub report. The United States, on the other hand, lost the first place and is now stationed as the seventh-most favorable.

The list also includes Switzerland at 2nd place, Australia at 3rd, UAE at 4th, Singapore at 5th, and Malaysia at 6th.

The crypto economy rankings took at look at numerous factors, including a favorable crypto outlook, clear digital asset tax rules, and more transparent regulatory communications.

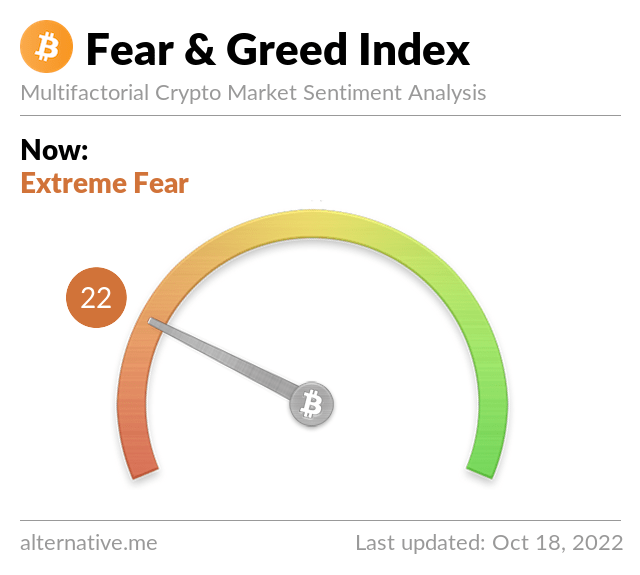

The Fear & Greed Index at 22, Market Sentiment Bearish

The fear and greed index has stabilized near the previous week’s levels after a huge drop from three weeks ago, when the number that represents crypto sentiment dropped from 45 to 24. The indicator now indicates “extreme fear” with a mark of 22, caused by the sudden drop of Bitcoin and other cryptocurrencies.

Fear & Greed Index | Source: Alternative

Crypto Calendar: Events to Watch This Week

➺ 18/10/2022 - AVAX - Avalanche Banff (V1.9.0)

➺ 20/10/2022 - ZIL - YouTube & Twitter AMA

➺ 21/10/2022 - LTC - Litecoin Summit 2022

➺ 23/10/2022 - AVAX - Avalanche Creates

Bitcoin (BTC/USDT) Analysis on KuCoin Chart

The largest cryptocurrency by market cap has been trading sideways for the past week, with its price ranging from $18,121 to $19,952. Unfortunately, BTC bulls haven’t been able to break the $20,000 barrier, which has proven to be a strong resistance level.

At the moment, Bitcoin is trading under the 50-day moving average (MA), which sits at the $19,672 level. If it manages to break the moving average level, this line could prove as a strong support point. However, BTC’s upside is still bound by a strong resistance zone between $20,000 and $20,500.

On the other hand, some analysts are showing that the largest cryptocurrency by market cap has been creating a triangle formation since its Sep 13 drop and that its push toward the upside indicates a slight positive sentiment.

BTC/USDT Chart on the Daily Timeframe | Source: KuCoin

When it comes to support and resistance levels, Bitcoin is likely to encounter resistance to the upside at an area between $20,000 and $20,500. On the other side, analysts state that traders should watch out for $18,135, as this is the only level separating Bitcoin from the $17,550 level.

Did you know that KuCoin offers premium TradingView charts to all its clients? With this, you can step up your Bitcoin technical analysis and easily identify various crypto chart patterns.

Sign up on KuCoin, and start trading today!

Follow us on Twitter >>> https://twitter.com/kucoincom

Join us on Telegram >>> https://t.me/Kucoin_Exchange

Download KuCoin App >>> https://www.kucoin.com/download

Also, Subscribe to our Youtube Channel >>>Listen to 60s Podcast