1. Market Overview

Yesterday, the global crypto market cap rose ~0.9%, reaching $3.31 trillion, as Bitcoin and several altcoins rebounded following recent volatility.

-

Bitcoin climbed 1.2% to about $106,800 after holding above the $106K mark.

-

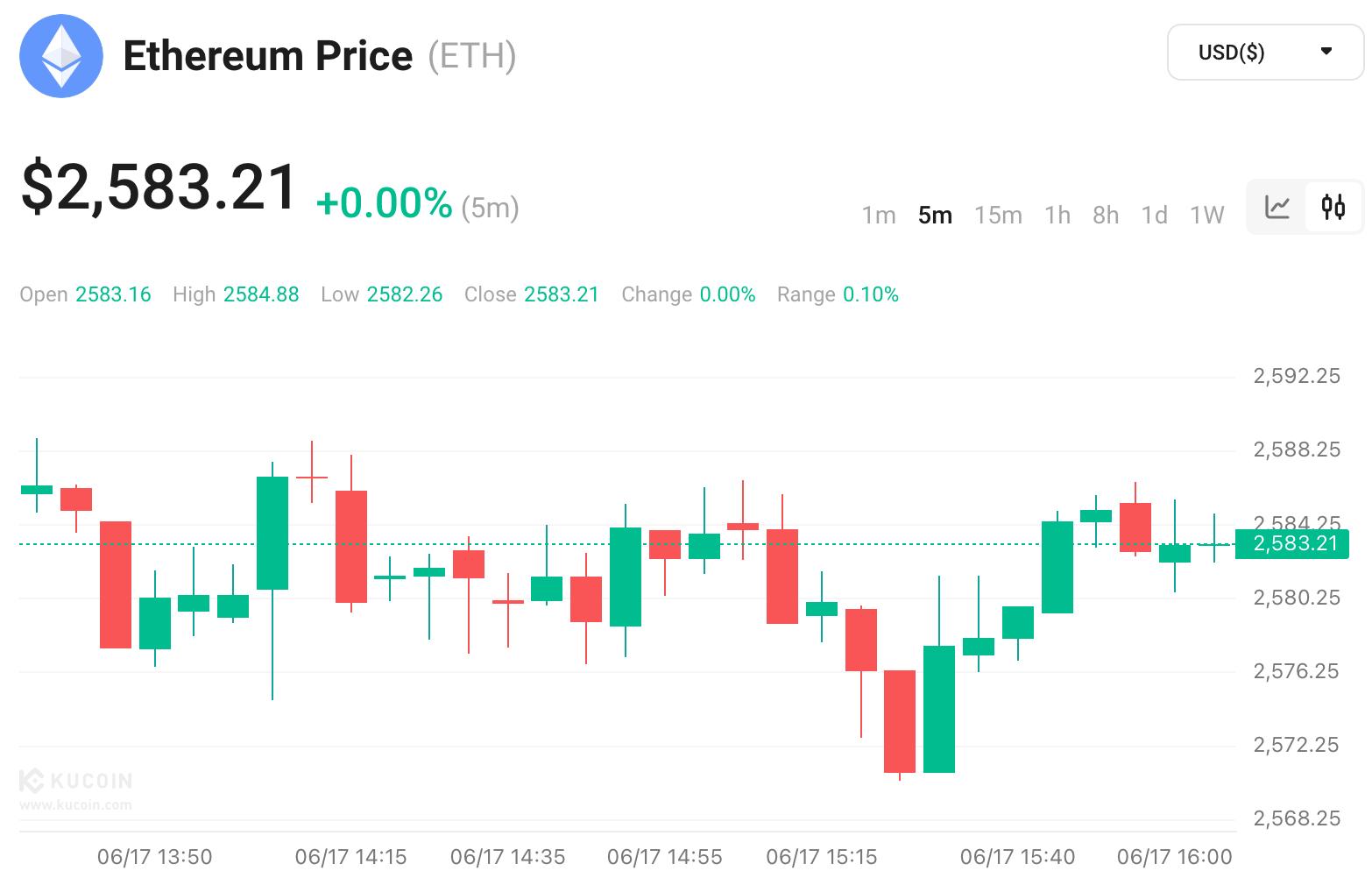

Ethereum saw modest gains, nudging 0.1% higher to around $2,600, though it remains below recent highs.

-

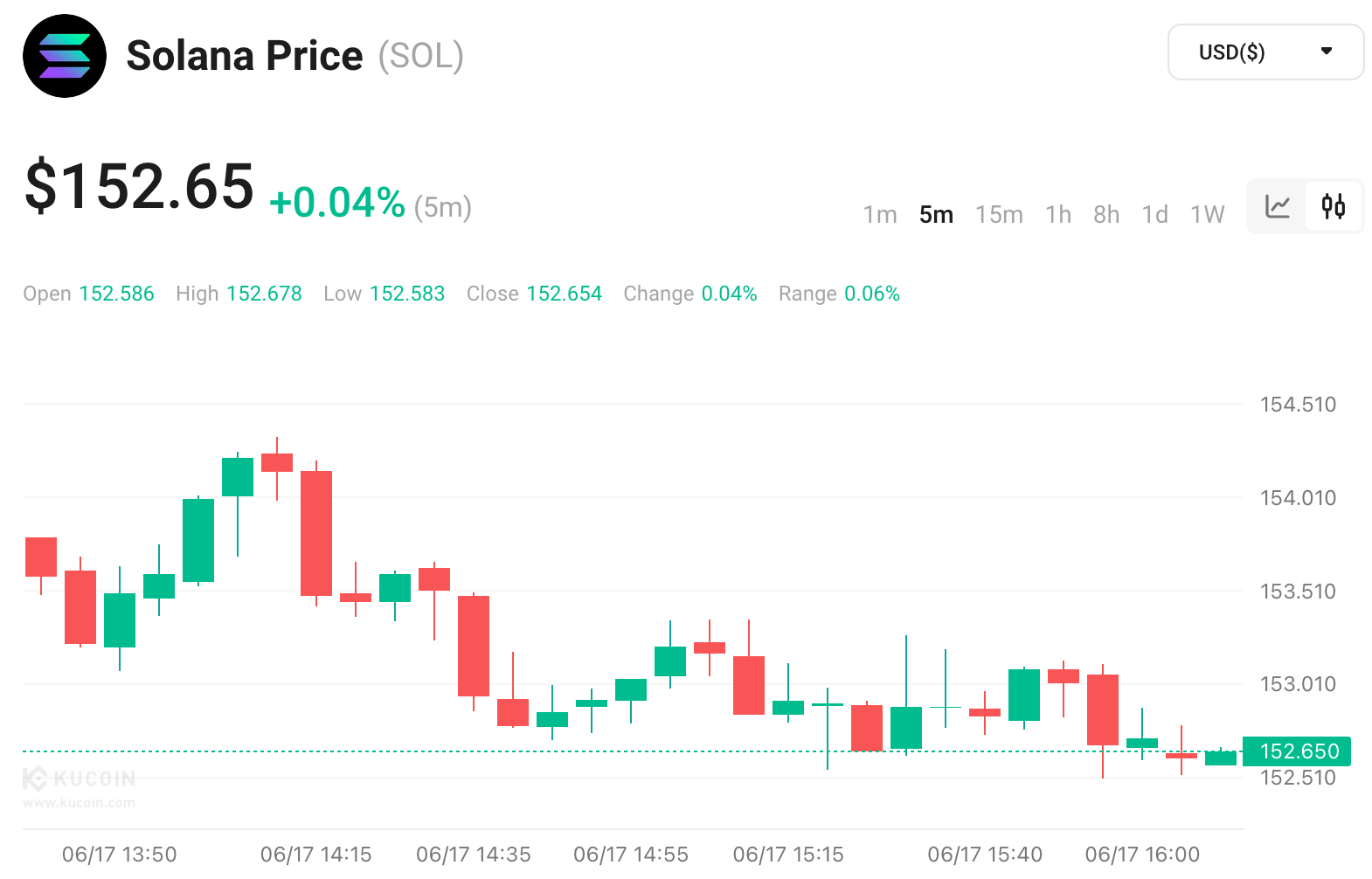

Solana surged ~7%, outpacing most top-tier tokens amid renewed buying interest.

-

UNI jumped over 7%, breaking past $7.70, with analysts eyeing a move toward $10.

2. Crypto Market Sentiment

Investor sentiment showed signs of stabilization:

-

Renewed U.S.–China trade tensions prompted some flight to crypto as a partial safe haven, even as broader risk-on dynamics resumed.

-

The ongoing Israel–Iran conflict remained a critical backdrop, with cautious optimism emerging after reports of de‑escalation.

-

Overall, crypto is increasingly viewed as a barometer of both risk appetite and geopolitical risk, with mixed reactions across assets.

3. Key Developments

-

Trade & Safe‑Haven Dynamics: On June 16, Bitcoin dipped slightly (–0.3%) amid trade fears but rebounded as investors interpreted crypto as both a hedge against macro risk and risk-on instrument.

-

Altcoin Standouts: Solana rallied ~7% and UNI surged 7.3%, with analyst Ali Martinez describing UNI’s move as “breaking out with momentum,” signaling increased interest in high-growth altcoins.

-

Geopolitical Ripples: Mixed news—reports of Iran seeking to resume talks with Israel helped equities, while ongoing tensions kept crypto volatility elevated.

-

Institutional Flows & ETFs: Despite short-term swings, ETF inflows persisted, with CoinShares reporting $1.9 billion inflows last week, confirming growing institutional conviction