Industry Edition

Japan’s Debt Concerns Trigger Pullback in Global and Crypto Markets

Summary

-

Macro Environment:

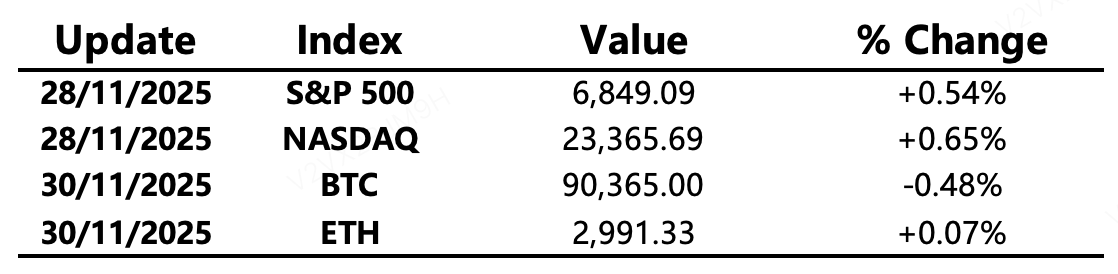

U.S. equities extended their strong upward momentum last Friday, with both the S&P 500 and Nasdaq closing higher for five consecutive sessions. The S&P 500 also recorded its strongest Thanksgiving week performance since 2008. However, sentiment reversed sharply in early trading on Monday. Japan’s new economic stimulus package has intensified concerns over its debt sustainability, pushing the 2-year JGB yield to its highest level since June 2008. Meanwhile, the Bank of Japan Governor reiterated that if economic conditions evolve as expected, the BOJ will consider raising interest rates—further heightening fears of a monetary policy shift. Under these pressures, U.S. equity futures, the Nikkei Index, and crypto assets all pulled back Monday morning.

-

Crypto Market:

Macro sentiment dominated crypto trading, with markets rapidly swinging from Thanksgiving optimism to concerns over Japan’s monetary tightening. Bitcoin tracked U.S. equities, failing to break above resistance near $93,000 and easing afterward. Altcoin market cap dominance stayed near 59%, with altcoins declining in line with broader risk assets.

-

Project Updates:

-

Trending tokens: PIPPIN, LSK, TEL

-

LSK: Over 50% of trading volume driven by Korean funds; LSK up 10%

-

GIGGLE: Market speculates on a new round of Binance trading fee buybacks

-

Major Asset Movements

Crypto Fear & Greed Index: 24 (down from 28 twenty-four hours ago), indicating Extreme Fear

What to Watch Today

-

BOJ Governor’s speech may hint at a rate hike.

-

dYdX community approved a one-month liquidation rebate pilot starting Dec 1.

-

Token unlocks:

-

SUI: 0.56% of circulating supply (~$85M)

-

SANTOS: 19% unlock (~$12.7M)

-

WAL: 0.65% unlock (~$5.5M)

-

Macro Economy

-

Japan’s 2-year JGB yield hits 1%, the highest since June 2008.

-

Japan finalizes ¥18.3 trillion supplementary budget to fund its stimulus package.

-

Trump says he will keep the stock market at “record-high levels.”

Policy Direction

-

Switzerland delays crypto tax information–sharing to 2027.

-

UK to tighten crypto tax enforcement; exchanges must report full user data starting 2026.

Industry Highlights

-

KuCoin EU obtains MiCA license in Austria, allowing regulated services across the European Economic Area.

-

Michael Saylor posts another Bitcoin tracker update, hinting at potential BTC accumulation.

-

U.S. Bank is testing issuance of a custom stablecoin on the Stellar network.

-

BlackRock executive: $2.34B outflows from IBIT this month are “normal”; remains confident in long-term spot ETF outlook.

-

Kazakhstan’s National Bank (NBK) is considering investing up to $300M into crypto assets.

Expanded Analysis of Industry Highlights

-

KuCoin Secures MiCA License in Austria, Expanding Services Across the EEA

-

Original Highlight: KuCoin EU obtains MiCA license in Austria, allowing regulated services across the European Economic Area.

-

In-Depth Expansion:

-

Significance of the MiCA License: MiCA (Markets in Crypto-Assets Regulation) is the EU's unified crypto-asset regulatory framework, considered one of the most comprehensive global crypto regulations. The Austrian license, secured by KuCoin’s EU entity (KuCoin EU Exchange GmbH), enables the exchange to use the "passporting" mechanism to offer fully regulated crypto services across 29 European Economic Area (EEA) countries, excluding Malta.

-

Impact on KuCoin: This marks a "decisive step" in KuCoin's global compliance journey, allowing it to operate under a clear, unified legal framework and significantly boosting its credibility in the European market.

-

Market Trend: KuCoin joins other major exchanges like Kraken, Coinbase, and Bybit in securing MiCA licenses, highlighting the prevalent trend among top crypto firms to seek regulatory clarity and compliant operations in the EU. KuCoin has stated that EEA users will be migrated to its EU platform, and the global platform will cease new registrations for EEA users to ensure full MiCA compliance.

-

-

Michael Saylor Posts Latest Bitcoin Tracker Update, Hinting at Potential BTC Accumulation

-

Original Highlight: Michael Saylor posts another Bitcoin tracker update, hinting at potential BTC accumulation.

-

In-Depth Expansion:

-

Context: MicroStrategy (MSTR), where Michael Saylor serves as Executive Chairman, is the publicly traded company with the largest Bitcoin holdings globally, following a strategy of continuously buying and holding BTC using debt and equity financing. His "Bitcoin tracker updates" are typically a signal to the community about the growth in the company's Bitcoin reserves.

-

Interpretation of the "Hint": While the exact content of the update (such as the latest holding amount and average cost) is key, the post itself often signals continued bullishness and a commitment to further accumulation to the market. Saylor's strategy has consistently leveraged the company's stock as a kind of "leveraged Bitcoin ETF."

-

Recent Focus: The market has recently focused on whether MicroStrategy might be removed from major indices like MSCI due to its disproportionately high concentration of Bitcoin holdings. If this occurs, it could force passive funds tracking these indices to sell MSTR stock. Against this backdrop, Saylor's commitment to posting updates and hinting at accumulation demonstrates confidence in the company's long-term Bitcoin strategy.

-

-

U.S. Bank is Testing Issuance of a Custom Stablecoin on the Stellar Network

-

Original Highlight: U.S. Bank is testing issuance of a custom stablecoin on the Stellar network.

-

In-Depth Expansion:

-

Partnership and Objective: U.S. Bancorp (U.S. Bank's parent company) is collaborating with PwC and the Stellar Development Foundation (SDF) on this stablecoin pilot. This move signifies a deeper exploration of blockchain technology by a major traditional financial institution, aiming to evaluate the stablecoin as a regulated settlement infrastructure.

-

Why Stellar: U.S. Bank chose the Stellar blockchain due to its platform's regulatory-compliant features required by financial institutions. Stellar possesses core functionalities like native asset freeze and transaction clawback, which are crucial for meeting bank KYC (Know Your Customer) requirements, risk mitigation, and regulatory needs. Additionally, Stellar is designed to support the high transaction speed (up to 1,000 transactions per second) needed for retail payments.

-

Industry Significance: This is a crucial signal of the transition of stablecoins from "experimental concepts" to "institutional-grade applications." Banks are beginning to explore how to integrate programmable, interest-bearing digital currencies into core banking operations, including liquidity management and cross-border payments.

-

-

BlackRock Executive Calls $2.34B IBIT Outflows This Month "Normal," Confident in Long-Term Spot ETF Outlook

-

Original Highlight: BlackRock executive: $2.34B outflows from IBIT this month are “normal”; remains confident in long-term spot ETF outlook.

-

In-Depth Expansion:

-

Specific Outflow Situation: BlackRock's iShares Bitcoin Trust (IBIT) experienced approximately $2.34 billion in net outflows this month (referring to November), including two single-day, high-volume withdrawals (e.g., $523 million on one day).

-

BlackRock's Response: Cristiano Castro, a director of business development at BlackRock, explained that this volatility is "perfectly normal" for an ETF, especially one with significant retail investor participation. He suggested that outflows are a natural component of market behavior, particularly during price volatility, as investors engage in capital rotation to manage short-term liquidity.

-

Confidence in Long-Term Prospects: The executive emphasized that IBIT was one of BlackRock's fastest-growing ETFs, with its rapid early growth demonstrating strong market demand for crypto investment products. Despite the outflows, the product remains a significant revenue driver for the company, and BlackRock remains optimistic about its long-term prospects, believing that restoring market confidence will eventually draw institutional and retail investors back.

-

-

Kazakhstan’s National Bank (NBK) Considering Investing up to $300M in Crypto Assets

-

Original Highlight: Kazakhstan’s National Bank (NBK) is considering investing up to $300M into crypto assets.

-

In-Depth Expansion:

-

Investment Plan Details: Timur Suleimenov, the Governor of the National Bank of Kazakhstan (NBK), revealed that the NBK has established a dedicated "crypto reserve" structure within its gold and foreign exchange reserve assets. This reserve will be used to invest in high-tech stocks and other tools related to digital financial assets, with a maximum investment of $300 million.

-

Funding Source and Strategy: The investment will come from the "Alternative Portfolio" within the gold and foreign exchange assets managed by the NBK, which is designed to invest in more progressive and higher-yielding instruments. Suleimenov stressed that the regulator will take a cautious approach, only investing when suitable market conditions and profitable assets are identified. They will not immediately deploy the full $300 million, with actual deployment potentially ranging between $50 million and $250 million.

-

Significance: This move underscores Kazakhstan's ambition, as a major crypto mining and financial hub, to integrate its national financial strategy with the digital asset space. The National Bank is treating crypto assets as a high-yield alternative investment, establishing the legal and infrastructure framework for its investment. This is a significant instance of a sovereign wealth or national-level reserve formally engaging with crypto assets.

-